See more : LS Networks Corporation Limited (000680.KS) Income Statement Analysis – Financial Results

Complete financial analysis of Quartz Mountain Resources Ltd. (QZMRF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Quartz Mountain Resources Ltd., a leading company in the Industrial Materials industry within the Basic Materials sector.

- Water Ways Technologies Inc. (WWT.V) Income Statement Analysis – Financial Results

- Lottery.com Inc. (LTRY) Income Statement Analysis – Financial Results

- Anghami Inc. (ANGH) Income Statement Analysis – Financial Results

- Biophytis S.A. (BPTSY) Income Statement Analysis – Financial Results

- Greencity Acquisition Corporation (GRCY) Income Statement Analysis – Financial Results

Quartz Mountain Resources Ltd. (QZMRF)

Industry: Industrial Materials

Sector: Basic Materials

About Quartz Mountain Resources Ltd.

Quartz Mountain Resources Ltd. operates as a mineral exploration company in British Columbia, Canada. The company explores for gold, silver, and copper deposits. It holds a 100% interest in Maestro property comprising ten mineral claims covering approximately 1,540 hectares located near Houston, British Columbia. It also has a mineral claims purchase agreement with United Mineral Services Ltd. to acquire a 100% interest in the Jake mineral property that comprising four staked claims; and an option to purchase a 100% interest in five adjacent claims located to the north of Smithers, northwestern British Columbia. The company was formerly known as Quartz Mountain Gold Corp. and changed its name to Quartz Mountain Resources Ltd. in November 1997. Quartz Mountain Resources Ltd. was incorporated in 1982 and is headquartered in Vancouver, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 523.94K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 11.61K | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 9.90K | 9.90K | 2.47K | 23.28 | 0.00 | 24.12K | 0.00 | 0.00 | 0.00 | 261.97K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | -9.90K | -9.90K | -2.47K | -23.28 | 0.00 | -24.12K | 0.00 | 0.00 | 0.00 | 261.97K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 11.61K | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 50.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 100.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 134.10K | 621.71K | 164.72K | 226.17K | 149.17K | 212.20K | 200.38K | 322.14K | 472.77K | 604.00K | 1.57M | 1.55M | 177.15K | 176.37K | 178.38K | 0.00 | 0.00 | 0.00 | 0.00 | 16.64K | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 761.31K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 118.99K | 0.00 | 0.00 | 0.00 |

| SG&A | 895.40K | 621.71K | 164.72K | 226.17K | 149.17K | 212.20K | 200.38K | 322.14K | 472.77K | 604.00K | 1.57M | 1.55M | 177.15K | 176.37K | 178.38K | 164.87K | 143.36K | 163.77K | 181.05K | 135.63K | 49.16K | 64.88K | 79.02K |

| Other Expenses | 0.00 | 514.13K | 90.91K | 23.28K | 0.00 | 24.12K | 700.00 | 470.00 | 14.07K | 261.97K | 3.88M | 2.25M | 0.00 | 0.00 | 8.17K | 0.00 | 0.00 | 0.00 | 0.00 | 59.67K | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 895.40K | 1.14M | 255.62K | 249.44K | 149.17K | 236.32K | 201.08K | 322.61K | 486.84K | 865.97K | 5.45M | 3.79M | 177.15K | 153.08K | 186.55K | 164.87K | 143.36K | 163.77K | 181.05K | 195.30K | 49.16K | 64.88K | 79.02K |

| Cost & Expenses | 895.40K | 1.15M | 258.10K | 249.44K | 149.17K | 236.32K | 201.08K | 322.61K | 486.84K | 865.97K | 5.45M | 3.79M | 177.15K | 153.08K | 186.55K | 164.87K | 143.36K | 163.77K | 181.05K | 195.30K | 49.16K | 64.88K | 79.02K |

| Interest Income | 12.41K | 3.37K | 1.38K | 1.09K | 1.85K | 2.34K | 2.11K | 2.97K | 10.75K | 9.23K | 10.98K | 206.38K | 1.52K | 1.84K | 4.79K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.11K | 2.70K | 1.46K | 6.29K | 6.24K | 0.00 | 0.00 | 17.39K | 42.61K | 44.09K | 40.33K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 9.90K | 9.90K | 2.47K | 180.07K | 115.74K | 190.41K | 1.00 | 1.00 | 10.75K | 9.23K | 10.98K | 139.00 | -8.98K | -13.85K | 59.50K | -30.62K | 319.45K | -60.08K | -58.08K | 32.42K | -53.29K | -789.51K | 0.00 |

