See more : Ball Corporation (0HL5.L) Income Statement Analysis – Financial Results

Complete financial analysis of Parker-Hannifin Corporation (PH) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Parker-Hannifin Corporation, a leading company in the Industrial – Machinery industry within the Industrials sector.

- Luxor Industrial Corporation (LXRRF) Income Statement Analysis – Financial Results

- Sabina Public Company Limited (SABINA-R.BK) Income Statement Analysis – Financial Results

- Federal Home Loan Mortgage Corporation (FMCKL) Income Statement Analysis – Financial Results

- Public Storage (PSA-PG) Income Statement Analysis – Financial Results

- ArcelorMittal S.A. (MT.AS) Income Statement Analysis – Financial Results

Parker-Hannifin Corporation (PH)

About Parker-Hannifin Corporation

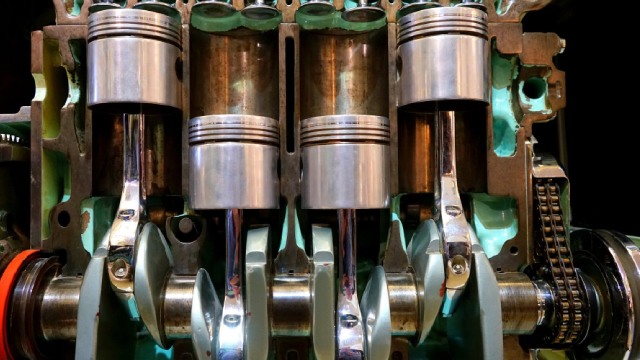

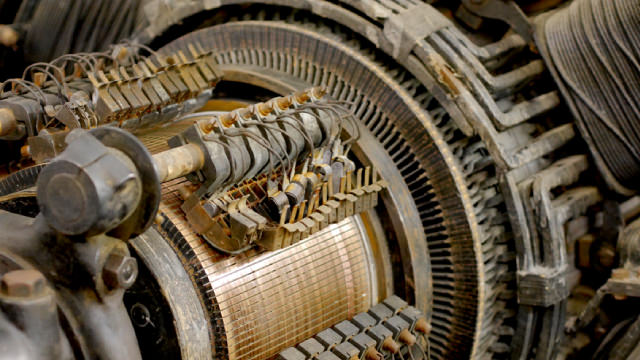

Parker-Hannifin Corporation manufactures and sells motion and control technologies and systems for various mobile, industrial, and aerospace markets worldwide. The company operates through two segments, Diversified Industrial and Aerospace Systems. The Company's Diversified Industrial segment offers sealing, shielding, thermal products and systems, adhesives, coatings, and noise vibration and harshness solutions; filters, systems, and diagnostics solutions to monitor and remove contaminants from fuel, air, oil, water, and other liquids and gases; connectors, which control, transmit, and contain fluid; control solutions for extreme corrosion resistance, temperatures, pressures, and precise flow; and hydraulic, pneumatic, and electromechanical components and systems for builders and users of mobile and industrial machinery and equipment. This segment sells its products to original equipment manufacturers (OEMs) and distributors who serve the replacement markets in manufacturing, packaging, processing, transportation, construction, refrigeration and air conditioning, agricultural, and military machinery and equipment industries. Its Aerospace Systems segment offers products for use in commercial and military airframe and engine programs, such as control actuation systems and components, engine build-up ducting, engine exhaust nozzles and assemblies, engine systems and components, fluid conveyance systems and components, fuel systems and components, fuel tank inerting systems, hydraulic systems and components, lubrication components, pilot controls, pneumatic control components, thermal management products, and wheels and brakes, as well as fluid metering, delivery, and atomization devices. This segment markets its products directly to OEMs and end users. It markets its products through direct-sales employees, independent distributors, and sales representatives. The company was founded in 1917 and is headquartered in Cleveland, Ohio.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 19.93B | 19.07B | 15.86B | 14.35B | 13.70B | 14.32B | 14.30B | 12.03B | 11.36B | 12.71B | 13.22B | 13.02B | 13.15B | 12.35B | 9.99B | 10.31B | 12.15B | 10.72B | 9.39B | 8.22B | 7.11B | 6.41B | 6.15B | 5.98B | 5.36B | 4.96B | 4.63B | 4.09B | 3.59B | 3.21B | 2.58B | 2.49B | 2.38B | 2.44B | 2.45B | 2.52B | 2.25B | 1.88B | 1.73B |

