See more : On the Beach Group plc (OTB.L) Income Statement Analysis – Financial Results

Complete financial analysis of Smiths Group plc (SMGZY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Smiths Group plc, a leading company in the Industrial – Machinery industry within the Industrials sector.

- Pantera Silver Corp. (PNTRF) Income Statement Analysis – Financial Results

- Ambow Education Holding Ltd. (AMBO) Income Statement Analysis – Financial Results

- Okamoto Industries, Inc. (5122.T) Income Statement Analysis – Financial Results

- Symphony Holdings Limited (1223.HK) Income Statement Analysis – Financial Results

- Dongwha Pharm.Co.,Ltd (000020.KS) Income Statement Analysis – Financial Results

Smiths Group plc (SMGZY)

About Smiths Group plc

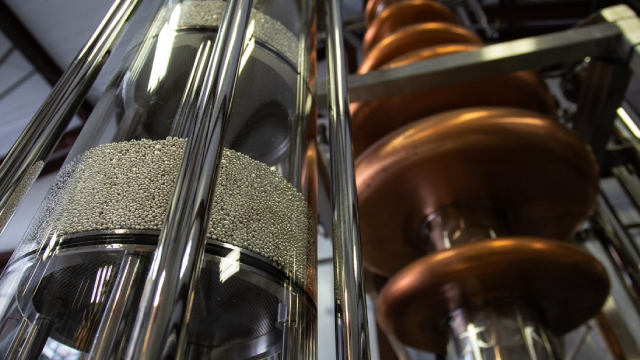

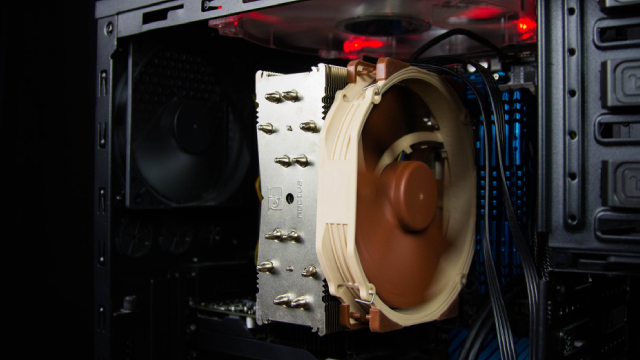

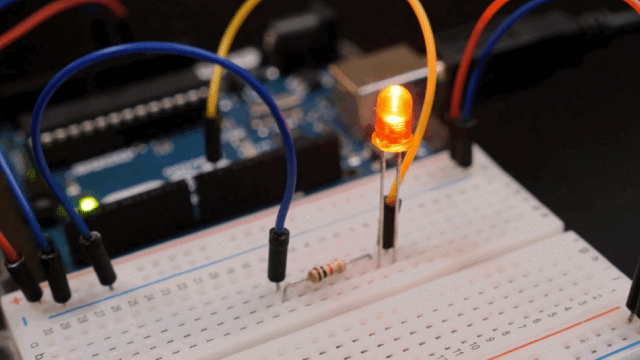

Smiths Group plc operates as a technology company serving the medical technology, security and defense, general industrial, energy, and space and aerospace markets worldwide. It operates through John Crane, Smiths Detection, Flex-Tek, Smiths Interconnect, and Smiths Medical divisions. The John Crane division offers mechanical seals, seal support systems, hydrodynamic bearings, packing materials, power transmission couplings, and specialized filtration systems. The Smiths Detection division provides sensors and systems that detect and identify explosives, narcotics, weapons, chemical agents, biohazards, and contraband. The Flex-Tek division offers engineered components that heat and move fluids and gases for the aerospace, medical, industrial, construction, and domestic appliance markets. The Smiths Interconnect division provides specialized electronic and radio frequency board-level and waveguide devices, connectors, cables, test sockets, and sub-systems for applications in the security and defense, medical, general industrial, and space and aerospace markets. The Smiths Medical division offers infusion systems, vascular access, patient airway, and temperature management equipment products; and specialised devices in areas of diagnostic and emergency patient transport. The company was formerly known as Smiths Industries and changed its name to Smiths Group plc in 2000. Smiths Group plc was founded in 1851 and is headquartered in London, the United Kingdom.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 3.13B | 3.04B | 2.57B | 2.41B | 2.55B | 2.50B | 3.21B | 3.28B | 2.95B | 2.90B | 2.95B | 3.11B | 3.03B | 2.84B | 2.77B | 2.66B | 2.32B | 2.16B | 2.18B | 3.01B | 2.73B | 3.06B | 3.22B | 4.96B | 1.46B | 1.32B | 1.20B | 1.08B | 1.01B | 899.30M | 766.30M | 725.80M | 635.30M | 655.50M | 673.00M | 704.90M | 666.40M | 429.95M | 401.20M |

