See more : RITEK Corporation (2349.TW) Income Statement Analysis – Financial Results

Complete financial analysis of Rockwell Automation, Inc. (ROK) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Rockwell Automation, Inc., a leading company in the Industrial – Machinery industry within the Industrials sector.

- Phillips 66 (R66.DE) Income Statement Analysis – Financial Results

- RightCrowd Limited (RCW.AX) Income Statement Analysis – Financial Results

- Fellow Pankki Oyj (FELLOW.HE) Income Statement Analysis – Financial Results

- Revolution Healthcare Acquisition Corp. (REVH) Income Statement Analysis – Financial Results

- Citizens Financial Corp. (CIWV) Income Statement Analysis – Financial Results

Rockwell Automation, Inc. (ROK)

About Rockwell Automation, Inc.

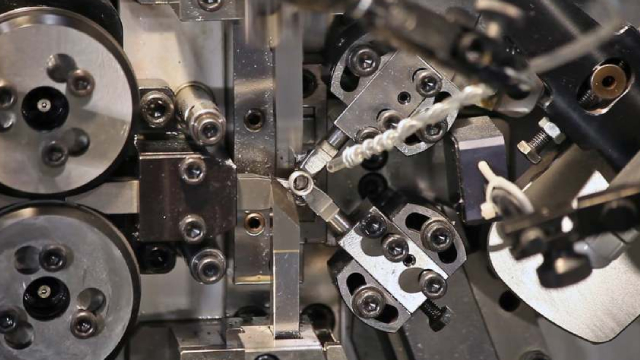

Rockwell Automation, Inc. provides industrial automation and digital transformation solutions in the United States and internationally. The company operates in three segments, Intelligent Devices, Software & Control, and Lifecycle Services. Its solutions include hardware and software products, and services. The Intelligent Devices segment offers drives, motion, safety, sensing, industrial components, and configured-to-order products. The Software & Control segment provides control and visualization software and hardware, information software, digital twin and simulation software, and network and security infrastructure solutions. The Lifecycle Services segment provides consulting, professional services and solutions, and connected and maintenance services. The company sells its solutions primarily through independent distributors in relation with its direct sales force. It serves discrete end markets, including automotive, semiconductor, warehousing and logistics, and other discrete markets, as well as general industries comprising printing and publishing, marine, glass, fiber and textiles, airports, and aerospace; hybrid end markets, such as food and beverage, life sciences, household and personal care, and tire, as well as eco industrial, including water/wastewater, waste management, mass transit, and renewable energy; and process end markets comprising oil and gas, mining, metals, chemicals, pulp and paper, and others. Rockwell Automation, Inc. was founded in 1903 and is headquartered in Milwaukee, Wisconsin.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 8.26B | 9.06B | 7.76B | 7.00B | 6.33B | 6.69B | 6.67B | 6.31B | 5.88B | 6.31B | 6.62B | 6.35B | 6.26B | 6.00B | 4.86B | 4.33B | 5.70B | 5.00B | 5.56B | 5.00B | 4.41B | 4.10B | 3.91B | 4.32B | 7.15B | 7.04B | 6.75B | 7.76B | 10.37B | 13.10B | 11.20B | 10.84B | 10.91B | 11.93B | 12.38B | 12.52B | 11.95B | 12.12B | 12.30B | 11.34B |

| Cost of Revenue | 5.07B | 5.34B | 4.66B | 4.10B | 3.73B | 3.79B | 3.79B | 3.69B | 3.40B | 3.60B | 3.87B | 3.78B | 3.74B | 3.61B | 2.92B | 2.76B | 3.36B | 2.91B | 3.37B | 3.11B | 2.85B | 2.75B | 2.67B | 3.03B | 4.55B | 4.57B | 4.45B | 4.99B | 7.34B | 9.43B | 8.18B | 8.05B | 8.25B | 8.94B | 9.20B | 9.37B | 9.01B | 9.07B | 9.35B | 8.50B |

| Gross Profit | 3.19B | 3.72B | 3.10B | 2.90B | 2.60B | 2.90B | 2.87B | 2.62B | 2.48B | 2.70B | 2.75B | 2.57B | 2.52B | 2.39B | 1.94B | 1.57B | 2.34B | 2.10B | 2.19B | 1.89B | 1.56B | 1.35B | 1.24B | 1.29B | 2.60B | 2.47B | 2.31B | 2.77B | 3.04B | 3.67B | 3.02B | 2.79B | 2.66B | 2.98B | 3.18B | 3.15B | 2.93B | 3.05B | 2.94B | 2.84B |

