See more : ZIOPHARM Oncology, Inc. (ZIOP) Income Statement Analysis – Financial Results

Complete financial analysis of Polished.com Inc. (POL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Polished.com Inc., a leading company in the Specialty Retail industry within the Consumer Cyclical sector.

- Public Joint Stock Company Krasnoyarskenergosbyt (KRSB.ME) Income Statement Analysis – Financial Results

- Golden Lime Public Company Limited (SUTHA.BK) Income Statement Analysis – Financial Results

- Groupimo S.A. (ALIMO.PA) Income Statement Analysis – Financial Results

- Golar LNG Partners LP (GMLPF) Income Statement Analysis – Financial Results

- Banimmo SA (BANI.BR) Income Statement Analysis – Financial Results

Polished.com Inc. (POL)

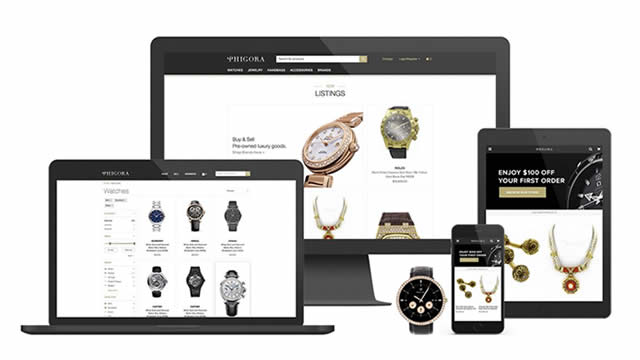

About Polished.com Inc.

Polished.com Inc. operates an e-commerce platform for appliances, furniture, and home goods in the United States. The company offers household appliances, including refrigerators, ranges, ovens, dishwashers, microwaves, freezers, washers, and dryers. It also sells furniture, décor, bed and bath, lighting, outdoor living, electronics, fitness equipment, plumbing fixtures, air conditioners, fireplaces, fans, dehumidifiers, humidifiers, air purifiers, and televisions. In addition, the company provides appliance installation services and old appliance removal services. The company was formerly known as 1847 Goedeker Inc. and changed its name to Polished.com Inc. in July 2022. Polished.com Inc. was founded in 1951 and is headquartered in Brooklyn, New York.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| Revenue | 534.47M | 362.31M | 55.13M | 47.62M | 56.31M |

| Cost of Revenue | 444.96M | 282.66M | 47.88M | 43.71M | 45.41M |

| Gross Profit | 89.52M | 79.66M | 7.26M | 3.91M | 10.90M |

| Gross Profit Ratio | 16.75% | 21.99% | 13.16% | 8.21% | 19.35% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 53.03M | 36.92M | 14.47M | 5.18M | 4.96M |

| Selling & Marketing | 25.46M | 11.96M | 4.87M | 2.71M | 2.64M |

| SG&A | 78.49M | 48.88M | 19.33M | 7.89M | 7.60M |

| Other Expenses | -2.55M | 7.99M | 549.71K | 0.00 | 37.05K |

| Operating Expenses | 89.94M | 56.88M | 19.88M | 7.89M | 7.64M |

| Cost & Expenses | 534.90M | 339.53M | 67.76M | 51.60M | 53.05M |

| Interest Income | 518.00K | 95.00K | 2.48K | 23.81K | 79.08K |

| Interest Expense | 3.94M | 3.20M | 1.63M | 2.51M | 149.00 |

| Depreciation & Amortization | 11.46M | 7.35M | -1.37M | 280.71K | 39.64K |

| EBITDA | -9.78M | 15.40M | -12.08M | -3.70M | 2.05M |

| EBITDA Ratio | -1.83% | 4.32% | -25.38% | -7.77% | 3.63% |

| Operating Income | -128.34M | 8.32M | -12.63M | -3.98M | 1.89M |

| Operating Income Ratio | -24.01% | 2.30% | -22.90% | -8.36% | 3.36% |

| Total Other Income/Expenses | -133.95M | -5.03M | -8.24M | -2.32M | 115.99K |

| Income Before Tax | -134.37M | 3.29M | -20.87M | -6.30M | 2.01M |

| Income Before Tax Ratio | -25.14% | 0.91% | -37.85% | -13.23% | 3.56% |

| Income Tax Expense | -8.41M | -4.38M | 698.30K | -698.30K | 37.20K |

| Net Income | -125.97M | 7.67M | -21.57M | -5.60M | 2.01M |

| Net Income Ratio | -23.57% | 2.12% | -39.12% | -11.77% | 3.56% |

| EPS | -59.17 | 5.94 | -197.38 | -58.98 | 0.00 |

| EPS Diluted | -59.17 | 5.94 | -197.38 | -58.98 | 0.00 |

| Weighted Avg Shares Out | 2.13M | 1.29M | 109.21K | 95.00K | 0.00 |

| Weighted Avg Shares Out (Dil) | 2.13M | 1.29M | 109.27K | 95.00K | 0.00 |

3 Ways To Beat The Tax Man: Amplify Energy, Pro-Dex And 1847 Goedeker

7 Small-Cap Stocks to Buy From the Beat-Up Bargain Bin

1847 Goedeker: In The Early Stage Of Growth And Transformation

Best Penny Stocks to Watch As September Comes to an End

Hot Penny Stocks to Buy Now? 3 to Watch For a Market Rebound

Why These Penny Stocks Are on Traders Watchlists in September

1847 Goedeker Issues Statement Regarding Director Candidate Nominations From Kanen Wealth Management

Top Penny Stocks to Buy In a Down Market? 3 For Your List

Trending Penny Stocks You Need to Know About Before Next Week

1847 Goedeker Appoints Albert Fouerti As CEO

Source: https://incomestatements.info

Category: Stock Reports