See more : ABM Knowledgeware Limited (ABMKNO.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Paramount Group, Inc. (PGRE) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Paramount Group, Inc., a leading company in the REIT – Office industry within the Real Estate sector.

- Intumit Inc. (7547.TWO) Income Statement Analysis – Financial Results

- MBL Infrastructures Limited (MBLINFRA.NS) Income Statement Analysis – Financial Results

- West Shore Bank Corp. (WSSH) Income Statement Analysis – Financial Results

- Chugai Pharmaceutical Co., Ltd. (CHGCF) Income Statement Analysis – Financial Results

- Hanshin Machinery Co., Ltd. (011700.KS) Income Statement Analysis – Financial Results

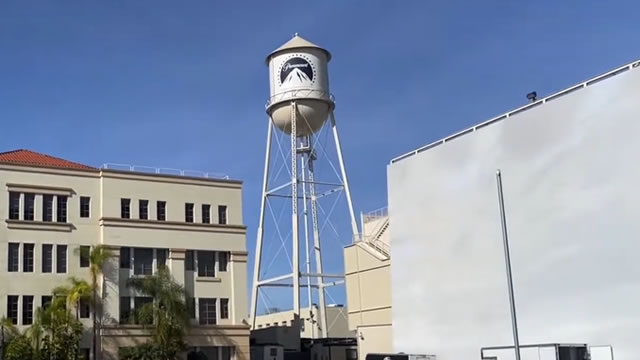

Paramount Group, Inc. (PGRE)

About Paramount Group, Inc.

Headquartered in New York City, Paramount Group, Inc. is a fully-integrated real estate investment trust that owns, operates, manages, acquires and redevelops high-quality, Class A office properties located in select central business district submarkets of New York City and San Francisco. Paramount is focused on maximizing the value of its portfolio by leveraging the sought-after locations of its assets and its proven property management capabilities to attract and retain high-quality tenants.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 742.79M | 740.38M | 726.79M | 714.24M | 769.18M | 758.96M | 718.97M | 683.34M | 662.41M | 419.89M | 58.65M | 54.29M | 56.99M |

| Cost of Revenue | 544.61M | 277.42M | 265.44M | 267.59M | 274.84M | 274.08M | 266.14M | 250.04M | 244.75M | 16.20M | 16.20M | 15.40M | 14.66M |

| Gross Profit | 198.18M | 462.96M | 461.35M | 446.65M | 494.34M | 484.88M | 452.83M | 433.30M | 417.65M | 403.70M | 42.46M | 38.89M | 42.34M |

| Gross Profit Ratio | 26.68% | 62.53% | 63.48% | 62.54% | 64.27% | 63.89% | 62.98% | 63.41% | 63.05% | 96.14% | 72.39% | 71.63% | 74.28% |

| Research & Development | 0.00 | -0.03 | 0.01 | -0.02 | 0.01 | 0.03 | 0.16 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 61.99M | 59.49M | 59.13M | 64.92M | 68.56M | 57.56M | 58.95M | 50.64M | 42.06M | 33.50M | 56.89M | 45.93M | 103.91M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 61.99M | 59.49M | 59.13M | 64.92M | 68.56M | 57.56M | 58.95M | 50.64M | 42.06M | 33.50M | 56.89M | 45.93M | 103.91M |

| Other Expenses | 0.00 | 232.52M | 232.49M | 235.20M | 248.35M | 258.23M | 266.04M | 269.45M | 294.62M | 0.00 | 322.00K | 16.67M | 784.00K |

| Operating Expenses | 61.99M | 292.00M | 291.62M | 300.12M | 316.90M | 315.79M | 324.99M | 320.09M | 336.68M | 33.50M | 72.10M | 62.60M | 119.92M |

| Cost & Expenses | 606.60M | 569.43M | 557.06M | 567.70M | 591.74M | 589.87M | 591.12M | 570.13M | 581.43M | 49.70M | 88.30M | 78.00M | 134.58M |

| Interest Income | 8.62M | 5.17M | 3.02M | 2.05M | 5.48M | 5.38M | 1.26M | 774.00K | 871.00K | 3.55M | 2.36M | 2.05M | |

| Interest Expense | 146.77M | 143.86M | 142.01M | 134.93M | 137.36M | 136.63M | 132.57M | 150.94M | 168.37M | 29.37M | 36.91M | 34.20M | |

