See more : Bridgewater Bancshares, Inc. (BWBBP) Income Statement Analysis – Financial Results

Complete financial analysis of Semtech Corporation (SMTC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Semtech Corporation, a leading company in the Semiconductors industry within the Technology sector.

- Zhejiang Wanma Co., Ltd. (002276.SZ) Income Statement Analysis – Financial Results

- Currency Exchange International, Corp. (CURN) Income Statement Analysis – Financial Results

- Djurslands Bank A/S (DJUR.CO) Income Statement Analysis – Financial Results

- Edible Garden AG Incorporated (EDBL) Income Statement Analysis – Financial Results

- Kkrrafton Developers Limited (KDL.BO) Income Statement Analysis – Financial Results

Semtech Corporation (SMTC)

About Semtech Corporation

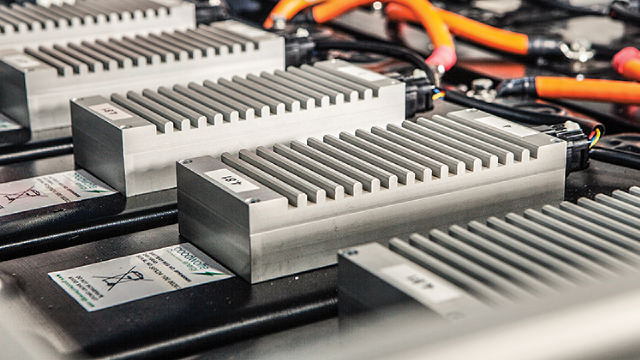

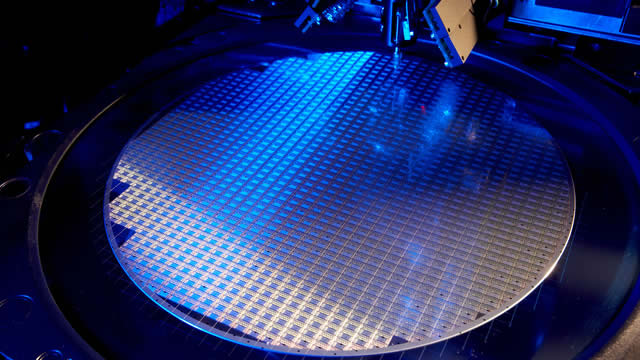

Semtech Corporation designs, develops, manufactures, and markets analog and mixed-signal semiconductor products and advanced algorithms. It provides signal integrity products, including a portfolio of optical data communications and video transport products used in various infrastructure, and industrial applications; a portfolio of integrated circuits for data centers, enterprise networks, passive optical networks, wireless base station optical transceivers, and high-speed interface applications; and video products for broadcast applications, as well as video-over-IP technology for professional audio video applications. The company also offers protection products, such as filter and termination devices that are integrated with the transient voltage suppressor devices, which protect electronic systems from voltage spikes; and wireless and sensing products comprising a portfolio of specialized radio frequency products used in various industrial, medical, and communications applications, as well as specialized sensing products used in industrial and consumer applications. In addition, it provides power products consisting of switching voltage regulators, combination switching and linear regulators, smart regulators, isolated switches, and wireless charging that control, alter, regulate, and condition the power within electronic systems. The company serves original equipment manufacturers and their suppliers in the enterprise computing, communications, and consumer and industrial end-markets. It sells its products directly, as well as through independent sales representative firms and independent distributors in North America, Europe, Asia- Pacific, and internationally. The company was incorporated in 1960 and is headquartered in Camarillo, California.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 868.76M | 756.53M | 740.86M | 595.12M | 547.51M | 627.20M | 587.85M | 544.27M | 490.22M | 557.89M | 594.98M | 578.83M | 480.60M | 454.50M | 286.56M | 294.82M | 284.79M | 252.54M | 239.41M | 253.61M | 192.08M | 192.96M | 191.21M | 256.69M | 173.77M | 114.52M | 102.81M | 65.38M | 61.68M | 25.80M | 21.30M | 20.20M | 26.50M | 22.20M | 18.80M | 19.10M | 15.60M | 11.90M | 13.00M |