| Gross Profit Ratio | 38.64% | 41.04% | 39.97% | 41.41% | 41.00% | 43.32% | 43.09% | 41.58% | 42.10% | 42.85% | 41.58% | 40.52% | 40.30% | 39.84% | 39.87% | 36.23% | 41.08% | 41.91% | 39.46% | 37.86% | 35.43% | 32.94% | 31.59% | 29.89% | 36.41% | 35.11% | 34.17% | 35.74% | 29.29% | 28.04% | 26.98% | 25.76% | 24.37% | 25.03% | 25.70% | 25.14% | 24.54% | 25.19% | 23.92% | 25.07% |

| Research & Development | 477.30M | 529.50M | 440.90M | 422.50M | 371.50M | 378.90M | 371.80M | 348.20M | 319.30M | 307.30M | 290.10M | 260.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 103.00M | 53.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.60B | 1.59B | 1.47B | 1.51B | 1.57B | 1.54B | 1.49B | 1.46B | 1.32B | 1.23B | 1.48B | 1.28B | 1.28B | 1.12B | 1.06B | 1.01B | 953.00M | 1.04B | 1.29B | 1.27B | 1.31B | 1.41B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 2.00B | 2.02B | 1.77B | 1.68B | 1.48B | 1.54B | 1.60B | 1.59B | 1.47B | 1.51B | 1.57B | 1.54B | 1.49B | 1.46B | 1.32B | 1.23B | 1.48B | 1.28B | 1.28B | 1.12B | 1.06B | 1.01B | 953.00M | 1.04B | 1.29B | 1.27B | 1.31B | 1.41B | 1.62B | 1.71B | 1.41B | 1.37B | 1.33B | 1.39B | 1.45B | 1.47B | 1.44B | 1.36B | 1.32B | 1.22B |

| Other Expenses | 0.00 | -71.30M | -1.60M | 5.70M | -29.70M | -362.40M | 130.60M | 80.90M | 6.30M | -5.50M | 9.70M | 5.70M | -5.00M | 2.10M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 369.00M | 337.00M | 306.00M | 484.00M | 542.00M | 571.00M | 493.90M | 490.90M | 558.10M | 601.40M | 620.00M | 614.60M | 493.90M | 491.30M | 558.10M | 595.30M |

| Operating Expenses | 3.19B | 2.02B | 1.77B | 1.68B | 1.48B | 1.54B | 1.60B | 1.59B | 1.47B | 1.51B | 1.57B | 1.54B | 1.49B | 1.46B | 1.33B | 1.23B | 1.48B | 1.28B | 1.28B | 1.12B | 1.06B | 1.01B | 953.00M | 1.04B | 1.66B | 1.61B | 1.72B | 1.94B | 2.16B | 2.28B | 1.91B | 1.87B | 1.89B | 1.99B | 2.07B | 2.09B | 1.93B | 1.85B | 1.88B | 1.81B |

| Cost & Expenses | 7.43B | 7.36B | 6.43B | 5.78B | 5.21B | 5.33B | 5.39B | 5.28B | 4.87B | 5.11B | 5.44B | 5.32B | 5.23B | 5.07B | 4.25B | 3.99B | 4.84B | 4.19B | 4.64B | 4.23B | 3.91B | 3.76B | 3.63B | 4.07B | 6.20B | 6.18B | 6.16B | 6.93B | 9.49B | 11.70B | 10.09B | 9.91B | 10.14B | 10.93B | 11.27B | 11.46B | 10.94B | 10.92B | 11.23B | 10.31B |

| Interest Income | 12.00M | 9.70M | 4.40M | 1.60M | 5.50M | 11.10M | 24.40M | 19.60M | 12.70M | 10.70M | 9.50M | 9.80M | 7.80M | 6.00M | 5.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 151.00M | 135.30M | 123.20M | 94.60M | 103.50M | 98.20M | 73.00M | 76.20M | 71.30M | 63.70M | 59.30M | 60.90M | 60.10M | 59.50M | 60.50M | 60.90M | 68.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 317.40M | 250.40M | 238.90M | 189.80M | 172.70M | 152.20M | 164.60M | 168.90M | 172.20M | 162.50M | 152.50M | 145.20M | 138.60M | 131.30M | 127.30M | 134.10M | 136.50M | 117.90M | 153.60M | 171.20M | 186.70M | 198.00M | 206.00M | 272.00M | 369.00M | 337.00M | 306.00M | 484.00M | 542.00M | 571.00M | 493.90M | 490.90M | 558.10M | 601.40M | 620.00M | 614.60M | 493.90M | 491.30M | 558.10M | 595.30M |

