See more : DT Cloud Acquisition Corporation (DYCQ) Income Statement Analysis – Financial Results

Complete financial analysis of Score Media and Gaming Inc. (SCR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Score Media and Gaming Inc., a leading company in the Electronic Gaming & Multimedia industry within the Technology sector.

- UMAX Group Corp. (UMAX) Income Statement Analysis – Financial Results

- Youdao, Inc. (DAO) Income Statement Analysis – Financial Results

- Valora Holding AG (0QLE.L) Income Statement Analysis – Financial Results

- Manila Electric Company (MAEOY) Income Statement Analysis – Financial Results

- Stefanutti Stocks Holdings Limited (SSK.JO) Income Statement Analysis – Financial Results

Score Media and Gaming Inc. (SCR)

About Score Media and Gaming Inc.

Score Media and Gaming Inc. operates as a sports media company in North America. It offers theScore, a mobile sports application that delivers customizable news, scores, stats, and notifications for various leagues and sports; and theScore esports, which produces and shares original video content pieces across its web and social platforms, including features and documentaries on high-profile teams, games, and players from across the esports scene, as well as highlights and interviews. The company also provides theScore Bet, a mobile sports betting platform that delivers various pre-game and in-game markets and betting options, lightning-fast scores, and in-game data comprising early cash-out, and easy and secure deposit and withdrawal options. In addition, it operates theScore.com, a web platform that provides sports news, scores, and video and editorial content written by original sports voices. The company was incorporated in 2012 and is based in Toronto, Canada.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 20.72M | 31.12M | 27.74M | 26.35M | 23.92M | 12.36M | 7.82M | 5.27M | 4.20M | 4.10M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 20.72M | 31.12M | 27.74M | 26.35M | 23.92M | 12.36M | 7.82M | 5.27M | 4.20M | 4.10M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 8.15M | 3.01M | 2.91M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 30.00M | 35.14M | 27.64M | 27.92M | 30.52M | 20.24M | 14.24M | 13.40M | 0.00 | 0.00 |

| Selling & Marketing | 13.04M | 2.47M | 2.49M | 3.59M | 5.79M | 2.79M | 1.93M | 0.00 | 0.00 | 0.00 |

| SG&A | 43.03M | 37.62M | 30.13M | 31.50M | 36.31M | 23.03M | 16.17M | 13.40M | 0.00 | 0.00 |

| Other Expenses | 5.40M | 103.00K | 903.00K | 3.08M | 4.44M | 2.73M | 2.45M | 3.07M | 12.55M | 9.66M |

| Operating Expenses | 56.58M | 40.73M | 33.93M | 34.58M | 40.75M | 25.76M | 18.62M | 16.47M | 12.55M | 9.66M |

| Cost & Expenses | 56.58M | 40.73M | 33.93M | 34.58M | 40.75M | 25.76M | 18.62M | 16.47M | 12.55M | 9.66M |

| Interest Income | 165.00K | 0.00 | 0.00 | 0.00 | 0.00 | 329.00K | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 4.79M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 706.00K | 283.00K |

| Depreciation & Amortization | 5.40M | 3.12M | 3.81M | 3.08M | 4.44M | 2.73M | 2.45M | 3.07M | 1.89M | 1.33M |

| EBITDA | -30.85M | -6.30M | -2.11M | -6.16M | -12.42M | -10.74M | -8.24M | -8.33M | -6.51M | -4.35M |

| EBITDA Ratio | -148.89% | -20.23% | -7.59% | -23.36% | -51.94% | -86.87% | -105.37% | -158.06% | -155.11% | -106.17% |

| Operating Income | -35.86M | -9.61M | -6.19M | -8.24M | -16.83M | -13.40M | -10.80M | -11.20M | -8.36M | -5.56M |

| Operating Income Ratio | -173.08% | -30.88% | -22.32% | -31.26% | -70.39% | -108.43% | -138.11% | -212.49% | -199.26% | -135.55% |

| Total Other Income/Expenses | -5.18M | 198.00K | 277.00K | -1.00M | -29.00K | -68.00K | 114.00K | -199.00K | -747.00K | -405.00K |

| Income Before Tax | -41.04M | -9.41M | -5.91M | -9.24M | -16.86M | -13.47M | -10.69M | -11.40M | -9.11M | -5.96M |

| Income Before Tax Ratio | -198.06% | -30.25% | -21.32% | -35.05% | -70.51% | -108.98% | -136.65% | -216.26% | -217.07% | -145.43% |

| Income Tax Expense | -3.11M | 198.00K | 277.00K | -1.00M | -29.00K | -68.00K | 114.00K | -199.00K | -41.00K | -122.00K |

| Net Income | -37.93M | -9.41M | -5.91M | -9.24M | -16.86M | -13.47M | -10.69M | -11.40M | -9.11M | -5.96M |

