See more : Allied Healthcare Products, Inc. (AHPI) Income Statement Analysis – Financial Results

Complete financial analysis of Peloton Interactive, Inc. (PTON) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Peloton Interactive, Inc., a leading company in the Leisure industry within the Consumer Cyclical sector.

- Chengdu CORPRO Technology Co., Ltd. (300101.SZ) Income Statement Analysis – Financial Results

- Dragon Capital Group, Corp. (DRGV) Income Statement Analysis – Financial Results

- Vantage Drilling International (VTDRF) Income Statement Analysis – Financial Results

- Frontier Lithium Inc. (HL2.F) Income Statement Analysis – Financial Results

- ZEAL Network SE (0QJQ.L) Income Statement Analysis – Financial Results

Peloton Interactive, Inc. (PTON)

About Peloton Interactive, Inc.

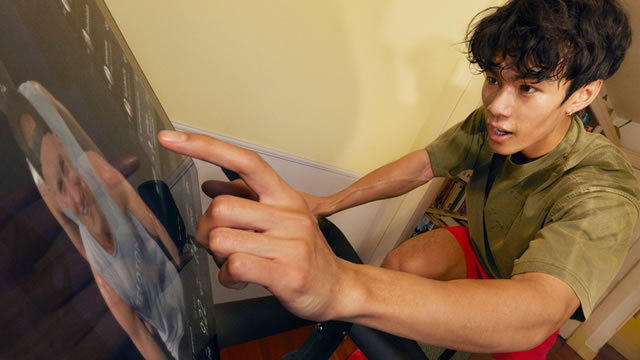

Peloton Interactive, Inc. provides interactive fitness products in North America and internationally. It offers connected fitness products with touchscreen that streams live and on-demand classes under the Peloton Bike, Peloton Bike+, Peloton Tread, and Peloton Tread+ names. The company also provides connected fitness subscriptions for various household users, and access to various live and on-demand classes, as well as Peloton Digital app for connected fitness subscribers to provide access to its classes. As of June 30, 2021, it had approximately 5.9 million members. The company markets and sells its interactive fitness products directly through its retail showrooms and at onepeloton.com. Peloton Interactive, Inc. was founded in 2012 and is headquartered in New York, New York.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 2.70B | 2.80B | 3.58B | 4.02B | 1.83B | 915.00M | 435.00M | 218.60M |

| Cost of Revenue | 1.49B | 1.88B | 2.88B | 2.57B | 989.10M | 531.40M | 245.40M | 144.70M |

| Gross Profit | 1.21B | 923.60M | 698.40M | 1.45B | 836.80M | 383.60M | 189.60M | 73.90M |

| Gross Profit Ratio | 44.68% | 32.98% | 19.50% | 36.10% | 45.83% | 41.92% | 43.59% | 33.81% |

| Research & Development | 304.80M | 318.40M | 359.50M | 247.80M | 89.00M | 54.80M | 23.40M | 13.00M |

| General & Administrative | 627.30M | 798.10M | 963.40M | 662.40M | 351.60M | 207.00M | 62.40M | 45.60M |

| Selling & Marketing | 635.50M | 648.20M | 1.02B | 729.70M | 477.00M | 324.00M | 151.40M | 86.00M |

| SG&A | 1.26B | 1.45B | 1.98B | 1.39B | 828.60M | 531.00M | 213.80M | 131.60M |

| Other Expenses | 167.80M | 2.90M | -1.50M | 100.00K | -3.80M | -300.00K | 0.00 | 0.00 |

| Operating Expenses | 1.74B | 1.76B | 2.34B | 1.64B | 917.60M | 585.80M | 237.20M | 144.60M |

| Cost & Expenses | 3.23B | 3.64B | 5.23B | 4.21B | 1.91B | 1.12B | 482.60M | 289.30M |

| Interest Income | 35.10M | 26.40M | 2.30M | 7.90M | 16.20M | 7.00M | 0.00 | 0.00 |

| Interest Expense | 112.50M | 97.10M | 43.00M | 14.80M | 900.00K | 1.70M | 300.00K | 0.00 |

| Depreciation & Amortization | 108.80M | 124.30M | 235.20M | 125.30M | 87.90M | 21.70M | 6.60M | 3.70M |

| EBITDA | -330.80M | -1.04B | -2.53B | -119.60M | -26.20M | -173.80M | -40.90M | -67.00M |

| EBITDA Ratio | -12.25% | -24.56% | -41.87% | -2.89% | -2.23% | -19.73% | -9.40% | -30.65% |

| Operating Income | -529.00M | -1.20B | -1.64B | -187.90M | -80.90M | -202.20M | -47.50M | -70.70M |

| Operating Income Ratio | -19.59% | -42.75% | -45.88% | -4.67% | -4.43% | -22.10% | -10.92% | -32.34% |

| Total Other Income/Expenses | -23.10M | -60.90M | -74.10M | -10.40M | 12.30M | 6.80M | -300.00K | -400.00K |

| Income Before Tax | -552.10M | -1.26B | -2.80B | -198.20M | -68.40M | -195.60M | -47.80M | -71.10M |

| Income Before Tax Ratio | -20.44% | -44.92% | -78.09% | -4.93% | -3.75% | -21.38% | -10.99% | -32.53% |

| Income Tax Expense | -200.00K | 3.70M | 19.60M | -9.20M | 3.30M | -100.00K | 100.00K | 0.00 |

| Net Income | -551.90M | -1.26B | -2.82B | -189.00M | -71.70M | -195.50M | -47.90M | -71.10M |

| Net Income Ratio | -20.44% | -45.06% | -78.63% | -4.70% | -3.93% | -21.37% | -11.01% | -32.53% |

| EPS | -1.51 | -3.64 | -8.74 | -0.64 | -0.32 | -0.69 | -0.21 | -0.30 |

| EPS Diluted | -1.51 | -3.64 | -8.74 | -0.64 | -0.32 | -0.69 | -0.21 | -0.30 |

| Weighted Avg Shares Out | 365.55M | 346.67M | 322.37M | 293.89M | 220.95M | 285.39M | 233.55M | 233.55M |

| Weighted Avg Shares Out (Dil) | 365.55M | 346.67M | 322.37M | 293.89M | 220.95M | 285.39M | 233.55M | 233.55M |

Peloton shares gain on price target boost, rating upgrade from UBS

Peloton Stock Surges as Cost-Cutting Moves Lead To UBS Upgrade

Buy 5 High-Flying Health & Fitness Stocks of 2024 With More Upside

Peloton: Big Winner For The Holidays And 2025

3 Stocks That Never Lived Up to the Hype

3-Stock Lunch: Microsoft, Peloton & Disney

2 Former Pandemic Darlings Eyeing a Big 2025 Turnaround

Peloton Stock Skyrockets 159% in 3 Months: Is it Too Late to Buy?

What Makes Peloton (PTON) a Strong Momentum Stock: Buy Now?

Peloton: Big Cost Improvement, Decent CEO Hiring, More Upside Ahead

Source: https://incomestatements.info

Category: Stock Reports