See more : Pharma Mar, S.A. (PHMMF) Income Statement Analysis – Financial Results

Complete financial analysis of Power Solutions International, Inc. (PSIX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Power Solutions International, Inc., a leading company in the Industrial – Machinery industry within the Industrials sector.

- Ignyte Acquisition Corp. (IGNY) Income Statement Analysis – Financial Results

- Portillo’s Inc. (PTLO) Income Statement Analysis – Financial Results

- China Oriental Group Company Limited (0581.HK) Income Statement Analysis – Financial Results

- TraWell Co S.p.A. (TWL.MI) Income Statement Analysis – Financial Results

- Ceres Power Holdings plc (CRPHY) Income Statement Analysis – Financial Results

Power Solutions International, Inc. (PSIX)

About Power Solutions International, Inc.

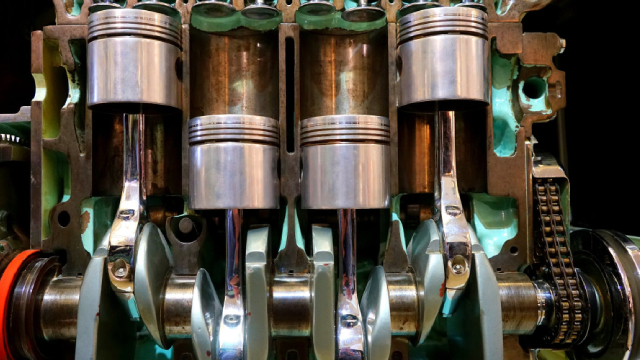

Power Solutions International, Inc. designs, engineers, manufactures, markets, and sells engines and power systems in the United States, North America, the Pacific Rim, Europe, and internationally. The company offers alternative-fueled power systems for original equipment manufacturers of off-highway industrial equipment and on-road vehicles; and large custom-engineered integrated electrical power generation systems. It also provides basic engine blocks integrated with fuel system parts, as well as complete packaged power systems, including combined front accessory drives, cooling systems, electronic systems, air intake systems, fuel systems, housings, power takeoff systems, exhaust systems, hydraulic systems, enclosures, brackets, hoses, tubes, packaging, telematics, and other assembled components. In addition, the company offers compression and spark-ignited internal combustion engines that run on various fuels, such as natural gas, propane, gasoline, diesel, and biofuels in the energy, industrial, and transportation markets. Further, it provides standby and prime power generation, demand response, microgrid, renewable energy resiliency, arbor equipment, and combined heat and power; forklifts, wood chippers, stump grinders, sweepers/industrial scrubbers, aerial lift platforms/scissor lifts, irrigation pumps, oil and gas compression, oil lifts, off road utility vehicles, ground support equipment, ice resurfacing equipment, and pump jacks; and light and medium duty vocational trucks and vans, school and transit buses, and terminal and utility tractors. The company has a strategic collaboration agreement with Weichai Power Co., Ltd. Power Solutions International, Inc. was founded in 1985 and is headquartered in Wood Dale, Illinois.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 458.97M | 481.33M | 456.26M | 417.64M | 546.08M | 496.04M | 416.62M | 339.47M | 389.45M | 348.00M | 237.84M | 202.34M | 154.97M | 77.54K | 98.36K | 114.39K | 84.93K | 80.66K | 70.13K | 84.21K |

| Cost of Revenue | 353.11M | 392.77M | 414.98M | 359.19M | 446.19M | 437.27M | 365.62M | 310.28M | 326.61M | 280.95M | 193.32M | 168.43M | 128.54M | 14.98K | 14.49K | 15.00K | 39.20K | 63.97K | 0.00 | 0.00 |

| Gross Profit | 105.86M | 88.56M | 41.27M | 58.45M | 99.89M | 58.77M | 50.99M | 29.19M | 62.83M | 67.05M | 44.53M | 33.92M | 26.43M | 62.56K | 83.87K | 99.39K | 45.73K | 16.69K | 70.13K | 84.21K |