| Cost of Revenue | 12.80B | 12.64B | 11.39B | 10.45B | 10.29B | 10.70B | 10.76B | 9.19B | 8.82B | 9.66B | 10.19B | 10.09B | 9.96B | 9.39B | 7.85B | 8.18B | 9.34B | 8.27B | 7.37B | 6.51B | 5.74B | 5.31B | 5.12B | 4.73B | 3.95B | 3.67B | 3.37B | 2.98B | 2.61B | 2.33B | 1.94B | 1.89B | 1.82B | 1.87B | 1.83B | 2.20B | 1.97B | 1.37B | 1.26B |

| Gross Profit | 7.13B | 6.43B | 4.47B | 3.90B | 3.41B | 3.62B | 3.54B | 2.84B | 2.54B | 3.06B | 3.03B | 2.93B | 3.19B | 2.96B | 2.15B | 2.13B | 2.81B | 2.45B | 2.02B | 1.71B | 1.36B | 1.10B | 1.03B | 1.25B | 1.41B | 1.29B | 1.26B | 1.11B | 971.50M | 886.00M | 636.00M | 598.50M | 557.00M | 567.40M | 623.00M | 321.20M | 286.30M | 504.30M | 472.10M |

| Gross Profit Ratio | 35.76% | 33.72% | 28.21% | 27.17% | 24.89% | 25.26% | 24.75% | 23.61% | 22.33% | 24.04% | 22.91% | 22.50% | 24.25% | 23.96% | 21.48% | 20.64% | 23.11% | 22.81% | 21.50% | 20.78% | 19.20% | 17.17% | 16.79% | 20.93% | 26.24% | 26.04% | 27.30% | 27.08% | 27.09% | 27.56% | 24.69% | 24.04% | 23.44% | 23.25% | 25.40% | 12.75% | 12.71% | 26.87% | 27.29% |

| Research & Development | 298.00M | 258.00M | 191.00M | 259.04M | 293.84M | 294.85M | 327.88M | 336.68M | 359.80M | 403.09M | 410.13M | 406.61M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 3.24B | 3.29B | 1.63B | 1.58B | 1.71B | 0.00 | 1.66B | 1.45B | 1.36B | 1.54B | 1.63B | 1.55B | 1.52B | 1.47B | 1.28B | 1.29B | 1.36B | 1.23B | 1.04B | 872.11M | 800.20M | 721.07M | 686.49M | 679.96M | 575.91M | 550.70M | 532.10M | 475.20M | 425.40M | 384.60M | 356.90M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 67.00M | -4.00M | -49.00M | -49.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 3.24B | 3.35B | 1.63B | 1.53B | 1.66B | 1.54B | 1.66B | 1.45B | 1.36B | 1.54B | 1.63B | 1.55B | 1.52B | 1.47B | 1.28B | 1.29B | 1.36B | 1.23B | 1.04B | 872.11M | 800.20M | 721.07M | 686.49M | 679.96M | 575.91M | 550.70M | 532.10M | 475.20M | 425.40M | 384.60M | 356.90M | 333.60M | 282.90M | 303.90M | 282.80M | 0.00 | 0.00 | 259.10M | 237.20M |

| Other Expenses | 0.00 | 178.36M | -977.75M | 126.34M | 68.34M | 50.66M | 33.75M | 104.66M | 73.24M | 38.89M | 434.40M | 28.50M | 0.00 | 0.00 | -311.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 206.41M | 202.00M | 182.70M | 169.80M | 141.40M | 119.90M | 113.10M | 114.20M | 107.00M | 104.00M | 97.50M | 95.80M | 84.80M | 66.50M | 58.10M |

