- Stock Market News Today Live Updates on December 22, 2024 : Wall Street Holidays next week: NYSE, Nasdaq to remain closed on THESE days

- Queen’s Board of Trustees approves audited consolidated financial statement

- Stock market crash: Sensex cracks 1,200 points; why is Indian stock market falling today? Explained with 5 factors

- The Stock Market Is Historically Pricey: Here’s How I’m Positioning My Portfolio for 2025

- What Will The Market Return In 2025?

Last Updated: 2024.10.10

to Chinese page

to Japanese page

You are watching: Results Summary | FAST RETAILING CO., LTD.

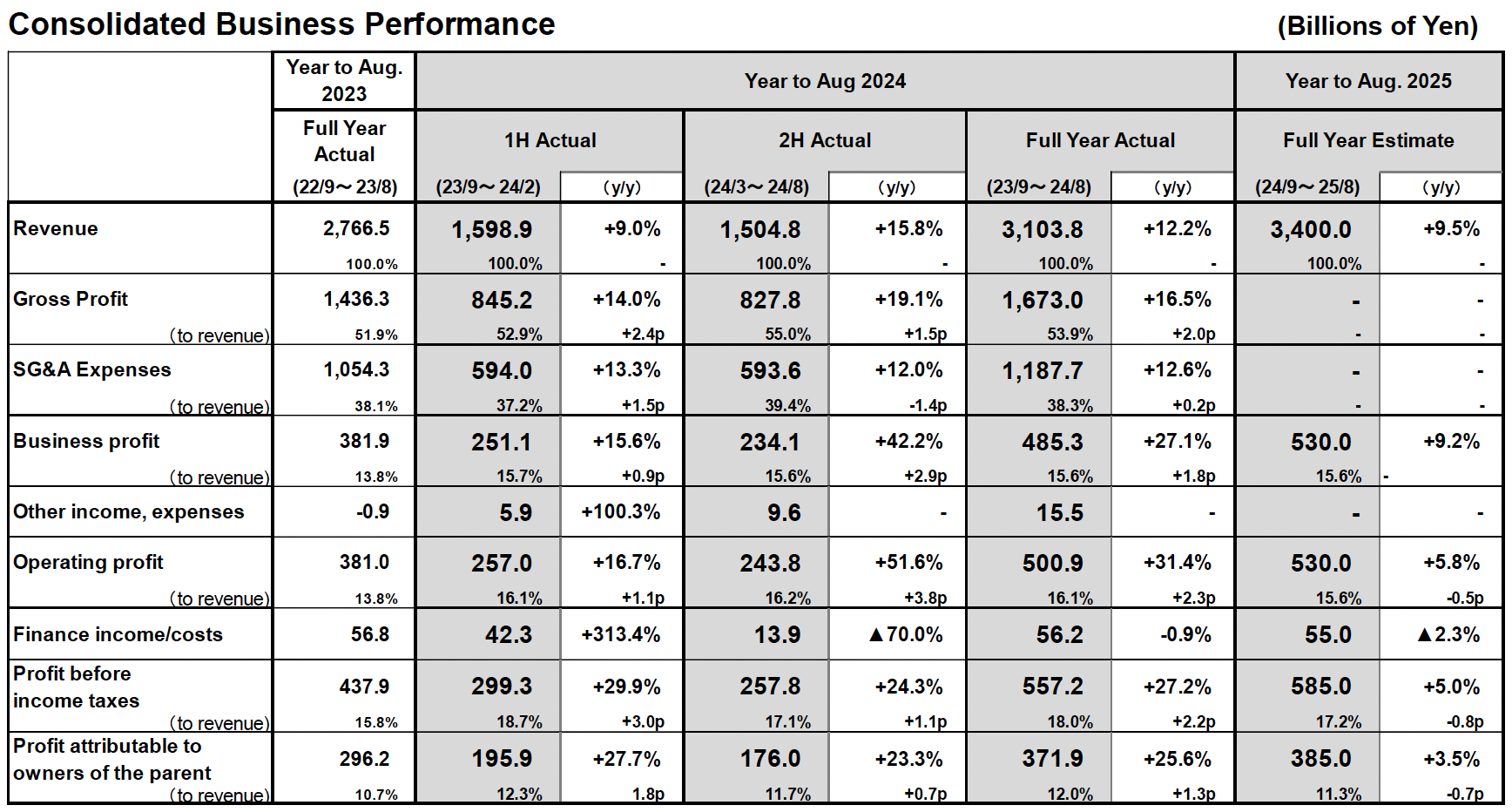

Below is the summary announced on October 10 of Results Summary for Fiscal 2024 (Year to August 31, 2024).