| EBITDA | 1.57B | 1.99B | 1.43B | 1.81B | 1.41B | 1.15B | 1.57B | 1.26B | 1.20B | 1.36B | 1.35B | 1.19B | 1.16B | 1.06B | 732.00M | 468.90M | 1.01B | 936.60M | 876.40M | 935.00M | 690.90M | 534.20M | 488.00M | 479.00M | 784.00M | 1.20B | 898.00M | 949.00M | 841.00M | 1.97B | 1.61B | 1.42B | 1.33B | 1.60B | 1.73B | 1.67B | 1.50B | 1.69B | 1.62B | 1.62B |

| EBITDA Ratio | 18.97% | 20.67% | 20.26% | 20.20% | 19.88% | 17.20% | 23.53% | 20.32% | 20.18% | 21.46% | 20.32% | 18.69% | 18.61% | 17.64% | 15.07% | 10.98% | 17.63% | 18.64% | 18.93% | 18.69% | 16.22% | 13.08% | 12.18% | 11.08% | 17.44% | 17.08% | 20.84% | 15.38% | 13.27% | 15.02% | 14.39% | 12.34% | 11.08% | 12.07% | 13.32% | 11.14% | 11.25% | 13.32% | 12.46% | 13.22% |

| Operating Income | 830.60M | 1.62B | 1.33B | 1.22B | 1.09B | 999.20M | 1.27B | 1.03B | 1.01B | 1.20B | 1.18B | 1.04B | 1.03B | 867.60M | 613.10M | 341.50M | 858.60M | 818.70M | 919.10M | 773.30M | 504.20M | 345.00M | 282.00M | 251.00M | 947.00M | 866.00M | 592.00M | 830.00M | 881.00M | 1.40B | 1.12B | 927.30M | 768.40M | 998.30M | 1.11B | 1.06B | 1.00B | 1.20B | 1.06B | 1.03B |

| Operating Income Ratio | 10.05% | 17.91% | 17.19% | 17.48% | 17.15% | 14.93% | 19.10% | 16.36% | 17.15% | 18.97% | 17.87% | 16.31% | 16.47% | 14.46% | 12.62% | 7.88% | 15.07% | 16.36% | 16.53% | 15.46% | 11.43% | 8.41% | 7.21% | 5.81% | 13.24% | 12.30% | 8.77% | 10.69% | 8.49% | 10.66% | 9.98% | 8.55% | 7.04% | 8.37% | 8.99% | 8.46% | 8.39% | 9.90% | 8.66% | 9.07% |

| Total Other Income/Expenses | 268.50M | -84.80M | -261.70M | 308.50M | 20.70M | -98.20M | 33.80M | -72.90M | -65.00M | -69.20M | -49.60M | -55.20M | -65.10M | -61.60M | -68.90M | -67.60M | -49.70M | -30.10M | -23.20M | -36.30M | -66.10M | -47.40M | -49.00M | -39.00M | -7.00M | 24.00M | -567.00M | -95.00M | -8.00M | -170.00M | -96.60M | -23.20M | 10.00M | 25.20M | -60.50M | 146.60M | 50.90M | -13.30M | -6.00M | 33.90M |

| Income Before Tax | 1.10B | 1.61B | 1.07B | 1.53B | 1.14B | 901.00M | 1.33B | 1.04B | 943.10M | 1.13B | 1.13B | 980.90M | 965.90M | 867.60M | 544.20M | 273.90M | 808.90M | 788.60M | 891.40M | 737.00M | 438.10M | 299.00M | 233.00M | 168.00M | 943.00M | 890.00M | 25.00M | 923.00M | 896.00M | 1.23B | 1.02B | 904.10M | 778.40M | 1.02B | 1.05B | 1.21B | 1.05B | 1.19B | 1.06B | 1.06B |

| Income Before Tax Ratio | 13.30% | 17.76% | 13.83% | 21.81% | 17.95% | 13.46% | 19.96% | 16.44% | 16.04% | 17.87% | 17.12% | 15.44% | 15.43% | 14.46% | 11.20% | 6.32% | 14.20% | 15.76% | 16.03% | 14.73% | 9.93% | 7.29% | 5.96% | 3.89% | 13.19% | 12.64% | 0.37% | 11.89% | 8.64% | 9.36% | 9.11% | 8.34% | 7.13% | 8.58% | 8.50% | 9.63% | 8.81% | 9.79% | 8.61% | 9.37% |

| Income Tax Expense | 151.80M | 330.50M | 154.50M | 181.90M | 112.90M | 205.20M | 795.30M | 211.70M | 213.40M | 299.90M | 307.40M | 224.60M | 228.90M | 170.50M | 103.80M | 56.00M | 231.30M | 219.30M | 263.30M | 218.60M | 84.00M | 17.00M | 7.00M | 43.00M | 307.00M | 308.00M | 134.00M | 337.00M | 341.00M | 484.00M | 387.20M | 342.20M | 295.40M | 423.00M | 427.70M | 470.80M | 241.10M | 551.60M | 447.40M | 467.20M |

