See more : Brand Concepts Limited (BCONCEPTS.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Panasonic Holdings Corporation (PCRFY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Panasonic Holdings Corporation, a leading company in the Consumer Electronics industry within the Technology sector.

- Suzhou Maxwell Technologies Co., Ltd. (300751.SZ) Income Statement Analysis – Financial Results

- China Ocean Group Development Limited (8047.HK) Income Statement Analysis – Financial Results

- TCI GENE Inc. (6879.TWO) Income Statement Analysis – Financial Results

- Karma Energy Limited (KARMAENG.BO) Income Statement Analysis – Financial Results

- Polarean Imaging plc (POLX.L) Income Statement Analysis – Financial Results

Panasonic Holdings Corporation (PCRFY)

About Panasonic Holdings Corporation

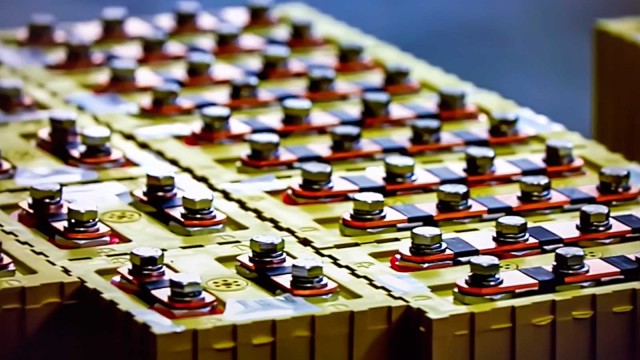

Panasonic Holdings Corporation, together with its subsidiaries, develops, manufactures, sells, and services various electrical and electronic products worldwide. It operates through Appliances, Life Solutions, Connected Solutions, Automotive, and Industrial Solutions segments. The Appliances segment offers air conditioners, refrigerators, washing machines, vacuum cleaners, microwave ovens, rice cookers, personal care products, TVs, digital cameras, video equipment, home audio equipment, fixed-phones, show cases, compressors, and fuel cells. The Life Solutions segment provides lighting fixtures, lamps, wiring devices, solar photovoltaic systems, spatial sterilizing/deodorizing equipment, interior and exterior furnishing materials, ventilation and air conditioning equipment, air purifiers, bicycles, and nursing care related products, as well as kitchen and bath products. The Connected Solutions segment offers aircraft in-flight entertainment systems and communications services, electronic component mounting machines, welding equipment, PCs and tablets, projectors, and professional AV systems, as well as solutions for various industries. The Automotive segment provides automotive-use infotainment systems, head-up displays, automotive audio systems, automotive switches, vehicle camera modules, advanced driver assistance systems, automotive mirrors, and cylindrical and prismatic lithium-ion batteries, as well as devices and systems for electric automobiles. The Industrial Solutions segment offers relays, switches, power supply products, industrial motors and sensors, capacitors, coils, resistors, electronic circuit board materials, semiconductors, and LCD panels, as well as small lithiumion, dry, and micro batteries. The company was formerly known as Panasonic Corporation. Panasonic Holdings Corporation was founded in 1918 and is headquartered in Kadoma, Japan.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 8,496.42B | 8,378.94B | 7,388.79B | 6,698.79B | 7,490.60B | 8,002.73B | 7,982.16B | 7,343.71B | 7,553.72B | 7,715.04B | 7,736.54B | 7,303.05B | 7,846.22B | 8,692.67B | 7,417.98B | 1,770.66B | 9,042.68B | 9,108.69B | 8,893.24B | 8,717.82B | 7,655.17B | 7,276.71B | 6,888.71B | 7,717.79B | 7,307.64B | 7,582.20B | 7,886.77B | 7,662.34B | 6,865.37B | 6,745.16B | 6,597.86B | 6,985.92B | 7,456.76B | 6,622.40B | 5,966.63B | 5,500.45B | 4,807.48B | 4,584.54B | 5,093.91B |

