See more : PT Ricky Putra Globalindo Tbk (RICY.JK) Income Statement Analysis – Financial Results

Complete financial analysis of ReWalk Robotics Ltd. (RWLK) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of ReWalk Robotics Ltd., a leading company in the Medical – Devices industry within the Healthcare sector.

- Bebop Channel Corp (BBOP) Income Statement Analysis – Financial Results

- Taisei Lamick Co., Ltd. (4994.T) Income Statement Analysis – Financial Results

- Boozt AB (publ) (0RPY.L) Income Statement Analysis – Financial Results

- Pingdingshan Tianan Coal. Mining Co., Ltd. (601666.SS) Income Statement Analysis – Financial Results

- Eris Lifesciences Limited (ERIS.BO) Income Statement Analysis – Financial Results

ReWalk Robotics Ltd. (RWLK)

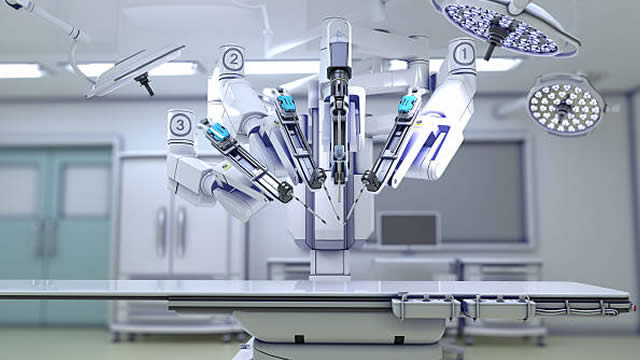

About ReWalk Robotics Ltd.

ReWalk Robotics Ltd., a medical device company, designs, develops, and commercializes robotic exoskeletons for individuals with mobility impairments or other medical conditions in the United States, Europe, the Asia-Pacific, and Africa. The company offers ReWalk Personal and ReWalk Rehabilitation for spinal cord injuries and everyday use by paraplegic individuals at home and in communities; ReStore, a soft exo-suit intended for use in the rehabilitation of individuals with lower limb disability due to stroke in the clinical rehabilitation environment; and MyoCycle and MediTouch tutor movement biofeedback devices for use at home or in clinic. It markets and sells its products directly to third party payers; institutions, including rehabilitation centers; and individuals, as well as through third-party distributors. The company was formerly known as Argo Medical Technologies Ltd. ReWalk Robotics Ltd. was incorporated in 2001 and is headquartered in Yokneam Ilit, Israel.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 13.85M | 5.51M | 5.97M | 4.39M | 4.87M | 6.55M | 7.75M | 5.87M |

| Cost of Revenue | 9.40M | 3.61M | 3.06M | 2.20M | 2.15M | 3.72M | 4.65M | 5.13M |

| Gross Profit | 4.45M | 1.91M | 2.90M | 2.19M | 2.73M | 2.83M | 3.10M | 736.00K |

| Gross Profit Ratio | 32.14% | 34.57% | 48.66% | 49.83% | 55.94% | 43.16% | 40.00% | 12.54% |

| Research & Development | 4.15M | 4.03M | 2.94M | 3.46M | 5.35M | 7.35M | 6.04M | 9.03M |

| General & Administrative | 10.00M | 7.13M | 5.63M | 4.98M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 13.92M | 9.84M | 6.99M | 5.75M | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 23.92M | 16.98M | 12.62M | 10.73M | 11.43M | 14.69M | 19.05M | 22.15M |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 28.07M | 21.01M | 15.56M | 14.19M | 16.77M | 22.04M | 25.09M | 31.18M |

| Cost & Expenses | 37.47M | 24.61M | 18.62M | 16.40M | 18.92M | 25.76M | 29.75M | 36.31M |

| Interest Income | 1.35M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -1.00 |

| Interest Expense | 20.00K | 22.00K | 25.00K | 907.00K | 1.53M | 2.42M | 2.48M | 2.01M |

| Depreciation & Amortization | 1.85M | 202.00K | 266.00K | 285.00K | 321.00K | 463.00K | 642.00K | 696.00K |

| EBITDA | -21.77M | -18.90M | -12.39M | -11.73M | -13.72M | -18.79M | -21.48M | -29.79M |

| EBITDA Ratio | -157.10% | -343.35% | -208.30% | -267.29% | -281.70% | -286.49% | -275.38% | -506.82% |

| Operating Income | -23.61M | -19.10M | -12.66M | -12.00M | -14.05M | -19.21M | -21.99M | -30.44M |

| Operating Income Ratio | -170.43% | -346.62% | -212.12% | -273.25% | -288.28% | -293.57% | -283.66% | -518.67% |

| Total Other Income/Expenses | 1.47M | 0.00 | 13.00K | -921.00K | -1.50M | -2.47M | -2.61M | -2.06M |

| Income Before Tax | -22.15M | -19.10M | -12.64M | -12.93M | -15.54M | -21.68M | -24.60M | -32.50M |

| Income Before Tax Ratio | -159.85% | -346.62% | -211.90% | -294.22% | -318.98% | -331.25% | -317.27% | -553.76% |

| Income Tax Expense | -12.00K | 467.00K | 94.00K | 51.00K | 7.00K | -5.00K | 119.00K | 3.00K |

| Net Income | -22.13M | -19.57M | -12.74M | -12.98M | -15.55M | -21.68M | -24.72M | -32.50M |

| Net Income Ratio | -159.76% | -355.09% | -213.48% | -295.38% | -319.13% | -331.17% | -318.81% | -553.81% |

| EPS | -2.59 | -2.20 | -1.86 | -5.74 | -18.90 | -103.04 | -213.98 | -431.63 |

| EPS Diluted | -2.59 | -2.20 | -1.86 | -5.74 | -18.90 | -103.04 | -213.98 | -431.63 |

| Weighted Avg Shares Out | 8.53M | 8.91M | 6.85M | 2.25M | 823.33K | 210.36K | 115.51K | 75.30K |

| Weighted Avg Shares Out (Dil) | 8.53M | 8.91M | 6.85M | 2.25M | 823.33K | 210.36K | 115.51K | 75.30K |

ReWalk Robotics (RWLK) Reports Q3 Loss, Tops Revenue Estimates

3 Tech Penny Stocks That Could Rocket in 2022

Rewalk Robotics (RWLK): Why The Price Surged Today

Will ReWalk Robotics (RWLK) Report Negative Q3 Earnings? What You Should Know

ReWalk Robotics is a Catch-22 Investment

Hot Penny Stocks to Buy This Week? 3 For Your October Watchlist

7 Popular Penny Stocks That You Shouldn't Touch With a 10-Foot Pole

ReWalk Robotics Is Much, Much More Than a Meme Stock

ReWalk Robotics Announces Closing of $32.5 Million Registered Direct Offering Priced At Premium to Market

RWLK Stock: Why It Fell Over 18% Today

Source: https://incomestatements.info

Category: Stock Reports