【Financial Highlights】

■FY2024 consolidated results: Fast Retailing reports considerable full-year revenue and profit gains. Revenue tops 3 trillion yen and operating profit surpasses 500 billion yen

- FY2024 revenue: 3.1038 trillion yen (+12.2% year-on-year), operating profit: 500.9 billion yen (+31.4%), and profit attributable to owners of the parent: 371.9 billion yen (+25.6%). Revenue topped 3 trillion yen and operating profit surpassed 500 billion yen for the first time.

- We have been accelerating the diversification of our earnings pillars and establishing solid frameworks to facilitate stronger global earnings. In addition, UNIQLO brand visibility is expanding worldwide, and demand is growing not just among local customers, but tourists as well.

- We plan to offer a year-end dividend of 225 yen per share. When added to the 175 yen interim dividend, that would generate a scheduled annual dividend of 400 yen for FY2024, an increase of 110 yen compared with the previous year.

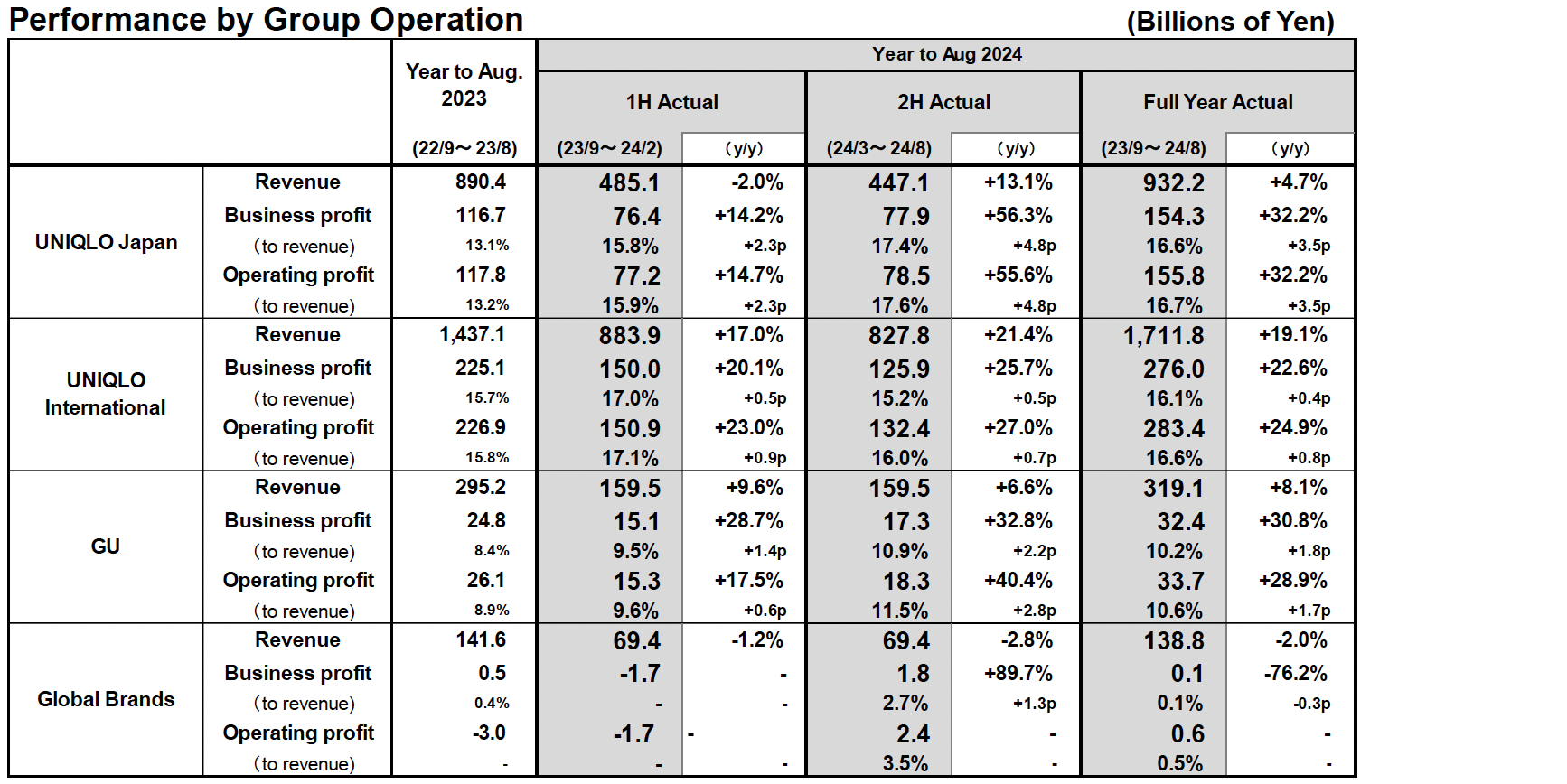

■UNIQLO Japan: Full-year revenue increases, profit expands sharply, achieved a new record high

- FY2024 revenue: 932.2 billion yen (+4.7%), operating profit: 155.8 billion yen (+32.2%).

- FY2024 same-store sales increased 3.2% year-on-year on the back of a particularly strong 11.7% expansion in the second half. Sales of core Summer items proved strong. Revenue from overseas visitor demand also rose sharply.

- The full-year gross profit margin improved by 2.9 points thanks to stronger control over production orders, which reduced the impact of spot exchange rates used for additional production orders and resulted in an improvement in cost of sales and a reduction in the second-half discounting rate.

■UNIQLO International: Large full-year revenue and profit increases. Operating profit margins expand to 15% or higher in all markets

- FY2024 revenue: 1.7118 trillion yen (+19.1%), operating profit: 283.4 billion yen (+24.9%). Achieved a record performance.

- Greater China reported a year-on-year rise in full-year revenue and a slight increase in operating profit. While the Mainland China market reported strong sales in the first half, second-half sales were lackluster. We are continuing to structurally reform business operations in the market through a scrap-and-build strategy of replacing smaller, less-profitable stores with large, better-located ones; enhancing branding and local store management; and other measures.