| Cost of Revenue | 6,002.07B | 6,117.49B | 5,306.58B | 4,723.94B | 5,339.56B | 5,736.23B | 5,642.95B | 5,157.16B | 5,340.00B | 5,527.21B | 5,638.87B | 5,419.89B | 5,864.52B | 6,389.18B | 5,341.06B | 5,667.29B | 6,358.76B | 6,394.82B | 6,154.54B | 6,179.08B | 5,326.02B | 5,233.65B | 5,143.08B | 5,507.21B | 4,831.28B | 4,936.05B | 5,127.08B | 4,957.96B | 4,437.60B | 4,193.72B | 4,074.21B | 4,260.97B | 4,571.61B | 4,134.50B | 3,749.12B | 3,450.72B | 3,153.24B | 2,969.25B | 3,127.09B |

| Gross Profit | 2,494.36B | 2,261.45B | 2,082.21B | 1,974.85B | 2,151.04B | 2,266.50B | 2,339.21B | 2,186.54B | 2,213.72B | 2,187.82B | 2,097.67B | 1,883.16B | 1,981.70B | 2,303.49B | 2,076.92B | -3,896.63B | 2,683.92B | 2,713.87B | 2,738.70B | 2,538.74B | 2,329.15B | 2,043.06B | 1,745.64B | 2,210.58B | 2,476.37B | 2,646.15B | 2,759.69B | 2,704.37B | 2,427.78B | 2,551.45B | 2,523.65B | 2,724.95B | 2,885.15B | 2,487.91B | 2,217.51B | 2,049.73B | 1,654.24B | 1,615.29B | 1,966.83B |

| Gross Profit Ratio | 29.36% | 26.99% | 28.18% | 29.48% | 28.72% | 28.32% | 29.31% | 29.77% | 29.31% | 28.36% | 27.11% | 25.79% | 25.26% | 26.50% | 28.00% | -220.07% | 29.68% | 29.79% | 30.80% | 29.12% | 30.43% | 28.08% | 25.34% | 28.64% | 33.89% | 34.90% | 34.99% | 35.29% | 35.36% | 37.83% | 38.25% | 39.01% | 38.69% | 37.57% | 37.17% | 37.26% | 34.41% | 35.23% | 38.61% |

| Research & Development | 491.22B | 469.79B | 419.81B | 419.76B | 475.01B | 488.76B | 448.88B | 436.13B | 438.85B | 457.25B | 478.82B | 502.22B | 520.22B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 526.20B | 496.20B | 480.30B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 2,104.36B | 1,947.37B | 1,724.51B | 1,667.70B | 1,864.38B | 1,939.47B | 1,938.01B | 1,842.93B | 1,798.01B | 1,805.91B | 1,792.56B | 1,722.22B | 1,937.98B | 1,998.24B | 1,886.47B | 2,025.35B | 2,165.92B | 2,254.37B | 2,324.51B | 2,230.12B | 1,975.99B | 1,918.60B | 1,957.76B | 2,021.29B | 1,425.61B | 1,587.41B | 1,577.04B | 1,982.11B | 1,859.77B | 1,838.86B | 1,868.72B | 1,966.69B | 1,997.42B | 1,739.28B | 1,531.19B | 1,415.20B | 1,215.31B | 1,137.33B | 1,213.25B |

| Selling & Marketing | -491.22B | 98.22B | 83.56B | 241.49B | 84.76B | 97.60B | 112.24B | 105.29B | 0.00 | 0.00 | 0.00 | 0.00 | 137.94B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1,613.13B | 1,947.37B | 1,724.51B | 1,667.70B | 1,864.38B | 1,939.47B | 1,938.01B | 1,842.93B | 1,798.01B | 1,805.91B | 1,792.56B | 1,722.22B | 1,937.98B | 1,998.24B | 1,886.47B | 2,025.35B | 2,165.92B | 2,254.37B | 2,324.51B | 2,230.12B | 1,975.99B | 1,918.60B | 1,957.76B | 2,021.29B | 1,425.61B | 1,587.41B | 1,577.04B | 1,982.11B | 1,859.77B | 1,838.86B | 1,868.72B | 1,966.69B | 1,997.42B | 1,739.28B | 1,531.19B | 1,415.20B | 1,215.31B | 1,137.33B | 1,213.25B |

