See more : Nouveau Monde Graphite Inc. (NMG) Income Statement Analysis – Financial Results

Complete financial analysis of Siemens Aktiengesellschaft (SIEGY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Siemens Aktiengesellschaft, a leading company in the Industrial – Machinery industry within the Industrials sector.

- Hagoromo Foods Corporation (2831.T) Income Statement Analysis – Financial Results

- Kawasaki Heavy Industries, Ltd. (7012.T) Income Statement Analysis – Financial Results

- PT Dwi Guna Laksana Tbk (DWGL.JK) Income Statement Analysis – Financial Results

- Phoenix Pioneer technology Co., Ltd. (6920.TWO) Income Statement Analysis – Financial Results

- Passus S.A. (PAS.WA) Income Statement Analysis – Financial Results

Siemens Aktiengesellschaft (SIEGY)

About Siemens Aktiengesellschaft

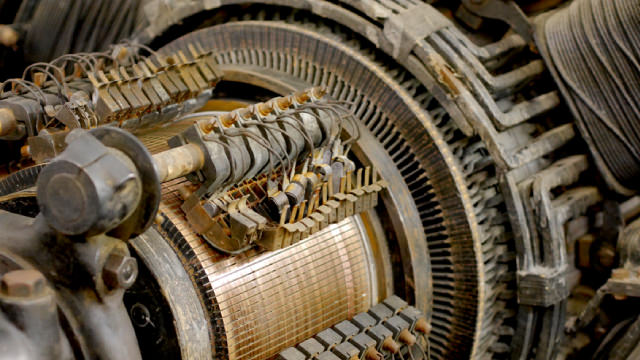

Siemens Aktiengesellschaft, a technology company, focuses in the areas of automation and digitalization in Europe, Commonwealth of Independent States, Africa, the Middle East, the Americas, Asia, and Australia. It operates through Digital Industries, Smart Infrastructure, Mobility, Siemens Healthineers, and Siemens Financial Services segments. The Digital Industries segment offers automation systems and software for factories, numerical control systems, motors, drives and inverters, and integrated automation systems for machine tools and production machines; process control systems, machine-to-machine communication products, sensors and radio frequency identification systems; software for production and product lifecycle management, and simulation and testing of mechatronic systems; and cloud-based industrial Internet of Things operating systems. The Smart Infrastructure segment offers products, systems, solutions, services, and software to support sustainable transition in energy generation from fossil and renewable sources; sustainable buildings and communities; and buildings, electrification, and electrical products. The Mobility segment provides passenger and freight transportation, such as vehicles, trams and light rail, and commuter trains, as well as trains and passenger coaches; locomotives for freight or passenger transport and solutions for automated transportation; products and solutions for rail automation; electrification products; and intermodal solutions. The Siemens Healthineers segment develops, manufactures, and sells various diagnostic and therapeutic products and services; and provides clinical consulting services. The Siemens Financial Services segment offers debt and equity investments; leasing, lending, and working capital financing solutions; and equipment, project, and structured financing solutions. Siemens Aktiengesellschaft was founded in 1847 and is headquartered in Munich, Germany.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 75.93B | 77.77B | 71.98B | 62.27B | 57.14B | 86.85B | 83.04B | 83.05B | 79.64B | 75.64B | 71.92B | 75.88B | 78.30B | 73.52B | 75.98B | 76.65B | 77.33B | 72.45B | 87.33B | 75.45B | 75.17B | 74.23B | 84.02B | 87.00B | 78.40B | 68.58B |

| Cost of Revenue | 46.11B | 45.77B | 46.13B | 39.53B | 36.95B | 60.92B | 58.18B | 58.02B | 55.83B | 53.79B | 51.17B | 55.05B | 56.09B | 51.39B | 54.33B | 55.94B | 56.28B | 51.57B | 63.81B | 53.50B | 53.52B | 53.35B | 60.81B | 63.90B | 54.97B | 49.09B |

| Gross Profit | 29.82B | 32.00B | 25.85B | 22.74B | 20.19B | 25.93B | 24.86B | 25.03B | 23.82B | 21.85B | 20.76B | 20.83B | 22.20B | 22.13B | 21.65B | 20.71B | 21.04B | 20.88B | 23.51B | 21.94B | 21.65B | 20.88B | 23.21B | 23.11B | 23.42B | 19.49B |

| Gross Profit Ratio | 39.28% | 41.15% | 35.91% | 36.52% | 35.33% | 29.85% | 29.94% | 30.14% | 29.91% | 28.88% | 28.86% | 27.45% | 28.36% | 30.10% | 28.49% | 27.02% | 27.21% | 28.82% | 26.93% | 29.08% | 28.80% | 28.13% | 27.62% | 26.56% | 29.88% | 28.42% |

| Research & Development | 6.28B | 6.18B | 5.59B | 4.86B | 4.60B | 5.67B | 5.56B | 5.16B | 4.73B | 4.48B | 4.07B | 4.29B | 4.24B | 3.93B | 3.85B | 3.90B | 3.78B | 3.40B | 5.02B | 5.16B | 5.06B | 5.07B | 5.82B | 6.78B | 5.59B | 5.24B |