| Depreciation & Amortization | 250.64M | 569.43M | 557.06M | 604.06M | 575.36M | 591.34M | 593.98M | 535.59M | 294.62M | 10.58M | 10.58M | 10.10M | 10.70M |

| EBITDA | 27.54M | 354.15M | 381.12M | 356.85M | 407.35M | 425.85M | 391.03M | 417.20M | 441.00M | 212.49M | 343.24M | 182.77M | 447.29M |

| EBITDA Ratio | 3.71% | 47.83% | 52.44% | 49.96% | 52.96% | 56.46% | 53.21% | 56.97% | 57.87% | 70.17% | -24.83% | -14.42% | -103.33% |

| Operating Income | 136.19M | 121.64M | 148.63M | 120.96M | 159.01M | 121.62M | 123.19M | 107.94M | 70.62M | 331.59M | 331.59M | 168.81M | 471.36M |

| Operating Income Ratio | 18.34% | 16.43% | 20.45% | 16.94% | 20.67% | 16.03% | 17.13% | 15.80% | 10.66% | 78.97% | 565.34% | 310.94% | 827.05% |

| Total Other Income/Expenses | -506.07M | -146.57M | -372.40M | -133.59M | -165.87M | -99.49M | -10.84M | -104.08M | -46.91M | -130.51M | -17.72M | -25.94M | 9.08M |

| Income Before Tax | -369.88M | -24.93M | 5.70M | -12.63M | -29.29M | 22.13M | 112.35M | 3.85M | 23.71M | 313.87M | 313.87M | 146.72M | 443.93M |

| Income Before Tax Ratio | -49.80% | -3.37% | 0.78% | -1.77% | -3.81% | 2.92% | 15.63% | 0.56% | 3.58% | 74.75% | 535.13% | 270.26% | 778.91% |

| Income Tax Expense | 1.43M | 3.27M | 3.64M | 1.49M | 312.00K | 3.14M | 5.18M | 1.79M | 2.57M | -11.03M | 11.03M | 6.98M | 42.97M |

| Net Income | -259.74M | -28.20M | 2.06M | -14.12M | -29.60M | 9.15M | 86.38M | -9.93M | -4.42M | 324.90M | 16.51M | 2.30M | 53.88M |

| Net Income Ratio | -34.97% | -3.81% | 0.28% | -1.98% | -3.85% | 1.21% | 12.01% | -1.45% | -0.67% | 77.38% | 28.16% | 4.23% | 94.53% |

| EPS | -1.20 | -0.13 | 0.01 | -0.06 | -0.13 | 0.04 | 0.37 | -0.05 | -0.02 | 1.53 | 0.07 | 0.01 | 0.22 |

| EPS Diluted | -1.20 | -0.13 | 0.01 | -0.06 | -0.13 | 0.04 | 0.37 | -0.05 | -0.02 | 1.53 | 0.07 | 0.01 | 0.22 |

| Weighted Avg Shares Out | 216.92M | 221.31M | 218.70M | 222.44M | 231.54M | 239.53M | 236.37M | 218.05M | 212.11M | 212.11M | 244.00M | 244.00M | 244.00M |

| Weighted Avg Shares Out (Dil) | 216.92M | 221.31M | 218.70M | 222.44M | 231.54M | 239.56M | 236.40M | 218.05M | 212.11M | 212.11M | 244.00M | 244.00M | 244.00M |

Skydance reportedly accuses Paramount committee of violating merger deal

David Ellison's Skydance demands Paramount stop talks with Edgar Bronfman

Skydance Urges Paramount To Spurn Edgar Bronfman-Led Offer

Skydance asks Paramount to stop negotiating with Bronfman, WSJ reports

Skydance Demands That Paramount Stops Negotiating With Bronfman

SHAREHOLDER ALERT: Levi & Korsinsky, LLP Notifies Shareholders of an Investigation into Paramount Gl

Paramount to consider rival takeover bid from Edgar Bronfman Jr.

Paramount Extends Deadline To Review Bronfman Takeover Offer

Looks like Paramount really does have a second bidder

Paramount special committee extends Skydance 'go shop' period as it reviews Bronfman offer

Source: https://incomestatements.info

Category: Stock Reports