| Cost of Revenue | 572.51M | 277.98M | 274.78M | 231.57M | 210.83M | 250.17M | 235.88M | 219.41M | 197.11M | 229.09M | 259.77M | 264.22M | 194.96M | 186.20M | 130.51M | 135.23M | 128.51M | 115.56M | 105.00M | 105.71M | 81.33M | 83.10M | 97.92M | 111.82M | 82.73M | 60.24M | 53.88M | 38.11M | 35.88M | 16.50M | 14.20M | 13.10M | 17.10M | 13.70M | 11.50M | 10.90M | 9.00M | 7.30M | 8.90M |

| Gross Profit | 296.25M | 478.56M | 466.08M | 363.55M | 336.68M | 377.02M | 351.97M | 324.86M | 293.11M | 328.79M | 335.21M | 314.61M | 285.65M | 268.31M | 156.05M | 159.59M | 156.28M | 136.97M | 134.41M | 147.91M | 110.75M | 109.86M | 93.29M | 144.87M | 91.04M | 54.28M | 48.93M | 27.27M | 25.81M | 9.30M | 7.10M | 7.10M | 9.40M | 8.50M | 7.30M | 8.20M | 6.60M | 4.60M | 4.10M |

| Gross Profit Ratio | 34.10% | 63.26% | 62.91% | 61.09% | 61.49% | 60.11% | 59.87% | 59.69% | 59.79% | 58.94% | 56.34% | 54.35% | 59.43% | 59.03% | 54.45% | 54.13% | 54.87% | 54.24% | 56.14% | 58.32% | 57.66% | 56.94% | 48.79% | 56.44% | 52.39% | 47.40% | 47.59% | 41.71% | 41.84% | 36.05% | 33.33% | 35.15% | 35.47% | 38.29% | 38.83% | 42.93% | 42.31% | 38.66% | 31.54% |

| Research & Development | 186.45M | 167.45M | 147.93M | 117.53M | 107.37M | 109.92M | 104.80M | 102.50M | 113.74M | 119.37M | 137.44M | 120.01M | 80.58M | 69.62M | 44.85M | 41.41M | 43.06M | 41.26M | 37.53M | 33.49M | 30.37M | 31.34M | 29.74M | 32.01M | 20.34M | 14.03M | 9.20M | 4.02M | 2.83M | 900.00K | 700.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 218.72M | 234.30M | 166.41M | 161.83M | 162.21M | 150.80M | 145.70M | 136.03M | 135.95M | 128.43M | 125.28M | 148.95M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 1.50M | 1.50M | 1.80M | 1.00M | 900.00K | 600.00K | 600.00K | 400.00K | 200.00K | 100.00K | 100.00K | 119.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 220.22M | 235.80M | 168.21M | 162.83M | 163.11M | 151.40M | 146.30M | 136.43M | 136.15M | 128.53M | 125.38M | 149.07M | 100.63M | 110.40M | 77.45M | 72.89M | 74.26M | 70.66M | 44.55M | 44.45M | 37.21M | 34.43M | 33.80M | 36.16M | 27.21M | 20.09M | 16.93M | 11.82M | 11.20M | 5.60M | 5.00M | 5.50M | 6.90M | 6.00M | 5.00M | 5.20M | 4.90M | 4.00M | 4.70M |

| Other Expenses | 834.76M | 821.00K | 4.94M | 8.27M | 16.55M | 3.82M | -902.00K | -1.72M | -1.80M | -257.00K | -1.39M | -977.00K | 10.85M | 9.52M | 2.35M | 0.00 | -4.24M | 0.00 | 0.00 | 0.00 | 0.00 | 13.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -498.00K | 1.00M | 1.10M | 1.00M | 1.40M | 1.40M | 1.20M | 800.00K | 600.00K | 500.00K | 400.00K |

