See more : NowVertical Group Inc. (NOWVF) Income Statement Analysis – Financial Results

Complete financial analysis of Santander Consumer USA Holdings Inc. (SC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Santander Consumer USA Holdings Inc., a leading company in the Financial – Credit Services industry within the Financial Services sector.

- Wuhan Sanzhen Industry Holding Co.,Ltd (600168.SS) Income Statement Analysis – Financial Results

- TravelCenters of America LLC SR NT 8.25%2028 (TANNI) Income Statement Analysis – Financial Results

- Codan Limited (CDA.AX) Income Statement Analysis – Financial Results

- Zecotek Photonics Inc. (ZMSPF) Income Statement Analysis – Financial Results

- Healthcare Trust of America, Inc. (HTA) Income Statement Analysis – Financial Results

Santander Consumer USA Holdings Inc. (SC)

Industry: Financial - Credit Services

Sector: Financial Services

Website: https://www.santanderconsumerusa.com

About Santander Consumer USA Holdings Inc.

Santander Consumer USA Holdings Inc., a specialized consumer finance company, provides vehicle finance and third-party servicing in the United States. It offers vehicle financial products and services, including retail installment contracts and vehicle leases, as well as dealer loans for inventory, construction, real estate, working capital, and revolving lines of credit. The company also provides financial products and services related to recreational and marine vehicles; originates vehicle loans through RoadLoans.com, a web-based direct lending program; purchases vehicle retail installment contracts from other lenders; and services automobile, and recreational and marine vehicle portfolios for other lenders. In addition, it originates private-label loans and leases; and offers personal loans, as well as provides point-of-sale financing. The company was founded in 1995 and is headquartered in Dallas, Texas. Santander Consumer USA Holdings Inc. is a subsidiary of Santander Holdings USA, Inc.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 6.74B | 6.57B | 6.06B | 5.72B | 5.82B | 6.07B | 5.60B | 3.84B | 2.87B | 2.63B | 2.01B |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 6.74B | 6.57B | 6.06B | 5.72B | 5.82B | 6.07B | 5.60B | 3.84B | 2.87B | 2.63B | 2.01B |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 2.63B | 2.63B | 2.28B | 2.16B | 1.79B | 1.42B | 1.42B | 574.14M | 361.71M | 369.55M | 249.80M |

| Selling & Marketing | 0.00 | -262.06M | -264.78M | -275.70M | -293.36M | -241.52M | -201.02M | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 2.63B | 2.37B | 2.02B | 1.88B | 1.49B | 1.18B | 1.22B | 574.14M | 361.71M | 369.55M | 249.80M |

| Other Expenses | -6.96B | 4.59B | 4.36B | 4.44B | 4.41B | 4.14B | 3.26B | -2.95B | -1.75B | -1.47B | -1.32B |

| Operating Expenses | -4.33B | 6.96B | 6.38B | 6.32B | 5.91B | 5.32B | 4.48B | -2.37B | -1.39B | -1.10B | -1.07B |

| Cost & Expenses | -4.33B | 6.96B | 6.38B | 6.32B | 5.91B | 5.32B | 4.48B | -2.37B | -1.39B | -1.10B | -1.07B |

| Interest Income | 5.14B | 5.12B | 4.92B | 4.78B | 5.04B | 5.27B | 4.64B | 3.78B | 2.95B | 2.59B | 2.08B |

| Interest Expense | 1.20B | 1.36B | 1.16B | 950.95M | 754.69M | 561.75M | 476.34M | 376.71M | 312.38M | 296.27M | 218.19M |

| Depreciation & Amortization | 2.21B | 1.99B | 1.67B | 1.40B | 1.09B | 833.07M | 825.00M | 188.92M | 187.35M | 258.22M | 124.49M |

| EBITDA | 4.62B | 4.70B | 4.02B | 3.18B | 3.01B | 2.68B | 2.51B | 1.65B | 1.67B | 1.79B | 1.06B |

| EBITDA Ratio | 68.56% | 71.49% | 66.32% | 55.59% | 51.76% | 44.17% | 44.81% | 43.07% | 58.13% | 67.97% | 52.70% |

| Operating Income | 2.41B | 2.71B | 2.35B | 1.77B | 1.92B | 1.85B | 1.69B | 1.46B | 1.48B | 1.53B | 934.25M |

| Operating Income Ratio | 35.80% | 41.23% | 38.79% | 31.04% | 32.94% | 30.44% | 30.09% | 38.15% | 51.60% | 58.15% | 46.50% |

