See more : Gujarat Hy-Spin Limited (GUJHYSPIN.BO) Income Statement Analysis – Financial Results

Complete financial analysis of RBC Bearings Incorporated (RBC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of RBC Bearings Incorporated, a leading company in the Manufacturing – Tools & Accessories industry within the Industrials sector.

- Omnicell, Inc. (OMCL) Income Statement Analysis – Financial Results

- GigCapital5, Inc. (GIA-UN) Income Statement Analysis – Financial Results

- Global Self Storage, Inc. (SELF) Income Statement Analysis – Financial Results

- Fresnillo plc (FNLPF) Income Statement Analysis – Financial Results

- Allfunds Group plc (ALLFG.AS) Income Statement Analysis – Financial Results

RBC Bearings Incorporated (RBC)

Industry: Manufacturing - Tools & Accessories

Sector: Industrials

Website: https://www.rbcbearings.com

About RBC Bearings Incorporated

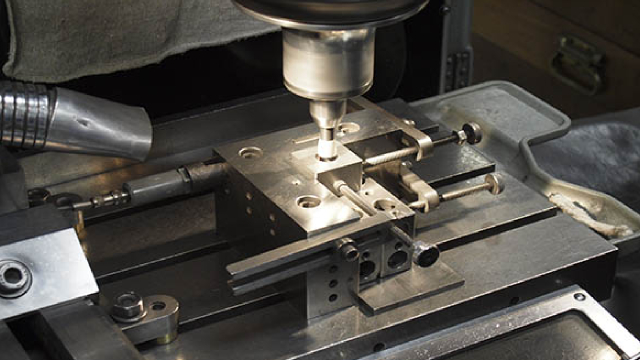

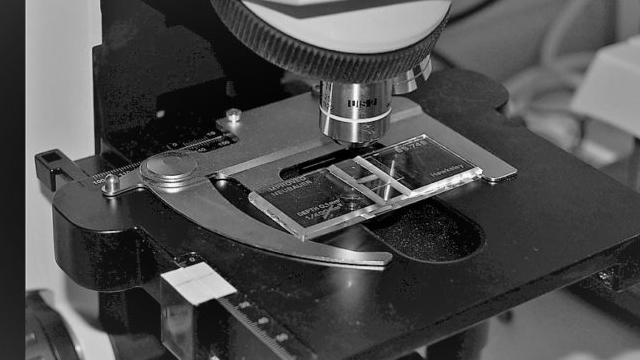

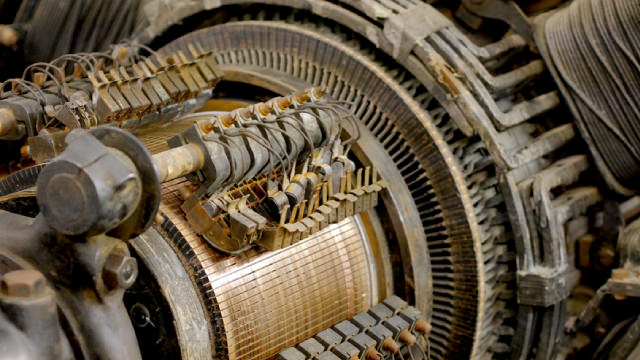

RBC Bearings Incorporated manufactures and markets engineered precision bearings and components in the United States and internationally. It operates through two segments, Aerospace/Defense and Industrial. The company produces plain bearings with self-lubricating or metal-to-metal designs, including rod end bearings, spherical plain bearings, and journal bearings; roller bearings, such as tapered roller bearings, needle roller bearings, and needle bearing track rollers and cam followers, which are anti-friction products that are used in industrial applications and military aircraft platforms; and ball bearings include high precision aerospace, airframe control, thin section, and industrial ball bearings that utilize high precision ball elements to reduce friction in high-speed applications. It also offers mounted bearing products include mounted ball bearings, mounted roller bearings, and mounted plain bearings; and enclosed gearing product lines, including quantis gearmotor, torque arm, tigear, magnagear & maxum, and controlled start transmission. In addition, the company produces power transmission components include mechanical drive components, couplings, and conveyor components; engineered hydraulics and valves for aircraft and submarine applications, and aerospace and defense aftermarket services; fasteners; precision mechanical components, which are used in various general industrial applications; and machine tool collets that are used for holding circulars or rod-like pieces. It serves automotive, tool holding, agricultural and