See more : Nice Information & Telecommunication, Inc. (036800.KQ) Income Statement Analysis – Financial Results

Complete financial analysis of Renren Inc. (RENN) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Renren Inc., a leading company in the Software – Application industry within the Technology sector.

- Verizon Communications Inc. (VERIZ.BR) Income Statement Analysis – Financial Results

- Matriks Bilgi Dagitim Hizmetleri A.S. (MTRKS.IS) Income Statement Analysis – Financial Results

- V R FILMS & STUDIOS LIMITED (VRFILMS.BO) Income Statement Analysis – Financial Results

- PT Jakarta Setiabudi Internasional Tbk (JSPT.JK) Income Statement Analysis – Financial Results

- Seven Hills Realty Trust (SEVN) Income Statement Analysis – Financial Results

Renren Inc. (RENN)

About Renren Inc.

Renren Inc. engages in the software as a service business in the People's Republic of China. The company develops Chime, a software as a service platform that offers customer relationship management, intelligent data exchange webpage service, and team management solutions for real estate professionals. It also provides online and mobile services for the trucking industry in the United States. The company was formerly known as Oak Pacific Interactive and changed its name to Renren Inc. in December 2010. Renren Inc. was founded in 2002 and is based in Beijing, the People's Republic of China.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 45.81M | 32.22M | 18.11M | 349.78M | 498.20M | 202.10M | 63.36M | 41.11M | 82.95M | 156.69M | 176.09M | 117.97M | 76.54M | 46.68M |

| Cost of Revenue | 10.41M | 6.84M | 3.45M | 346.89M | 476.47M | 184.40M | 51.77M | 36.72M | 47.97M | 68.70M | 66.62M | 26.23M | 16.62M | 10.38M |

| Gross Profit | 35.40M | 25.38M | 14.66M | 2.89M | 21.73M | 17.70M | 11.60M | 4.39M | 34.98M | 88.00M | 109.47M | 91.73M | 59.91M | 36.31M |

| Gross Profit Ratio | 77.27% | 78.77% | 80.94% | 0.83% | 4.36% | 8.76% | 18.30% | 10.68% | 42.17% | 56.16% | 62.17% | 77.76% | 78.28% | 77.77% |

| Research & Development | 16.19M | 10.72M | 11.35M | 26.15M | 26.35M | 23.68M | 20.75M | 32.39M | 50.68M | 80.53M | 79.54M | 40.31M | 23.70M | 12.94M |

| General & Administrative | 14.79M | 20.13M | 22.24M | 46.65M | 71.09M | 52.95M | 42.58M | 46.80M | 51.43M | 51.00M | 38.86M | 17.22M | 7.51M | 6.51M |

| Selling & Marketing | 19.62M | 14.00M | 8.29M | 25.14M | 34.56M | 28.95M | 21.28M | 30.50M | 38.34M | 66.44M | 82.79M | 62.05M | 20.28M | 19.38M |

| SG&A | 34.41M | 34.13M | 30.54M | 71.79M | 105.66M | 81.90M | 63.86M | 77.31M | 89.77M | 117.44M | 121.65M | 79.27M | 27.79M | 25.89M |

| Other Expenses | 50.00K | 13.23M | 3.54M | 12.41M | 0.00 | 0.00 | 0.00 | 0.00 | 53.93M | 1.74M | 211.00K | 2.35M | 739.00K | 211.00K |

| Operating Expenses | 50.65M | 58.08M | 41.88M | 110.35M | 132.01M | 105.58M | 84.61M | 109.70M | 140.44M | 197.97M | 201.19M | 121.93M | 52.23M | 39.03M |

| Cost & Expenses | 61.06M | 64.92M | 45.33M | 457.24M | 608.47M | 289.98M | 136.38M | 146.42M | 188.42M | 266.67M | 267.81M | 148.16M | 68.85M | 49.41M |

| Interest Income | 602.00K | 238.00K | 8.08M | 8.84M | 5.76M | 2.03M | 919.00K | 2.19M | 12.68M | 12.79M | 20.07M | 9.62M | 335.00K | 288.00K |

| Interest Expense | 25.00K | 51.00K | 303.00K | 4.62M | 5.10M | 10.19M | 12.44M | 2.04M | 12.68M | 12.79M | 20.07M | 9.62M | 335.00K | 288.00K |

| Depreciation & Amortization | 4.53M | -11.89M | 12.59M | 12.18M | 1.44M | 2.03M | 2.68M | 8.94M | 18.49M | 19.19M | 16.14M | 8.64M | 6.26M | 4.84M |

