See more : Ruichang Intl Hldg Ltd (1334.HK) Income Statement Analysis – Financial Results

Complete financial analysis of Six Flags Entertainment Corporation (SIX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Six Flags Entertainment Corporation, a leading company in the Leisure industry within the Consumer Cyclical sector.

- Times China Holdings Limited (TMPPF) Income Statement Analysis – Financial Results

- Inflection Point Acquisition Corp. (IPAX) Income Statement Analysis – Financial Results

- Moody’s Corporation (MCO) Income Statement Analysis – Financial Results

- Hercules Site Services Plc (HERC.L) Income Statement Analysis – Financial Results

- Eagle Financial Bancorp, Inc. (EFBI) Income Statement Analysis – Financial Results

Six Flags Entertainment Corporation (SIX)

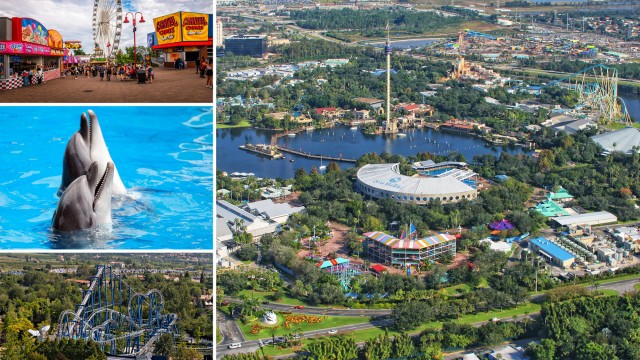

About Six Flags Entertainment Corporation

Six Flags Entertainment Corporation owns and operates regional theme and waterparks under the Six Flags name. Its parks offer various thrill rides, water attractions, themed areas, concerts and shows, restaurants, game venues, and retail outlets. The company also sells food, beverages, merchandise, and other products and services within its parks. As of February 28, 2022, the company operated 27 parks in the United States, Mexico, and Canada. The company was formerly known as Six Flags, Inc. and changed its name to Six Flags Entertainment Corporation in April 2010. Six Flags Entertainment Corporation was founded in 1961 and is based in Arlington, Texas.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.41B | 1.36B | 1.50B | 356.58M | 1.49B | 1.46B | 1.36B | 1.32B | 1.26B | 1.18B | 1.11B | 1.07B | 1.01B | 898.93M | 912.86M | 1.02B | 972.78M | 945.67M | 1.09B | 1.04B | 1.24B | 1.04B | 1.05B | 1.01B | 927.00M | 813.60M | 193.90M | 93.40M | 41.50M |

| Cost of Revenue | 0.00 | 108.15M | 125.73M | 34.12M | 130.30M | 121.80M | 110.37M | 109.58M | 100.71M | 90.52M | 86.66M | 80.17M | 77.29M | 0.00 | 502.27M | 505.71M | 513.24M | 496.32M | 549.65M | 533.06M | 618.82M | 500.99M | 499.33M | 463.14M | 437.60M | 395.00M | 102.50M | 52.70M | 4.64M |

| Gross Profit | 1.41B | 1.25B | 1.37B | 322.46M | 1.36B | 1.34B | 1.25B | 1.21B | 1.16B | 1.09B | 1.02B | 990.16M | 935.89M | 898.93M | 410.59M | 515.59M | 459.54M | 449.34M | 540.04M | 504.63M | 617.85M | 536.94M | 546.64M | 543.84M | 489.40M | 418.60M | 91.40M | 40.70M | 36.86M |

| Gross Profit Ratio | 100.00% | 92.04% | 91.60% | 90.43% | 91.24% | 91.68% | 91.88% | 91.69% | 92.03% | 92.30% | 92.19% | 92.51% | 92.37% | 100.00% | 44.98% | 50.48% | 47.24% | 47.52% | 49.56% | 48.63% | 49.96% | 51.73% | 52.26% | 54.01% | 52.79% | 51.45% | 47.14% | 43.58% | 88.83% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 156.75M | 205.49M | 142.11M | 195.01M | 127.00M | 158.50M | 291.79M | 234.81M | 310.96M | 189.22M | 225.88M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 37.30M | 0.00 | 0.00 | 0.00 | 68.40M | 63.70M | 62.80M | 0.00 | 0.00 | 61.20M | 61.50M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 226.94M | 156.75M | 205.49M | 142.11M | 195.01M | 127.00M | 158.50M | 291.79M | 234.81M | 310.96M | 189.22M | 225.88M | 215.06M | 192.62M | 196.87M | 214.34M | 244.38M | 239.93M | 211.32M | 203.64M | 245.04M | 197.44M | 197.12M | 178.56M | 176.20M | 133.30M | 36.50M | 16.90M | 9.27M |