semiconductor machinery, commercial and defense aerospace, ground defense, construction and mining, oil and natural resource extraction, heavy truck, marine, rail and train, packaging, food and beverage, packaging and canning, wind, and general industrial markets through its direct sales force, as well as a network of industrial and aerospace distributors. The company was founded in 1919 and is headquartered in Oxford, Connecticut.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.56B | 1.47B | 942.94M | 608.98M | 727.46M | 702.52M | 674.95M | 615.39M | 597.47M | 445.28M | 418.89M | 403.05M | 397.51M | 335.63M | 274.70M | 355.80M | 330.60M | 306.06M | 274.51M | 243.02M | 187.33M | 172.86M | 168.33M | 176.44M |

| Cost of Revenue | 889.80M | 864.54M | 585.87M | 374.88M | 438.36M | 425.86M | 416.84M | 385.79M | 378.69M | 275.14M | 254.09M | 250.12M | 256.93M | 225.85M | 190.14M | 237.58M | 217.02M | 205.95M | 191.56M | 174.60M | 135.43M | 124.09M | 114.58M | 116.25M |

| Gross Profit | 670.50M | 604.75M | 357.07M | 234.11M | 289.10M | 276.65M | 258.11M | 229.60M | 218.78M | 170.14M | 164.80M | 152.93M | 140.58M | 109.77M | 84.57M | 118.22M | 113.58M | 100.11M | 82.95M | 68.41M | 51.90M | 48.77M | 53.76M | 60.19M |

| Gross Profit Ratio | 42.97% | 41.16% | 37.87% | 38.44% | 39.74% | 39.38% | 38.24% | 37.31% | 36.62% | 38.21% | 39.34% | 37.94% | 35.37% | 32.71% | 30.78% | 33.23% | 34.36% | 32.71% | 30.22% | 28.15% | 27.70% | 28.22% | 31.93% | 34.11% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 117.71M | 0.00 | 103.02M | 98.91M | 75.94M | 72.10M | 65.90M | 0.00 | 53.20M | 47.40M | 56.20M | 49.00M | 0.00 | 42.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -203.00K | 0.00 | -96.00K | -191.00K | -31.00K | -131.00K | -149.00K | 0.00 | -494.00K | -33.00K | -421.00K | 18.00K | 0.00 | -455.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 253.50M | 229.69M | 158.63M | 106.00M | 122.57M | 117.50M | 113.12M | 102.92M | 98.72M | 75.91M | 71.97M | 65.75M | 61.40M | 52.71M | 47.37M | 55.78M | 49.02M | 42.26M | 41.95M | 32.75M | 28.11M | 26.65M | 25.64M | 27.04M |

| Other Expenses | 74.80M | -88.69M | -69.21M | -16.62M | -10.51M | -27.89M | -17.63M | -13.08M | -16.55M | -8.62M | -4.06M | 2.96M | 1.54M | 300.00K | 2.50M | 7.30M | 1.80M | 2.36M | 5.70M | -3.42M | 1.66M | 1.42M | 937.00K | 776.00K |

| Operating Expenses | 328.30M | 229.69M | 158.63M | 106.00M | 122.57M | 117.50M | 113.12M | 102.92M | 98.72M | 75.91M | 71.97M | 67.27M | 62.94M | 53.58M | 49.90M | 63.25M | 50.70M | 44.61M | 40.60M | 29.33M | 29.77M | 28.07M | 26.58M | 27.82M |