| Other Expenses | 0.00 | 26.94B | -12.46B | 27.80B | -1.79B | -73.61B | 30.74B | 75.21B | -202.17B | -142.30B | -221.26B | -249.82B | 259.14B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 365.39B | 370.32B | 364.95B | 349.02B | 300.77B | 459.97B | 481.98B | 519.43B | 498.41B | 274.37B | 236.32B | 217.63B | 152.36B | 0.00 | 187.87B |

| Operating Expenses | 2,104.36B | 1,974.31B | 1,712.05B | 1,695.50B | 1,862.59B | 1,865.85B | 1,968.75B | 1,918.14B | 1,798.01B | 1,805.91B | 1,549.07B | 1,630.41B | 1,937.98B | 1,998.24B | 1,886.47B | 2,025.35B | 2,165.92B | 2,254.37B | 2,324.51B | 2,230.12B | 1,975.99B | 1,918.60B | 1,957.76B | 2,021.29B | 2,317.20B | 2,453.94B | 2,422.28B | 2,331.14B | 2,160.54B | 2,298.83B | 2,350.71B | 2,486.13B | 2,495.83B | 2,013.64B | 1,767.51B | 1,632.84B | 1,367.67B | 1,302.87B | 1,401.12B |

| Cost & Expenses | 8,106.42B | 8,091.80B | 7,018.63B | 6,419.44B | 7,202.15B | 7,602.09B | 7,611.70B | 7,075.30B | 7,138.01B | 7,333.12B | 7,187.94B | 7,050.30B | 7,802.49B | 8,387.42B | 7,227.53B | 7,692.63B | 8,524.68B | 8,649.19B | 8,479.05B | 8,409.20B | 7,302.01B | 7,152.24B | 7,100.84B | 7,528.50B | 7,148.48B | 7,389.98B | 7,549.36B | 7,289.10B | 6,598.14B | 6,492.55B | 6,424.92B | 6,747.10B | 7,067.45B | 6,148.14B | 5,516.63B | 5,083.55B | 4,520.91B | 4,272.12B | 4,528.21B |

| Interest Income | 88.97B | 48.97B | 22.13B | 20.85B | 31.36B | 25.60B | 22.77B | 21.83B | 18.94B | 14.98B | 10.63B | 9.33B | 13.39B | 11.59B | 12.35B | 23.48B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 24.70B | 21.13B | 19.26B | 18.63B | 34.06B | 20.65B | 24.72B | 23.55B | 17.01B | 17.57B | 21.91B | 25.60B | 28.40B | 27.52B | 25.72B | 19.39B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 399.98B | 382.29B | 339.15B | 317.57B | 372.98B | 296.04B | 287.75B | 260.70B | 274.76B | 286.53B | 331.08B | 339.37B | 338.11B | 367.26B | 298.27B | 364.81B | 319.57B | 317.76B | 309.32B | 325.67B | 278.86B | 297.06B | 353.54B | 375.81B | 365.39B | 370.32B | 364.95B | 349.02B | 300.77B | 459.97B | 481.98B | 519.43B | 498.41B | 274.37B | 236.32B | 217.63B | 152.36B | 165.54B | 187.87B |

| EBITDA | 696.23B | 705.31B | 597.02B | 670.14B | 698.09B | 670.84B | 569.38B | 569.38B | 670.38B | 526.58B | 104.72B | 381.84B | 316.85B | 501.07B | 501.07B | 840.02B | 777.23B | 723.67B | 633.96B | 648.55B | 467.88B | 467.88B | 479.67B | 444.41B | 444.41B | 561.81B | 624.15B | 676.29B | 647.99B | 597.71B | 597.71B | 696.58B | 461.41B | 459.48B | 421.84B | 238.89B | 238.89B | 292.12B | 562.62B |

| EBITDA Ratio | 9.30% | 8.59% | 9.73% | 8.91% | 9.32% | 9.16% | 8.66% | 7.75% | 6.74% | 6.83% | 8.57% | 1.43% | 5.04% | 3.64% | 6.75% | 100.00% | 10.35% | 8.86% | 8.69% | 7.94% | 8.47% | 6.43% | 6.96% | 8.47% | 6.08% | 7.41% | 7.91% | 9.03% | 9.85% | 9.61% | 9.06% | 9.97% | 9.87% | 6.97% | 7.70% | 7.67% | 4.97% | 6.37% | 11.04% |