| Operating Expenses | 1.37B | 404.07M | 321.08M | 288.63M | 287.02M | 287.96M | 278.97M | 264.23M | 274.95M | 285.25M | 324.36M | 299.02M | 192.06M | 189.55M | 122.30M | 114.30M | 113.09M | 111.92M | 82.09M | 77.94M | 67.58M | 78.96M | 63.54M | 68.17M | 47.55M | 34.12M | 26.12M | 15.84M | 13.52M | 7.50M | 6.80M | 6.50M | 8.30M | 7.40M | 6.20M | 6.00M | 5.50M | 4.50M | 5.10M |

| Cost & Expenses | 1.81B | 682.05M | 595.85M | 520.19M | 497.85M | 538.14M | 514.84M | 483.64M | 472.06M | 514.34M | 584.12M | 563.24M | 387.02M | 375.74M | 252.81M | 249.53M | 241.60M | 227.48M | 187.08M | 183.65M | 148.91M | 162.06M | 161.46M | 179.99M | 130.28M | 94.36M | 80.00M | 53.95M | 49.40M | 24.00M | 21.00M | 19.60M | 25.40M | 21.10M | 17.70M | 16.90M | 14.50M | 11.80M | 14.00M |

| Interest Income | 3.05M | 5.80M | 1.47M | 2.54M | 9.11M | 0.00 | 0.00 | 205.00K | 0.00 | 165.00K | 342.00K | 404.00K | 593.00K | 574.00K | 3.05M | 5.68M | 0.00 | 13.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 106.00M | 17.65M | 5.09M | 5.34M | 9.11M | 9.20M | 7.96M | 9.30M | 7.82M | 5.93M | 18.17M | 14.36M | 1.21M | 0.00 | 139.00K | 3.00K | 0.00 | 151.00K | 15.19M | 15.19M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 84.45M | 36.89M | 35.30M | 31.87M | 39.58M | 49.64M | 49.00M | 47.06M | 48.33M | 37.35M | 61.54M | 49.19M | 18.54M | 9.52M | 8.36M | 8.32M | 10.23M | 11.81M | 11.75M | 9.79M | 9.00M | 9.58M | 10.33M | 8.84M | 4.12M | 3.72M | 2.78M | 1.75M | 1.14M | 1.00M | 1.10M | 1.00M | 1.40M | 1.40M | 1.20M | 800.00K | 600.00K | 500.00K | 400.00K |

| EBITDA | -851.10M | 130.82M | 180.41M | 100.18M | 93.27M | 138.41M | 127.79M | 107.69M | 77.22M | 96.97M | -55.79M | 63.80M | 112.72M | 95.78M | 42.47M | 54.51M | 53.41M | 35.68M | 57.50M | 79.76M | 52.17M | 30.90M | 40.08M | 85.53M | 46.94M | 23.88M | 25.58M | 14.59M | 13.42M | 3.10M | 1.63M | 1.60M | 2.50M | 2.50M | 2.30M | 3.00M | 1.70M | 600.00K | -600.00K |

| EBITDA Ratio | -97.97% | 10.55% | 20.30% | 14.00% | 12.62% | 19.06% | 17.01% | 15.47% | 8.45% | 14.53% | 11.93% | 11.02% | 23.33% | 19.42% | 12.77% | 19.81% | 16.22% | 14.87% | 28.83% | 31.45% | 27.16% | 27.82% | 22.38% | 33.32% | 27.01% | 21.53% | 25.48% | 19.98% | 22.32% | 10.47% | 7.04% | 7.43% | 9.43% | 11.71% | 11.17% | 15.71% | 10.90% | 5.88% | -6.92% |

| Operating Income | -944.32M | 92.80M | 145.02M | 74.96M | 52.01M | 98.48M | 68.74M | 84.08M | 30.00M | 42.26M | -108.92M | 15.59M | 93.59M | 78.76M | 30.92M | 41.89M | 43.19M | 23.87M | 47.37M | 69.97M | 43.17M | 30.90M | 27.02M | 76.69M | 42.96M | 18.58M | 21.81M | 11.43M | 11.79M | 1.80M | 300.00K | 600.00K | 1.10M | 1.10M | 1.10M | 2.20M | 1.10M | 100.00K | -1.00M |