| Cost & Expenses | 1.22B | 1.09B | 744.50M | 480.88M | 560.92M | 543.37M | 529.96M | 488.71M | 477.42M | 351.05M | 326.06M | 317.39M | 319.87M | 279.43M | 240.03M | 300.83M | 267.72M | 250.57M | 232.16M | 203.93M | 165.20M | 152.16M | 141.15M | 144.06M |

| Interest Income | 0.00 | 76.70M | 41.50M | 1.40M | 1.89M | 5.17M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 78.70M | 76.70M | 41.51M | 1.43M | 1.89M | 5.17M | 7.51M | 8.71M | 8.72M | 1.06M | 1.02M | 868.00K | 1.05M | 1.79M | 1.66M | 3.57M | 2.97M | 7.85M | 15.78M | 33.21M | 20.40M | 20.77M | 23.46M | 26.95M |

| Depreciation & Amortization | 119.30M | 122.60M | 65.53M | 32.74M | 31.42M | 29.66M | 28.36M | 27.37M | 25.81M | 15.05M | 14.99M | 14.72M | 14.19M | 12.97M | 11.83M | 12.16M | 10.69M | 10.00M | 10.53M | 10.32M | 9.18M | -20.77M | -25.51M | -28.76M |

| EBITDA | 459.80M | 409.00M | 185.79M | 144.23M | 181.55M | 179.45M | 164.52M | 145.24M | 142.15M | 111.53M | 106.02M | 95.78M | 91.21M | 67.64M | 46.35M | 67.13M | 73.32M | 65.49M | 52.88M | 49.41M | 31.31M | 20.70M | 27.18M | 32.37M |

| EBITDA Ratio | 29.47% | 19.49% | 13.70% | 18.31% | 21.45% | 18.68% | 18.87% | 18.46% | 17.32% | 19.23% | 21.19% | 25.64% | 23.26% | 16.29% | 16.87% | 19.14% | 22.27% | 25.27% | 22.89% | 27.36% | 16.71% | 11.98% | 16.15% | 18.35% |

| Operating Income | 342.20M | 170.97M | 63.70M | 78.75M | 124.60M | 132.04M | 128.14M | 113.69M | 103.84M | 88.43M | 88.65M | 78.10M | 77.65M | 56.19M | 34.67M | 54.97M | 62.85M | 51.92M | 38.58M | 32.14M | 22.13M | 20.70M | 27.18M | 32.37M |

| Operating Income Ratio | 21.93% | 11.64% | 6.76% | 12.93% | 17.13% | 18.79% | 18.99% | 18.48% | 17.38% | 19.86% | 21.16% | 19.38% | 19.53% | 16.74% | 12.62% | 15.45% | 19.01% | 16.96% | 14.05% | 13.23% | 11.81% | 11.98% | 16.15% | 18.35% |

| Total Other Income/Expenses | -80.40M | 38.73M | 24.02M | -4.54M | 4.77M | -5.95M | -8.92M | -9.70M | -9.06M | -3.88M | -897.00K | -5.48M | -1.67M | -3.32M | -1.66M | -3.57M | -2.97M | -12.89M | -19.51M | -28.25M | -20.40M | -20.54M | -23.46M | -26.95M |

| Income Before Tax | 261.80M | 209.68M | 87.72M | 110.06M | 154.14M | 126.09M | 119.85M | 104.88M | 94.79M | 84.56M | 87.75M | 80.19M | 75.98M | 52.88M | 33.01M | 51.40M | 59.88M | 44.07M | 19.07M | 5.88M | 1.73M | 162.00K | 3.72M | 5.42M |

| Income Before Tax Ratio | 16.78% | 14.27% | 9.30% | 18.07% | 21.19% | 17.95% | 17.76% | 17.04% | 15.86% | 18.99% | 20.95% | 19.90% | 19.11% | 15.75% | 12.02% | 14.45% | 18.11% | 14.40% | 6.95% | 2.42% | 0.93% | 0.09% | 2.21% | 3.07% |