| Other Expenses | 388.70M | 708.68M | 761.68M | 509.90M | 726.02M | -3.51M | -271.00K | -1.68M | -223.00K | -356.00K | -1.23M | -612.00K | -73.00K | 221.20M | 0.00 | 204.91M | 187.39M | 176.41M | 202.30M | 217.78M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 615.65M | 865.43M | 967.17M | 652.00M | 921.03M | 817.42M | 779.29M | 888.09M | 807.44M | 856.49M | 734.78M | 785.60M | 781.93M | 413.82M | 342.77M | 371.64M | 426.23M | 399.28M | 356.69M | 355.06M | 431.57M | 349.29M | 396.92M | 367.13M | 337.30M | 248.50M | 58.20M | 26.20M | 32.91M |

| Cost & Expenses | 615.65M | 973.58M | 1.09B | 686.12M | 1.05B | 939.22M | 889.67M | 997.67M | 908.15M | 947.01M | 821.44M | 865.77M | 859.22M | 413.82M | 845.04M | 877.35M | 939.47M | 895.60M | 906.34M | 888.12M | 1.05B | 850.28M | 896.25M | 830.27M | 774.90M | 643.50M | 160.70M | 78.90M | 37.55M |

| Interest Income | 0.00 | 1.63M | 465.00K | 688.00K | 1.40M | 791.00K | 756.00K | 505.00K | 302.00K | 468.00K | 899.00K | 820.00K | 997.00K | -878.00K | 878.00K | 2.34M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 151.95M | 141.59M | 152.44M | 154.72M | 113.30M | 107.24M | 99.01M | 81.87M | 75.90M | 72.59M | 74.15M | 46.62M | 66.21M | 106.31M | 106.31M | 178.52M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 116.32M | 117.12M | 114.43M | 120.17M | 118.23M | 115.69M | 111.67M | 106.89M | 107.41M | 108.11M | 128.08M | 148.05M | 169.00M | 0.00 | 145.89M | 139.61M | 146.45M | 141.83M | 153.58M | 159.54M | 194.93M | 160.80M | 209.17M | 188.56M | 161.10M | 115.20M | 21.70M | 9.30M | 3.87M |

| EBITDA | 374.90M | 497.66M | 500.32M | -234.37M | 551.94M | 636.67M | 580.81M | 426.93M | 462.98M | 346.57M | 415.33M | 417.09M | 320.77M | -34.01M | 217.71M | 245.17M | 254.82M | 230.52M | 382.18M | 374.68M | 411.80M | 353.88M | 341.98M | 363.56M | 287.00M | 228.30M | 46.60M | 23.90M | 7.99M |

| EBITDA Ratio | 26.53% | 36.64% | 33.42% | -65.73% | 37.10% | 43.50% | 42.74% | 32.36% | 36.63% | 29.48% | 37.42% | 38.97% | 31.66% | -3.78% | 23.85% | 24.01% | 26.19% | 24.38% | 35.07% | 36.11% | 33.30% | 34.10% | 32.69% | 36.10% | 30.96% | 28.06% | 24.03% | 25.59% | 19.26% |

| Operating Income | 320.15M | 380.53M | 385.88M | -354.54M | 433.71M | 524.49M | 469.41M | 321.73M | 355.79M | 228.79M | 288.49M | 204.56M | 1.20M | -34.01M | 71.82M | 143.95M | 33.31M | 50.07M | 225.36M | 230.39M | 216.87M | 193.08M | 132.81M | 175.00M | 125.90M | 113.10M | 24.90M | 14.60M | 4.13M |

| Operating Income Ratio | 22.65% | 28.02% | 25.78% | -99.43% | 29.16% | 35.83% | 34.54% | 24.38% | 28.15% | 19.46% | 25.99% | 19.11% | 0.12% | -3.78% | 7.87% | 14.09% | 3.42% | 5.29% | 20.68% | 22.20% | 17.54% | 18.60% | 12.70% | 17.38% | 13.58% | 13.90% | 12.84% | 15.63% | 9.94% |

| Total Other Income/Expenses | -165.97M | -179.99M | -164.57M | -168.52M | -121.95M | -5.39M | -41.35M | -6.59M | -16.66M | 3.82M | -10.42M | 53.67M | -84.86M | -21.25M | -165.41M | 92.31M | -75.55M | -39.57M | -45.26M | -65.57M | -30.59M | 10.24M | 16.91M | 1.71M | 26.20M | 57.00M | 8.30M | -100.00K | -177.00K |

| Income Before Tax | 154.17M | 200.54M | 221.31M | -523.06M | 311.76M | 411.86M | 329.05M | 233.27M | 263.22M | 160.01M | 203.93M | 211.61M | 3.88M | -55.26M | -203.02M | 19.36M | -237.88M | -202.66M | -85.19M | -145.26M | -94.85M | -30.17M | -56.77M | -46.34M | 5.30M | 76.30M | 23.70M | 3.30M | -1.81M |

