See more : Mapletree Pan Asia Commercial Trust (MPCMF) Income Statement Analysis – Financial Results

Complete financial analysis of QinetiQ Group plc (QNTQF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of QinetiQ Group plc, a leading company in the Aerospace & Defense industry within the Industrials sector.

- Monte Carlo Fashions Limited (MONTECARLO.NS) Income Statement Analysis – Financial Results

- Hitron Technologies Inc. (2419.TW) Income Statement Analysis – Financial Results

- Salazar Resources Limited (SRLZF) Income Statement Analysis – Financial Results

- Talisker Resources Ltd. (TSKFF) Income Statement Analysis – Financial Results

- EC Healthcare (2138.HK) Income Statement Analysis – Financial Results

QinetiQ Group plc (QNTQF)

About QinetiQ Group plc

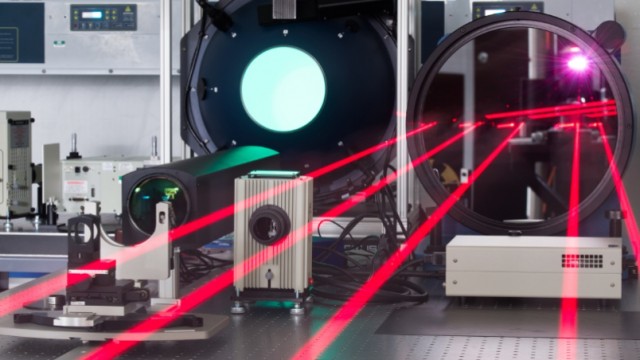

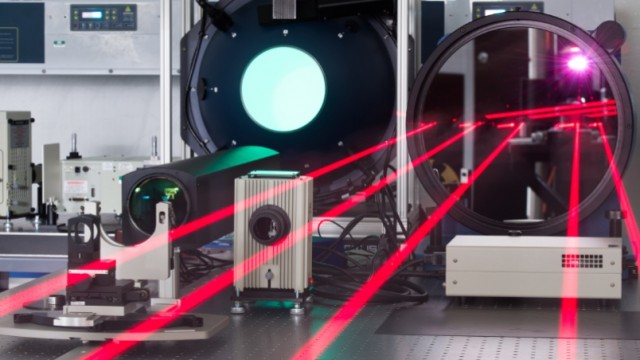

QinetiQ Group plc operates as a science and engineering company primarily in the defense, security, and infrastructure markets in the United States, Australia, Europe, and internationally. The company operates through EMEA Services and Global Products segments. It offers advanced materials and manufacturing products; artificial intelligence, analytics, and advanced computing technologies; cyber and electromagnetic technologies; human protection and performance systems; novel systems, and weapons and effects; maritime platform, and system design and assessment products; power sources, and energy storage and distribution products; robotics and autonomy services; secure communications and navigation systems; and sensing, processing, and data fusion systems. The company also provides testing and evaluation, training and simulation, and cyber and digital resilience services, as well as unmanned air, land, and surface targets. It serves defense, aviation and aerospace, energy and utility, financial services, government, law enforcement, marine, space, and telecommunications sectors. The company was founded in 2001 and is based in Farnborough, the United Kingdom.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.91B | 1.58B | 1.32B | 1.28B | 1.07B | 911.10M | 833.00M | 783.10M | 755.70M | 763.80M | 1.19B | 1.33B | 1.47B | 1.70B | 1.63B | 1.62B | 1.37B | 1.15B | 1.05B | 855.90M | 795.40M | 774.90M |

| Cost of Revenue | 1.64B | 1.10B | 904.00M | 846.40M | 663.10M | 752.60M | 690.90M | 647.00M | 630.20M | 636.90M | 653.40M | 1.13B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 230.80M | 160.00M | 149.10M | 145.20M |

| Gross Profit | 268.70M | 480.50M | 416.40M | 431.80M | 409.80M | 158.50M | 142.10M | 136.10M | 125.50M | 126.90M | 538.00M | 194.90M | 1.47B | 1.70B | 1.63B | 1.62B | 1.37B | 1.15B | 820.90M | 695.90M | 646.30M | 629.70M |