| Income Tax Expense | 51.90M | 43.02M | 22.65M | 20.43M | 28.10M | 20.90M | 32.71M | 34.26M | 30.89M | 26.31M | 27.55M | 23.85M | 25.98M | 18.01M | 8.63M | 16.95M | 19.69M | 15.59M | 6.63M | -1.39M | 1.07M | -113.00K | 25.51M | 28.76M |

| Net Income | 209.90M | 166.70M | 42.70M | 90.10M | 120.35M | 105.19M | 87.14M | 70.62M | 63.89M | 58.25M | 60.21M | 56.34M | 50.00M | 34.87M | 24.39M | 34.45M | 40.19M | 28.48M | 12.44M | 7.26M | 663.00K | 49.00K | 1.67M | 3.62M |

| Net Income Ratio | 13.45% | 11.35% | 4.53% | 14.80% | 16.54% | 14.97% | 12.91% | 11.48% | 10.69% | 13.08% | 14.37% | 13.98% | 12.58% | 10.39% | 8.88% | 9.68% | 12.16% | 9.30% | 4.53% | 2.99% | 0.35% | 0.03% | 0.99% | 2.05% |

| EPS | 6.46 | 5.00 | 1.58 | 3.61 | 5.12 | 4.32 | 3.64 | 3.00 | 2.75 | 2.52 | 2.63 | 2.52 | 2.28 | 1.61 | 1.13 | 1.60 | 1.87 | 1.38 | 0.96 | 1.17 | 0.11 | 0.01 | 0.27 | 1.30 |

| EPS Diluted | 6.40 | 4.95 | 1.56 | 3.58 | 5.06 | 4.26 | 3.58 | 2.97 | 2.72 | 2.49 | 2.59 | 2.47 | 2.23 | 1.58 | 1.12 | 1.58 | 1.84 | 1.33 | 0.86 | 0.67 | 0.11 | 0.01 | 0.19 | 0.60 |

| Weighted Avg Shares Out | 28.92M | 28.76M | 26.95M | 24.85M | 24.63M | 24.36M | 23.95M | 23.52M | 23.21M | 23.07M | 22.87M | 22.40M | 21.88M | 21.68M | 21.59M | 21.57M | 21.46M | 20.58M | 12.93M | 6.20M | 6.19M | 6.19M | 6.19M | 2.79M |

| Weighted Avg Shares Out (Dil) | 29.19M | 29.07M | 27.31M | 25.05M | 24.92M | 24.72M | 24.36M | 23.78M | 23.51M | 23.39M | 23.24M | 22.81M | 22.39M | 22.08M | 21.75M | 21.74M | 21.80M | 21.34M | 14.45M | 10.85M | 6.19M | 6.19M | 8.89M | 6.05M |

RBC Bearings' Q2 Earnings & Revenues Miss Estimates, Increase Y/Y

RBC Bearings Incorporated (RBC) Q2 2025 Earnings Call Transcript

RBC Bearings (RBC) Q2 Earnings and Revenues Lag Estimates

RBC Bearings Incorporated Announces Fiscal Second Quarter 2025 Results

RBC Bearings Named to Fortune® 100 Fastest-Growing Companies List for 2024

RBC Bearings (RBC) Reports Next Week: Wall Street Expects Earnings Growth

RBC Bearings to Webcast Second Quarter Fiscal Year 2025 Earnings Conference Call November 1st

Will RBC Bearings (RBC) Beat Estimates Again in Its Next Earnings Report?

These 2 Industrial Products Stocks Could Beat Earnings: Why They Should Be on Your Radar

Republican Victory Favored as Most Beneficial for U.S.

Source: https://incomestatements.info

Category: Stock Reports