| Cost of Revenue | 1.96B | 1.92B | 1.61B | 1.49B | 1.56B | 1.43B | 1.75B | 1.76B | 1.60B | 1.56B | 1.63B | 1.69B | 1.65B | 1.53B | 1.48B | 1.45B | 1.27B | 1.16B | 1.17B | 1.81B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 1.17B | 1.12B | 961.00M | 915.00M | 989.00M | 1.07B | 1.46B | 1.53B | 1.35B | 1.33B | 1.33B | 1.41B | 1.38B | 1.31B | 1.29B | 1.22B | 1.06B | 1.00B | 1.02B | 1.19B | 2.73B | 3.06B | 3.22B | 4.96B | 1.46B | 1.32B | 1.20B | 1.08B | 1.01B | 899.30M | 766.30M | 725.80M | 635.30M | 655.50M | 673.00M | 704.90M | 666.40M | 429.95M | 401.20M |

| Gross Profit Ratio | 37.29% | 36.81% | 37.45% | 38.03% | 38.81% | 42.79% | 45.56% | 46.49% | 45.74% | 46.01% | 44.93% | 45.51% | 45.68% | 46.02% | 46.70% | 45.68% | 45.48% | 46.36% | 46.56% | 39.62% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 73.00M | 80.00M | 76.00M | 83.00M | 84.00M | 75.00M | 98.00M | 87.00M | 107.00M | 114.00M | 108.20M | 0.00 | 68.00M | 69.20M | 66.70M | 52.70M | 52.30M | 55.00M | 101.00M | 136.80M | 129.70M | 116.50M | 109.50M | 63.30M | 53.90M | 48.80M | 48.20M | 50.00M | 49.20M | 44.80M | 48.60M | 45.90M | 43.60M | 43.90M | 108.00M | 0.00 | 0.00 | 0.00 |

| General & Administrative | 426.00M | 406.00M | 351.00M | 355.00M | 392.00M | 375.00M | 485.00M | 577.00M | 575.00M | 533.00M | 550.20M | 496.70M | 596.50M | -82.70M | -42.30M | -122.00M | -307.30M | -302.30M | 38.30M | 208.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 219.00M | 221.00M | 200.00M | 188.00M | 270.00M | 267.00M | 435.00M | 449.00M | 403.00M | 406.00M | 398.30M | 425.60M | 411.90M | 384.30M | 369.70M | 370.50M | 311.80M | 311.50M | 316.90M | 283.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 645.00M | 627.00M | 551.00M | 543.00M | 662.00M | 642.00M | 920.00M | 1.03B | 978.00M | 939.00M | 948.50M | 922.30M | 1.01B | 301.60M | 327.40M | 248.50M | 4.50M | 9.20M | 355.20M | 491.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 108.00M | 41.00M | 258.00M | 53.00M | 57.00M | 42.00M | 29.00M | -6.00M | -16.00M | -8.00M | -8.40M | 0.00 | 23.50M | -8.60M | -3.60M | -800.00K | 2.00M | 1.00M | 2.20M | 392.20M | 12.20M | 39.80M | 32.00M | -411.00M | 1.12B | 1.02B | 910.00M | -6.60M | -2.60M | -2.30M | 601.30M | -4.50M | 496.10M | 93.00M | 103.10M | 99.11M | 666.40M | 62.22M | 55.68M |

