See more : SimFabric S.A. (SIM.WA) Income Statement Analysis – Financial Results

Complete financial analysis of Vicarious Surgical Inc. (RBOT) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Vicarious Surgical Inc., a leading company in the Medical – Devices industry within the Healthcare sector.

- Personalized Nursing Services Société Anonyme (PNSB.BR) Income Statement Analysis – Financial Results

- China Youzan Limited (CHNVF) Income Statement Analysis – Financial Results

- CLASSYS Inc. (214150.KQ) Income Statement Analysis – Financial Results

- Sugita Ace Co.,Ltd. (7635.T) Income Statement Analysis – Financial Results

- Xtierra Inc. (XRESF) Income Statement Analysis – Financial Results

Vicarious Surgical Inc. (RBOT)

About Vicarious Surgical Inc.

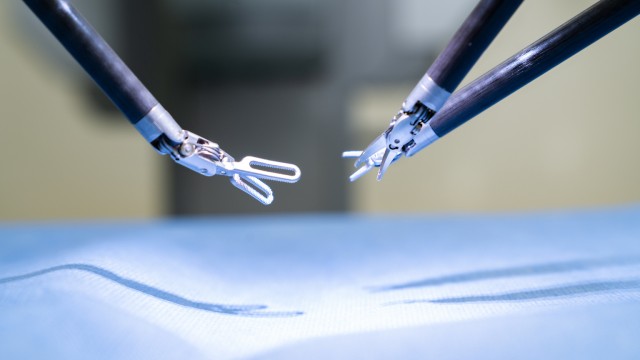

Vicarious Surgical Inc. engages in developing and selling single-incision surgical robot that virtually transports surgeons inside the patient to perform minimally invasive surgery. It offers Vicarious System, a single-incision surgical robot for ventral hernia repair. The company was incorporated in 2014 and is headquartered in Waltham, Massachusetts.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 1.85M | 1.94M | 316.00K | 0.00 | 0.00 |

| Gross Profit | -1.85M | -1.94M | -316.00K | 0.00 | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 47.58M | 43.90M | 22.10M | 9.80M | 7.48M |

| General & Administrative | 26.86M | 29.72M | 13.50M | 2.33M | 2.05M |

| Selling & Marketing | 6.23M | 6.46M | 2.98M | 861.00K | 250.00K |

| SG&A | 33.09M | 36.18M | 16.47M | 3.19M | 2.30M |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 80.67M | 80.08M | 38.57M | 12.99M | 9.78M |

| Cost & Expenses | 80.67M | 80.08M | 38.57M | 12.99M | 9.78M |

| Interest Income | 4.43M | 1.44M | 20.00K | 113.00K | 469.00 |

| Interest Expense | 25.00K | 200.00K | 89.00K | 3.00K | 0.00 |

| Depreciation & Amortization | 1.85M | 1.94M | 316.00K | 157.00K | 104.00K |

| EBITDA | -69.19M | 7.30M | -34.80M | -161.18K | -9.68M |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -80.67M | -80.08M | -38.57M | -12.99M | -9.78M |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | 9.60M | 85.24M | 3.02M | 110.00K | 469.00K |

| Income Before Tax | -71.07M | 5.16M | -7.27M | -12.88M | -9.31M |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 0.00 | -84.00M | -227.00K | 3.00K | -67.86K |

| Net Income | -71.07M | 89.16M | -7.04M | -12.88M | -9.31M |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | -14.70 | 20.77 | -2.19 | -4.91 | -1.70 |

| EPS Diluted | -14.60 | 20.99 | -2.19 | -4.91 | -1.70 |

| Weighted Avg Shares Out | 4.83M | 4.29M | 3.22M | 2.62M | 5.47M |

| Weighted Avg Shares Out (Dil) | 4.87M | 4.25M | 3.22M | 2.62M | 5.47M |

Vicarious Surgical (RBOT) to Broaden User Network With New Deal

Vicarious Surgical to Present at the Gilmartin Group Emerging Growth Company Showcase

Vicarious Surgical: Huge Potential But Low Margin Of Safety To Commercialization

Vicarious Surgical to Present at the Canaccord Genuity 43rd Annual Growth Conference

Vicarious Surgical stock tanks on discounted public offering

Why Is Vicarious Surgical (RBOT) Stock Down 41% Today?

Vicarious Surgical Announces Pricing of Public Offering

Vicarious Surgical Announces Launch of Proposed Public Offering

Vicarious Surgical Inc. (RBOT) Q2 2023 Earnings Call Transcript

Vicarious Surgical Reports Second Quarter 2023 Financial Results and Announces Clinical Plan and Regulatory Intent

Source: https://incomestatements.info

Category: Stock Reports