- UNIQLO South Korea reported higher full-year revenue and profits. UNIQLO Southeast Asia, India & Australia reported significant full-year revenue and profit gains.

- UNIQLO North America and UNIQLO Europe both generated large increases in revenue and profit on the back of growing customer support for LifeWear and strong sales.

■GU: Full-year revenue increases, profit expands sharply

- FY2024 revenue: 319.1 billion yen (+8.1%), operating profit: 33.7 billion yen (+28.9%).

- Same-store sales increased on strong sales of products that captured global mass fashion trends.

- Efforts to improve cost of sales resulted in a higher gross profit margin and a sharp increase in operating profit.

- Opened our first GU flagship store outside Japan in the United States in September 2024. Revenue has surpassed our expectations since the opening and the store is performing strongly.

■Global Brands: Full-year revenue declines, business profit contracts sharply

- FY2024 revenue: 138.8 billion yen (−2.0%), business profit: 0.1 billion yen (−76.2%), operating profit: 0.6 billion yen (compared with a 3.0 billion yen loss in FY2023). While operating profit moved into the black, this was the result of impairment losses recorded on the closure of unprofitable stores in FY2023.

- Theory reported higher revenue but a large contraction in profits. In local currency terms, Theory revenue declined on lackluster sales performances in both the United States and Asia.

- PLST reported significantly lower revenue due to a reduced store network. However, the gross profit margin improved significantly, and operating profit moved into the black.

- While Comptoir des Cotonniers reported significantly lower revenue, losses contracted as determined operational reforms improved overall cost structures.

■FY2025 consolidated business estimates: Expect revenue and profit to rise, with both measures generating record-high performances

- FY2025 consolidated revenue:3.4000 trillion yen (+9.5%), consolidated operating profit: 530.0 billion yen (+5.8%), profit attributable to owners of the parent: 385.0 billion yen (+3.5%).

- We forecast an annual dividend per share in FY2025 of 450 yen, split equally between interim and year-end dividends of 225 yen each. That represents an increase in the full-year dividend of 50 yen per share.

