See more : WhiteHorse Finance, Inc. (WHF) Income Statement Analysis – Financial Results

Complete financial analysis of Rheinmetall AG (RNMBY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Rheinmetall AG, a leading company in the Aerospace & Defense industry within the Industrials sector.

- Baker Hughes Company (0RR8.L) Income Statement Analysis – Financial Results

- Lumi Rental Company (4262.SR) Income Statement Analysis – Financial Results

- Metalert, Inc. (GTXO) Income Statement Analysis – Financial Results

- Sunyard Technology Co.,Ltd (600571.SS) Income Statement Analysis – Financial Results

- MMTC Limited (MMTC.NS) Income Statement Analysis – Financial Results

Rheinmetall AG (RNMBY)

Industry: Aerospace & Defense

Sector: Industrials

Website: https://www.rheinmetall.com/en/rheinmetall_ag/home.php

About Rheinmetall AG

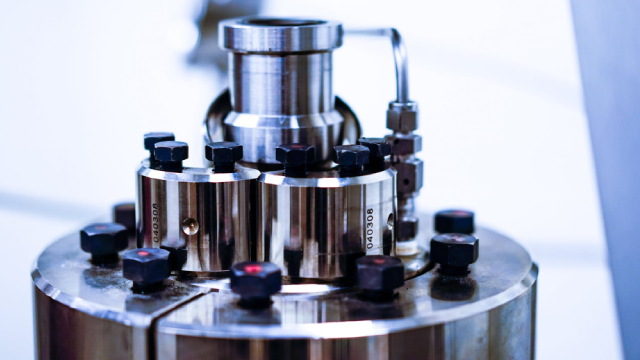

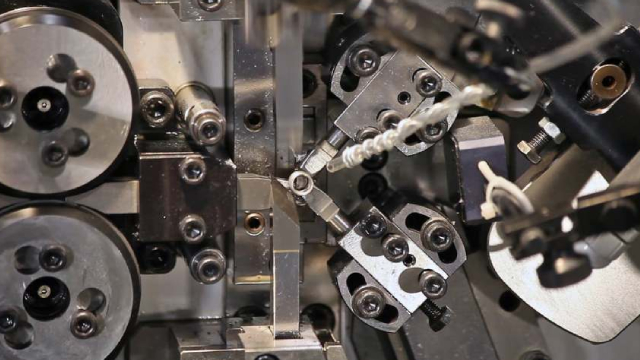

Rheinmetall AG provides technologies to the mobility and security sectors worldwide. The company operates in five segments: Vehicle Systems, Weapon and Ammunition, Electronic Solutions, Sensors and Actuators, and Materials and Trade. The Vehicle Systems segment offers combat, support, logistics, and special vehicles, including armored tracked vehicles, CBRN protection systems, turret systems, and wheeled logistics and tactical vehicles. The Weapon and Ammunition segment provides threat-appropriate, effective and accurate firepower, and protection solutions, such as large and medium-caliber weapons and ammunition, weapon stations, protection systems, and propellants and powders. The Electronic Solutions segment offers a chain of systems network, such as sensors, networking platforms, automated connected effectors for soldiers, and cyberspace protection solutions, and training and simulation solutions. Its products include air defense systems; soldier systems; command, control, and reconnaissance systems; fire control systems; sensors; and simulations for the army, air force, navy, and civil applications. The Sensors and Actuators segment provides a portfolio of products comprising exhaust gas recirculation systems; throttle valves, control dampers, and exhaust flaps for electromotors; solenoid valves; actuators and valve train systems; oil, water, and vacuum pumps for passenger cars, commercial vehicles, and light and heavy-duty off-road applications; and industrial solutions. The Materials and Trade segment focuses on the development of system components for the basic motors, such as engine blocks, structural components, and cylinder heads; plain bearings, and bushes; and replacement parts. It also engages in the aftermarket activities. The company was formerly known as Rheinmetall Berlin AG and changed its name to Rheinmetall AG in 1996. Rheinmetall AG was founded in 1889 and is headquartered in Düsseldorf, Germany.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 7.18B | 6.41B | 5.66B | 5.88B | 6.26B | 6.15B | 5.90B | 5.60B | 5.18B | 4.69B | 4.61B | 4.70B | 4.45B | 3.99B | 3.42B | 3.93B | 4.01B | 3.63B | 3.45B | 3.41B | 4.25B | 4.57B |

| Cost of Revenue | 3.24B | 3.03B | 2.63B | 2.93B | 3.21B | 3.17B | 3.15B | 3.01B | 2.78B | 2.55B | 2.43B | 2.46B | 2.24B | 1.99B | 1.63B | 2.01B | -2.12B | -1.84B | -1.67B | -1.61B | 2.01B | 2.08B |