| Operating Income Ratio | -108.70% | 12.27% | 19.57% | 12.60% | 9.50% | 15.70% | 11.69% | 15.45% | 6.12% | 7.57% | -18.31% | 2.69% | 19.47% | 17.33% | 10.79% | 14.21% | 15.16% | 9.45% | 19.79% | 27.59% | 22.47% | 16.01% | 14.13% | 29.88% | 24.72% | 16.22% | 21.21% | 17.48% | 19.11% | 6.98% | 1.41% | 2.97% | 4.15% | 4.95% | 5.85% | 11.52% | 7.05% | 0.84% | -7.69% |

| Total Other Income/Expenses | -97.23M | -14.33M | -5.95M | -11.98M | -7.42M | -28.36M | -6.75M | -11.02M | -9.62M | -5.76M | -19.56M | -15.34M | 593.00K | 574.00K | 3.05M | 4.29M | 15.12M | 13.55M | 2.33M | 6.30M | -451.00K | 15.19M | 6.81M | 9.33M | 1.15M | 786.00K | 350.00K | 1.29M | -444.00K | 228.00K | -200.00K | -100.00K | -200.00K | -400.00K | -200.00K | -200.00K | 0.00 | -100.00K | 300.00K |

| Income Before Tax | -1.04B | 78.47M | 139.07M | 62.98M | 44.59M | 63.10M | 59.87M | 73.06M | 20.38M | 36.50M | -128.48M | 249.00K | 94.18M | 79.33M | 33.97M | 46.18M | 58.31M | 37.41M | 54.66M | 76.27M | 42.72M | 46.08M | 33.83M | 86.03M | 44.10M | 19.36M | 22.16M | 11.41M | 11.34M | 1.70M | 200.00K | 500.00K | 900.00K | 700.00K | 900.00K | 2.00M | 1.10M | 0.00 | -700.00K |

| Income Before Tax Ratio | -119.89% | 10.37% | 18.77% | 10.58% | 8.14% | 10.06% | 10.18% | 13.42% | 4.16% | 6.54% | -21.59% | 0.04% | 19.60% | 17.45% | 11.85% | 15.66% | 20.47% | 14.81% | 22.83% | 30.07% | 22.24% | 23.88% | 17.69% | 33.52% | 25.38% | 16.91% | 21.55% | 17.46% | 18.39% | 6.59% | 0.94% | 2.48% | 3.40% | 3.15% | 4.79% | 10.47% | 7.05% | 0.00% | -5.38% |

| Income Tax Expense | 50.52M | 17.34M | 15.54M | 3.44M | 12.83M | -84.00K | 23.19M | 18.40M | 8.88M | 8.55M | 35.99M | -41.69M | 5.09M | 6.76M | 33.01M | 8.66M | 10.52M | 6.28M | 11.67M | 17.38M | 10.25M | 11.90M | 9.47M | 25.81M | 14.71M | 6.47M | 7.40M | 3.76M | 3.81M | 500.00K | 200.00K | 100.00K | 200.00K | 200.00K | 100.00K | 300.00K | 500.00K | -200.00K | -100.00K |

| Net Income | -1.09B | 61.38M | 125.66M | 59.90M | 31.87M | 63.06M | 36.43M | 54.66M | 11.50M | 27.95M | -164.47M | 41.94M | 89.09M | 72.57M | 956.00K | 37.52M | 47.78M | 31.13M | 42.99M | 58.89M | 32.47M | 34.18M | 26.00M | 60.22M | 29.40M | 12.90M | 14.76M | 7.65M | 7.53M | 1.20M | 100.00K | 400.00K | 700.00K | 500.00K | 800.00K | 1.70M | 600.00K | 200.00K | -900.00K |

