See more : Pyxis Tankers Inc. (PXS) Income Statement Analysis – Financial Results

Complete financial analysis of Lordstown Motors Corp. (RIDEQ) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Lordstown Motors Corp., a leading company in the Auto – Manufacturers industry within the Consumer Cyclical sector.

- RITEK Corporation (2349.TW) Income Statement Analysis – Financial Results

- Team Société anonyme (MLTEA.PA) Income Statement Analysis – Financial Results

- Shanghai Hongda New Material Co., Ltd. (002211.SZ) Income Statement Analysis – Financial Results

- Kingstate Electronics Corp. (3206.TWO) Income Statement Analysis – Financial Results

- Icon Offshore Bhd (5255.KL) Income Statement Analysis – Financial Results

Lordstown Motors Corp. (RIDEQ)

About Lordstown Motors Corp.

Lordstown Motors Corp. develops, manufactures, and sells Endurance, an electric full-size pickup truck for fleet customers in the United States. Lordstown Motors Corp. was incorporated in 2018 and is based in Lordstown, Ohio. On June 27, 2023, Lordstown Motors Corp., along with its affiliates, filed a voluntary petition for reorganization under Chapter 11 in the U.S. Bankruptcy Court for the District of Delaware.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue | 2.34M | 194.00K | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 91.55M | 30.02M | 11.11M | 0.00 | 0.00 |

| Gross Profit | -89.21M | -29.83M | -11.11M | 0.00 | 0.00 |

| Gross Profit Ratio | -3,812.39% | -15,375.77% | 0.00% | 0.00% | 0.00% |

| Research & Development | 33.34M | 107.82M | 284.02M | 73.69M | 5.87M |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 28.79M | 4.53M |

| SG&A | 42.61M | 138.27M | 105.36M | 28.79M | 4.53M |

| Other Expenses | 0.00 | 788.00K | -10.08M | -20.87M | 0.00 |

| Operating Expenses | 75.96M | 246.09M | 389.38M | 102.48M | 10.39M |

| Cost & Expenses | 167.51M | 276.11M | 400.49M | 102.48M | 10.39M |

| Interest Income | 0.00 | 3.21M | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 0.00 | 703.00K | 0.00 |

| Depreciation & Amortization | 54.41M | 8.48M | 11.11M | -198.00K | 15.59M |

| EBITDA | -110.76M | -267.44M | -399.26M | -123.35M | 5.20M |

| EBITDA Ratio | -4,733.29% | -137,855.15% | 0.00% | 0.00% | 0.00% |

| Operating Income | -165.17M | -275.92M | -400.49M | -102.48M | -10.39M |

| Operating Income Ratio | -7,058.38% | -142,224.23% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -177.90M | -6.49M | -9.88M | -21.57M | 0.00 |

| Income Before Tax | -343.07M | -282.40M | -410.37M | -124.05M | -10.39M |

| Income Before Tax Ratio | -14,660.94% | -145,569.07% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 0.00 | 0.00 | 0.00 | 198.00K | -15.59M |

| Net Income | -343.07M | -282.40M | -410.37M | -124.05M | -10.39M |

| Net Income Ratio | -14,660.94% | -145,569.07% | 0.00% | 0.00% | 0.00% |

| EPS | -21.67 | -20.30 | -34.06 | -19.24 | -2.28 |

| EPS Diluted | -21.67 | -20.30 | -34.06 | -19.24 | -2.28 |

| Weighted Avg Shares Out | 15.95M | 13.91M | 12.05M | 6.45M | 4.55M |

| Weighted Avg Shares Out (Dil) | 15.95M | 13.91M | 12.05M | 6.45M | 4.55M |

RIDE Stock Pops Even as GM Sheds Its Lordstown Motors Stake

GM to sell stake in EV startup Lordstown Motors - CNBC

GM sells its stake in embattled EV start-up Lordstown Motors

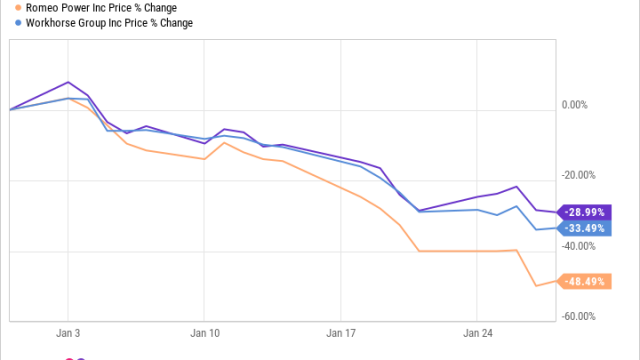

Why Are Lordstown Motors, Romeo Power, and Workhorse Group Up Today?

Why Lordstown Stock Is Sinking, but Blink Charging and Hyzon Are Soaring Friday

Does This Huge Deal With Foxconn Make Lordstown Motors Stock a Buy?

Foxconn buys Lordstown Motors' Ohio factory for $230M, plans to help produce Endurance electric pickup

Foxconn buys Lordstown Motors' old GM factory for $230 million

Foxconn finalizes $50 million stock deal with Lordstown Motors

Lordstown stock rallies 10% after EV maker and Foxconn seal deal to sell Ohio plant, develop new vehicles

Source: https://incomestatements.info

Category: Stock Reports