See more : Greencity Acquisition Corporation (GRCYU) Income Statement Analysis – Financial Results

Complete financial analysis of PolyMet Mining Corp. (PLM) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of PolyMet Mining Corp., a leading company in the Industrial Materials industry within the Basic Materials sector.

- Ashirwad Steels & Industries Limited (ASHSI.BO) Income Statement Analysis – Financial Results

- Arima Communications Corp. (8101.TW) Income Statement Analysis – Financial Results

- Goldrea Resources Corp. (GORAF) Income Statement Analysis – Financial Results

- Sports Gear Co., Ltd. (6768.TW) Income Statement Analysis – Financial Results

- Imprimerie Chirat Société Anonyme (MLIMP.PA) Income Statement Analysis – Financial Results

PolyMet Mining Corp. (PLM)

About PolyMet Mining Corp.

PolyMet Mining Corp., through its subsidiary, Poly Met Mining, Inc., engages in the exploration and development of natural resource properties. Its primary mineral property is the NorthMet project, a polymetallic project that hosts copper, nickel, cobalt, gold, silver, and platinum group metal mineralization covering an area of approximately 4,300 acres located in northeastern Minnesota, the United States. The company was formerly known as Fleck Resources Ltd. and changed its name to PolyMet Mining Corp. in June 1998. PolyMet Mining Corp. was incorporated in 1981 and is headquartered in Saint Paul, Minnesota. PolyMet Mining Corp. operates as a subsidiary of Glencore AG.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 172.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.33 | 69.12K | 66.19K | 68.67K |

| Cost of Revenue | 243.00K | 257.00K | 224.00K | 122.00K | 130.00K | 0.00 | 18.00K | 32.00K | 32.00K | 26.00K | 38.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | -243.00K | -257.00K | -224.00K | -122.00K | -130.00K | 0.00 | -18.00K | -32.00K | -32.00K | 146.00K | -38.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.33 | 69.12K | 66.19K | 68.67K |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 84.88% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 8.69M | 9.58M | 9.04M | 7.75M | 6.94M | 2.99K | 6.58M | 5.48M | 5.46M | 6.63M | 5.87M | 2.71M | 2.29M | 8.72M | 3.35M | 4.34M | 8.97M | 5.17M | 2.22M | 288.05K | 310.87K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.41K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 8.69M | 9.58M | 9.04M | 7.75M | 6.94M | 5.40K | 6.58M | 5.48M | 5.46M | 6.63M | 5.87M | 2.71M | 2.29M | 8.72M | 3.35M | 4.34M | 8.97M | 5.17M | 2.22M | 288.05K | 310.87K | 600.53K | 740.18K | 967.72K | 728.09K | 206.00K |

| Other Expenses | 5.93M | 4.90M | 12.89M | 2.07M | 1.80M | 0.00 | 1.47M | 1.66M | 1.64M | 1.52M | 792.00K | 656.00K | 607.00K | 439.00K | 31.00K | 56.00K | 8.85M | 11.12M | 1.62M | 91.90K | 117.92K | 20.52K | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 14.62M | 14.49M | 21.94M | 9.82M | 8.74M | 11.13K | 8.04M | 7.14M | 7.10M | 8.15M | 6.66M | 3.37M | 2.90M | 9.16M | 3.38M | 4.40M | 17.82M | 16.30M | 3.85M | 379.95K | 428.79K | 621.05K | 756.51K | 967.72K | 728.09K | 206.00K |

| Cost & Expenses | 14.86M | 14.74M | 22.16M | 9.94M | 8.87M | 11.13K | 8.06M | 7.17M | 7.13M | 8.18M | 6.70M | 3.37M | 2.90M | 9.16M | 3.38M | 4.40M | 17.82M | 16.30M | 3.85M | 379.95K | 428.79K | 621.05K | 756.51K | 967.72K | 728.09K | 206.00K |

