See more : Chicago Atlantic BDC, Inc. (LIEN) Income Statement Analysis – Financial Results

Complete financial analysis of Schrödinger, Inc. (SDGR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Schrödinger, Inc., a leading company in the Medical – Healthcare Information Services industry within the Healthcare sector.

- Select Harvests Limited (SHV.AX) Income Statement Analysis – Financial Results

- Korean Reinsurance Company (003690.KS) Income Statement Analysis – Financial Results

- Ta Yih Industrial Co., Ltd. (1521.TW) Income Statement Analysis – Financial Results

- Tethys Oil AB (publ) (0A1V.L) Income Statement Analysis – Financial Results

- Gateway Distriparks Limited (GDL.NS) Income Statement Analysis – Financial Results

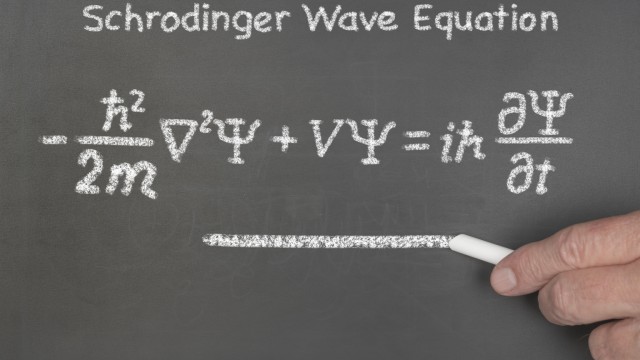

Schrödinger, Inc. (SDGR)

Industry: Medical - Healthcare Information Services

Sector: Healthcare

Website: https://www.schrodinger.com

About Schrödinger, Inc.

Schrödinger, Inc., together with its subsidiaries, provides physics-based software platform that enables discovery of novel molecules for drug development and materials applications. The company operates in two segments, Software and Drug Discovery. The Software segment is focused on selling its software for drug discovery in the life sciences industry, as well as to customers in materials science industries. The Drug Discovery segment focuses on building a portfolio of preclinical and clinical programs, internally and through collaborations. The company serves biopharmaceutical and industrial companies, academic institutions, and government laboratories worldwide. Schrödinger, Inc. was incorporated in 1990 and is based in New York, New York.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Revenue | 216.67M | 180.96M | 137.93M | 108.10M | 85.54M | 66.64M | 55.69M |

| Cost of Revenue | 75.97M | 79.93M | 72.31M | 44.62M | 36.45M | 23.70M | 15.89M |

| Gross Profit | 140.69M | 101.02M | 65.62M | 63.47M | 49.09M | 42.94M | 39.80M |

| Gross Profit Ratio | 64.93% | 55.83% | 47.57% | 58.72% | 57.39% | 64.43% | 71.46% |

| Research & Development | 181.77M | 126.37M | 90.90M | 64.70M | 39.40M | 34.52M | 27.67M |

| General & Administrative | 99.15M | 90.83M | 64.01M | 41.90M | 27.04M | 18.55M | 14.44M |

| Selling & Marketing | 37.23M | 30.64M | 22.15M | 17.80M | 21.36M | 17.83M | 16.72M |

| SG&A | 136.37M | 121.47M | 86.16M | 59.69M | 48.40M | 36.38M | 31.15M |

| Other Expenses | 0.00 | 3.95M | 1.06M | 2.25M | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 318.14M | 247.84M | 177.06M | 124.39M | 87.81M | 70.91M | 58.82M |

| Cost & Expenses | 394.11M | 327.77M | 249.37M | 169.01M | 124.26M | 94.61M | 74.71M |

| Interest Income | 0.00 | 3.95M | 1.06M | 2.25M | 1.88M | 433.00K | 359.00K |

| Interest Expense | 0.00 | 3.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 5.55M | 4.34M | 2.85M | 3.66M | 3.64M | 2.89M | 1.69M |

| EBITDA | -171.90M | -142.47M | -108.60M | -57.26M | -35.08M | -25.08M | -17.34M |

| EBITDA Ratio | -79.34% | -80.01% | -86.97% | -79.12% | -52.60% | -36.41% | -28.18% |

| Operating Income | -177.45M | -149.12M | -111.44M | -60.92M | -38.72M | -27.97M | -19.02M |

| Operating Income Ratio | -81.90% | -82.41% | -80.80% | -56.35% | -45.26% | -41.97% | -34.15% |

| Total Other Income/Expenses | 220.37M | -2.31M | 10.64M | 34.62M | 12.74M | -379.00K | 1.96M |

| Income Before Tax | 42.92M | -149.13M | -100.81M | -26.29M | -25.97M | -28.35M | -17.06M |

| Income Before Tax Ratio | 19.81% | -82.41% | -73.09% | -24.32% | -30.36% | -42.54% | -30.63% |

| Income Tax Expense | 2.20M | 63.00K | 411.00K | 345.00K | -291.00K | 77.00K | 332.00K |

| Net Income | 40.72M | -149.19M | -101.22M | -26.64M | -25.68M | -28.43M | -17.39M |

| Net Income Ratio | 18.79% | -82.45% | -73.38% | -24.64% | -30.02% | -42.66% | -31.23% |

| EPS | 0.57 | -2.10 | -1.43 | -0.44 | -0.41 | -0.59 | -0.43 |

| EPS Diluted | 0.54 | -2.10 | -1.43 | -0.44 | -0.41 | -0.59 | -0.43 |

| Weighted Avg Shares Out | 71.78M | 71.17M | 70.59M | 60.02M | 63.27M | 48.47M | 40.38M |

| Weighted Avg Shares Out (Dil) | 74.99M | 71.17M | 70.59M | 60.02M | 63.27M | 48.47M | 40.38M |

Schrödinger Reports Inducement Grants under Nasdaq Listing Rule 5635(c)(4)

Schrodinger: Buy The Drug-Discovery Platform And Get The Pipeline Nearly For Free

1 Growth Stock That Could Dominate AI's Next Breakthrough

Schrödinger to Present at Jefferies Global Healthcare Conference

Schrödinger Reports Inducement Grants under Nasdaq Listing Rule 5635(c)(4)

7 Pharma Stocks Harnessing AI Brainpower for Big Breakthroughs

What's the Difference Between Biotech Stocks and TechBio Stocks?

Schrödinger, Inc. (SDGR) Q1 2024 Earnings Call Transcript

Schrodinger, Inc. (SDGR) Reports Q1 Loss, Misses Revenue Estimates

Schrödinger Reports First Quarter 2024 Financial Results

Source: https://incomestatements.info

Category: Stock Reports