See more : SSE PLC (SCT.DE) Income Statement Analysis – Financial Results

Complete financial analysis of ReTo Eco-Solutions, Inc. (RETO) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of ReTo Eco-Solutions, Inc., a leading company in the Construction Materials industry within the Basic Materials sector.

- Vantage Towers AG (VTAGY) Income Statement Analysis – Financial Results

- Varopakorn Public Company Limited (VARO.BK) Income Statement Analysis – Financial Results

- General Electric Company (GEC.DE) Income Statement Analysis – Financial Results

- Aidma Holdings, Inc. (7373.T) Income Statement Analysis – Financial Results

- GCM Grosvenor Inc. (GCMGW) Income Statement Analysis – Financial Results

ReTo Eco-Solutions, Inc. (RETO)

About ReTo Eco-Solutions, Inc.

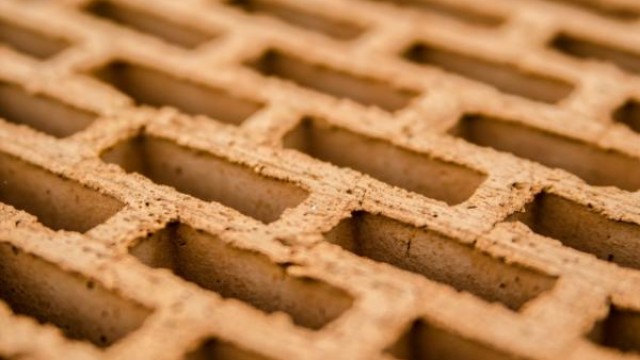

ReTo Eco-Solutions, Inc., together with its subsidiaries, manufactures and distributes construction materials primarily in China. Its products include aggregates, bricks, pavers, and tiles. The company's construction materials are used for water absorption, flood control, and water retention; for gardens, roads, bridges, city squares, retaining walls, and slope construction; for hydraulic ecological projects, such as slope protection and river transformation; and for insulation, decoration, and building walls. It also offers construction materials manufacturing equipment, such as automated production equipment with hydraulic integration in China, South Asia, North America, the Middle East, North Africa, and Southeast Asia. In addition, the company undertakes municipal construction projects, including sponge city projects. ReTo Eco-Solutions, Inc. was founded in 1999 and is headquartered in Beijing, the People's Republic of China.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 3.24M | 6.47M | 3.60M | 9.73M | 29.55M | 37.57M | 35.55M | 32.42M | 17.38M | 13.76M |

| Cost of Revenue | 3.03M | 5.67M | 3.21M | 8.58M | 22.19M | 20.37M | 17.59M | 18.27M | 9.27M | 8.00M |

| Gross Profit | 210.07K | 806.67K | 385.73K | 1.16M | 7.36M | 17.20M | 17.96M | 14.15M | 8.12M | 5.76M |

| Gross Profit Ratio | 6.49% | 12.46% | 10.71% | 11.89% | 24.91% | 45.79% | 50.53% | 43.65% | 46.70% | 41.86% |

| Research & Development | 1.17M | 960.60K | 346.95K | 334.90K | 438.37K | 799.60K | 603.45K | 503.69K | 458.25K | 629.24K |

| General & Administrative | 9.41M | 8.59M | 4.62M | 4.64M | 3.95M | 5.27M | 5.31M | 3.88M | 2.61M | 2.20M |

| Selling & Marketing | 1.19M | 3.77M | 826.24K | 1.28M | 1.31M | 1.99M | 1.80M | 1.58M | 1.46M | 1.43M |

| SG&A | 9.99M | 12.37M | 5.45M | 5.92M | 5.26M | 7.25M | 7.11M | 5.46M | 4.07M | 3.63M |

| Other Expenses | 0.00 | -289.63K | -1.94M | 430.73K | 294.00K | 15.46K | 167.00K | 0.00 | 92.88K | 0.00 |

| Operating Expenses | 11.55M | 13.33M | 5.79M | 6.26M | 5.70M | 8.05M | 7.71M | 5.96M | 4.53M | 3.81M |