| Total Other Income/Expenses | -1.20B | -1.36B | -1.16B | -950.95M | -754.69M | -561.75M | -476.34M | -378.53M | -292.45M | -276.29M | -218.19M |

| Income Before Tax | 1.21B | 1.35B | 1.19B | 823.51M | 1.16B | 1.29B | 1.21B | 1.09B | 1.19B | 1.25B | 716.06M |

| Income Before Tax Ratio | 17.94% | 20.60% | 19.67% | 14.40% | 19.96% | 21.18% | 21.59% | 28.28% | 41.41% | 47.64% | 35.64% |

| Income Tax Expense | 298.92M | 359.90M | 276.34M | -364.09M | 394.25M | 458.03M | 443.64M | 389.42M | 453.62M | 464.03M | 277.94M |

| Net Income | 910.91M | 994.37M | 915.93M | 1.19B | 766.47M | 827.29M | 766.35M | 697.49M | 715.00M | 768.20M | 438.11M |

| Net Income Ratio | 13.51% | 15.13% | 15.11% | 20.77% | 13.18% | 13.63% | 13.67% | 18.18% | 24.91% | 29.23% | 21.81% |

| EPS | 2.87 | 2.86 | 2.54 | 3.30 | 2.14 | 2.33 | 2.20 | 2.01 | 2.07 | 3.12 | 1.78 |

| EPS Diluted | 2.87 | 2.86 | 2.54 | 3.30 | 2.13 | 2.31 | 2.15 | 2.01 | 2.07 | 3.12 | 1.78 |

| Weighted Avg Shares Out | 317.69M | 347.51M | 360.67M | 359.61M | 358.28M | 355.10M | 348.72M | 346.18M | 346.16M | 246.06M | 245.78M |

| Weighted Avg Shares Out (Dil) | 317.69M | 347.51M | 360.67M | 360.29M | 359.17M | 358.88M | 355.72M | 346.18M | 346.16M | 246.06M | 245.78M |

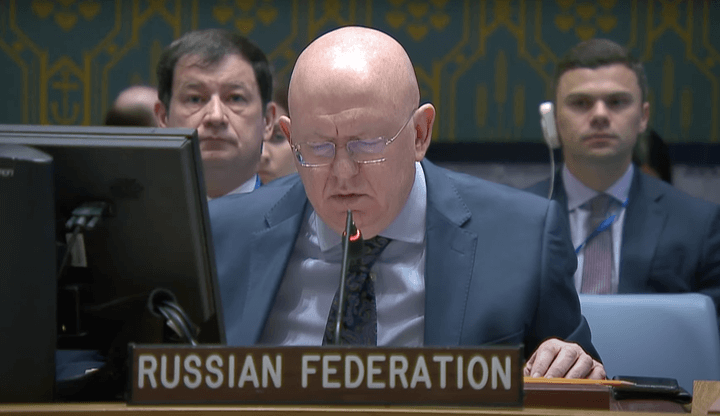

Nebenzya: Russia will no longer submit a resolution on Nord Stream to a vote in the UN Security Council

Ukraine demanded to convene the UN Security Council due to the deployment of Russian nuclear weapons in Belarus

Ukrainian Foreign Ministry urged to convene UN Security Council over plans to deploy Russian tactical nuclear weapons in Belarus

Celltrion USA announces submission of the Biologics License Application (BLA) of novel subcutaneous formulation of CT-P13 to U.S. Food and Drug Administration

Horseed SC Whip MCC To Win Somali Super Cup Match, as Football Activities Resume in Somalia

Santander Holdings USA, Inc. Announces Federal Reserve Approval of its Acquisition of the Shares It Does Not Own of Santander Consumer USA Holdings Inc. and the Expiration of its Tender Offer to Acquire Such Shares

Santander Holdings USA, Inc. Announces Extension of Tender Offer to Acquire Shares it Does not Own of Santander Consumer USA Holdings Inc. for $41.50 per Share

Santander Holdings USA, Inc. Announces Extension of Tender Offer to Acquire Shares it Does not Own of Santander Consumer USA Holdings Inc. for $41.50 per Share

Santander Consumer USA Invests $35 Million to Bridge the Digital Divide in Communities Across the U.S.

Santander Holdings USA, Inc. Announces Extension of Tender Offer to Acquire Shares it Does not Own of Santander Consumer USA Holdings Inc. for $41.50 per Share

Source: https://incomestatements.info

Category: Stock Reports