| Gross Profit Ratio | 23.07% | 18.40% | 9.05% | 13.99% | 18.29% | 11.85% | 12.24% | 8.60% | 16.13% | 19.27% | 18.72% | 16.76% | 17.05% | 80.69% | 85.27% | 86.89% | 53.85% | 20.70% | 100.00% | 100.00% |

| Research & Development | 19.46M | 18.90M | 22.44M | 25.38M | 24.93M | 28.60M | 19.94M | 18.96M | 21.68M | 16.90M | 10.44M | 7.38M | 4.71M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 15.72M | 14.39M | 11.58M | 8.30M | 5.24M | 100.89K | 100.22K | 132.75K | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 59.63M | 44.26M | 28.52M | 11.66M | 9.72M | 7.55M | 5.93M | 6.67M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 40.39M | 42.94M | 57.87M | 51.74M | 54.11M | 59.63M | 44.26M | 28.52M | 27.38M | 24.10M | 19.12M | 14.22M | 11.91M | 100.89K | 100.22K | 132.75K | 150.65K | 110.80K | 125.75K | 151.16K |

| Other Expenses | 1.75M | 2.12M | 2.54M | 3.05M | 3.64M | 176.00K | -2.36M | -359.00K | -229.00K | -183.00K | -10.00K | -448.00K | 0.00 | 2.68K | 4.07K | 5.81K | 6.29K | 12.37K | 11.12K | 9.02K |

| Operating Expenses | 61.59M | 63.96M | 82.84M | 80.17M | 82.68M | 93.24M | 69.04M | 53.20M | 53.64M | 41.00M | 29.56M | 21.60M | 16.62M | 103.57K | 104.29K | 138.56K | 156.94K | 123.16K | 136.87K | 160.18K |

| Cost & Expenses | 414.70M | 456.73M | 497.83M | 439.36M | 528.87M | 530.51M | 434.66M | 363.48M | 380.25M | 321.95M | 222.88M | 190.03M | 145.16M | 103.57K | 104.29K | 138.56K | 196.13K | 187.13K | 136.87K | 160.18K |

| Interest Income | 0.00 | 13.03M | 7.31M | 5.71M | 7.87M | 0.00 | 0.00 | 0.00 | 7.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 25.00 | 98.00 | 54.00 |

| Interest Expense | 17.07M | 13.03M | 7.31M | 5.71M | 7.87M | 7.63M | 10.84M | 11.22M | 4.33M | 1.33M | 657.00K | 1.02M | 1.34M | 2.13M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 5.60M | 6.69M | 7.41M | 8.20M | 8.80M | 10.20M | 9.47M | 10.30M | 9.67M | 4.71M | 1.57M | 1.11M | 820.00K | 2.68K | 4.07K | 5.81K | 6.29K | 12.37K | 11.12K | 9.02K |

| EBITDA | 49.88M | 31.29M | -34.17M | -12.78M | 28.00M | -36.73M | -26.86M | -14.35M | 1.04M | 40.58M | -11.78M | 12.97M | 8.99M | 5.05M | -5.93K | -18.37K | -104.92K | -97.41K | -55.62K | -66.95K |

| EBITDA Ratio | 10.87% | 6.50% | -7.49% | -2.94% | 4.89% | -4.86% | -2.62% | -4.15% | 4.79% | 8.78% | 6.95% | 6.41% | 6.86% | -31.31% | -27.31% | -16.06% | -130.13% | -112.54% | -104.75% | -69.37% |

| Operating Income | 44.28M | 24.60M | -41.57M | -21.72M | 17.20M | -36.71M | -18.05M | -25.34M | 9.20M | 26.04M | 14.97M | 12.32M | 9.81M | -26.03K | -5.93K | -24.18K | -111.21K | -106.47K | -66.73K | -75.97K |

| Operating Income Ratio | 9.65% | 5.11% | -9.11% | -5.20% | 3.15% | -7.40% | -4.33% | -7.46% | 2.36% | 7.48% | 6.29% | 6.09% | 6.33% | -33.57% | -6.03% | -21.14% | -130.94% | -132.00% | -95.15% | -90.21% |