| EBITDA | -10.72M | -44.58M | -14.64M | -95.28M | 88.94M | -93.73M | -167.77M | -206.03M | 98.14M | 88.26M | -37.90M | 60.18M | -58.89M | -65.02M |

| EBITDA Ratio | -23.41% | -138.37% | -80.85% | -27.24% | 17.85% | -46.38% | -264.76% | -501.15% | 118.31% | 56.33% | -21.52% | 51.02% | -76.95% | -139.28% |

| Operating Income | -15.25M | -32.70M | -27.23M | -107.46M | -113.40M | -87.88M | -73.01M | 105.31M | 159.39M | 113.66M | -91.72M | -30.19M | 7.68M | -2.73M |

| Operating Income Ratio | -33.29% | -101.48% | -150.38% | -30.72% | -22.76% | -43.48% | -115.23% | 256.15% | 192.15% | 72.54% | -52.09% | -25.59% | 10.04% | -5.84% |

| Total Other Income/Expenses | -52.11M | -12.68M | 10.29M | 7.46M | -33.10M | -85.39M | -100.39M | -319.89M | -168.49M | 46.20M | 25.06M | 70.54M | -70.21M | -65.47M |

| Income Before Tax | -67.36M | -45.37M | -16.94M | -100.00M | -146.50M | -173.26M | -173.40M | -214.59M | -9.09M | -67.46M | -66.66M | 40.35M | -62.53M | -68.20M |

| Income Before Tax Ratio | -147.06% | -140.83% | -93.53% | -28.59% | -29.41% | -85.73% | -273.66% | -521.96% | -10.96% | -43.05% | -37.86% | 34.21% | -81.70% | -146.08% |

| Income Tax Expense | -2.34M | -969.00K | -65.00K | 24.00K | 9.85M | 4.48M | 2.47M | 3.12M | 6.52M | -7.45M | 920.00K | 668.00K | -1.33M | -31.00K |

| Net Income | -65.02M | -44.41M | -16.87M | -100.02M | 72.54M | -110.43M | -185.35M | -220.13M | 60.46M | 63.73M | -75.03M | 41.26M | -64.16M | -70.12M |

| Net Income Ratio | -141.94% | -137.82% | -93.17% | -28.59% | 14.56% | -54.64% | -292.52% | -535.45% | 72.88% | 40.67% | -42.61% | 34.97% | -83.82% | -150.19% |

| EPS | -2.58 | -1.82 | -0.71 | -4.29 | 2.98 | -4.82 | -8.16 | -9.72 | 2.57 | 2.57 | -2.93 | 2.18 | -11.80 | -12.58 |

| EPS Diluted | -2.58 | -1.82 | -0.71 | -4.29 | 2.98 | -4.82 | -8.16 | -9.72 | 2.55 | 2.54 | -2.93 | 2.06 | -11.80 | -12.58 |

| Weighted Avg Shares Out | 25.20M | 24.43M | 23.64M | 23.31M | 24.35M | 22.93M | 22.73M | 22.65M | 23.54M | 24.85M | 25.59M | 18.90M | 5.44M | 5.57M |

| Weighted Avg Shares Out (Dil) | 25.20M | 24.43M | 23.64M | 23.31M | 24.35M | 22.93M | 22.73M | 22.65M | 23.73M | 25.13M | 25.59M | 20.03M | 5.44M | 5.57M |

RENN Fund, Inc. Announces Record Date for Year End Distribution

Best Idea: Renren And Beyond

Renren Announces Board Changes

On 1,000 Seeking Alpha Articles

Renren: An Update On Our Best Idea For 2022

Renren: Chris DeMuth Of Sifting The World Discusses His Top Idea For 2022

Renren Is So Bad It's Good

Why Renren Shares Are Falling

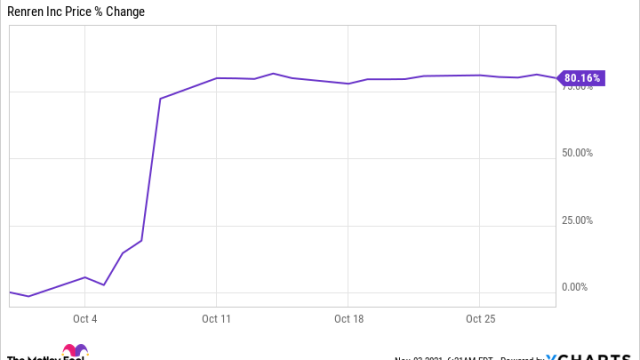

Here's Why Renren Stock Skyrocketed 80.2% in October

Renren In Search Of Identity As Its Stock Surges On Lawsuit Settlement

Source: https://incomestatements.info

Category: Stock Reports