See more : Hut 8 Mining Corp. (HUT) Income Statement Analysis – Financial Results

Complete financial analysis of SharpSpring, Inc. (SHSP) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of SharpSpring, Inc., a leading company in the Software – Application industry within the Technology sector.

- Vantone Neo Development Group Co.,Ltd. (600246.SS) Income Statement Analysis – Financial Results

- Haier Smart Home Co., Ltd. (QIHCF) Income Statement Analysis – Financial Results

- Valmet Oyj (VOYJF) Income Statement Analysis – Financial Results

- The Procter & Gamble Company (PRG.DE) Income Statement Analysis – Financial Results

- Indiabulls Enterprises Limited (IEL.BO) Income Statement Analysis – Financial Results

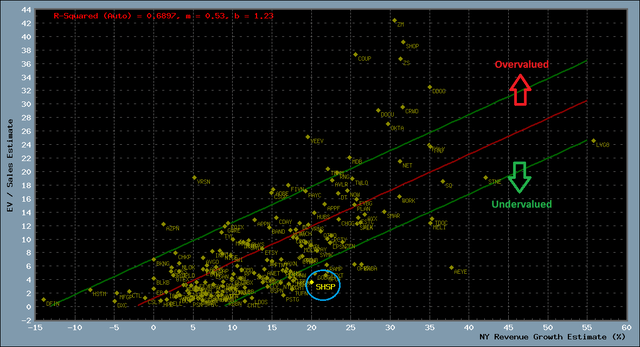

SharpSpring, Inc. (SHSP)

About SharpSpring, Inc.

SharpSpring, Inc. operates as a cloud-based based marketing technology company. The company is headquartered in Gainesville Florida, Florida and currently employs 104 full-time employees. The firm offers SharpSpring, a marketing automation solution for small and medium-sized businesses and is primarily sold to marketing agencies that use the platform on behalf of their clients. The features of SharpSpring includes Web tracking, lead scoring and automated workflow that enables businesses deliver the message to the customer. SharpSpring marketing automation solution also offers customer relation management tool and call tracking functionality. Its SharpSpring Mail+ provides customers with marketing automation functionality and traditional email marketing capabilities. SharpSpring Mail+ offers tools, such as automated workflows, triggered emails and dynamic list segmentation. The Company’s subsidiaries include SharpSpring Technologies, Inc., InterInbox SA, ERNEPH 2012A (Pty) Ltd. doing business as ISMS, Perfect Audience and SMTP Holdings S.a.r.l.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 29.29M | 22.70M | 18.65M | 13.45M | 11.54M | 14.59M | 7.50M | 5.75M | 5.35M | 4.28M | 2.74M |

| Cost of Revenue | 8.06M | 7.14M | 5.80M | 5.00M | 4.46M | 3.95M | 1.72M | 1.05M | 1.28M | 822.79K | 639.24K |

| Gross Profit | 21.23M | 15.56M | 12.85M | 8.45M | 7.08M | 10.64M | 5.78M | 4.70M | 4.08M | 3.46M | 2.10M |

| Gross Profit Ratio | 72.47% | 68.53% | 68.91% | 62.85% | 61.34% | 72.92% | 77.12% | 81.76% | 76.14% | 80.77% | 76.63% |

| Research & Development | 6.07M | 5.04M | 4.30M | 2.88M | 2.31M | 2.16M | 803.43K | 234.58K | 403.30K | 351.09K | 225.39K |

| General & Administrative | 10.23M | 8.62M | 6.36M | 5.35M | 4.42M | 4.82M | 3.14M | 1.71M | 1.18M | 1.17M | 852.53K |

| Selling & Marketing | 10.89M | 11.79M | 10.09M | 6.98M | 5.34M | 5.83M | 1.83M | 817.97K | 775.07K | 361.40K | 276.25K |