| Cost & Expenses | 14.18M | 19.00M | 9.01M | 14.83M | 27.89M | 28.42M | 25.30M | 24.24M | 13.79M | 11.82M |

| Interest Income | 25.18K | 3.23K | 1.90K | 857.55K | 4.55K | 5.94K | 967.00K | 1.45M | 1.03M | 1.07M |

| Interest Expense | 420.51K | 321.69K | 103.34K | 1.54M | 1.25M | 1.07M | 1.01M | 1.45M | 1.03M | 0.00 |

| Depreciation & Amortization | 924.37K | 1.10M | 1.05M | 869.73K | 2.37M | 1.61M | 1.57M | 1.36M | 1.26M | 966.59K |

| EBITDA | -14.74M | -13.98M | -19.18M | -2.99M | -3.23M | 6.37M | 11.99M | 9.27M | 4.94M | 2.47M |

| EBITDA Ratio | -455.49% | -184.77% | -180.15% | -24.10% | 14.66% | 29.01% | 33.72% | 29.45% | 28.42% | 17.93% |

| Operating Income | -11.34M | -12.52M | -5.41M | -5.10M | 1.96M | 7.20M | 10.25M | 8.19M | 3.59M | 1.50M |

| Operating Income Ratio | -350.54% | -193.42% | -150.18% | -52.39% | 6.63% | 19.16% | 28.84% | 25.26% | 20.66% | 10.91% |

| Total Other Income/Expenses | -4.74M | -145.95K | -12.82M | -413.78K | -7.23M | -1.07M | -3.42M | -1.73M | -939.45K | -625.64K |

| Income Before Tax | -16.09M | -15.40M | -20.47M | -14.56M | -11.29M | 6.15M | 9.41M | 6.46M | 2.65M | 876.15K |

| Income Before Tax Ratio | -497.04% | -237.84% | -568.71% | -149.59% | -38.20% | 16.36% | 26.46% | 19.91% | 15.25% | 6.37% |

| Income Tax Expense | -16.64K | -17.56K | 3.47K | 569.97K | 1.01M | 1.58M | 2.76M | 1.95M | 295.76K | 208.00K |

| Net Income | -15.64M | -15.38M | -20.48M | -15.13M | -12.30M | 4.48M | 5.98M | 4.10M | 2.31M | 650.39K |

| Net Income Ratio | -483.32% | -237.57% | -568.81% | -155.45% | -41.61% | 11.93% | 16.82% | 12.66% | 13.31% | 4.73% |

| EPS | -19.44 | -39.64 | -78.28 | -62.72 | -53.72 | 19.69 | 3.50 | 1.84 | 1.04 | 0.00 |

| EPS Diluted | -19.44 | -39.64 | -78.28 | -62.72 | -53.72 | 19.69 | 3.50 | 1.84 | 1.04 | 0.00 |

| Weighted Avg Shares Out | 804.57K | 388.01K | 261.61K | 241.25K | 228.88K | 227.60K | 191.30K | 223.40K | 223.40K | 0.00 |

| Weighted Avg Shares Out (Dil) | 804.57K | 388.01K | 261.61K | 241.25K | 228.88K | 227.60K | 191.30K | 223.40K | 223.40K | 0.00 |

ReTo Eco-Solutions Trading on Increased Volume After Winning Sales Contract: Technicals To Watch

RETO Stock Price Increases Over 20% Pre-Market: Why It Happened

RETO Stock Price Increases Over 100% Pre-Market: Why It Happened

ReTo Eco-Solutions Wins Prestigious Awards for New Materials, New Technology, Comprehensive Strength and Spirit of Craftsmanship

ReTo Eco-Solutions and Tsinghua University Jointly Develop R&D Demonstration for National Key Project

ReTo Eco-Solutions Regains Nasdaq Compliance

ReTo Eco-Solutions Reports Full Year 2019 Financial Results

Source: https://incomestatements.info

Category: Stock Reports