| Operating Income | 390.00B | 288.57B | 357.53B | 258.60B | 293.75B | 411.50B | 380.54B | 276.78B | 415.71B | 381.91B | 548.60B | 252.74B | 43.73B | 305.25B | 190.45B | 72.87B | 518.00B | 459.50B | 414.19B | 308.62B | 353.16B | 124.46B | -212.12B | 189.29B | 159.17B | 192.21B | 337.41B | 373.24B | 267.24B | 252.62B | 172.94B | 238.82B | 389.31B | 474.26B | 450.00B | 416.90B | 286.57B | 126.58B | 565.70B |

| Operating Income Ratio | 4.59% | 3.44% | 4.84% | 3.86% | 3.92% | 5.14% | 4.77% | 3.77% | 5.50% | 4.95% | 7.09% | 3.46% | 0.56% | 3.51% | 2.57% | 4.12% | 5.73% | 5.04% | 4.66% | 3.54% | 4.61% | 1.71% | -3.08% | 2.45% | 2.18% | 2.54% | 4.28% | 4.87% | 3.89% | 3.75% | 2.62% | 3.42% | 5.22% | 7.16% | 7.54% | 7.58% | 5.96% | 2.76% | 11.11% |

| Total Other Income/Expenses | 132.37B | 46.79B | 81.04B | 32.45B | 122.71B | -32.91B | -37.97B | -59.74B | -187.53B | -98.89B | -559.32B | -1,065.59B | -856.57B | -334.57B | -304.20B | -186.62B | -84.26B | -88.27B | 62.74B | -137.38B | -181.92B | -73.50B | -276.85B | 198.43B | 77.78B | -4.66B | -9.12B | -314.01B | -208.01B | -128.73B | -49.05B | -68.37B | -536.49B | 91.62B | 83.28B | -28.18B | 102.15B | 276.69B | 62.52B |

| Income Before Tax | 420.94B | 316.41B | 360.40B | 260.82B | 291.05B | 416.46B | 378.59B | 275.07B | 217.05B | 182.46B | 206.23B | -398.39B | -812.84B | 178.81B | -29.32B | -113.75B | 433.74B | 439.12B | 371.23B | 247.06B | 171.24B | 50.96B | -488.98B | 91.81B | 236.95B | 187.56B | 328.29B | 292.72B | 59.23B | 214.89B | 123.89B | 170.45B | 335.01B | 565.88B | 533.28B | 500.03B | 388.72B | 403.28B | 628.22B |

| Income Before Tax Ratio | 4.95% | 3.78% | 4.88% | 3.89% | 3.89% | 5.20% | 4.74% | 3.75% | 2.87% | 2.36% | 2.67% | -5.46% | -10.36% | 2.06% | -0.40% | -6.42% | 4.80% | 4.82% | 4.17% | 2.83% | 2.24% | 0.70% | -7.10% | 1.19% | 3.24% | 2.47% | 4.16% | 3.82% | 0.86% | 3.19% | 1.88% | 2.44% | 4.49% | 8.54% | 8.94% | 9.09% | 8.09% | 8.80% | 12.33% |

| Income Tax Expense | -40.20B | 35.85B | 94.96B | 76.93B | 51.01B | 113.72B | 126.56B | 102.62B | 14.54B | -1.98B | 89.67B | 384.67B | 9.77B | 103.01B | 141.83B | 37.36B | 114.27B | 191.93B | 167.02B | 153.45B | 98.78B | 70.08B | -57.28B | 50.07B | 137.18B | 174.12B | 234.73B | 155.11B | 116.69B | 127.04B | 99.49B | 132.42B | 202.02B | 306.06B | 299.14B | 286.71B | 226.28B | 239.26B | 379.77B |

| Net Income | 443.99B | 265.50B | 255.33B | 165.08B | 225.71B | 284.15B | 236.04B | 149.36B | 193.26B | 179.49B | 120.44B | -754.25B | -772.17B | 74.02B | -103.47B | -93.23B | 281.08B | 217.14B | 154.43B | 58.55B | 42.25B | -19.11B | -431.69B | 41.74B | 99.77B | 13.43B | 93.56B | 137.61B | -57.46B | 87.85B | 24.40B | 38.03B | 132.99B | 259.82B | 234.15B | 213.31B | 162.44B | 164.01B | 248.45B |