| General & Administrative | 13.98B | 13.94B | 12.86B | 11.19B | 10.77B | 13.35B | 12.94B | 12.23B | 11.67B | 11.41B | 10.42B | 11.29B | 11.16B | 10.30B | 11.13B | 10.90B | 13.59B | 12.10B | 15.47B | 13.68B | 13.57B | 13.53B | 15.46B | 16.64B | 3.36B | 2.65B |

| Selling & Marketing | 0.00 | -388.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 10.40B | 9.78B |

| SG&A | 13.98B | 13.55B | 12.86B | 11.19B | 10.77B | 13.35B | 12.94B | 12.23B | 11.67B | 11.41B | 10.42B | 11.29B | 11.16B | 10.30B | 11.13B | 10.90B | 13.59B | 12.10B | 15.47B | 13.68B | 13.57B | 13.53B | 15.46B | 16.64B | 13.76B | 12.43B |

| Other Expenses | 9.56B | 0.00 | 123.00M | 268.00M | 257.00M | 220.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 29.82B | 20.41B | 18.57B | 16.32B | 15.63B | 19.24B | 18.95B | 17.69B | 16.68B | 16.12B | 14.53B | 15.50B | 15.16B | 14.17B | 15.73B | 14.36B | 18.42B | 15.73B | 20.37B | 18.81B | 18.63B | 18.60B | 21.27B | 23.42B | 19.01B | 18.15B |

| Cost & Expenses | 75.93B | 68.53B | 64.70B | 55.84B | 52.59B | 80.16B | 77.13B | 75.71B | 72.50B | 69.91B | 65.69B | 70.55B | 71.25B | 65.56B | 70.06B | 70.30B | 74.71B | 67.30B | 84.18B | 72.31B | 72.15B | 71.95B | 82.08B | 87.32B | 73.98B | 67.24B |

| Interest Income | 2.83B | 2.40B | 1.63B | 1.48B | 1.55B | 1.63B | 1.48B | 1.49B | 1.31B | 1.26B | 1.06B | 948.00M | 2.23B | 2.21B | 2.16B | 833.00M | 894.00M | 758.00M | 160.00M | 720.00M | 723.00M | 789.00M | 1.06B | 964.00M | 0.00 | 0.00 |

| Interest Expense | 1.79B | 1.37B | 689.00M | 644.00M | 815.00M | 1.13B | 1.09B | 1.05B | 989.00M | 818.00M | 764.00M | 789.00M | 1.73B | 1.72B | 1.89B | 683.00M | 997.00M | 262.00M | 39.00M | 511.00M | 451.00M | 544.00M | 743.00M | 32.00M | 35.00M | 0.00 |

| Depreciation & Amortization | 3.16B | 3.61B | 3.55B | 3.08B | 3.01B | 2.34B | 3.42B | 3.21B | 2.76B | 2.55B | 2.41B | 2.89B | 2.74B | 2.64B | 4.12B | 2.92B | 3.21B | 3.75B | 3.01B | 3.43B | 3.34B | 3.33B | 4.13B | 6.26B | 4.06B | 3.44B |

| EBITDA | 16.17B | 16.04B | 9.40B | 11.22B | 9.41B | 10.18B | 12.56B | 12.45B | 11.16B | 10.59B | 10.10B | 9.40B | 10.21B | 12.15B | 11.48B | 9.27B | 6.92B | 9.01B | 6.82B | 7.64B | 8.16B | 7.25B | 8.34B | 5.95B | 8.48B | 3.87B |

| EBITDA Ratio | 21.30% | 20.62% | 13.05% | 17.89% | 16.03% | 13.76% | 15.04% | 15.01% | 13.95% | 13.79% | 14.05% | 12.55% | 15.01% | 17.62% | 16.05% | 12.10% | 9.03% | 12.43% | 7.79% | 9.65% | 10.79% | 8.63% | 8.47% | 6.84% | 10.81% | 5.65% |

| Operating Income | 0.00 | 9.36B | 5.83B | 8.07B | 6.00B | 8.46B | 9.07B | 9.25B | 8.35B | 7.88B | 7.69B | 6.63B | 9.01B | 10.31B | 8.08B | 6.35B | 3.77B | 5.26B | 3.79B | 3.85B | 4.77B | 3.07B | 2.99B | -317.00M | 4.42B | 437.00M |

| Operating Income Ratio | 0.00% | 12.04% | 8.11% | 12.96% | 10.50% | 9.74% | 10.92% | 11.14% | 10.48% | 10.42% | 10.70% | 8.74% | 11.50% | 14.03% | 10.63% | 8.28% | 4.88% | 7.25% | 4.34% | 5.10% | 6.34% | 4.14% | 3.56% | -0.36% | 5.64% | 0.64% |