| Gross Profit Ratio | 14.05% | 30.40% | 31.54% | 33.78% | 38.20% | 17.40% | 17.06% | 17.38% | 16.61% | 16.61% | 45.16% | 14.68% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 78.05% | 81.31% | 81.25% | 81.26% |

| Research & Development | 331.70M | 328.40M | 302.10M | 300.40M | 292.30M | 300.00M | 311.60M | 307.70M | 300.80M | 307.20M | 314.90M | 336.50M | 346.30M | 395.00M | 425.60M | 468.50M | 465.90M | 520.10M | 510.30M | 502.60M | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 900.00K | 1.70M | 1.50M | 1.30M | 1.60M | 1.60M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | -256.40M | 27.20M | 15.70M | 9.20M | 9.90M | 10.00M | 30.80M | 9.20M | 9.50M | 7.60M | 7.00M | 5.80M | 5.10M | 4.10M | 200.00K | -7.20M | -4.00M | -1.20M | -400.00K | -2.50M | 12.00M | 0.00 |

| Operating Expenses | 76.20M | 328.40M | 302.10M | 300.40M | 292.30M | 35.10M | 2.30M | 4.70M | 35.70M | 19.10M | 1.08B | 1.18B | 1.11B | 1.64B | 1.57B | 1.48B | 1.25B | 1.05B | 975.00M | 848.90M | 599.60M | 592.50M |

| Cost & Expenses | 1.72B | 1.43B | 1.21B | 1.15B | 955.40M | 787.70M | 693.20M | 651.70M | 665.90M | 656.00M | 1.08B | 1.18B | 1.11B | 1.64B | 1.57B | 1.48B | 1.25B | 1.05B | 975.00M | 848.90M | 748.70M | 737.70M |

| Interest Income | 4.10M | 6.80M | 500.00K | 300.00K | 1.10M | 200.00K | 400.00K | 100.00K | 400.00K | 2.40M | 1.90M | 1.70M | 8.60M | 10.90M | 1.80M | 6.00M | 3.60M | 4.20M | 8.40M | 3.60M | 5.70M | 1.10M |

| Interest Expense | 19.50M | 13.30M | 1.90M | 2.00M | 2.00M | 2.00M | 1.00M | 900.00K | 900.00K | 4.10M | 14.60M | 17.70M | 2.40M | 6.90M | 11.50M | 15.20M | 13.50M | 16.20M | 19.00M | 5.40M | 20.20M | 5.50M |

| Depreciation & Amortization | 90.70M | 74.60M | 62.30M | 61.20M | 53.20M | 44.50M | 31.90M | 30.00M | 27.90M | 24.70M | 34.60M | 50.00M | 61.80M | 77.30M | 149.90M | 65.90M | 56.00M | 47.10M | 46.10M | 44.80M | 42.00M | 50.50M |

| EBITDA | 292.90M | 226.70M | 176.60M | 205.60M | 170.70M | 172.20M | 150.00M | 143.50M | 119.30M | 134.30M | 132.40M | -69.30M | 429.10M | 115.00M | 119.20M | 187.80M | 128.20M | 152.40M | 137.60M | 52.90M | 113.50M | 66.70M |

| EBITDA Ratio | 15.32% | 14.34% | 13.37% | 15.07% | 15.91% | 17.28% | 18.01% | 18.32% | 17.64% | 17.58% | 2.78% | -3.77% | 25.88% | 6.75% | 11.01% | 11.61% | 11.75% | 12.59% | 12.44% | 6.18% | 12.80% | 11.27% |

| Operating Income | 192.50M | 152.10M | 114.30M | 131.40M | 117.50M | 122.40M | 119.60M | 114.80M | 106.60M | 109.60M | 24.00M | -121.40M | 363.00M | 54.70M | -25.30M | 128.10M | 76.40M | 93.40M | 69.50M | 50.70M | 58.40M | 16.60M |

| Operating Income Ratio | 10.07% | 9.62% | 8.66% | 10.28% | 10.95% | 13.43% | 14.36% | 14.66% | 14.11% | 14.35% | 2.01% | -9.14% | 24.70% | 3.21% | -1.56% | 7.92% | 5.59% | 8.13% | 6.61% | 5.92% | 7.34% | 2.14% |

