See more : DL E&C Co.,Ltd. (375500.KS) Income Statement Analysis – Financial Results

Complete financial analysis of Redwire Corporation (RDW) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Redwire Corporation, a leading company in the Aerospace & Defense industry within the Industrials sector.

- Pratiksha Chemicals Limited (PRATIKSH.BO) Income Statement Analysis – Financial Results

- PPS International (Holdings) Limited (8201.HK) Income Statement Analysis – Financial Results

- Deutsche Bank Aktiengesellschaft (DBK.DE) Income Statement Analysis – Financial Results

- NRB Industrial Bearings Limited (NIBL.NS) Income Statement Analysis – Financial Results

- Vascon Engineers Limited (VASCONEQ.BO) Income Statement Analysis – Financial Results

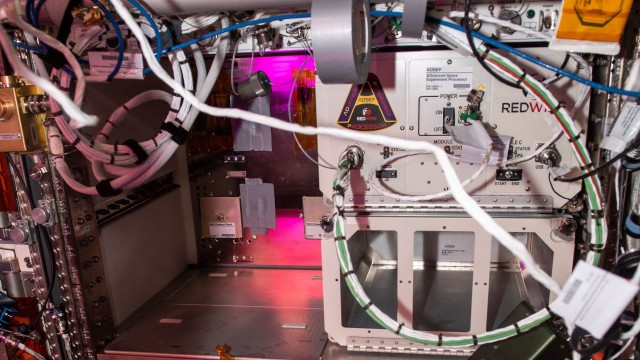

Redwire Corporation (RDW)

About Redwire Corporation

Redwire Corporation, a space infrastructure company, develops, manufactures, and sells mission critical space solutions and components for national security, civil, and commercial space markets in the United States, Luxembourg, Germany, South Korea, Poland, and internationally. The company provides various antennas; and advanced sensors and components, which include solar arrays, composite booms, radio frequency antennas, payload adapters, space-qualifies camera systems, and star trackers and sun sensors. It also sells a proprietary enterprise software suite that enables digital engineering and generation of interactive modeling and simulations of individual components, entire spacecraft, and full constellations in a cloud-based Software as a Service business model. In addition, the company offers on-orbit servicing, assembly, and manufacturing solutions; and low-earth orbit commercialization, digitally engineered spacecraft, and space domain awareness and resiliency technology solutions. Redwire Corporation is headquartered in Jacksonville, Florida.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue | 243.80M | 160.55M | 137.60M | 57.44M | 19.01M |

| Cost of Revenue | 185.83M | 131.85M | 108.22M | 45.30M | 15.02M |

| Gross Profit | 57.97M | 28.70M | 29.38M | 12.14M | 3.99M |

| Gross Profit Ratio | 23.78% | 17.87% | 21.35% | 21.13% | 21.01% |

| Research & Development | 4.98M | 4.94M | 4.52M | 2.40M | 890.00K |

| General & Administrative | 67.33M | 69.04M | 77.54M | 18.20M | 0.00 |

| Selling & Marketing | 1.20M | 1.31M | 1.16M | 160.36K | 0.00 |

| SG&A | 68.53M | 70.34M | 78.70M | 18.36M | 6.32M |

| Other Expenses | -31.08M | 16.08M | 3.84M | -39.66K | 0.00 |

| Operating Expenses | 42.42M | 75.28M | 83.21M | 20.76M | 7.23M |

| Cost & Expenses | 258.48M | 207.14M | 191.44M | 66.06M | 22.25M |

| Interest Income | 0.00 | 8.22M | 6.46M | 1.17M | 107.00K |

| Interest Expense | 10.70M | 8.22M | 6.46M | 1.15M | 0.00 |

| Depreciation & Amortization | 10.72M | 11.55M | 10.58M | 3.17M | 66.00K |

| EBITDA | -6.33M | -118.82M | -55.77M | -15.44M | -3.15M |

| EBITDA Ratio | -2.60% | -19.01% | -28.64% | -9.50% | -16.57% |

| Operating Income | -14.68M | -46.59M | -53.83M | -8.62M | -3.22M |

| Operating Income Ratio | -6.02% | -29.02% | -39.12% | -15.01% | -16.91% |

| Total Other Income/Expenses | -13.07M | 7.86M | -2.62M | -11.13M | -131.00K |

| Income Before Tax | -27.75M | -138.59M | -72.81M | -19.75M | -3.35M |

| Income Before Tax Ratio | -11.38% | -86.32% | -52.91% | -34.39% | -17.60% |

| Income Tax Expense | -486.00K | -7.97M | -11.27M | -4.04M | 10.00K |

| Net Income | -27.26M | -130.62M | -61.54M | -15.71M | -3.36M |

| Net Income Ratio | -11.18% | -81.36% | -44.72% | -27.35% | -17.66% |

| EPS | -0.73 | -2.03 | -0.98 | -0.42 | 0.00 |

| EPS Diluted | -0.73 | -2.03 | -0.98 | -0.42 | 0.00 |

| Weighted Avg Shares Out | 64.65M | 64.28M | 62.69M | 37.20M | 0.00 |

| Weighted Avg Shares Out (Dil) | 64.65M | 64.28M | 62.69M | 37.20M | 0.00 |

The 3 Most Undervalued Penny Stocks to Buy in September 2023

Redwire to Present at H.C. Wainwright 25th Annual Global Investment Conference September 11, 2023

Redwire to Present at Jefferies Industrials Conference on September 7, 2023

Redwire and Sierra team up to make drugs in space on inflatable habitat's first mission

Sierra Space and Redwire Partner to Bring In-Space Biotech Facilities to Customers via the Sierra Space Platform

NASA Picks 11 Winners for Moon and Space Projects

Redwire Corporation (RDW) Q2 2023 Earnings Call Transcript

Redwire Corporation (RDW) Reports Q2 Loss, Tops Revenue Estimates

Space company Redwire trims quarterly losses, builds order backlog past $270 million

Redwire Corporation Reports Second Quarter 2023 Financial Results

Source: https://incomestatements.info

Category: Stock Reports