| Total Other Income/Expenses | 11.23B | 1.84B | -122.00M | -570.00M | 1.29B | -937.00M | -1.02B | -946.00M | -941.00M | -661.00M | -265.00M | -789.00M | -1.73B | -1.55B | -2.10B | -2.57B | -899.00M | -46.00M | 577.00M | 1.05B | -537.00M | 1.09B | 1.54B | 3.00B | 3.78B | 2.43B |

| Income Before Tax | 11.23B | 11.20B | 7.15B | 7.50B | 5.67B | 7.52B | 8.05B | 8.31B | 7.40B | 7.22B | 7.43B | 5.84B | 7.28B | 9.24B | 5.81B | 3.89B | 2.87B | 5.10B | 4.37B | 4.19B | 4.23B | 3.37B | 3.48B | 2.68B | 5.29B | 2.87B |

| Income Before Tax Ratio | 14.79% | 14.40% | 9.94% | 12.04% | 9.93% | 8.66% | 9.69% | 10.00% | 9.30% | 9.54% | 10.33% | 7.70% | 9.30% | 12.57% | 7.65% | 5.08% | 3.72% | 7.04% | 5.01% | 5.55% | 5.63% | 4.54% | 4.14% | 3.08% | 6.75% | 4.18% |

| Income Tax Expense | 2.32B | 2.69B | 2.74B | 1.86B | 1.38B | 1.87B | 2.05B | 2.18B | 2.01B | 1.87B | 2.03B | 1.63B | 2.09B | 2.23B | 1.70B | 1.43B | 1.02B | 1.19B | 1.08B | 979.00M | 661.00M | 867.00M | 849.00M | 781.00M | 1.91B | 1.01B |

| Net Income | 8.30B | 7.95B | 3.72B | 6.16B | 4.03B | 5.17B | 5.81B | 5.96B | 5.45B | 7.28B | 5.37B | 4.28B | 4.15B | 5.72B | 3.90B | 2.29B | 5.73B | 3.81B | 3.14B | 2.25B | 3.41B | 2.45B | 2.60B | 2.09B | 8.86B | 1.87B |

| Net Income Ratio | 10.93% | 10.22% | 5.17% | 9.89% | 7.05% | 5.96% | 6.99% | 7.18% | 6.84% | 9.63% | 7.47% | 5.65% | 5.30% | 7.78% | 5.13% | 2.99% | 7.40% | 5.25% | 3.59% | 2.98% | 4.53% | 3.29% | 3.09% | 2.40% | 11.30% | 2.72% |

| EPS | 0.00 | 9.90 | 4.65 | 6.56 | 5.00 | 6.42 | 3.56 | 3.67 | 3.37 | 4.42 | 3.19 | 2.54 | 2.55 | 3.52 | 2.25 | 1.33 | 3.21 | 2.12 | 1.76 | 1.26 | 1.91 | 1.38 | 1.46 | 1.18 | 4.99 | 1.11 |

| EPS Diluted | 0.00 | 9.92 | 4.60 | 6.48 | 4.94 | 6.33 | 3.51 | 3.60 | 3.33 | 4.37 | 3.16 | 2.52 | 2.52 | 3.48 | 2.22 | 1.32 | 3.20 | 2.05 | 1.76 | 1.21 | 1.83 | 1.38 | 1.46 | 1.18 | 4.98 | 1.09 |

| Weighted Avg Shares Out | 0.00 | 803.26M | 801.34M | 801.83M | 806.34M | 807.27M | 1.63B | 1.62B | 1.62B | 1.65B | 1.69B | 1.69B | 1.75B | 1.75B | 1.74B | 1.73B | 1.79B | 1.80B | 1.78B | 1.78B | 1.78B | 1.78B | 1.78B | 1.77B | 1.78B | 1.69B |

| Weighted Avg Shares Out (Dil) | 0.00 | 801.34M | 809.68M | 811.49M | 817.36M | 818.31M | 1.66B | 1.66B | 1.64B | 1.67B | 1.70B | 1.70B | 1.77B | 1.77B | 1.76B | 1.74B | 1.79B | 1.87B | 1.79B | 1.87B | 1.87B | 1.78B | 1.78B | 1.77B | 1.78B | 1.70B |

Siemens and CELUS Collaborate to Simplify AI-Powered PCB Design for SMBs

Zacks Industry Outlook Siemens, W.W. Grainger and SiteOne Landscape Supply

3 Industrial Services Stocks to Consider Amid Industry Challenges

SIEGY vs. GWW: Which Stock Is the Better Value Option?

KODE Labs Welcomes Former Siemens Executive Ben Dwyer as Senior Vice President of Sales

Workhorse Group standardizes on Siemens Xcelerator as a Service for sustainable last mile delivery electric trucks

What Makes Siemens AG (SIEGY) a Strong Momentum Stock: Buy Now?

Siemens looks to digital platform to tackle automation downturn

SIEGY or GWW: Which Is the Better Value Stock Right Now?

Siemens files lawsuit in Texas against Citgo Petroleum parent

Source: https://incomestatements.info

Category: Stock Reports