| Operating Expenses | 753.00M | 670.00M | 809.00M | 596.00M | 719.00M | 684.00M | 949.00M | 1.03B | 962.00M | 939.00M | 948.50M | 922.30M | 1.01B | 869.60M | 868.30M | 797.50M | 1.21B | 1.22B | 720.40M | 806.00M | 2.37B | 2.63B | 2.80B | 3.90B | 1.19B | 1.07B | 958.80M | 873.60M | 835.60M | 755.60M | 646.10M | 615.10M | 542.00M | 611.90M | 663.40M | 671.20M | 666.40M | 429.95M | 401.20M |

| Cost & Expenses | 2.72B | 2.59B | 2.41B | 2.09B | 2.28B | 2.11B | 2.70B | 2.78B | 2.56B | 2.50B | 2.57B | 2.62B | 2.65B | 2.40B | 2.34B | 2.25B | 2.47B | 2.38B | 1.89B | 2.62B | 2.37B | 2.63B | 2.80B | 3.90B | 1.19B | 1.07B | 958.80M | 873.60M | 835.60M | 755.60M | 646.10M | 615.10M | 542.00M | 611.90M | 663.40M | 671.20M | 666.40M | 429.95M | 401.20M |

| Interest Income | 32.00M | 43.00M | 21.00M | 15.00M | 13.00M | 22.00M | 14.00M | 7.00M | 6.00M | 3.00M | 2.60M | 19.00M | 25.70M | 25.10M | 5.90M | 7.20M | 43.90M | 55.10M | 29.40M | 26.30M | 3.20M | 10.80M | 35.30M | 13.50M | 8.80M | 7.50M | 4.10M | 7.70M | 6.60M | 6.30M | 8.20M | 12.50M | 19.40M | 20.70M | 21.30M | 15.79M | 9.66M | 4.98M | 3.06M |

| Interest Expense | 73.00M | 85.00M | 58.00M | 51.00M | 60.00M | 70.00M | 64.00M | 66.00M | 62.00M | 63.00M | 70.80M | 64.30M | 64.80M | 60.30M | 65.10M | 54.40M | 43.20M | 57.80M | 57.30M | 38.20M | 15.40M | 39.80M | 32.00M | 129.70M | 18.40M | 14.50M | 10.20M | 10.20M | 9.30M | 8.70M | 6.50M | 7.50M | 5.60M | 3.90M | 4.40M | 3.16M | 2.33M | 1.53M | 2.23M |

| Depreciation & Amortization | 135.00M | 135.00M | 129.00M | 139.00M | 144.00M | 97.00M | 85.00M | 119.00M | 111.00M | 120.00M | 119.10M | 133.40M | 142.10M | 135.70M | 133.30M | 117.40M | 84.20M | 81.90M | 120.60M | 110.80M | 72.10M | 133.00M | 142.20M | 139.30M | 48.70M | 38.60M | 32.20M | 33.90M | 30.50M | 28.70M | 26.20M | 25.00M | 20.40M | 19.90M | 18.00M | 17.10M | 15.69M | 10.94M | 10.50M |

| EBITDA | 580.00M | 580.00M | 287.00M | 430.00M | 337.00M | 511.00M | 484.00M | 786.00M | 519.00M | 508.00M | 492.00M | 616.40M | 546.50M | 593.90M | 567.60M | 542.60M | 446.70M | 395.70M | 140.60M | 503.50M | 411.20M | 512.70M | 436.20M | 804.10M | 323.10M | 290.60M | 260.50M | 235.70M | 210.20M | 175.40M | 150.30M | 137.10M | 128.20M | 133.60M | 142.40M | 132.01M | 115.21M | 78.14M | 69.25M |

| EBITDA Ratio | 18.52% | 20.58% | 12.51% | 17.58% | 14.13% | 23.22% | 20.29% | 18.81% | 17.12% | 17.71% | 16.87% | 20.68% | 18.04% | 21.13% | 20.49% | 20.03% | 18.28% | 17.97% | 20.32% | 17.22% | 14.58% | 16.78% | 16.12% | 16.22% | 22.89% | 22.34% | 23.03% | 22.42% | 20.81% | 19.82% | 20.41% | 19.98% | 20.98% | 27.03% | 22.59% | 23.51% | 17.29% | 18.17% | 17.26% |