| Interest Income | 98.00K | 10.00K | 1.55M | 218.00K | 273.00K | 114.55 | 54.00K | 21.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 428.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 10.56M | 3.70M | 1.96M | 160.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 351.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | -7.49M | -1.67M | -38.99M | 122.00K | 130.00K | 1.94K | 18.00K | 32.00K | 32.00K | 26.00K | 38.00K | 31.00K | 31.00K | 31.00K | 31.00K | 56.00K | 510.00K | 4.22K | 1.71K | 275.00 | 6.32K | 20.52K | 16.32K | 0.00 | 0.00 | 0.00 |

| EBITDA | -11.49M | -14.48M | -18.47M | -12.25M | -5.57M | -5.40K | -9.23M | -3.74M | -4.01M | 0.00 | -5.02M | -3.34M | 2.88M | -9.26M | -3.29M | -3.88M | -17.31M | -16.52M | -3.91M | -613.20K | -395.00K | -646.01K | -815.71K | -691.23K | -661.90K | -68.67K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -4,699.42% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -61,141,542.87% | -1,000.00% | -1,000.00% | -100.00% |

| Operating Income | -12.90M | -12.81M | 20.08M | -12.37M | -13.52M | -7.34K | -9.24M | -7.49M | -7.12M | -8.11M | -6.74M | -3.37M | 2.85M | -9.29M | -3.33M | -3.94M | -17.82M | -16.52M | -3.92M | -613.47K | -401.32K | -666.53K | -832.03K | -691.23K | -661.90K | -68.67K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -4,714.53% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -62,364,961.88% | -1,000.00% | -1,000.00% | -100.00% |

| Total Other Income/Expenses | -19.91M | -2.11M | -51.00K | -47.96M | -7.55M | -3.68K | 15.00K | -1.85M | -159.00K | -2.11M | 118.00K | -333.00K | -11.53M | 130.00K | 1.31M | -459.00K | -503.00K | 221.46K | 68.27K | 233.52K | -27.48K | 45.48K | 75.52K | -207.37K | 0.00 | -68.67K |

| Income Before Tax | -33.60M | -15.57M | -20.83M | -57.90M | -15.04M | -11.02K | -9.23M | -9.35M | -7.28M | -8.13M | -6.63M | -3.70M | -8.67M | -9.16M | -2.02M | -4.40M | -18.32M | -16.30M | -3.85M | -379.95K | -428.79K | -621.05K | -756.51K | -898.60K | 0.00 | -137.34K |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -4,727.91% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -56,704,044.27% | -1,300.00% | 0.00% | -200.00% |

| Income Tax Expense | 492.00K | 3.73M | 1.99M | -1.81M | -4.07M | 0.00 | 22.00K | 32.00K | 188.00K | 10.00K | -15.00K | -657.00K | -1.39M | -135.00K | 2.52M | -709.00K | 75.00K | -369.49K | -70.50K | -233.14K | 42.89K | -71.45K | -145.58K | 207.37K | 728.09K | 137.33K |

| Net Income | -34.09M | -19.30M | -22.82M | -56.10M | -10.97M | -11.02K | -9.25M | -9.38M | -7.46M | -8.14M | -6.61M | -3.05M | -7.28M | -9.02M | -4.54M | -3.69M | -18.40M | -15.93M | -3.78M | -146.81K | -471.68K | -549.60K | -610.93K | -1.11M | -728.09K | -274.67K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -4,733.72% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -45,792,389.05% | -1,600.00% | -1,100.00% | -400.00% |

| EPS | -0.31 | -0.18 | -0.21 | -0.77 | -0.32 | -0.35 | -0.28 | -0.29 | -0.23 | -0.30 | -0.32 | -0.14 | -0.36 | -0.48 | -0.24 | -0.20 | -1.18 | -1.60 | -0.54 | -0.03 | -0.11 | -0.13 | -0.17 | -0.36 | -0.39 | -0.20 |