| Net Income Ratio | -125.70% | 8.11% | 16.96% | 10.07% | 5.82% | 10.05% | 6.20% | 10.04% | 2.35% | 5.01% | -27.64% | 7.25% | 18.54% | 15.97% | 0.33% | 12.73% | 16.78% | 12.33% | 17.95% | 23.22% | 16.90% | 17.71% | 13.60% | 23.46% | 16.92% | 11.26% | 14.36% | 11.70% | 12.21% | 4.65% | 0.47% | 1.98% | 2.64% | 2.25% | 4.26% | 8.90% | 3.85% | 1.68% | -6.92% |

| EPS | -17.03 | 0.96 | 1.94 | 0.92 | 0.48 | 0.96 | 0.52 | 0.84 | 0.18 | 0.42 | -2.44 | 0.64 | 1.37 | 1.16 | 0.02 | 0.61 | 0.72 | 0.43 | 0.57 | 0.74 | 0.44 | 0.47 | 0.37 | 0.91 | 0.48 | 0.22 | 0.27 | 0.16 | 0.16 | 0.04 | 0.01 | 0.02 | 0.02 | 0.02 | 0.03 | 0.07 | 0.03 | 0.01 | -0.06 |

| EPS Diluted | -17.03 | 0.96 | 1.92 | 0.91 | 0.47 | 0.92 | 0.51 | 0.83 | 0.17 | 0.41 | -2.44 | 0.62 | 1.32 | 1.12 | 0.02 | 0.61 | 0.71 | 0.42 | 0.55 | 0.70 | 0.42 | 0.44 | 0.33 | 0.79 | 0.42 | 0.21 | 0.25 | 0.15 | 0.16 | 0.04 | 0.01 | 0.02 | 0.02 | 0.02 | 0.03 | 0.05 | 0.02 | 0.01 | -0.06 |

| Weighted Avg Shares Out | 64.12M | 63.77M | 64.66M | 65.21M | 66.26M | 65.98M | 66.03M | 65.43M | 65.66M | 67.11M | 67.40M | 65.81M | 65.10M | 62.34M | 60.78M | 61.25M | 66.42M | 72.37M | 73.44M | 74.19M | 73.57M | 73.01M | 69.98M | 66.25M | 61.67M | 58.69M | 55.91M | 54.36M | 48.09M | 45.10M | 35.92M | 30.00M | 35.00M | 25.00M | 26.67M | 24.29M | 20.00M | 20.00M | 15.00M |

| Weighted Avg Shares Out (Dil) | 64.13M | 64.01M | 65.57M | 66.06M | 67.42M | 68.48M | 67.61M | 66.11M | 65.96M | 67.69M | 67.47M | 67.47M | 67.35M | 64.52M | 61.68M | 62.00M | 67.71M | 74.02M | 76.11M | 78.26M | 77.50M | 77.79M | 77.75M | 76.53M | 70.63M | 63.57M | 60.47M | 56.20M | 48.09M | 45.10M | 35.92M | 40.00M | 35.00M | 25.00M | 26.67M | 24.29M | 30.00M | 20.00M | 15.00M |

Semtech Announces Pricing of $575 Million Public Offering of Common Stock

Semtech Announces Proposed Public Offering of Common Stock

3 Chip and Data Center Stocks That Can Keep Rising in 2025

Hunting For Magnificent Growth Next Year? Check Out These 7 Stocks.

Beyond NVIDIA: Top 5 Semiconductor Stocks to Watch for 2025

Semtech Stock Leads Industrial Semiconductors' Comeback

3 Reasons Why Semtech (SMTC) Is a Great Growth Stock

Semtech Q3 Earnings Beat: Can Strong Guidance Lift the Stock?

Chip Stock Hits 2-Year Highs on Beat-and-Raise

Semtech Analysts Raise Their Forecasts After Upbeat Earnings

Source: https://incomestatements.info

Category: Stock Reports