| Operating Income | 415.00M | 403.00M | 192.00M | 326.00M | 241.00M | 443.00M | 494.00M | 674.00M | 387.00M | 394.00M | 377.60M | 493.20M | 406.60M | 438.00M | 435.90M | 428.50M | 325.70M | 257.10M | -7.80M | 382.00M | 292.40M | 379.70M | 333.70M | 414.90M | 265.60M | 244.50M | 224.20M | 197.00M | 173.20M | 140.90M | 114.10M | 102.80M | 88.20M | 157.30M | 134.00M | 148.60M | 99.52M | 67.20M | 58.74M |

| Operating Income Ratio | 13.25% | 13.27% | 7.48% | 13.55% | 9.46% | 17.73% | 15.38% | 20.55% | 13.12% | 13.60% | 12.79% | 15.87% | 13.42% | 15.41% | 15.74% | 16.08% | 14.03% | 11.90% | -0.36% | 12.71% | 10.70% | 12.42% | 10.35% | 8.37% | 18.15% | 18.47% | 18.71% | 18.31% | 17.18% | 15.67% | 14.89% | 14.16% | 13.88% | 24.00% | 19.91% | 21.08% | 14.93% | 15.63% | 14.64% |

| Total Other Income/Expenses | -43.00M | -80.00M | -89.00M | -86.00M | -108.00M | -92.00M | -82.00M | 32.00M | -116.00M | -69.00M | -76.00M | -90.80M | -40.70M | -40.10M | -62.80M | -57.70M | -6.40M | -1.10M | -29.50M | -16.10M | 8.00M | -122.10M | -56.30M | -527.20M | -9.60M | -7.00M | -6.10M | -5.40M | -2.80M | -2.90M | 3.50M | 1.80M | 14.00M | -47.50M | -14.00M | -36.86M | -2.33M | -1.53M | -2.23M |

| Income Before Tax | 372.00M | 360.00M | 103.00M | 240.00M | 133.00M | 304.00M | 435.00M | 601.00M | 346.00M | 325.00M | 302.00M | 441.80M | 365.90M | 397.90M | 373.10M | 370.80M | 319.30M | 256.00M | -37.30M | 365.90M | 300.10M | 217.40M | 277.40M | -112.30M | 256.00M | 237.50M | 218.10M | 191.60M | 170.40M | 138.00M | 117.60M | 104.60M | 102.20M | 109.80M | 120.00M | 111.74M | 97.18M | 65.67M | 56.52M |

| Income Before Tax Ratio | 11.88% | 11.85% | 4.01% | 9.98% | 5.22% | 12.17% | 13.54% | 18.32% | 11.73% | 11.22% | 10.23% | 14.21% | 12.08% | 14.00% | 13.47% | 13.92% | 13.76% | 11.85% | -1.71% | 12.17% | 10.98% | 7.11% | 8.61% | -2.26% | 17.49% | 17.94% | 18.20% | 17.80% | 16.90% | 15.35% | 15.35% | 14.41% | 16.09% | 16.75% | 17.83% | 15.85% | 14.58% | 15.27% | 14.09% |

| Income Tax Expense | 121.00M | 134.00M | 90.00M | 83.00M | 66.00M | 162.00M | 156.00M | 29.00M | 85.00M | 77.00M | 67.40M | 83.60M | 107.60M | 91.80M | 78.90M | 94.90M | 75.00M | 53.10M | 65.40M | 94.10M | 87.20M | 105.10M | 91.00M | 92.10M | 78.30M | 74.00M | 68.50M | 59.00M | 52.60M | 44.10M | 37.90M | 33.80M | 33.60M | 36.30M | 40.00M | 38.00M | 34.00M | 23.87M | 21.19M |

| Net Income | 250.00M | 231.00M | 13.00M | 157.00M | 67.00M | 142.00M | 277.00M | 570.00M | 259.00M | 246.00M | 233.00M | 315.00M | 256.60M | 383.80M | 310.00M | 269.50M | 268.50M | 1.73B | 24.20M | 271.80M | 212.90M | 111.50M | 185.10M | -206.00M | 177.00M | 163.20M | 148.20M | 131.70M | 117.80M | 93.90M | 79.70M | 70.80M | 68.60M | 70.80M | 71.00M | 73.53M | 65.59M | 41.87M | 31.61M |