| Operating Expenses | 3.49B | 3.35B | 1.63B | 1.53B | 1.66B | 1.54B | 1.66B | 1.45B | 1.36B | 1.54B | 1.63B | 1.55B | 1.52B | 1.47B | 1.28B | 1.29B | 1.36B | 1.23B | 1.04B | 872.11M | 800.20M | 721.07M | 686.49M | 679.96M | 782.31M | 752.70M | 714.80M | 645.00M | 566.80M | 504.50M | 470.00M | 447.80M | 389.90M | 407.90M | 380.30M | 95.80M | 84.80M | 325.60M | 295.30M |

| Cost & Expenses | 16.25B | 15.99B | 13.01B | 11.98B | 11.94B | 12.25B | 12.42B | 10.64B | 10.18B | 11.20B | 11.82B | 11.64B | 11.48B | 10.86B | 9.12B | 9.47B | 10.70B | 9.50B | 8.40B | 7.38B | 6.54B | 6.03B | 5.80B | 5.41B | 4.73B | 4.42B | 4.08B | 3.63B | 3.18B | 2.83B | 2.41B | 2.34B | 2.21B | 2.28B | 2.21B | 2.29B | 2.05B | 1.70B | 1.55B |

| Interest Income | 15.00M | 46.00M | 10.00M | 7.00M | 31.00M | 18.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 506.50M | 573.89M | 255.25M | 250.04M | 308.16M | 190.14M | 213.87M | 162.44M | 136.52M | 118.41M | 82.57M | 91.55M | 92.79M | 99.70M | 103.60M | 112.07M | 99.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 927.13M | 818.13M | 571.76M | 595.39M | 537.53M | 436.19M | 466.09M | 355.23M | 306.84M | 317.49M | 336.70M | 335.62M | 321.93M | 339.80M | 362.51M | 357.74M | 326.72M | 294.57M | 280.97M | 264.70M | 252.79M | 259.18M | 281.60M | 264.53M | 206.41M | 202.00M | 182.70M | 169.80M | 141.40M | 119.90M | 113.10M | 114.20M | 107.00M | 104.00M | 97.50M | 95.80M | 84.80M | 66.50M | 58.10M |

| EBITDA | 5.03B | 4.07B | 2.44B | 3.09B | 2.43B | 2.51B | 2.38B | 1.85B | 1.56B | 1.86B | 1.83B | 1.74B | 1.99B | 1.85B | 1.22B | 1.15B | 1.75B | 1.51B | 1.26B | 1.07B | 793.82M | 629.13M | 627.67M | 836.01M | 829.27M | 740.75M | 732.60M | 632.70M | 546.10M | 501.40M | 279.10M | 264.90M | 274.10M | 263.50M | 340.20M | 321.20M | 286.30M | 245.20M | 234.90M |

| EBITDA Ratio | 25.23% | 21.36% | 15.39% | 21.55% | 17.22% | 17.87% | 16.66% | 15.35% | 13.71% | 14.70% | 16.38% | 13.35% | 15.14% | 14.83% | 12.32% | 11.59% | 14.71% | 13.89% | 13.51% | 13.52% | 11.49% | 10.03% | 10.99% | 13.18% | 15.59% | 14.99% | 15.66% | 15.26% | 15.05% | 15.67% | 11.45% | 10.46% | 11.94% | 10.66% | 13.76% | 12.81% | 12.66% | 12.63% | 13.43% |

| Operating Income | 3.68B | 1.61B | 1.87B | 2.50B | 1.82B | 2.12B | 1.88B | 1.39B | 1.18B | 1.51B | 1.39B | 1.37B | 1.67B | 1.49B | 869.02M | 837.29M | 1.44B | 1.22B | 981.62M | 834.87M | 564.65M | 379.77M | 346.07M | 571.49M | 622.86M | 538.70M | 549.90M | 462.90M | 404.70M | 381.50M | 166.00M | 150.70M | 167.10M | 159.50M | 242.70M | 225.40M | 201.50M | 178.70M | 176.80M |

