See more : Thalys Medical Technology Group Inc. (603716.SS) Income Statement Analysis – Financial Results

Complete financial analysis of SenesTech, Inc. (SNES) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of SenesTech, Inc., a leading company in the Chemicals – Specialty industry within the Basic Materials sector.

- Petrocorp Inc. (PTCP) Income Statement Analysis – Financial Results

- VIB Vermögen AG (VIH1.DE) Income Statement Analysis – Financial Results

- Opthea Limited (OPT) Income Statement Analysis – Financial Results

- Jilin Expressway Co., Ltd. (601518.SS) Income Statement Analysis – Financial Results

- Persimmon Plc (PSMMY) Income Statement Analysis – Financial Results

SenesTech, Inc. (SNES)

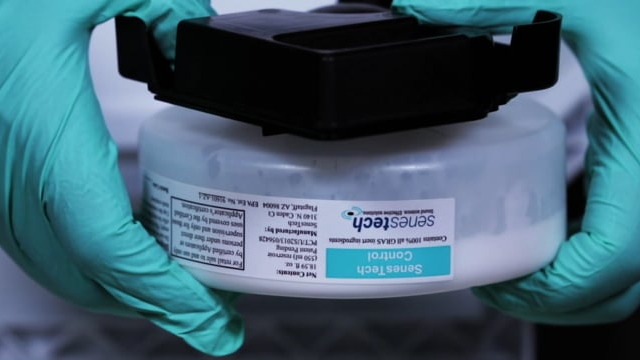

About SenesTech, Inc.

SenesTech, Inc. develops a technology for managing animal pest populations through fertility control. It offers ContraPest, a liquid bait that limits reproduction of male and female rats. The company was incorporated in 2004 and is headquartered in Phoenix, Arizona.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.19M | 1.02M | 576.00K | 258.00K | 143.00K | 297.00K | 52.00K | 318.00K | 241.00K | 199.00K |

| Cost of Revenue | 654.00K | 555.00K | 356.00K | 281.00K | 101.00K | 241.00K | 45.00K | 196.00K | 0.00 | 0.00 |

| Gross Profit | 539.00K | 464.00K | 220.00K | -23.00K | 42.00K | 56.00K | 7.00K | 122.00K | 241.00K | 199.00K |

| Gross Profit Ratio | 45.18% | 45.53% | 38.19% | -8.91% | 29.37% | 18.86% | 13.46% | 38.36% | 100.00% | 100.00% |

| Research & Development | 1.23M | 1.86M | 1.95M | 1.49M | 1.91M | 2.40M | 3.19M | 2.71M | 7.22M | 3.20M |

| General & Administrative | 6.70M | 7.59M | 7.22M | 6.44M | 0.00 | 9.53M | 9.13M | 8.13M | 8.67M | 2.70M |

| Selling & Marketing | 317.00K | 631.00K | 584.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 7.02M | 8.28M | 7.22M | 6.44M | 8.42M | 9.53M | 9.13M | 8.13M | 8.67M | 2.70M |

| Other Expenses | 27.00K | -26.00K | -24.00K | -24.00K | 266.00K | 21.00K | 87.00K | -31.00K | -678.00K | 31.00K |

| Operating Expenses | 8.27M | 10.14M | 9.15M | 7.91M | 10.33M | 11.94M | 12.32M | 10.83M | 15.89M | 5.90M |

| Cost & Expenses | 8.93M | 10.69M | 9.51M | 8.19M | 10.43M | 12.18M | 12.37M | 10.83M | 15.89M | 5.90M |

| Interest Income | 26.00K | 7.00K | 4.00K | 3.00K | 45.00K | 25.00K | 29.00K | 0.00 | 0.00 | 0.00 |

| Interest Expense | 4.00K | 2.00K | 11.00K | 28.00K | 42.00K | 74.00K | 86.00K | 87.00K | 855.00K | 632.00K |

| Depreciation & Amortization | 135.00K | 183.00K | 303.00K | 288.00K | 413.00K | 447.00K | 391.00K | 196.00K | 182.00K | 125.00K |

| EBITDA | -7.57M | -9.51M | -7.95M | -7.62M | -9.56M | -11.39M | -11.81M | -10.51M | -17.14M | -6.44M |

| EBITDA Ratio | -634.62% | -951.23% | -1,550.35% | -3,065.50% | -6,687.41% | -3,834.01% | -22,709.62% | -3,255.03% | -6,697.51% | -2,784.42% |

| Operating Income | -7.73M | -9.67M | -8.93M | -7.93M | -10.29M | -11.88M | -12.32M | -10.52M | -15.65M | -5.70M |

| Operating Income Ratio | -648.11% | -949.36% | -1,551.04% | -3,074.81% | -7,193.71% | -4,000.00% | -23,684.62% | -3,306.92% | -6,491.70% | -2,862.81% |

| Total Other Income/Expenses | 22.00K | -21.00K | 666.00K | -4.00K | 269.00K | -28.00K | 30.00K | -279.00K | -2.53M | -1.50M |

| Income Before Tax | -7.71M | -9.70M | -8.27M | -7.94M | -10.02M | -11.91M | -12.29M | -10.80M | -18.17M | -7.20M |

| Income Before Tax Ratio | -646.27% | -951.42% | -1,435.42% | -3,076.36% | -7,005.59% | -4,009.43% | -23,626.92% | -3,394.65% | -7,540.66% | -3,618.09% |

| Income Tax Expense | 0.00 | 19.00K | -292.00K | -239.00K | 308.00K | 46.00K | 173.00K | 56.00K | 177.00K | 663.00K |

| Net Income | -7.71M | -9.71M | -7.98M | -7.70M | -10.33M | -11.91M | -12.29M | -10.80M | -18.17M | -7.20M |

| Net Income Ratio | -646.27% | -953.29% | -1,384.72% | -2,983.72% | -7,220.98% | -4,009.43% | -23,626.92% | -3,394.65% | -7,540.66% | -3,618.09% |

| EPS | -11.51 | -186.39 | -171.04 | -614.56 | -1.90K | -245.50 | -450.00 | -672.84 | -1.09K | -403.93 |

| EPS Diluted | -115.10 | -186.39 | -171.04 | -614.56 | -1.90K | -245.50 | -450.00 | -672.84 | -1.09K | -403.93 |

| Weighted Avg Shares Out | 669.85K | 52.12K | 46.63K | 12.53K | 5.43K | 48.51K | 27.30K | 16.04K | 16.65K | 17.83K |

| Weighted Avg Shares Out (Dil) | 66.99K | 52.12K | 46.63K | 12.53K | 5.43K | 48.51K | 27.30K | 16.04K | 16.65K | 17.83K |

SenesTech (SNES) New Alliance to Aid Expansion in South Africa

SenesTech, Inc. (SNES) Q4 2022 Earnings Call Transcript

SenesTech to Report Fourth Quarter and Fiscal Year 2022 Financial Results on Thursday, March 16, 2023

SenesTech (SNES) Stock: 1-For-20 Reverse Split Declared

S&P 500 Rises 0.8%; Sea Shares Spike Higher

SenesTech, Inc. (SNES) Q3 2022 Earnings Call Transcript

Senestech, Inc. (SNES) Reports Q3 Loss, Misses Revenue Estimates

3 Strategies for Buying and Selling Penny Stocks Right Now

SenesTech to Participate in the Lytham Partners Fall 2022 Investor Conference

SenesTech, Inc. (SNES) CEO Ken Siegel on Q2 2022 Results - Earnings Call Transcript

Source: https://incomestatements.info

Category: Stock Reports