FY2024 Performance in Focus

See more : Analysts Have Made A Financial Statement On Metcash Limited’s (ASX:MTS) Half-Yearly Report

■UNIQLO Japan: Full-year revenue increases, profit expands sharply, achieved a new record high

UNIQLO Japan reported an increase in revenue and a considerable increase in profits in fiscal 2024, which resulted in a record annual performance for the business segment. Revenue totaled 932.2 billion yen (+4.7% year-on-year) and operating profit expanded to 155.8 billion yen (+32.2% year-on-year). Full-year same-store sales (including e-commerce) expanded by 3.2% year-on-year. In the first half from 1 September 2023 through 29 February 2024, same-store sales contracted by 3.4% year-on-year as a result of the warm winter weather. However, same-store sales subsequently increased by 11.7% year-on-year in the second half from 1 March through 31 August 2024 thanks to consistently high temperatures and successful efforts to accurately capture customer demand by maintaining strategic inventory of core summer ranges through the end of the summer season and by enhancing marketing initiatives. Buoyant demand from overseas visitors also contributed to the increase in UNIQLO Japan revenue as UNIQLO brand recognition continues to rise worldwide. The gross profit margin improved by 2.9 points year-on-year. This was due to successful efforts to ensure production orders closely reflected latest sales trends in order to reduce the impact of spot exchange rates used for additional production orders, thereby improving cost of sales and consequently reducing the second-half discounting rate. The UNIQLO Japan selling, general and administrative expense ratio improved by 0.5 point in fiscal 2024 as strong sales helped improve component cost ratios such as personnel and advertising and promotion.

■UNIQLO International: Large full-year revenue and profit increases. Operating profit margins expand to 15% or higher in all markets

UNIQLO International reported a record high performance in fiscal 2024 on the back of significant increases in both revenue and profit, with revenue rising to 1.7118 trillion yen (+19.1% year-on-year) and operating profit expanding to 283.4 billion yen (+24.9% year-on-year). Operating profit margins improved significantly in both North America and Europe, bringing operating profit margins across all regions to 15% or higher.

Breaking down the UNIQLO International performance into individual regions and markets, the Greater China region reported higher revenue and a slight increase in profit in fiscal 2024, with revenue rising to 677.0 billion yen (+9.2% year-on-year) and operating profit totaling 104.8 billion yen (+0.5% year-on-year). In local currency terms, full-year revenue increased while profit contracted slightly in the Mainland China and Hong Kong markets. While sales in those two markets proved strong in the first half of the business year, second-half revenue declined and profit contracted considerably as sales proved sluggish in comparison with the high bar set in the previous year and in the face of a slowdown in consumer appetite, unseasonal weather, and product lineups that did not fully satisfy the needs of local customers. By contrast, the Taiwan market reported increases in both full-year revenue and profit. UNIQLO South Korea and UNIQLO Southeast Asia, India & Australia reported significantly higher full-year revenue and profits, with combined revenue for those markets rising to 540.5 billion yen (+20.2% year-on-year) and operating profit totaling 97.6 billion yen (+24.8% year-on-year). Within that grouping, UNIQLO South Korea reported year-on-year increases in revenue and profit in fiscal 2024, while UNIQLO Southeast Asia, India & Australia reported significant full-year revenue and profit gains on strong sales of HEATTECH, fleece, Bra Tops, UV protection parkas, and other ranges. Meanwhile, UNIQLO North America achieved a significant increase in revenue and profit in fiscal 2024, with revenue totaling 217.7 billion yen (+32.8% year-on-year) and operating profit totaling 34.8 billion yen (+65.1% year-on-year). Same-stores sales increased sharply on the back of continued efforts to convey pertinent product-related information, especially relating to core products. UNIQLO Europe also reported substantial increases in revenue and profit in fiscal 2024, with revenue totaling 276.5 billion yen (+44.5% year-on-year) and operating profit expanding to 46.5 billion yen (+70.1% year-on-year) on the back of extremely strong sales at new stores and significantly stronger, double-digit growth in same-store sales.

