See more : Whitestone REIT (WSR) Income Statement Analysis – Financial Results

Complete financial analysis of Superdry plc (SEPGF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Superdry plc, a leading company in the Apparel – Manufacturers industry within the Consumer Cyclical sector.

- Samyung Trading Co., Ltd. (002810.KS) Income Statement Analysis – Financial Results

- Allied Telesis Holdings K.K. (6835.T) Income Statement Analysis – Financial Results

- Rajputana Investment and Finan (RAJPUTANA.BO) Income Statement Analysis – Financial Results

- Taiwan Microloops Corp. (6831.TWO) Income Statement Analysis – Financial Results

- B Communications Ltd (BCOM.TA) Income Statement Analysis – Financial Results

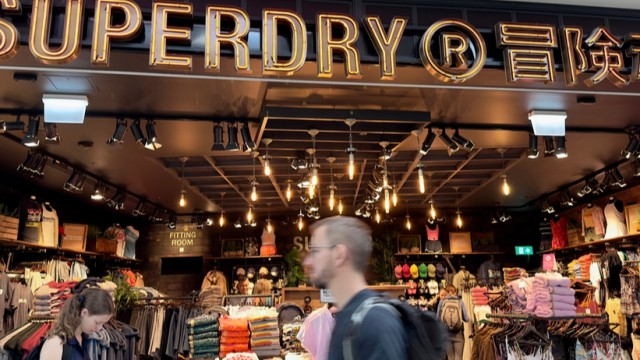

Superdry plc (SEPGF)

About Superdry plc

Superdry plc engages in the design, production, and sale of clothing and accessories primarily under the Superdry brand for men and women in the United Kingdom, the Republic of Ireland, Europe, and internationally. It operates through Retail and Wholesale segments. The company offers clothing, accessories, and footwear. It operates owned and ecommerce, multi-brand independents and distributors, franchise, and license stores. The company operates through 231 owned, 475 franchised and licensed, and 27 Superdry branded licensed stores; and 21 international websites. The company was formerly known as SuperGroup Plc and changed its name to Superdry plc in January 2018. Superdry plc was founded in 1985 and is based in Cheltenham, the United Kingdom.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 781.98M | 766.33M | 769.95M | 888.50M | 1.14B | 1.20B | 972.90M | 875.28M |

| Cost of Revenue | 439.54M | 398.12M | 438.07M | 521.82M | 564.74M | 560.03M | 434.05M | 386.73M |

| Gross Profit | 342.44M | 368.20M | 331.88M | 366.67M | 571.65M | 641.02M | 538.85M | 488.54M |

| Gross Profit Ratio | 43.79% | 48.05% | 43.10% | 41.27% | 50.30% | 53.37% | 55.39% | 55.82% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 204.58M | 187.63M | 166.68M | 217.97M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 216.50M | 197.80M | 178.90M | 217.20M | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 421.08M | 385.43M | 345.58M | 435.17M | 527.20M | 520.50M | 442.72M | 390.10M |

| Other Expenses | 0.00 | -1.89M | -7.06M | 15.14M | -113.29M | -3.03M | 0.00 | -7.47M |

| Operating Expenses | 423.97M | 387.31M | 352.65M | 420.03M | 640.48M | 523.53M | 442.72M | 397.57M |

| Cost & Expenses | 863.51M | 785.44M | 790.72M | 941.85M | 1.21B | 1.08B | 876.77M | 784.31M |

| Interest Income | 1.80M | 2.06M | 2.77M | 252.27K | 391.10K | 0.00 | 258.75K | 0.00 |

| Interest Expense | 10.20M | 10.06M | 9.97M | 9.71M | 1.69M | 300.00K | 0.00 | 100.00K |

| Depreciation & Amortization | 55.80M | 60.97M | 73.94M | 109.99M | 54.62M | 56.61M | 47.22M | 46.58M |

| EBITDA | -12.50M | 41.86M | 53.17M | -90.82M | -52.02M | 150.68M | 160.30M | 128.62M |

| EBITDA Ratio | -1.60% | 5.46% | 6.91% | 6.37% | -1.25% | 14.50% | 14.73% | 15.72% |

| Operating Income | -70.10M | -19.11M | -20.77M | -53.36M | -68.83M | 117.49M | 96.13M | 90.97M |

| Operating Income Ratio | -8.96% | -2.49% | -2.70% | -6.01% | -6.06% | 9.78% | 9.88% | 10.39% |

| Total Other Income/Expenses | -8.40M | 41.23M | -15.93M | -7.50M | -39.50M | -23.41M | 16.95M | -8.94M |

| Income Before Tax | -78.50M | 22.12M | -50.81M | -210.52M | -108.33M | 94.07M | 113.07M | 82.03M |

| Income Before Tax Ratio | -10.04% | 2.89% | -6.60% | -23.69% | -9.53% | 7.83% | 11.62% | 9.37% |

| Income Tax Expense | 69.60M | -6.03M | -830.73K | -29.64M | 16.17M | 20.11M | 24.32M | 20.66M |

| Net Income | -148.10M | 22.40M | -49.98M | -180.88M | -132.58M | 69.83M | 85.39M | 60.35M |

| Net Income Ratio | -18.94% | 2.92% | -6.49% | -20.36% | -11.67% | 5.81% | 8.78% | 6.90% |

| EPS | -1.81 | 0.34 | -0.61 | -2.21 | -0.41 | 0.22 | 0.26 | 0.19 |

| EPS Diluted | -1.81 | 0.33 | -0.61 | -2.21 | -0.41 | 0.21 | 0.26 | 0.19 |

| Weighted Avg Shares Out | 81.67M | 81.88M | 82.03M | 82.00M | 326.10M | 324.66M | 323.86M | 323.22M |

| Weighted Avg Shares Out (Dil) | 81.67M | 84.98M | 82.03M | 82.00M | 326.10M | 326.44M | 325.62M | 324.15M |

Superdry shares jump 18% on £40m Indian deal news

Superdry Posts $190m Loss Amid U.S. Wholesale Exit And Share Suspension

Superdry delayed results show big swing to losses, wholesale remains 'challenging'

Superdry shares suspended due to accounts delay

Superdry nosedives as it secures funding from Hilco

What made Superdry stock lose 15% on Friday?

Superdry plummets after issuing profit warning

Superdry warns on profits, considers equity raise

Superdry withdraws full-year 2023 profit guidance, considers equity capital raise

Superdry's Cowell deal 'phenomenal', says broker

Source: https://incomestatements.info

Category: Stock Reports