| Operating Income Ratio | 18.45% | 8.47% | 11.79% | 17.40% | 13.29% | 14.83% | 13.16% | 11.53% | 10.37% | 11.89% | 10.55% | 10.56% | 12.69% | 12.07% | 8.70% | 8.12% | 11.88% | 11.37% | 10.46% | 10.16% | 7.95% | 5.92% | 5.63% | 9.56% | 11.63% | 10.86% | 11.87% | 11.31% | 11.28% | 11.87% | 6.44% | 6.05% | 7.03% | 6.53% | 9.90% | 8.94% | 8.95% | 9.52% | 10.22% |

| Total Other Income/Expenses | -82.01M | -479.54M | -255.25M | -155.33M | -87.34M | -190.34M | 63.56M | -57.77M | -63.28M | -79.51M | 162.97M | -63.06M | -91.59M | -76.92M | -114.20M | -154.21M | -107.88M | -58.97M | -81.67M | -78.78M | -50.07M | -82.39M | -128.03M | -37.89M | -60.68M | -61.06M | -45.90M | -38.10M | -30.20M | -33.10M | -53.50M | -42.60M | -61.70M | -56.00M | -59.50M | -54.80M | -37.70M | -22.00M | -21.40M |

| Income Before Tax | 3.59B | 2.68B | 1.61B | 2.25B | 1.51B | 1.93B | 1.70B | 1.33B | 1.11B | 1.43B | 1.56B | 1.31B | 1.58B | 1.41B | 754.82M | 681.45M | 1.33B | 1.16B | 899.96M | 756.47M | 494.07M | 297.38M | 218.04M | 533.60M | 562.19M | 477.70M | 504.00M | 424.80M | 374.50M | 348.40M | 112.50M | 108.10M | 105.40M | 103.50M | 183.20M | 170.60M | 163.80M | 156.70M | 155.40M |

| Income Before Tax Ratio | 18.04% | 14.06% | 10.18% | 15.66% | 11.04% | 13.50% | 11.90% | 11.05% | 9.81% | 11.27% | 11.78% | 10.07% | 11.99% | 11.45% | 7.55% | 6.61% | 10.92% | 10.82% | 9.59% | 9.21% | 6.95% | 4.64% | 3.55% | 8.92% | 10.50% | 9.63% | 10.88% | 10.38% | 10.44% | 10.84% | 4.37% | 4.34% | 4.44% | 4.24% | 7.47% | 6.77% | 7.27% | 8.35% | 8.98% |

| Income Tax Expense | 749.67M | 596.13M | 298.04M | 500.10M | 305.92M | 420.49M | 640.96M | 344.80M | 307.51M | 419.69M | 515.30M | 362.22M | 421.21M | 356.57M | 198.45M | 172.94M | 377.06M | 329.24M | 261.68M | 208.50M | 148.29M | 101.11M | 87.89M | 189.43M | 193.96M | 167.20M | 180.80M | 150.80M | 134.80M | 130.20M | 60.30M | 43.00M | 41.90M | 44.30M | 72.80M | 67.80M | 57.30M | 71.50M | 67.20M |

| Net Income | 2.84B | 2.08B | 1.32B | 1.75B | 1.20B | 1.51B | 1.06B | 983.41M | 806.84M | 1.01B | 1.04B | 948.43M | 1.15B | 1.05B | 554.07M | 508.52M | 949.47M | 830.05M | 673.17M | 604.69M | 345.78M | 196.27M | 130.15M | 340.79M | 368.23M | 310.50M | 319.50M | 274.00M | 239.70M | 218.20M | 47.70M | 65.10M | 11.20M | 59.20M | 115.20M | 102.80M | 106.50M | 85.20M | 88.20M |