| EBITDA | -895.40K | -1.10M | -226.30K | 0.00 | 0.00 | 236.32K | -167.96K | -284.61K | -476.09K | -856.74K | -5.44M | -3.79M | -186.12K | -166.93K | -127.05K | -195.49K | 176.09K | -223.84K | -239.14K | -193.87K | -104.24K | -854.39K | -79.02K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -163.52% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -1,670.61% | 0.00% | 0.00% | 0.00% |

| Operating Income | -895.40K | -992.37K | -256.72K | -248.35K | -147.32K | -236.32K | -201.08K | -322.61K | -486.84K | -865.97K | -5.45M | -3.79M | -177.15K | -153.08K | -186.55K | -164.87K | -143.36K | -163.77K | -181.05K | -226.29K | -50.95K | -64.88K | -79.02K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -165.28% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -1,949.97% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -15.06K | 149.31K | 146.33K | 2.70M | -37.98K | -44.06K | -31.99K | 377.16K | -954.81K | -39.93K | 1.90M | 206.24K | 0.00 | 0.00 | -54.71K | 0.00 | -281.39K | 0.00 | 0.00 | -1.42K | 73.38K | 793.24K | 4.59 |

| Income Before Tax | -910.46K | -993.07K | -79.97K | 2.52M | -153.72K | -234.47K | -199.95K | 92.55K | -1.41M | -865.43K | -3.46M | -3.59M | -166.64K | -137.39K | -241.26K | -109.17K | -424.75K | -74.05K | -104.47K | -181.28K | 22.43K | 728.36K | -79.02K |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -165.18% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -1,562.11% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | -37.00 | 2.78K | 36.45K | 6.29K | 6.24K | -2.34K | -2.11K | 14.41K | 31.86K | 34.86K | 29.34K | -206.38K | 166.64K | 137.39K | 241.26K | 109.17K | 424.75K | 74.05K | 104.47K | 181.28K | -22.43K | -728.36K | 79.02K |

| Net Income | -910.43K | -995.85K | -116.42K | 2.52M | -159.95K | -234.47K | -199.95K | 92.55K | -1.41M | -865.43K | -3.46M | -3.59M | -166.64K | -137.39K | -241.26K | -109.17K | -424.75K | -74.05K | -104.47K | -181.28K | 22.43K | 728.36K | -79.02K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -165.18% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -1,562.11% | 0.00% | 0.00% | 0.00% |

| EPS | -0.02 | -0.03 | 0.00 | 0.16 | -0.02 | -0.02 | -0.02 | 0.01 | -0.17 | -0.11 | -0.44 | -0.65 | -0.04 | -0.03 | -0.06 | -0.03 | -0.11 | -0.02 | -0.03 | -0.06 | 0.01 | 0.28 | -0.03 |

| EPS Diluted | -0.02 | -0.03 | 0.00 | 0.13 | -0.02 | -0.02 | -0.02 | 0.01 | -0.17 | -0.11 | -0.44 | -0.65 | -0.04 | -0.03 | -0.06 | -0.03 | -0.11 | -0.02 | -0.03 | -0.06 | 0.01 | 0.28 | -0.03 |

| Weighted Avg Shares Out | 43.22M | 37.16M | 26.87M | 15.96M | 10.04M | 9.53M | 8.79M | 8.42M | 8.19M | 8.19M | 7.87M | 5.52M | 4.02M | 4.02M | 4.02M | 4.02M | 4.02M | 3.70M | 3.51M | 3.03M | 2.74M | 2.58M | 2.48M |

| Weighted Avg Shares Out (Dil) | 43.22M | 37.16M | 26.87M | 19.17M | 10.04M | 9.53M | 8.79M | 8.42M | 8.19M | 8.19M | 7.87M | 5.52M | 4.02M | 4.02M | 4.02M | 4.02M | 4.02M | 3.70M | 3.51M | 3.03M | 2.74M | 2.58M | 2.48M |

Quartz Mountain Announces Appointment of Myke Clark to Board of Directors

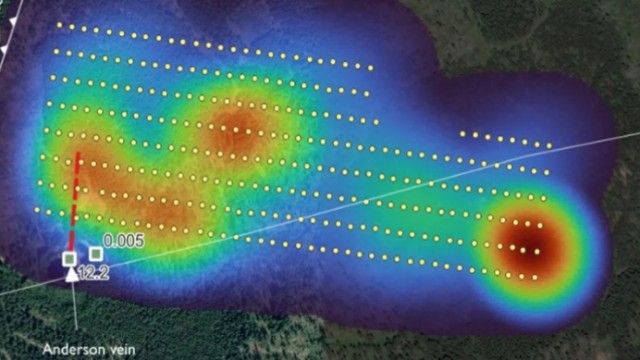

Ximen reports promising results from rock and soil geochemical surveys on the Quartz Mountain

Source: https://incomestatements.info

Category: Stock Reports