| Net Income Ratio | 7.98% | 7.61% | 0.51% | 6.53% | 2.63% | 5.68% | 8.62% | 17.38% | 8.78% | 8.49% | 7.89% | 10.13% | 8.47% | 13.50% | 11.19% | 10.11% | 11.57% | 79.97% | 1.11% | 9.04% | 7.79% | 3.65% | 5.74% | -4.15% | 12.09% | 12.33% | 12.37% | 12.24% | 11.68% | 10.44% | 10.40% | 9.75% | 10.80% | 10.80% | 10.55% | 10.43% | 9.84% | 9.74% | 7.88% |

| EPS | 0.72 | 0.66 | 0.03 | 0.40 | 0.17 | 0.36 | 0.70 | 1.42 | 0.66 | 0.62 | 0.59 | 0.91 | 0.65 | 0.98 | 0.80 | 0.69 | 0.69 | 3.15 | 0.06 | 0.72 | 0.57 | 0.30 | 0.50 | -0.56 | 0.84 | 0.79 | 0.72 | 0.65 | 0.58 | 0.47 | 0.40 | 0.36 | 0.35 | 0.36 | 0.37 | 0.38 | 0.35 | 0.29 | 0.22 |

| EPS Diluted | 0.72 | 0.65 | 0.03 | 0.39 | 0.17 | 0.36 | 0.69 | 1.40 | 0.65 | 0.62 | 0.58 | 0.90 | 0.65 | 0.97 | 0.79 | 0.69 | 0.69 | 3.10 | 0.06 | 0.72 | 0.57 | 0.30 | 0.50 | -0.56 | 0.84 | 0.78 | 0.72 | 0.65 | 0.58 | 0.47 | 0.40 | 0.36 | 0.35 | 0.36 | 0.37 | 0.38 | 0.35 | 0.29 | 0.22 |

| Weighted Avg Shares Out | 345.90M | 352.89M | 386.68M | 396.35M | 396.19M | 395.94M | 395.72M | 395.42M | 395.10M | 394.74M | 394.30M | 393.32M | 392.58M | 391.72M | 390.03M | 388.79M | 387.45M | 549.15M | 376.91M | 374.96M | 373.77M | 372.41M | 371.00M | 368.51M | 210.01M | 207.29M | 204.88M | 203.25M | 201.59M | 200.02M | 198.98M | 197.62M | 195.94M | 194.82M | 193.81M | 192.93M | 187.36M | 143.66M | 143.43M |

| Weighted Avg Shares Out (Dil) | 347.29M | 354.68M | 388.35M | 398.58M | 398.81M | 398.38M | 401.00M | 400.52M | 398.96M | 398.55M | 398.40M | 397.47M | 395.48M | 395.24M | 392.77M | 392.59M | 391.85M | 556.93M | 379.82M | 375.93M | 374.37M | 372.97M | 371.84M | 369.92M | 211.05M | 208.99M | 206.76M | 203.25M | 201.59M | 200.02M | 198.98M | 197.62M | 195.94M | 194.82M | 193.81M | 192.93M | 187.36M | 143.66M | 143.43M |

SMGZY or TRI: Which Is the Better Value Stock Right Now?

Are Investors Undervaluing Smiths Group (SMGZY) Right Now?

SMGZY vs. CLMB: Which Stock Is the Better Value Option?

SMGZY or CLMB: Which Is the Better Value Stock Right Now?

Smiths Group plc (SMGZY) Q4 2024 Earnings Call Transcript

Smiths Group tumbles as interims undershoot market hopes

UK engineering firm Smiths Group to acquire two North American firms

SMGZY vs. AMPL: Which Stock Is the Better Value Option?

SMGZY or PLTR: Which Is the Better Value Stock Right Now?

SMGZY vs. AMPL: Which Stock Is the Better Value Option?

Source: https://incomestatements.info

Category: Stock Reports