| Net Income Ratio | 5.23% | 3.17% | 3.46% | 2.46% | 3.01% | 3.55% | 2.96% | 2.03% | 2.56% | 2.33% | 1.56% | -10.33% | -9.84% | 0.85% | -1.39% | -5.27% | 3.11% | 2.38% | 1.74% | 0.67% | 0.55% | -0.26% | -6.27% | 0.54% | 1.37% | 0.18% | 1.19% | 1.80% | -0.84% | 1.30% | 0.37% | 0.54% | 1.78% | 3.92% | 3.92% | 3.88% | 3.38% | 3.58% | 4.88% |

| EPS | 190.21 | 113.75 | 109.41 | 70.75 | 96.76 | 121.83 | 101.20 | 64.33 | 83.40 | 77.65 | 52.10 | -326.28 | -333.96 | 35.75 | -44.76 | -15.18 | 132.90 | 99.29 | 69.31 | 25.55 | 18.19 | -8.27 | -186.74 | 20.09 | 48.44 | 0.65 | 4.42 | 6.54 | -2.75 | 43.20 | 11.29 | 18.38 | 61.12 | 117.11 | 108.50 | 100.71 | 80.63 | 84.33 | 129.15 |

| EPS Diluted | 190.15 | 113.72 | 109.37 | 70.72 | 96.70 | 121.75 | 101.15 | 64.31 | 83.39 | 77.64 | 52.10 | -326.28 | -333.96 | 35.75 | -44.76 | -45.09 | 132.90 | 99.29 | 69.31 | 25.55 | 18.04 | -8.27 | -186.74 | 19.68 | 46.45 | 0.65 | 4.14 | 6.06 | -27.61 | 40.61 | 11.29 | 18.38 | 61.12 | 117.11 | 108.50 | 100.71 | 80.63 | 84.33 | 127.13 |

| Weighted Avg Shares Out | 2.33B | 2.33B | 2.33B | 2.33B | 2.33B | 2.33B | 2.33B | 2.32B | 2.32B | 2.31B | 2.31B | 2.31B | 2.31B | 2.31B | 2.31B | 6.14B | 2.31B | 2.31B | 2.31B | 2.31B | 2.32B | 2.31B | 2.31B | 2.31B | 2.31B | 20.55B | 21.16B | 21.08B | 20.90B | 2.31B | 2.31B | 2.31B | 2.31B | 2.31B | 2.31B | 2.31B | 2.31B | 2.31B | 1.92B |

| Weighted Avg Shares Out (Dil) | 2.33B | 2.33B | 2.33B | 2.33B | 2.33B | 2.33B | 2.33B | 2.32B | 2.32B | 2.31B | 2.31B | 2.31B | 2.31B | 2.31B | 2.31B | 2.07B | 2.31B | 2.31B | 2.31B | 2.31B | 2.34B | 2.31B | 2.31B | 2.31B | 2.31B | 2.08B | 2.06B | 2.31B | 2.08B | 2.31B | 2.31B | 2.31B | 2.31B | 2.31B | 2.31B | 2.31B | 2.31B | 2.31B | 1.95B |

Panasonic Holdings Corporation (PCRFY) Q4 2024 Earnings Call Transcript

7 Blue-Chip Stocks That Can Triple in the Next 24 Months

Multibagger EV Plays: 3 Stocks to Hold Through Thick and Thin for Outsized Returns

Shhh! 3 Secret EV Stocks Flying Below Wall Street's Radar

3 Battery Stocks That Could Be Multibaggers in the Making: April Edition

3 EV Stocks to Buy for 10-Bagger Returns by 2030: April Edition

Peraso stock ($PRSO) soars 40% on Panasonic deal

Wall Street Favorites: 3 Battery Stocks With Strong Buy Ratings for April 2024

7 Battery Stocks to Buy Before the Next Big Rally

EV Revival: 3 Stocks Poised for a Triumphant Return

Source: https://incomestatements.info

Category: Stock Reports