| EPS Diluted | -0.31 | -0.18 | -0.21 | -0.77 | -0.32 | -0.35 | -0.28 | -0.29 | -0.23 | -0.30 | -0.32 | -0.14 | -0.36 | -0.48 | -0.24 | -0.20 | -1.18 | -1.60 | -0.54 | -0.03 | -0.11 | -0.13 | -0.17 | -0.35 | -0.39 | -0.20 |

| Weighted Avg Shares Out | 109.93M | 109.29M | 109.06M | 72.82M | 34.72M | 31.89K | 33.50M | 32.09M | 31.96M | 27.39M | 20.74M | 21.83M | 20.25M | 18.89M | 18.59M | 18.11M | 15.55M | 9.96M | 7.04M | 4.40M | 4.42M | 4.33M | 3.66M | 3.08M | 1.86M | 1.35M |

| Weighted Avg Shares Out (Dil) | 109.93M | 109.29M | 109.06M | 72.82M | 34.72M | 31.89K | 33.50M | 32.09M | 31.96M | 27.39M | 20.74M | 21.83M | 20.25M | 18.89M | 18.59M | 18.11M | 15.55M | 9.96M | 7.04M | 4.80M | 4.42M | 4.33M | 3.66M | 3.16M | 1.86M | 1.35M |

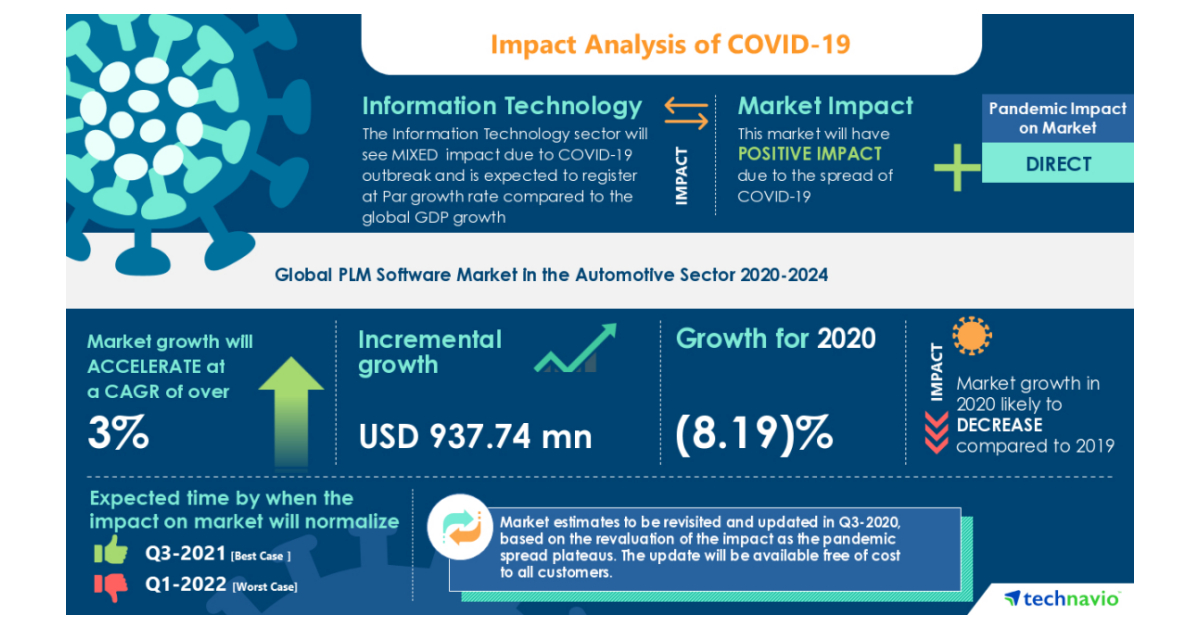

PLM Software Market in the Automotive Sector- Roadmap for Recovery from COVID-19 | Rise in IoT Integration to boost the Market Growth | Technavio

Source: https://incomestatements.info

Category: Stock Reports