See more : Technology One Limited (TNE.AX) Income Statement Analysis – Financial Results

Complete financial analysis of Polarean Imaging plc (PLLWF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Polarean Imaging plc, a leading company in the Medical – Devices industry within the Healthcare sector.

- James Halstead plc (JHD.L) Income Statement Analysis – Financial Results

- Sabina Public Company Limited (SABINA-R.BK) Income Statement Analysis – Financial Results

- Lithium Plus Minerals Ltd (LPM.AX) Income Statement Analysis – Financial Results

- Halfords Group plc (HLFDF) Income Statement Analysis – Financial Results

- Electronic Servitor Publication Network, Inc. (XESP) Income Statement Analysis – Financial Results

Polarean Imaging plc (PLLWF)

About Polarean Imaging plc

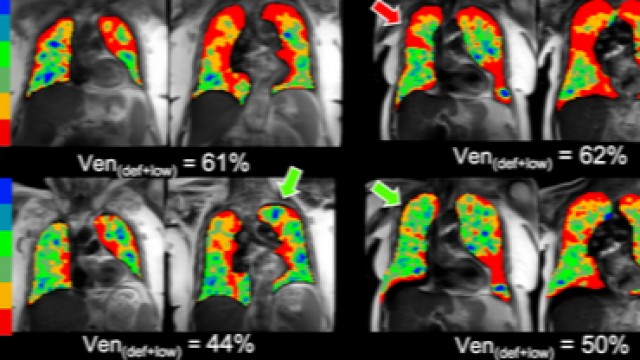

Polarean Imaging plc operates as a medical drug-device combination company serving the medical imaging market in the United States, Canada, Germany, and the United Kingdom. The company engages in the development and commercialization of gas polarizer devices and ancillary instruments. It develops equipment that enables existing magnetic resonance imaging (MRI) systems to achieve a level of pulmonary functional imaging and specializes in the use of hyperpolarized xenon gas (129Xe) as an imaging agent to visualize ventilation and gas exchange regionally in the smallest airways of the lungs, the tissue barrier between the lung and the bloodstream, and in the pulmonary vasculature; and a novel diagnostic approach. The company is also involved in the development and manufacture of MRI radiofrequency coils, which are required components for imaging 129Xe in the MRI system. Polarean Imaging plc was incorporated in 2016 and is based in Durham, North Carolina.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 890.93K | 1.03M | 1.19M | 1.06M | 2.30M | 2.44M | 1.24M | 880.65K | 902.34K | 965.43K |

| Cost of Revenue | 555.45K | 684.73K | 677.40K | 346.30K | 925.61K | 633.46K | 297.22K | 488.89K | 308.56K | 168.03K |

| Gross Profit | 335.48K | 348.28K | 508.03K | 710.47K | 1.38M | 1.81M | 939.95K | 391.76K | 593.78K | 797.40K |

| Gross Profit Ratio | 37.66% | 33.71% | 42.86% | 67.23% | 59.78% | 74.03% | 75.98% | 44.49% | 65.80% | 82.60% |

| Research & Development | 4.19M | 607.76K | 638.59K | 480.89K | 161.31K | 642.46K | 176.11K | 145.44K | 162.98K | 269.83K |

| General & Administrative | 3.34M | 8.46M | 6.52M | 5.05M | 6.01M | 6.16M | 4.05M | 1.28M | 1.19M | 769.96K |

| Selling & Marketing | 3.56M | 3.31M | 5.56M | 917.78K | 324.79K | 31.77K | 28.75K | 35.24K | 25.39K | 86.41K |

| SG&A | 6.90M | 11.78M | 12.08M | 5.97M | 6.33M | 6.19M | 4.08M | 1.32M | 1.21M | 856.37K |

| Other Expenses | 1.80M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 12.89M | 14.02M | 14.82M | 7.33M | 7.39M | 7.07M | 4.86M | 1.45M | 1.51M | 869.11K |