| Gross Profit | 3.94B | 3.38B | 3.03B | 2.95B | 3.05B | 2.98B | 2.75B | 2.59B | 2.40B | 2.14B | 2.18B | 2.25B | 2.21B | 2.00B | 1.79B | 1.92B | 6.12B | 5.47B | 5.12B | 5.03B | 2.23B | 2.49B |

| Gross Profit Ratio | 54.86% | 52.71% | 53.55% | 50.13% | 48.71% | 48.52% | 46.62% | 46.25% | 46.29% | 45.71% | 47.28% | 47.77% | 49.71% | 50.14% | 52.43% | 48.94% | 152.81% | 150.77% | 148.35% | 147.29% | 52.59% | 54.56% |

| Research & Development | 0.00 | 351.00M | 337.00M | 343.00M | 355.00M | 336.00M | 295.00M | 216.00M | 239.00M | 222.00M | 213.00M | 191.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 147.00M | 125.00M | 65.00M | 82.00M | 79.00M | 76.00M | 79.00M | 125.00M | 121.00M | 101.00M | 106.00M | 226.00M | 1.26B | 0.00 | 0.00 | 1.08B | 0.00 | 0.00 | 0.00 | 0.00 | 1.34B | 1.45B |

| Selling & Marketing | 117.00M | 109.00M | 93.00M | 81.00M | 99.00M | 106.00M | 97.00M | 97.00M | 95.00M | 99.00M | 82.00M | 91.00M | 0.00 | 0.00 | 0.00 | 0.00 | -87.00M | -75.00M | -86.00M | -100.00M | 0.00 | 0.00 |

| SG&A | 264.00M | 234.00M | 158.00M | 163.00M | 178.00M | 182.00M | 176.00M | 222.00M | 216.00M | 200.00M | 188.00M | 317.00M | 1.26B | 0.00 | 0.00 | 1.08B | -87.00M | -75.00M | -86.00M | -100.00M | 1.34B | 1.45B |

| Other Expenses | 3.67B | 2.40B | 2.25B | 2.41B | 2.39B | 11.00M | 11.00M | 9.00M | 10.00M | 7.00M | 5.00M | 5.00M | 618.00M | 1.72B | 2.00M | -120.00M | 0.00 | 0.00 | 0.00 | 0.00 | 689.00M | 653.00M |

| Operating Expenses | 3.94B | 2.63B | 2.41B | 2.57B | 2.57B | 2.54B | 2.34B | 2.20B | 2.09B | 2.07B | 2.02B | 2.00B | 1.88B | 1.72B | 1.73B | 1.68B | -87.00M | -75.00M | -86.00M | -100.00M | 2.03B | 2.10B |

| Cost & Expenses | 6.28B | 5.66B | 5.04B | 5.50B | 5.77B | 5.70B | 5.49B | 5.22B | 4.87B | 4.62B | 4.45B | 4.45B | 4.12B | 3.71B | 3.36B | 3.68B | -2.20B | -1.92B | -1.76B | -1.71B | 4.04B | 4.18B |

| Interest Income | 29.00M | 12.00M | 4.00M | 9.00M | 11.00M | 6.00M | 9.00M | 5.00M | 3.00M | 2.00M | 2.00M | 4.00M | 18.00M | 19.00M | 2.00M | 62.00M | 57.00M | 0.00 | 0.00 | 0.00 | 84.00M | 102.00M |

| Interest Expense | 111.00M | 32.00M | 31.00M | 42.00M | 46.00M | 39.00M | 48.00M | 59.00M | 69.00M | 82.00M | 79.00M | 66.00M | 65.00M | 68.00M | 61.00M | 2.00M | 7.00M | 0.00 | 0.00 | 0.00 | 2.00M | 2.00M |

| Depreciation & Amortization | 308.00M | 249.00M | 237.00M | 250.00M | 278.00M | 275.00M | 220.00M | 227.00M | 203.00M | 208.00M | 212.00M | 194.00M | 184.00M | 167.00M | 165.00M | 166.00M | 168.00M | 151.00M | 157.00M | 168.00M | 238.00M | 309.00M |

| EBITDA | 1.23B | 1.00B | 867.00M | 710.00M | 801.00M | 842.00M | 605.00M | 585.00M | 493.00M | 312.00M | 337.00M | 494.00M | 520.00M | 445.00M | 180.00M | 293.00M | 388.00M | 2.07B | 1.91B | 1.88B | 364.00M | 601.00M |

| EBITDA Ratio | 17.20% | 15.65% | 15.52% | 14.47% | 12.81% | 13.13% | 10.26% | 10.44% | 9.42% | 6.78% | 8.82% | 10.12% | 11.67% | 11.63% | 6.67% | 8.96% | 59.18% | 57.00% | 55.39% | 55.14% | 8.57% | 13.15% |

| Operating Income | 846.00M | 754.00M | 624.00M | 293.00M | 521.00M | 448.00M | 385.00M | 353.00M | 275.00M | 77.00M | 81.00M | 283.00M | 336.00M | 278.00M | 13.00M | 244.00M | 263.00M | 213.00M | 227.00M | 202.00M | 206.00M | 394.00M |