| Total Other Income/Expenses | -9.80M | 1.00M | -4.30M | 10.50M | 6.20M | 800.00K | 25.20M | -1.20M | 14.90M | -4.10M | -13.10M | -15.60M | -45.00M | -28.10M | -40.80M | -14.10M | -25.00M | -4.10M | 3.00M | 27.30M | -7.10M | -5.90M |

| Income Before Tax | 182.70M | 173.80M | 119.40M | 141.90M | 123.80M | 123.20M | 144.80M | 131.50M | 90.20M | 105.40M | 4.10M | -137.00M | 331.60M | 26.60M | -66.10M | 114.00M | 51.40M | 89.30M | 72.50M | 78.00M | 51.30M | 10.70M |

| Income Before Tax Ratio | 9.55% | 11.00% | 9.04% | 11.10% | 11.54% | 13.52% | 17.38% | 16.79% | 11.94% | 13.80% | 0.34% | -10.32% | 22.56% | 1.56% | -4.07% | 7.05% | 3.76% | 7.77% | 6.89% | 9.11% | 6.45% | 1.38% |

| Income Tax Expense | 43.10M | 20.20M | 29.70M | 20.70M | 16.60M | 9.30M | 6.70M | 8.20M | 8.40M | 12.00M | 16.80M | -3.80M | 73.70M | 21.60M | -2.80M | 20.40M | 4.00M | 20.30M | 12.10M | 5.70M | 10.10M | 3.60M |

| Net Income | 139.60M | 154.40M | 90.00M | 121.70M | 106.30M | 113.90M | 138.10M | 123.30M | 106.10M | 104.70M | -12.70M | -133.20M | 246.30M | 5.00M | -63.30M | 93.60M | 47.40M | 69.00M | 58.10M | 73.90M | 42.70M | 11.30M |

| Net Income Ratio | 7.30% | 9.77% | 6.82% | 9.52% | 9.91% | 12.50% | 16.58% | 15.75% | 14.04% | 13.71% | -1.07% | -10.03% | 16.76% | 0.29% | -3.89% | 5.79% | 3.47% | 6.00% | 5.52% | 8.63% | 5.37% | 1.46% |

| EPS | 0.24 | 0.27 | 0.16 | 0.21 | 0.19 | 0.20 | 0.24 | 0.21 | 0.17 | 0.19 | -0.02 | -0.21 | 0.38 | 0.01 | -0.10 | 0.14 | 0.07 | 0.11 | 0.10 | 0.12 | 0.05 | 0.02 |

| EPS Diluted | 0.24 | 0.27 | 0.16 | 0.21 | 0.19 | 0.20 | 0.24 | 0.21 | 0.17 | 0.19 | -0.02 | -0.21 | 0.38 | 0.01 | -0.10 | 0.14 | 0.07 | 0.10 | 0.10 | 0.12 | 0.05 | 0.02 |

| Weighted Avg Shares Out | 586.55M | 575.90M | 573.20M | 569.70M | 567.00M | 566.00M | 565.20M | 573.90M | 587.00M | 630.90M | 651.70M | 648.70M | 650.50M | 654.60M | 653.50M | 652.70M | 656.20M | 656.60M | 582.40M | 573.00M | 647.99M | 647.99M |

| Weighted Avg Shares Out (Dil) | 585.70M | 582.30M | 579.60M | 575.80M | 572.40M | 570.00M | 567.20M | 578.70M | 590.70M | 634.60M | 651.70M | 648.70M | 654.50M | 661.40M | 653.50M | 655.50M | 659.70M | 667.60M | 594.80M | 585.80M | 647.99M | 647.99M |

QinetiQ Group plc (QNTQF) Q2 2022 Earnings Call Transcript

Qinetiq wins more contracts with defence departments amid war in Ukraine

Wednesday's agenda: Barratt Developments to spotlight state of housing sector, Qinetiq updates

QinetiQ bags contract with US Army

QinetiQ Group plc (QNTQF) CEO Steve Wadey on Q4 2022 Results - Earnings Call Transcript

QinetiQ Group grows ‘robust' order book amid rising geopolitical uncertainty

QinetiQ still preferred to Chemring by Jefferies

QinetiQ reports 'strong' fourth quarter and expects to beat guidance for the year

QinetiQ on track to meet full-year forecast

QinetiQ looks attractive to Citi after contract problems

Source: https://incomestatements.info

Category: Stock Reports