| Net Income | 952.50M | 1.39B | 919.10M | 1.34B | 1.02B | 695.80M | 535.50M | 825.70M | 729.70M | 827.60M | 826.80M | 756.30M | 737.00M | 697.80M | 464.30M | 220.70M | 577.60M | 1.49B | 607.00M | 540.00M | 414.90M | 286.00M | 121.00M | 305.00M | 636.00M | 562.00M | -427.00M | 644.00M | 726.00M | 742.00M | 634.10M | 561.90M | -1.04B | 600.50M | 624.30M | 734.90M | 811.90M | 635.10M | 611.20M | 595.30M |

| Net Income Ratio | 11.53% | 14.11% | 11.84% | 19.21% | 16.17% | 10.39% | 8.03% | 13.08% | 12.41% | 13.12% | 12.48% | 11.91% | 11.77% | 11.63% | 9.56% | 5.09% | 10.14% | 29.73% | 10.91% | 10.79% | 9.41% | 6.97% | 3.10% | 7.06% | 8.89% | 7.98% | -6.32% | 8.30% | 7.00% | 5.66% | 5.66% | 5.18% | -9.50% | 5.03% | 5.04% | 5.87% | 6.80% | 5.24% | 4.97% | 5.25% |

| EPS | 8.32 | 11.13 | 8.02 | 11.69 | 8.83 | 5.88 | 4.42 | 6.43 | 5.68 | 6.25 | 6.05 | 5.44 | 5.27 | 4.92 | 3.27 | 1.55 | 3.94 | 9.37 | 3.44 | 2.45 | 1.71 | 1.54 | 0.66 | 0.66 | 1.88 | 1.49 | -2.16 | 3.01 | 3.34 | 3.42 | 2.87 | 2.55 | -4.62 | 2.57 | 2.56 | 2.87 | 3.04 | 2.27 | 2.01 | 1.95 |

| EPS Diluted | 8.28 | 11.06 | 7.96 | 11.58 | 8.77 | 5.83 | 4.22 | 6.35 | 5.56 | 6.09 | 5.91 | 5.36 | 5.13 | 4.80 | 3.22 | 1.55 | 3.90 | 9.23 | 3.37 | 2.39 | 1.65 | 1.51 | 0.64 | 0.65 | 1.86 | 1.47 | -2.16 | 2.97 | 3.28 | 3.42 | 2.82 | 2.51 | -4.56 | 2.54 | 2.53 | 2.84 | 3.01 | 2.23 | 1.98 | 1.91 |

| Weighted Avg Shares Out | 114.00M | 114.80M | 115.90M | 116.00M | 115.80M | 118.30M | 121.10M | 128.40M | 128.50M | 132.40M | 136.70M | 138.90M | 139.80M | 141.90M | 141.79M | 141.60M | 146.50M | 158.70M | 176.60M | 220.41M | 186.00M | 185.40M | 184.90M | 182.60M | 188.90M | 190.19M | 197.90M | 213.95M | 217.37M | 216.96M | 220.84M | 220.24M | 224.31M | 233.54M | 243.71M | 255.92M | 267.07M | 279.56M | 303.78M | 304.87M |

| Weighted Avg Shares Out (Dil) | 114.50M | 115.60M | 116.70M | 117.10M | 116.60M | 119.30M | 126.90M | 129.90M | 131.10M | 135.70M | 139.70M | 140.90M | 143.40M | 145.20M | 144.00M | 142.20M | 148.20M | 161.20M | 179.90M | 225.94M | 191.70M | 190.10M | 188.80M | 185.10M | 191.30M | 192.89M | 197.90M | 216.84M | 221.34M | 216.96M | 224.75M | 223.75M | 227.26M | 236.30M | 246.60M | 258.63M | 269.73M | 284.57M | 308.38M | 311.26M |

Rockwell Automation Reports Second Quarter 2024 Results; Updates Fiscal 2024 Guidance

Rockwell Automation Expanding Presence in India with New Manufacturing Facility

Rockwell Automation to Present at Oppenheimer's 19th Annual Industrial Growth Conference

What Schneider's Results Say About Eaton, Rockwell Automation

Rockwell Automation to Report Second Quarter Fiscal 2024 Results

Rockwell Automation (ROK) to Post Q2 Earnings: What's in Store?

Rockwell Automation (ROK) Q2 Earnings Preview: What You Should Know Beyond the Headline Estimates

Analysts Estimate Rockwell Automation (ROK) to Report a Decline in Earnings: What to Look Out for

Rockwell Automation Declares Quarterly Dividend at $1.25 Per Share on Common Stock

Got $5,000? These 3 Artificial Intelligence (AI) Stocks Are Still Cheap Buys

Source: https://incomestatements.info

Category: Stock Reports