See more : Chinese Estates Holdings Limited (0127.HK) Income Statement Analysis – Financial Results

Complete financial analysis of Impinj, Inc. (PI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Impinj, Inc., a leading company in the Communication Equipment industry within the Technology sector.

- The PMI Group, Inc. (PMIR) Income Statement Analysis – Financial Results

- Gouverneur Bancorp, Inc. (GOVB) Income Statement Analysis – Financial Results

- Sinoseal Holding Co., Ltd. (300470.SZ) Income Statement Analysis – Financial Results

- TRICCAR, Inc. (TCCR) Income Statement Analysis – Financial Results

- Group 107 Ltd. (G107.TA) Income Statement Analysis – Financial Results

Impinj, Inc. (PI)

About Impinj, Inc.

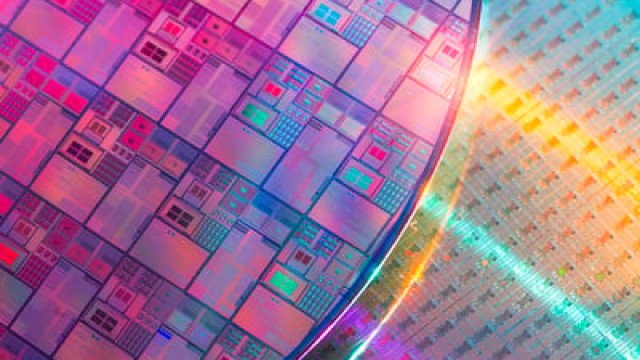

Impinj, Inc. operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. Its platform, which comprises multiple product families, wirelessly connects individual items and delivers data about the connected items to business and consumer applications. The company's platform comprises endpoint ICs, a miniature radios-on-a-chip that attaches to a host item and includes a number to identify the item. Its platform also consists of systems products that comprise reader ICs, readers, and gateways to wirelessly provide power to and communicate bidirectionally with endpoint ICs on host items, as well as to read, write, authenticate, and engage the endpoint ICs on those items; and software and algorithms that enables its partners to deliver use cases, such as retail self-checkout and loss prevention, and warehouse pallet and carton tracking to end-users. The company primarily serves retail, supply chain and logistics, aviation, automotive, healthcare, industrial and manufacturing, sports, food, datacenter, travel, banking, and linen and uniform tracking sectors through distributors, system integrators, value-added resellers, and software solution partners. Impinj, Inc. was incorporated in 2000 and is headquartered in Seattle, Washington.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2010 | 2009 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 307.54M | 257.80M | 190.28M | 138.92M | 152.84M | 122.63M | 125.30M | 112.29M | 78.48M | 63.76M | 55.49M | 31.80M | 20.82M |

| Cost of Revenue | 155.56M | 119.92M | 91.33M | 73.78M | 78.83M | 64.35M | 60.36M | 52.83M | 37.51M | 30.12M | 27.04M | 17.61M | 9.00M |

| Gross Profit | 151.98M | 137.88M | 98.95M | 65.14M | 74.00M | 58.28M | 64.94M | 59.45M | 40.97M | 33.64M | 28.45M | 14.19M | 11.82M |

| Gross Profit Ratio | 49.42% | 53.48% | 52.00% | 46.89% | 48.42% | 47.52% | 51.83% | 52.95% | 52.21% | 52.76% | 51.27% | 44.61% | 56.76% |

| Research & Development | 88.56M | 74.11M | 64.06M | 48.59M | 38.88M | 34.17M | 32.22M | 25.19M | 17.01M | 14.29M | 11.58M | 10.66M | 9.49M |

| General & Administrative | 60.83M | 45.47M | 36.14M | 34.96M | 24.14M | 22.30M | 18.16M | 12.43M | 8.03M | 6.12M | 5.14M | 5.59M | 5.27M |

| Selling & Marketing | 41.12M | 37.89M | 34.29M | 28.66M | 32.64M | 32.93M | 31.58M | 22.33M | 14.34M | 10.83M | 9.59M | 8.26M | 7.32M |

| SG&A | 101.95M | 83.36M | 70.42M | 63.62M | 56.78M | 55.23M | 49.74M | 34.76M | 22.37M | 16.94M | 15.46M | 13.84M | 12.59M |

| Other Expenses | 4.95M | 285.00K | -11.31M | 650.00K | 1.24M | 808.00K | 0.00 | 0.00 | 673.00K | 1.96M | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 195.47M | 157.47M | 134.48M | 112.21M | 95.66M | 89.40M | 81.96M | 59.94M | 39.37M | 33.19M | 26.85M | 24.50M | 22.08M |