■GU: Full-year revenue increases, profit expands sharply

GU reported an increase in revenue and a significant expansion in profits in fiscal 2024, with revenue reaching 319.1 billion yen (+8.1% year-on-year) and operating profit expanding to 33.7 billion yen (+28.9% year-on-year). GU same-store sales expanded as the brand witnessed strong sales of Heavy Weight Sweatshirts, Sweat Look T-shirt, Barrel Leg Jeans, and several other items that incorporated global mass fashion trends. Strong demand from overseas visitors also contributed to the strong revenue figures. The considerable expansion in profits was underpinned by efforts to improve cost of sales, which resulted in a higher gross profit margin.

■Global Brands: Full-year revenue declines, business profit contracts sharply

In fiscal 2024, the Global Brands segment reported a decline in revenue to 138.8 billion yen (−2.0% year-on-year). Business profit, a measure that illustrates pure business profitability by deducting cost of sales and selling, general and administrative expenses from the revenue total, contracted to 0.1 billion yen (−76.2% year-on-year). These declines were the result of a reduction in store numbers associated with structural reforms at PLST and Comptoir des Cotonniers operations, and sluggish sales at the Theory label. Operating profit moved back into the black to the tune of 0.6 billion yen (compared with a loss of 3.0 billion yen in fiscal 2023) but that was due to the recording of impairment losses relating to the closure of unprofitable stores. Our Theory operation reported a decline in revenue in local currency terms on the back of sluggish sales growth in the United States and lackluster sales in Asia due to depressed consumer appetite. While the PLST label reported significantly lower revenue from fewer stores, same-store sales increased and continue to show signs of a steady recovery. The PLST gross profit margin improved significantly and operating profit moved into the black as the label continued its shift toward a new business model that does not rely on discounting. Finally, while Comptoir des Cotonniers reported a decline in revenue on the back of fewer store numbers, the brand also reported a contraction in operational losses as restructuring measures helped improve cost structures.

■FY2025 consolidated business estimates: Expect revenue and profit to rise, with both measures generating record-high performances

In fiscal 2025, the Fast Retailing Group expects to achieve consolidated revenue of 3.4000 trillion yen (+9.5% year-on-year), operating profit of 530.0 billion yen (+5.8% year-on-year), profit before income taxes of 585.0 billion (+5.0% year-on-year), and profit attributable to owners of the parent of 385.0 billion yen (+3.5% year-on-year).

We will dedicate the year ending 31 August, 2025 to generating further qualitative improvements in all aspects of our business in order to achieve sustainable business growth and become a truly global company, and we intend to focus on advancing initiatives in the following five priority areas.

- (1) Strengthening investment in human capital

- (2) Further progressing the development of a digital consumer retailing industry

- (3) Accelerating the expansion of our global operations

- (4) Expanding GU and Global Brands

- (5) Pursuing a business model in which the development of business contributes to sustainability

See more : What Is an Income Statement? Format, Contents, & Expenses

In terms of individual business segments, we expect UNIQLO Japan will generate slightly higher revenue and profit in fiscal 2025. It will be a tough challenge to exceed the strong fiscal 2024 performance, which was boosted primarily by extremely strong second-half sales, but we expect to be able to generate a slight increase in same-store sales by striving to improve product power and appeal, marketing, and local store management. Meanwhile, UNIQLO International is forecast to generate considerable increases in both revenue and profit in fiscal 2025, with UNIQLO Greater China and UNIQLO South Korea reporting higher revenue and profit, and the North America, Europe, and Southeast Asia, India & Australia regions reporting significant revenue and profit gains on the back of a continued expansion in global operations. Finally, our GU and Global Brands segments are predicted to generate higher revenue and profit in fiscal 2025.

We plan to continue to strengthen the opening of high-quality stores in fiscal 2025, primarily within our UNIQLO International operation. In terms of store numbers, we predict our network will total 3,698 stores by the end of August 2025, comprising 797 UNIQLO Japan stores (including franchise stores), 1,778 UNIQLO International stores, 489 GU stores, and 634 Global Brands stores (including franchise stores).

We forecast an annual dividend per share in fiscal 2025 of 450 yen (interim and year-end dividends of 225 yen each). That would represent an increase in the full-year dividend of 50 yen per share compared with the previous year.

Fast Retailing Co., Ltd. discloses business results data and offers a variety of press releases on its IR website

Source link https://www.fastretailing.com/eng/ir/financial/summary.html

Source: https://incomestatements.info

Category: News