See more : Chang Chun Eurasia Group Co., Ltd. (600697.SS) Income Statement Analysis – Financial Results

Complete financial analysis of Semilux International Ltd. Ordinary Shares (SELX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Semilux International Ltd. Ordinary Shares, a leading company in the Hardware, Equipment & Parts industry within the Technology sector.

- Gateway Bank, F.S.B. (GWBK) Income Statement Analysis – Financial Results

- Fortive Corporation (FTV-PA) Income Statement Analysis – Financial Results

- SBFC Finance Limited (SBFC.NS) Income Statement Analysis – Financial Results

- Gujarat Poly Electronics Limited (GUJARATPOLY.BO) Income Statement Analysis – Financial Results

- Smart Decision, Inc. (SDEC) Income Statement Analysis – Financial Results

Semilux International Ltd. Ordinary Shares (SELX)

About Semilux International Ltd. Ordinary Shares

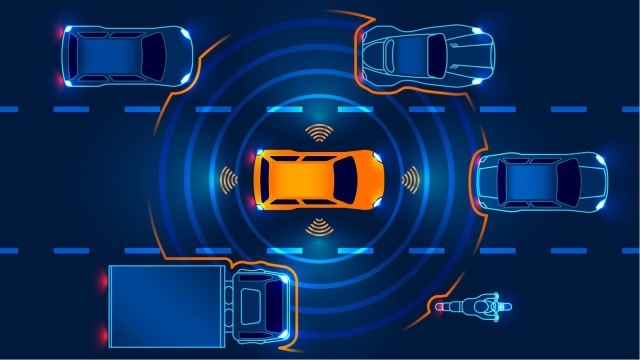

Semilux International Ltd., an optical technology company, designs and produces optics and fluorescent modules for the needs of clients. Its products include solid state AI LiDAR, AI ADB headlight systems, AI optical image fusion systems, and IC design services, as well as other products, such as filters, diffusers, color wheels, fluorescent wheels, and gobo filters. Its products are used in autonomous driving and intelligent lighting industries and unmanned aerial vehicles. The company was founded in 2009 and is headquartered in Taichung, Taiwan.

| Metric | 2023 | 2022 | 2021 |

|---|---|---|---|

| Revenue | 32.84M | 102.44M | 126.13M |

| Cost of Revenue | 48.05M | 56.53M | 69.31M |

| Gross Profit | -15.21M | 45.91M | 56.82M |

| Gross Profit Ratio | -46.31% | 44.82% | 45.05% |

| Research & Development | 24.20M | 26.85M | 40.92M |

| General & Administrative | 24.36M | 25.65M | 18.39M |

| Selling & Marketing | 11.36M | 12.53M | 10.49M |

| SG&A | 35.72M | 38.18M | 28.88M |

| Other Expenses | 0.00 | 2.84M | 7.17M |

| Operating Expenses | 59.92M | 65.03M | 69.80M |

| Cost & Expenses | 107.97M | 121.55M | 139.11M |

| Interest Income | 14.68M | 3.46M | 419.00K |

| Interest Expense | 2.94M | 2.88M | 2.20M |

| Depreciation & Amortization | 24.40M | 24.81M | 36.92M |

| EBITDA | -34.67M | 12.00M | 9.91M |

| EBITDA Ratio | -105.58% | 11.71% | 25.00% |

| Operating Income | -75.13M | -19.37M | -12.98M |

| Operating Income Ratio | -228.77% | -18.91% | -10.29% |

| Total Other Income/Expenses | 13.12M | 40.82M | -16.24M |

| Income Before Tax | -62.01M | 21.45M | -29.21M |

| Income Before Tax Ratio | -188.82% | 20.94% | -23.16% |

| Income Tax Expense | 1.02M | 6.43M | 1.30M |

| Net Income | -50.03M | 14.83M | -11.44M |

| Net Income Ratio | -152.33% | 14.48% | -9.07% |

| EPS | -6.30 | 1.87 | -1.44 |

| EPS Diluted | -6.30 | 1.87 | -1.44 |

| Weighted Avg Shares Out | 7.94M | 7.94M | 7.94M |

| Weighted Avg Shares Out (Dil) | 7.94M | 7.94M | 7.94M |

Semilux International Ltd. Announces Filing of Annual Report on Form 20-F for December 31, 2023

Why Is Semilux International (SELX) Stock Down 16% Today?

Semilux International Ltd. Announces Closing of up to $50 Million Common Stock Purchase Transaction with White Lion Capital

Semilux International Ltd. and Taiwan Color Optics, Inc., a Taiwan-based provider of LiDAR and ADB components and solutions, together with Chenghe Acquisition Co. Announce Closing of Business Combination

Source: https://incomestatements.info

Category: Stock Reports