See more : Manz AG (M5Z.DE) Income Statement Analysis – Financial Results

Complete financial analysis of SiTime Corporation (SITM) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of SiTime Corporation, a leading company in the Semiconductors industry within the Technology sector.

- Relief Therapeutics Holding AG (RLF.SW) Income Statement Analysis – Financial Results

- Imagicaaworld Entertainment Limited (IMAGICAA.BO) Income Statement Analysis – Financial Results

- Blackrock MuniYield California Fund, Inc. (MYC) Income Statement Analysis – Financial Results

- Salee Printing Public Company Limited (SLP.BK) Income Statement Analysis – Financial Results

- Sakol Energy Public Company Limited (SKE.BK) Income Statement Analysis – Financial Results

SiTime Corporation (SITM)

About SiTime Corporation

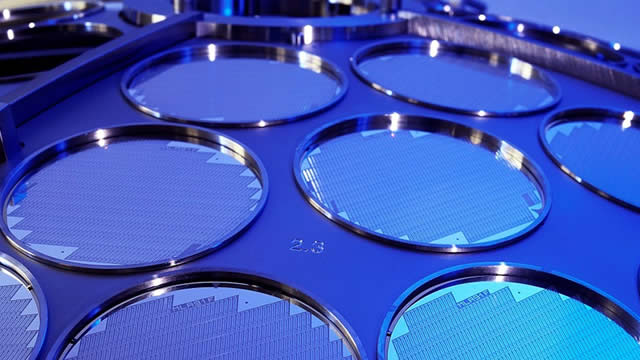

SiTime Corporation designs, develops, and sells silicon timing systems solutions in Taiwan, Hong Kong, the United States, and internationally. The company provides resonators and clock integrated circuits, and various types of oscillators. Its solutions have applications in various markets, including communications and enterprise, automotive, industrial, Internet of Things, mobile, consumer, and aerospace and defense. The company sells its timing products through distributors and resellers. SiTime Corporation was incorporated in 2003 and is headquartered in Santa Clara, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Revenue | 143.99M | 283.61M | 218.81M | 116.16M | 84.07M | 85.21M | 101.07M |

| Cost of Revenue | 61.91M | 100.64M | 79.35M | 58.22M | 44.52M | 49.01M | 53.15M |

| Gross Profit | 82.09M | 182.96M | 139.46M | 57.93M | 39.56M | 36.21M | 47.92M |

| Gross Profit Ratio | 57.01% | 64.51% | 63.74% | 49.87% | 47.05% | 42.49% | 47.41% |

| Research & Development | 97.59M | 90.29M | 52.10M | 31.65M | 23.80M | 22.78M | 20.99M |

| General & Administrative | 82.37M | 74.23M | 53.02M | 34.59M | 20.34M | 6.61M | 7.96M |

| Selling & Marketing | 1.60M | 2.30M | 1.50M | 300.00K | 300.00K | 14.61M | 13.38M |

| SG&A | 83.97M | 76.53M | 54.52M | 34.89M | 20.64M | 21.22M | 21.34M |

| Other Expenses | 7.73M | -97.00K | -488.00K | -32.00K | -28.00K | -66.00K | -29.00K |

| Operating Expenses | 181.56M | 166.82M | 106.62M | 66.55M | 44.43M | 44.00M | 42.33M |

| Cost & Expenses | 243.47M | 267.46M | 185.97M | 124.77M | 88.95M | 93.00M | 95.48M |

| Interest Income | 26.96M | 7.29M | 0.00 | 0.00 | 1.71M | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 0.00 | 726.00K | 1.71M | 1.51M | 870.00K |

| Depreciation & Amortization | 16.13M | 11.84M | 7.93M | 6.40M | 8.27M | 7.41M | 3.55M |

| EBITDA | -87.24M | 27.99M | 40.77M | -2.24M | 3.37M | -443.00K | 9.11M |

| EBITDA Ratio | -60.59% | 5.69% | 15.01% | -7.44% | -5.83% | -0.52% | 9.01% |

| Operating Income | -107.20M | 4.30M | 24.92M | -8.61M | -4.87M | -7.79M | 5.59M |

| Operating Income Ratio | -74.45% | 1.52% | 11.39% | -7.42% | -5.80% | -9.14% | 5.53% |

| Total Other Income/Expenses | 26.82M | 7.19M | -488.00K | -758.00K | -1.74M | -1.58M | -899.00K |

| Income Before Tax | -80.38M | 23.34M | 32.36M | -9.37M | -6.62M | -9.37M | 4.69M |

| Income Before Tax Ratio | -55.82% | 8.23% | 14.79% | -8.07% | -7.87% | -10.99% | 4.64% |

| Income Tax Expense | 152.00K | 82.00K | 78.00K | 1.00K | -8.00K | -26.00K | -32.00K |

| Net Income | -80.54M | 23.25M | 32.28M | -9.37M | -6.61M | -9.34M | 4.72M |

| Net Income Ratio | -55.93% | 8.20% | 14.75% | -8.07% | -7.86% | -10.96% | 4.67% |

| EPS | -3.63 | 1.09 | 1.70 | -0.58 | -0.63 | -0.65 | 0.33 |

| EPS Diluted | -3.63 | 1.03 | 1.53 | -0.58 | -0.63 | -0.65 | 0.33 |

| Weighted Avg Shares Out | 22.19M | 21.25M | 19.01M | 16.06M | 10.56M | 14.30M | 14.30M |

| Weighted Avg Shares Out (Dil) | 22.19M | 22.66M | 21.14M | 16.06M | 10.56M | 14.30M | 14.30M |

3 Growth Stocks to Buy Now -- 10x Small-Cap Stocks to Buy

SiTime Delivers 25x Better Timekeeping for Aerospace and Defense

Chipmaker Macom Tops Quarterly Goals But Stumbles With Sales Outlook

SiTime Corporation (SITM) Q4 2022 Earnings Call Transcript

SiTime (SITM) Beats Q4 Earnings and Revenue Estimates

SiTime Reports Fourth Quarter 2022 Financial Results

SiTime Expands Portfolio of Precision Timing Solutions for Aerospace and Defense with Two New Endura Oscillator Families

SiTime Expands Portfolio of Precision Timing Solutions for Aerospace and Defense with Two New Endura Oscillator Families

SiTime Corporation to Announce Fourth Quarter 2022 Financial Results on February 1, 2023

Semiconductor Stocks Brace For Bumpy 2023; Here's Who Can Weather The Storm

Source: https://incomestatements.info

Category: Stock Reports