| Operating Income Ratio | 11.79% | 11.76% | 11.03% | 4.99% | 8.33% | 7.29% | 6.53% | 6.30% | 5.31% | 1.64% | 1.76% | 6.02% | 7.54% | 6.97% | 0.38% | 6.21% | 6.57% | 5.87% | 6.57% | 5.92% | 4.85% | 8.62% |

| Total Other Income/Expenses | -31.00M | -43.00M | -43.00M | -62.00M | -5.00M | 37.00M | -38.00M | -53.00M | -54.00M | -55.00M | -94.00M | -67.00M | -41.00M | -49.00M | -59.00M | -50.00M | -50.00M | -213.00M | -227.00M | -202.00M | -86.00M | -104.00M |

| Income Before Tax | 815.00M | 711.00M | 582.00M | 57.00M | 477.00M | 485.00M | 346.00M | 299.00M | 221.00M | 22.00M | 35.00M | 239.00M | 295.00M | 229.00M | -46.00M | 184.00M | 0.00 | 0.00 | 0.00 | 0.00 | 120.00M | 290.00M |

| Income Before Tax Ratio | 11.36% | 11.09% | 10.29% | 0.97% | 7.63% | 7.89% | 5.87% | 5.34% | 4.26% | 0.47% | 0.76% | 5.08% | 6.62% | 5.74% | -1.35% | 4.69% | 0.00% | 0.00% | 0.00% | 0.00% | 2.82% | 6.34% |

| Income Tax Expense | 185.00M | 183.00M | 150.00M | 56.00M | 123.00M | 131.00M | 94.00M | 84.00M | 61.00M | 6.00M | 13.00M | 49.00M | 70.00M | 55.00M | 6.00M | 49.00M | 2.06B | 1.80B | 1.64B | 1.62B | 52.00M | 16.00M |

| Net Income | 535.00M | 474.00M | 432.00M | 1.00M | 335.00M | 305.00M | 224.00M | 200.00M | 151.00M | 18.00M | 29.00M | 190.00M | 225.00M | 174.00M | -52.00M | 134.00M | 145.00M | 120.00M | 113.00M | 96.00M | 68.00M | 274.00M |

| Net Income Ratio | 7.46% | 7.39% | 7.64% | 0.02% | 5.36% | 4.96% | 3.80% | 3.57% | 2.91% | 0.38% | 0.63% | 4.04% | 5.05% | 4.36% | -1.52% | 3.41% | 3.62% | 3.31% | 3.27% | 2.81% | 1.60% | 5.99% |

| EPS | 12.02 | 10.93 | 9.98 | 0.02 | 7.78 | 1.42 | 1.05 | 0.94 | 0.77 | 0.09 | 0.15 | 1.00 | 1.17 | 0.91 | -0.29 | 0.78 | 0.81 | 0.67 | 0.63 | 1.07 | 0.76 | 3.04 |

| EPS Diluted | 11.55 | 10.93 | 9.98 | 0.02 | 7.78 | 1.42 | 1.05 | 0.94 | 0.77 | 0.09 | 0.15 | 1.00 | 1.17 | 0.91 | -0.29 | 0.78 | 0.81 | 0.67 | 0.63 | 1.07 | 0.76 | 3.04 |

| Weighted Avg Shares Out | 44.50M | 43.36M | 43.28M | 43.17M | 43.06M | 214.75M | 214.00M | 213.05M | 194.90M | 191.05M | 189.65M | 190.50M | 191.65M | 191.15M | 181.30M | 172.70M | 180.00M | 180.00M | 180.00M | 90.00M | 90.00M | 90.00M |

| Weighted Avg Shares Out (Dil) | 46.34M | 43.36M | 43.28M | 43.17M | 43.06M | 214.75M | 214.00M | 213.05M | 194.90M | 191.05M | 189.65M | 190.50M | 191.65M | 191.15M | 181.30M | 172.70M | 180.00M | 180.00M | 180.00M | 90.00M | 90.00M | 90.00M |

Rheinmetall: What Is Left After A 125% Surge On Growing War Concerns?

Rheinmetall to buy military vehicle parts maker Loc Performance in $950 mln deal

Rheinmetall expects up to 25 bln eur in orders for JV with Leonardo

German orders drive strong rise in Rheinmetall backlog in H1

Rheinmetall confirms 2024 guidance as Q2 sales beat expectations

Rheinmetall CEO expects order backlog of 60-70 bln euros at end-2024

Rheinmetall, Leonardo say deal paves way for EU defence consolidation

Italy plans 20 bln euro tank order from Germany's Rheinmetall, reports Handelsblatt

Rheinmetall, Torsus partner up for special operations vehicles

Continental turns to arms maker Rheinmetall to help workers find new jobs

Source: https://incomestatements.info

Category: Stock Reports