Complete financial analysis of SmileDirectClub, Inc. (SDC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of SmileDirectClub, Inc., a leading company in the Medical – Instruments & Supplies industry within the Healthcare sector.

- WELL Health Technologies Corp. (WELL.TO) Income Statement Analysis – Financial Results

- Relay Therapeutics, Inc. (RLAY) Income Statement Analysis – Financial Results

- Ford Motor Company (FMC1.DE) Income Statement Analysis – Financial Results

- Chariot Limited (CHAR.L) Income Statement Analysis – Financial Results

- Patria Latin American Opportunity Acquisition Corp. (PLAOU) Income Statement Analysis – Financial Results

SmileDirectClub, Inc. (SDC)

Industry: Medical - Instruments & Supplies

Sector: Healthcare

Website: https://www.smiledirectclub.com

About SmileDirectClub, Inc.

SmileDirectClub, Inc., an oral care company, offers clear aligner therapy treatment. The company manages the end-to-end process, which include marketing, aligner manufacturing, fulfillment, treatment by a doctor, and monitoring through completion of their treatment with a network of approximately 250 licensed orthodontists and general dentists through its teledentistry platform, SmileCheck in the United States, Puerto Rico, Canada, Australia, the United Kingdom, New Zealand, Ireland, Hong Kong, Germany, Singapore, France, Spain, and Austria. It also offers aligners, impression and whitening kits, whitening gels, and retainers; and toothbrushes, toothpastes, water flossers, SmileSpa, and various ancillary oral care products. The company was founded in 2014 and is headquartered in Nashville, Tennessee.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|

| Revenue | 470.74M | 637.61M | 656.78M | 750.43M | 423.23M | 145.95M |

| Cost of Revenue | 142.89M | 177.60M | 206.85M | 178.39M | 133.97M | 64.01M |

| Gross Profit | 327.85M | 460.01M | 449.93M | 572.04M | 289.27M | 81.94M |

| Gross Profit Ratio | 69.65% | 72.15% | 68.51% | 76.23% | 68.35% | 56.14% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 278.78M | 325.57M | 311.98M | 580.84M | 121.74M | 48.20M |

| Selling & Marketing | 290.23M | 388.45M | 322.92M | 481.47M | 213.08M | 64.24M |

| SG&A | 569.01M | 714.02M | 634.90M | 1.06B | 334.82M | 112.45M |

| Other Expenses | 1.58M | -4.31M | 878.00K | 142.00K | -15.15M | 0.00 |

| Operating Expenses | 569.01M | 714.02M | 634.90M | 1.06B | 334.82M | 112.45M |

| Cost & Expenses | 711.90M | 891.62M | 841.75M | 1.24B | 468.79M | 176.46M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 17.96M | 23.15M | 45.01M | 15.73M | 13.71M | 2.15M |

| Depreciation & Amortization | 75.97M | 65.80M | 57.27M | 27.48M | 8.86M | 2.51M |

| EBITDA | -165.18M | -188.21M | -127.71M | -462.80M | -51.84M | -27.99M |

| EBITDA Ratio | -35.09% | -29.52% | -19.44% | -61.67% | -12.25% | -19.18% |

| Operating Income | -241.16M | -254.01M | -184.97M | -490.27M | -45.56M | -30.50M |

| Operating Income Ratio | -51.23% | -39.84% | -28.16% | -65.33% | -10.76% | -20.90% |

| Total Other Income/Expenses | -37.34M | -75.10M | -57.91M | -45.26M | -28.85M | -2.15M |

| Income Before Tax | -278.50M | -334.38M | -275.38M | -535.54M | -74.41M | -32.65M |

| Income Before Tax Ratio | -59.16% | -52.44% | -41.93% | -71.36% | -17.58% | -22.37% |

| Income Tax Expense | -642.00K | 1.27M | 3.12M | 2.27M | 361.00K | 128.00K |

| Net Income | -277.85M | -335.65M | -278.50M | -537.81M | -74.77M | -32.78M |

| Net Income Ratio | -59.02% | -52.64% | -42.40% | -71.67% | -17.67% | -22.46% |

| EPS | -0.71 | -0.87 | -0.72 | -1.41 | -0.19 | -0.09 |

| EPS Diluted | -0.71 | -0.87 | -0.72 | -1.41 | -0.19 | -0.09 |

| Weighted Avg Shares Out | 390.21M | 387.78M | 385.20M | 381.92M | 384.86M | 384.86M |

| Weighted Avg Shares Out (Dil) | 390.21M | 387.78M | 385.20M | 381.92M | 384.86M | 384.86M |

SmileDirectClub winds down operations — but customers are told to keep paying

SmileDirectClub Saga Illustrates Promise and Peril of Direct-to-Consumer Retail Models

Spooky Season: 7 Stocks Scaring Away Gains This October

SDC Stock Alert: Prepare for SmileDirectClub's Nasdaq Delisting Tomorrow

Why Is SmileDirectClub (SDC) Stock Down 25% Today?

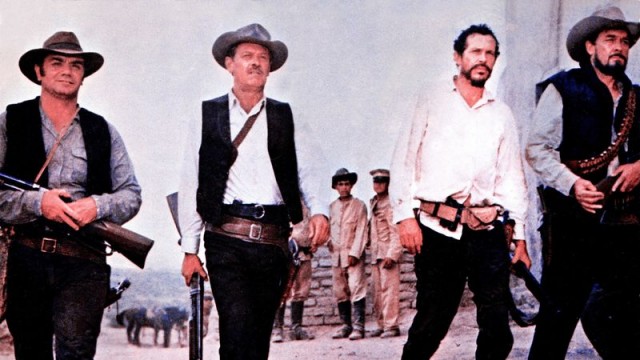

The ‘wild bunch' have taken control of the bond market. Here's where they could wreak havoc next.

Does anyone want to buy bankrupt SmileDirectClub?

SDC Stock: There Are No SmileDirectClub Shares Available to Short

SDC Stock Alert: Are Retail Investors About to Pile Into SmileDirectClub?

Why Is SmileDirectClub (SDC) Stock Down 54% Today?

Source: https://incomestatements.info

Category: Stock Reports