| SG&A | 21.12M | 20.40M | 16.45M | 12.33M | 9.76M | 10.65M | 4.97M | 2.53M | 1.96M | 1.53M | 1.13M |

| Other Expenses | 642.15K | 381.00K | 968.56K | 527.47K | 1.36M | 1.51M | 285.07K | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 27.83M | 25.82M | 21.72M | 15.74M | 13.43M | 14.32M | 6.06M | 2.76M | 2.36M | 1.88M | 1.35M |

| Cost & Expenses | 35.89M | 32.96M | 27.52M | 20.74M | 17.89M | 18.27M | 7.77M | 3.81M | 3.64M | 2.70M | 1.99M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 1.60M | 1.01M | 892.23K | 807.57K | 1.52M | 1.71M | 424.70K | 102.31K | 32.91K | 6.22K | 3.13K |

| EBITDA | -5.74M | -11.35M | -8.92M | -6.27M | 4.60M | -6.07M | -547.77K | 2.04M | 1.75M | 1.58M | 746.78K |

| EBITDA Ratio | -19.59% | -49.99% | -47.81% | -46.63% | 39.86% | -41.63% | -7.30% | 35.51% | 32.62% | 36.98% | 27.30% |

| Operating Income | -6.61M | -10.26M | -8.86M | -7.29M | -6.35M | -3.68M | -274.19K | 1.94M | 1.71M | 1.58M | 742.34K |

| Operating Income Ratio | -22.55% | -45.21% | -47.52% | -54.19% | -55.00% | -25.26% | -3.66% | 33.74% | 32.01% | 36.82% | 27.13% |

| Total Other Income/Expenses | -729.99K | -2.10M | -945.70K | 209.17K | -1.24M | -4.10M | -698.28K | 0.00 | 0.00 | 559.00 | 1.31K |

| Income Before Tax | -7.33M | -12.36M | -9.81M | -7.08M | -7.59M | -7.78M | -972.47K | 1.94M | 1.71M | 1.58M | 743.65K |

| Income Before Tax Ratio | -25.04% | -54.44% | -52.60% | -52.64% | -65.72% | -53.34% | -12.97% | 33.74% | 32.01% | 36.83% | 27.18% |

| Income Tax Expense | -1.51M | 29.35K | -330.99K | -2.10M | -1.87M | 461.95K | -131.26K | 668.16K | 644.00K | 670.50K | 348.75K |

| Net Income | -5.83M | -12.39M | -9.48M | -4.98M | 4.95M | -8.24M | -841.21K | 1.27M | 1.07M | 905.63K | 394.90K |

| Net Income Ratio | -19.90% | -54.57% | -50.82% | -36.99% | 42.90% | -56.51% | -11.22% | 22.12% | 19.98% | 21.16% | 14.43% |

| EPS | -0.45 | -1.20 | -1.11 | -0.59 | 0.63 | -1.30 | -0.17 | 0.42 | 0.37 | 0.33 | 0.15 |

| EPS Diluted | -0.45 | -1.20 | -1.11 | -0.59 | 0.63 | -1.30 | -0.17 | 0.41 | 0.37 | 0.30 | 0.15 |

| Weighted Avg Shares Out | 12.81M | 10.32M | 8.51M | 8.40M | 7.90M | 6.35M | 4.91M | 3.00M | 2.88M | 2.75M | 2.69M |

| Weighted Avg Shares Out (Dil) | 12.81M | 10.32M | 8.51M | 8.40M | 7.90M | 6.35M | 4.91M | 3.07M | 2.92M | 3.03M | 2.69M |

Marin Software: Is It Worth The Risk?

SharpSpring: Good Performance In A Difficult Economic Environment

Why Greenhaven Road Capital is Bullish on SharpSpring and Digital Turbine

Fly Insider: Gamestop, SharpSpring among week's notable insider trades NBIX;GME;BSET;KWR;KROS;TGE;SHSP;WDAY;MRVL;PEN

Source: https://incomestatements.info

Category: Stock Reports