| Cost & Expenses | 351.02M | 277.38M | 225.81M | 185.99M | 174.50M | 153.75M | 142.32M | 112.78M | 76.88M | 63.31M | 53.89M | 42.11M | 31.08M |

| Interest Income | 0.00 | 2.41M | 2.53M | 4.76M | 552.00K | 0.00 | 508.00K | 616.00K | 673.00K | 838.00K | 1.27M | 8.00K | 234.00K |

| Interest Expense | 4.85M | 4.92M | 2.55M | 5.41M | 1.79M | 1.40M | 908.00K | 1.63M | 1.21M | 901.00K | 0.00 | 793.00K | 524.00K |

| Depreciation & Amortization | 13.62M | 6.04M | 4.60M | 4.50M | 4.81M | 4.53M | 3.95M | 2.87M | 1.97M | 1.37M | 994.00K | 1.32M | 1.50M |

| EBITDA | -27.94M | -13.54M | -43.96M | -41.92M | -16.19M | -29.53M | -12.56M | 3.00M | 4.25M | 2.66M | 3.51M | -9.19M | -8.18M |

| EBITDA Ratio | -9.08% | -5.14% | -22.20% | -30.17% | -10.21% | -21.02% | -10.02% | 2.67% | 5.41% | 4.17% | 6.33% | -28.28% | -40.99% |

| Operating Income | -43.48M | -19.58M | -35.53M | -47.07M | -21.66M | -34.87M | -17.02M | -488.00K | 1.60M | 456.00K | 2.52M | -10.32M | -10.27M |

| Operating Income Ratio | -14.14% | -7.60% | -18.67% | -33.88% | -14.17% | -28.43% | -13.58% | -0.43% | 2.04% | 0.72% | 4.53% | -32.45% | -49.33% |

| Total Other Income/Expenses | -204.00K | -4.64M | -13.86M | -4.76M | -1.13M | -595.00K | -400.00K | -1.02M | -535.00K | -63.00K | -2.18M | -978.00K | 67.00K |

| Income Before Tax | -43.69M | -24.12M | -51.11M | -51.83M | -22.79M | -35.46M | -17.42M | -1.51M | 1.07M | 393.00K | 333.00K | -11.30M | -10.20M |

| Income Before Tax Ratio | -14.21% | -9.35% | -26.86% | -37.31% | -14.91% | -28.92% | -13.90% | -1.34% | 1.36% | 0.62% | 0.60% | -35.52% | -49.01% |

| Income Tax Expense | -322.00K | 184.00K | 153.00K | 89.00K | 198.00K | -233.00K | -97.00K | 168.00K | 166.00K | 96.00K | 98.00K | 90.00K | -50.00K |

| Net Income | -43.37M | -24.30M | -51.26M | -51.92M | -22.99M | -35.23M | -17.32M | -1.67M | 900.00K | 297.00K | -11.07M | -11.39M | -9.86M |

| Net Income Ratio | -14.10% | -9.43% | -26.94% | -37.38% | -15.04% | -28.73% | -13.82% | -1.49% | 1.15% | 0.47% | -19.94% | -35.81% | -47.37% |

| EPS | -1.62 | -0.95 | -2.12 | -2.28 | -1.05 | -1.65 | -0.84 | -0.16 | -0.81 | -0.86 | -3.52 | -0.89 | -0.77 |

| EPS Diluted | -1.62 | -0.95 | -2.12 | -2.28 | -1.05 | -1.65 | -0.84 | -0.16 | -0.81 | -0.86 | -3.52 | -0.89 | -0.77 |

| Weighted Avg Shares Out | 26.75M | 25.54M | 24.18M | 22.82M | 21.85M | 21.33M | 20.68M | 10.78M | 12.79M | 12.79M | 3.14M | 12.79M | 12.79M |

| Weighted Avg Shares Out (Dil) | 26.75M | 25.54M | 24.18M | 22.82M | 21.85M | 21.33M | 20.68M | 10.78M | 12.79M | 12.79M | 3.14M | 12.79M | 12.79M |

Why Impinj Stock Popped Today

Impinj Announces Preliminary Fourth-Quarter 2023 Revenue and Adjusted EBITDA Ahead of Participation at 26th Annual Needham Growth Conference

See Which Inside Buyers Are Scooping Up More Shares Now

Why Impinj Stock Soared 34% Higher This Morning

Why Impinj Stock Soared This Week

Impinj, Inc. (PI) Q3 2023 Earnings Call Transcript

Impinj (PI) Reports Break-Even Earnings for Q3

Impinj Reports Third Quarter 2023 Financial Results

Impinj to Announce Third-Quarter 2023 Financial Results

3 Semiconductor Stocks to Sell While You Still Can

Source: https://incomestatements.info

Category: Stock Reports