| Net Income Ratio | -183.07% | -30.25% | -21.32% | -35.05% | -70.51% | -108.98% | -136.65% | -216.26% | -217.07% | -145.43% |

| EPS | -1.15 | -0.29 | -0.20 | -0.31 | -0.57 | -0.49 | -0.53 | -1.09 | -0.96 | -0.63 |

| EPS Diluted | -1.15 | -0.29 | -0.20 | -0.31 | -0.57 | -0.49 | -0.53 | -1.09 | -0.96 | -0.63 |

| Weighted Avg Shares Out | 33.11M | 32.90M | 29.60M | 29.56M | 29.52M | 27.38M | 20.01M | 10.42M | 9.50M | 9.50M |

| Weighted Avg Shares Out (Dil) | 33.11M | 32.90M | 29.60M | 29.56M | 29.52M | 27.38M | 20.01M | 10.42M | 9.50M | 9.50M |

Strathcona Resources Ltd. Reports Third Quarter 2024 Financial and Operating Results, Provides 2025 Guidance and Announces Quarterly Dividend

Cognition Therapeutics to Present at Zacks SCR Life Sciences Investor Forum

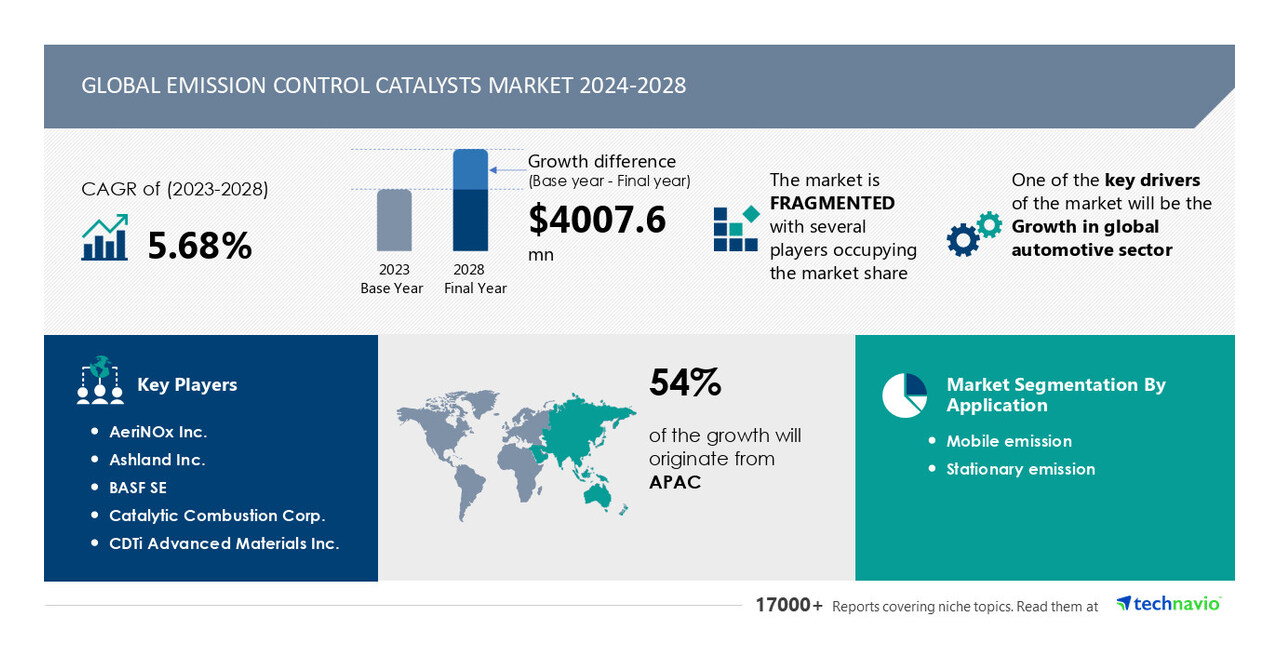

AI-Driven Market Transformation, Emission Control Catalysts Market to Grow by USD 4.01 Billion (2024-2028) Boosted by Global Automotive Sector - Technavio Report

Strathcona Resources Ltd. Reports Second Quarter 2024 Financial and Operating Results and Announces Inaugural Quarterly Dividend

Strathcona Resources Announces up to $2 Billion Carbon Capture Partnership with Canada Growth Fund

BETZ: An Easier & Safer Way To Invest In The Online Gambling Market

theScore Announces Shareholder Approval of its Acquisition by the Arrangement with Penn National Gaming

Why Acquiring theScore Could Be Good News for Penn National Gaming

theScore Selects Toronto's Waterfront Innovation Centre as Site for New, Expansive Headquarters

3 Sports Betting Stocks That Could Get Bought Out Next

Source: https://incomestatements.info

Category: Stock Reports