| Total Other Income/Expenses | -17.07M | -13.03M | -7.31M | -4.97M | -8.55M | -17.85M | -29.12M | -10.52M | 3.63M | 8.50M | -28.97M | -1.47M | -2.97M | 919.00 | 25.00K | 0.00 | 5.60K | -3.30K | 17.95K | -8.48K |

| Income Before Tax | 27.21M | 11.57M | -48.88M | -26.70M | 8.66M | -54.56M | -47.17M | -35.86M | 13.89M | 34.54M | -14.00M | 10.85M | 6.83M | -25.11K | 19.07K | -24.18K | -105.61K | -109.77K | -48.79K | -84.45K |

| Income Before Tax Ratio | 5.93% | 2.40% | -10.71% | -6.39% | 1.59% | -11.00% | -11.32% | -10.56% | 3.57% | 9.93% | -5.89% | 5.36% | 4.41% | -32.39% | 19.39% | -21.14% | -124.35% | -136.09% | -69.56% | -100.28% |

| Income Tax Expense | 900.00K | 304.00K | -406.00K | -3.71M | 409.00K | 169.00K | 443.00K | 11.61M | -388.00K | 10.81M | 4.76M | 4.14M | 2.77M | 800.00 | 800.00 | 800.00 | 800.00 | -3.20K | 800.00 | -57.91K |

| Net Income | 26.31M | 11.27M | -48.47M | -22.98M | 8.25M | -54.73M | -47.61M | -47.47M | 14.28M | 23.73M | -18.76M | 6.70M | 4.06M | -25.91K | 18.27K | -24.98K | -106.41K | -106.57K | -49.59K | -26.54K |

| Net Income Ratio | 5.73% | 2.34% | -10.62% | -5.50% | 1.51% | -11.03% | -11.43% | -13.98% | 3.67% | 6.82% | -7.89% | 3.31% | 2.62% | -33.42% | 18.58% | -21.84% | -125.29% | -132.12% | -70.70% | -31.51% |

| EPS | 1.15 | 0.49 | -2.12 | -1.00 | 0.38 | -2.94 | -3.45 | -4.47 | -0.27 | 2.01 | -1.92 | 0.74 | 0.44 | -0.08 | 0.16 | -0.21 | -0.90 | -0.90 | -0.42 | -0.23 |

| EPS Diluted | 1.15 | 0.49 | -2.12 | -1.00 | 0.38 | -2.94 | -3.45 | -4.34 | -1.11 | 1.38 | -1.92 | 0.74 | 0.44 | -0.08 | 0.16 | -0.21 | -0.90 | -0.90 | -0.42 | -0.23 |

| Weighted Avg Shares Out | 22.96M | 22.94M | 22.91M | 22.87M | 21.51M | 18.59M | 13.79M | 10.62M | 10.81M | 10.71M | 9.77M | 9.07M | 3.51M | 312.50K | 117.82K | 117.82K | 117.82K | 117.82K | 117.82K | 117.82K |

| Weighted Avg Shares Out (Dil) | 22.97M | 22.95M | 22.91M | 22.87M | 21.53M | 18.59M | 13.79M | 10.93M | 10.99M | 11.13M | 9.78M | 9.07M | 3.51M | 312.50K | 117.82K | 117.82K | 117.82K | 117.82K | 117.82K | 117.82K |

Four Growth Stocks For The Fourth Industrial Revolution

Power Solutions International to Participate in the 15th Annual Craig-Hallum Alpha Select Conference

Power Solutions: A Hidden Gem From SA Quant

Power Solutions International Announces Third Quarter 2024 Financial Results

Power Solutions International's Products Featured at TCI 2024

Power Solutions: 10x Run Is More Than Just Shareholder Excitement

Power Solutions Stock: Buy This Heavy Dip

Power Solutions International to attend The Battery Show in Detroit, October 7-10

Power Solutions: The Rally May Be In Its Early Innings

Power Solutions International: A Company With Great Potential Set To Continue Growth Further

Source: https://incomestatements.info

Category: Stock Reports