| Cost & Expenses | 13.45M | 14.70M | 15.50M | 7.67M | 8.31M | 7.71M | 5.16M | 1.94M | 1.81M | 1.04M |

| Interest Income | 759.00 | 35.05K | 2.59K | 100.77K | 508.00 | 184.00 | 129.00 | 147.00 | 159.31K | 37.69K |

| Interest Expense | 15.99K | 23.76K | 20.74K | 19.73K | 91.68K | 188.06K | 34.06K | 4.32K | 0.00 | 0.00 |

| Depreciation & Amortization | 959.78K | 1.02M | 918.40K | 942.62K | 775.69K | 598.87K | 387.84K | 9.35K | 9.99K | 12.74K |

| EBITDA | -11.19M | -12.78M | -13.38M | -5.73M | -5.26M | -4.64M | -3.55M | -1.05M | -617.40K | -58.97K |

| EBITDA Ratio | -1,256.55% | -1,243.32% | -1,128.88% | -532.81% | -228.79% | -190.22% | -287.32% | -118.80% | -68.42% | -6.11% |

| Operating Income | -12.56M | -13.67M | -14.32M | -6.62M | -6.01M | -5.27M | -3.92M | -1.06M | -627.39K | -71.71K |

| Operating Income Ratio | -1,409.33% | -1,323.38% | -1,207.70% | -626.02% | -261.27% | -215.93% | -317.17% | -119.86% | -69.53% | -7.43% |

| Total Other Income/Expenses | 671.36K | -235.03K | 300.44K | 81.04K | -91.17K | -187.87K | -33.93K | -4.17K | -159.31K | -37.69K |

| Income Before Tax | -11.88M | -13.91M | -14.02M | -6.53M | -6.10M | -5.45M | -3.96M | -1.06M | -1.07M | -109.40K |

| Income Before Tax Ratio | -1,333.97% | -1,346.13% | -1,182.36% | -618.35% | -265.24% | -223.63% | -319.91% | -120.33% | -118.66% | -11.33% |

| Income Tax Expense | 0.00 | -211.26K | 1.00 | 100.77K | 508.00 | 465.85K | -18.62K | 0.00 | 0.00 | 0.00 |

| Net Income | -11.88M | -13.91M | -14.02M | -6.53M | -6.10M | -5.45M | -3.96M | -1.06M | -1.07M | -109.40K |

| Net Income Ratio | -1,333.97% | -1,346.13% | -1,182.36% | -618.35% | -265.24% | -223.63% | -319.91% | -120.33% | -118.66% | -11.33% |

| EPS | -0.06 | -0.07 | -0.07 | -0.04 | -0.06 | -0.08 | -0.14 | -0.99 | -1.49 | -0.17 |

| EPS Diluted | -0.06 | -0.07 | -0.07 | -0.04 | -0.06 | -0.08 | -0.14 | -0.99 | -1.49 | -0.17 |

| Weighted Avg Shares Out | 214.28M | 211.95M | 196.96M | 150.21M | 107.20M | 69.94M | 28.46M | 1.07M | 717.11K | 627.93K |

| Weighted Avg Shares Out (Dil) | 214.28M | 211.95M | 196.96M | 150.21M | 107.20M | 69.94M | 28.46M | 1.07M | 717.11K | 627.92K |

Polarean Imaging's CEO discusses new partnership and growth strategies

Polarean Imaging hails new polariser order from top US academic medical unit

Polarean Imaging partners up to enhance potential of Xenon 129 MRI technology

Polarean Imaging new CEO sets out new sales initiatives, extends cash runway

Plarean Imaging says Medicare code in line with expectations

Polarean Imaging up 8% as US grant reimbursement code

Polarean Imaging MRI technology granted billing code for healthcare providers

Polarean hits another key milestone with University of Missouri upgrade

Polarean Imaging appoints new CEO as Hullihen prepares to retire

Polarean Imaging and electrical giant Phillps in lung imaging collaboration

Source: https://incomestatements.info

Category: Stock Reports