| Income Before Tax Ratio | 10.91% | 14.76% | 14.78% | -146.69% | 20.96% | 28.14% | 24.21% | 17.68% | 20.83% | 13.61% | 18.37% | 19.77% | 0.38% | -6.15% | -22.24% | 1.90% | -24.45% | -21.43% | -7.82% | -14.00% | -7.67% | -2.91% | -5.43% | -4.60% | 0.57% | 9.38% | 12.22% | 3.53% | -4.35% |

| Income Tax Expense | 35.23M | 46.96M | 49.62M | -140.97M | 91.94M | 95.86M | 16.03M | 76.54M | 70.37M | 46.52M | 47.60M | -172.23M | -8.07M | 2.90M | 2.90M | 116.63M | 6.20M | 4.32M | 3.71M | 31.98M | -33.13M | -4.06M | -7.20M | 5.62M | 24.50M | 40.70M | 9.60M | 1.50M | -762.00K |

| Net Income | 71.41M | 153.58M | 129.92M | -382.09M | 179.07M | 276.00M | 273.82M | 118.30M | 154.69M | 76.02M | 118.55M | 354.01M | -22.66M | -245.51M | -229.17M | -112.96M | -253.16M | -305.62M | -110.94M | -464.81M | -61.71M | -105.70M | -58.10M | -51.96M | -30.50M | 34.80M | 14.10M | 1.80M | -1.19M |

| Net Income Ratio | 5.05% | 11.31% | 8.68% | -107.16% | 12.04% | 18.86% | 20.15% | 8.97% | 12.24% | 6.47% | 10.68% | 33.07% | -2.24% | -27.31% | -25.10% | -11.06% | -26.02% | -32.32% | -10.18% | -44.79% | -4.99% | -10.18% | -5.55% | -5.16% | -3.29% | 4.28% | 7.27% | 1.93% | -2.86% |

| EPS | 0.86 | 1.82 | 1.52 | -4.51 | 2.12 | 3.28 | 3.15 | 1.28 | 1.65 | 0.80 | 1.22 | 3.40 | -0.21 | 0.00 | -1.17 | -0.29 | -0.67 | -0.81 | -0.30 | -1.25 | -0.17 | -0.29 | -0.16 | -0.16 | -0.06 | 0.07 | 0.10 | 0.03 | -0.02 |

| EPS Diluted | 0.85 | 1.81 | 1.50 | -4.51 | 2.11 | 3.23 | 3.09 | 1.25 | 1.58 | 0.77 | 1.18 | 3.30 | -0.21 | 0.00 | -1.17 | -0.29 | -0.67 | -0.81 | -0.30 | -1.25 | -0.17 | -0.29 | -0.16 | -0.16 | -0.06 | 0.06 | 0.10 | 0.03 | -0.02 |

| Weighted Avg Shares Out | 83.31M | 84.37M | 85.71M | 84.80M | 84.35M | 84.10M | 86.80M | 92.35M | 93.58M | 94.48M | 96.94M | 107.68M | 110.15M | 97.72B | 195.44M | 387.80M | 378.99M | 376.97M | 372.44M | 372.14M | 370.47M | 370.04M | 356.88M | 314.94M | 488.70M | 265.72M | 141.00M | 35.89M | 78.76M |

| Weighted Avg Shares Out (Dil) | 83.59M | 84.70M | 86.65M | 84.80M | 84.97M | 85.45M | 88.49M | 94.40M | 97.98M | 98.14M | 100.37M | 110.94M | 110.15M | 97.72B | 195.44M | 387.80M | 378.99M | 376.97M | 372.44M | 372.14M | 370.52M | 370.32M | 356.88M | 314.94M | 488.70M | 274.07M | 148.42M | 600.00M | 78.76M |

Six Flags (SIX), Google Cloud Partner for New Virtual Assistant

Six Flags Great Adventure Celebrates 50th Anniversary With the Largest Park Investment in Nearly 20 Years

Six Flags Unveils Thrilling New Rides and Experiences Including Three Roller Coasters, Family Rides, Water Attractions, and an Upscale Glamping Experience

The All-New Bobcat Coaster Pounces into Six Flags Great Escape in 2024

Six Flags teams up with Google Cloud to introduce new virtual assistant to its theme parks

Bad weather dampens Six Flags, SeaWorld, Cedar Fair theme park traffic

Bad weather dampens Six Flags, SeaWorld, Cedar Fair theme park traffic

CORRECTING and REPLACING Six Flags Reports Second Quarter 2023 Performance

Six Flags' bottom line battered by extreme weather as attendance plunges by 400K

Core CPI Inflation In Line With Estimates in July

Source: https://incomestatements.info

Category: Stock Reports