| Net Income Ratio | 14.27% | 10.93% | 8.29% | 12.17% | 8.78% | 10.56% | 7.42% | 8.18% | 7.10% | 7.96% | 7.88% | 7.29% | 8.76% | 8.50% | 5.54% | 4.93% | 7.82% | 7.74% | 7.17% | 7.36% | 4.87% | 3.06% | 2.12% | 5.70% | 6.88% | 6.26% | 6.90% | 6.70% | 6.68% | 6.79% | 1.85% | 2.62% | 0.47% | 2.43% | 4.70% | 4.08% | 4.73% | 4.54% | 5.10% |

| EPS | 22.13 | 16.23 | 10.24 | 13.54 | 9.39 | 11.63 | 7.98 | 7.37 | 5.96 | 7.08 | 6.98 | 6.36 | 7.62 | 6.51 | 3.44 | 3.15 | 5.64 | 4.75 | 3.77 | 3.39 | 1.96 | 1.13 | 0.75 | 1.99 | 2.23 | 1.90 | 1.92 | 1.64 | 1.44 | 1.32 | 0.29 | 0.39 | 0.07 | 0.37 | 0.71 | 0.63 | 0.65 | 0.55 | 0.59 |

| EPS Diluted | 21.84 | 16.04 | 10.09 | 13.35 | 9.29 | 11.48 | 7.83 | 7.25 | 5.89 | 6.97 | 6.87 | 6.26 | 7.45 | 6.37 | 3.40 | 3.13 | 5.53 | 4.68 | 3.71 | 3.35 | 1.94 | 1.12 | 0.75 | 1.97 | 2.21 | 1.89 | 1.90 | 1.64 | 1.44 | 1.32 | 0.29 | 0.39 | 0.07 | 0.37 | 0.71 | 0.63 | 0.65 | 0.55 | 0.57 |

| Weighted Avg Shares Out | 128.51M | 128.37M | 128.54M | 129.00M | 128.42M | 130.00M | 133.00M | 133.38M | 135.35M | 142.93M | 149.10M | 149.22M | 151.22M | 161.13M | 160.91M | 161.56M | 168.29M | 174.64M | 178.72M | 178.20M | 176.42M | 174.21M | 172.77M | 171.54M | 165.37M | 163.34M | 166.32M | 167.07M | 166.97M | 165.86M | 166.31M | 165.43M | 167.92M | 161.37M | 162.94M | 163.96M | 162.93M | 153.90M | 150.27M |

| Weighted Avg Shares Out (Dil) | 130.24M | 129.82M | 130.36M | 130.83M | 129.81M | 131.78M | 135.43M | 135.56M | 136.91M | 145.11M | 151.44M | 151.59M | 154.66M | 164.80M | 162.90M | 162.72M | 171.64M | 177.49M | 181.28M | 180.68M | 178.24M | 175.24M | 174.31M | 172.70M | 166.87M | 164.49M | 168.07M | 168.06M | 167.02M | 165.86M | 166.31M | 165.43M | 167.92M | 161.37M | 162.94M | 163.96M | 162.93M | 155.78M | 153.76M |

These 3 Outstanding Dividend-Growth Stocks Could Fund Your Retirement

Parker-Hannifin Gains From End-Market Strength Amid Headwinds

Parker Scheduled to Present at Robert W. Baird Global Industrial Conference on November 13 at 10:50 a.m.

SK Capital Closes Acquisition of North America Composites & Fuel Containment Division from Parker Hannifin; Changes Name to Axillon Aerospace

Parker Completes Divestiture of North America Composites & Fuel Containment Division

Parker-Hannifin Corporation (PH) Q1 2025 Earnings Call Transcript

Parker-Hannifin Q1 Earnings Beat, Aerospace Systems Sales Up Y/Y

Parker-Hannifin (PH) Reports Q1 Earnings: What Key Metrics Have to Say

Parker-Hannifin (PH) Surpasses Q1 Earnings Estimates

Parker Reports Fiscal 2025 First Quarter Results

Source: https://incomestatements.info

Category: Stock Reports