See more : Syrah Resources Limited (SRHYY) Income Statement Analysis – Financial Results

Complete financial analysis of Snam S.p.A. (SNMRY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Snam S.p.A., a leading company in the Regulated Gas industry within the Utilities sector.

- Jaiprakash Power Ventures Limited (JPPOWER.NS) Income Statement Analysis – Financial Results

- Juniper Networks, Inc. (JNP.DE) Income Statement Analysis – Financial Results

- X5 Retail Group N.V. (FIVE.IL) Income Statement Analysis – Financial Results

- Public Joint Stock Company Magnit (MGNT.ME) Income Statement Analysis – Financial Results

- BankInvest Optima 55 Akk. KL (BIV55A.CO) Income Statement Analysis – Financial Results

Snam S.p.A. (SNMRY)

About Snam S.p.A.

Snam S.p.A., together with its subsidiaries, engages in the operation of natural gas transport and storage infrastructure in Italy. The company operates through Natural Gas Transportation, Liquefied Natural Gas (LNG) Regasification, and Natural Gas Storage segments. It provides natural gas transportation and dispatching services with approximately 32,700 kilometers of high-and medium-pressure gas pipelines; and owns and manages LNG regasification plants. The company also offers natural gas storage services through an integrated group of infrastructure comprising deposits, wells, gas treatment and compression plants, and the operational dispatching systems; and operates nine storage concessions, including five in Lombardy, three in Emilia-Romagna, and one in Abruzzo. In addition, it engages in the lease and maintenance of fibre optic telecommunications cables, as well as provides integrated services in the natural gas mobility sector; energy efficiency solutions for residential, industrial, tertiary, and public administration sectors; and management of biogas and biomethane plants. Further, the company offers engineering and project management services; and supervision of infrastructure planning activities. It also operates in Albania, Saudi Arabia, Austria, China, Egypt, the United Arab Emirates, France, Greece, the United Kingdom, and the United States. The company was formerly known as Snam Rete Gas S.p.A. and changed its name to Snam S.p.A. in January 2012. Snam S.p.A. was founded in 1941 and is headquartered in San Donato Milanese, Italy.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 4.29B | 3.50B | 3.29B | 2.75B | 2.64B | 2.56B | 2.49B | 2.49B | 3.91B | 3.84B | 3.82B | 3.86B | 3.54B | 3.48B | 2.44B | 1.90B | 1.79B | 1.76B | 1.81B | 1.94B | 1.94B |

| Cost of Revenue | 1.42B | 1.62B | 1.50B | 1.05B | 954.00M | 945.00M | 897.00M | 390.00M | 782.00M | 763.00M | 667.00M | 772.00M | 659.00M | 623.00M | 403.00M | 294.00M | 258.00M | 275.00M | 252.00M | 344.00M | 377.00M |

| Gross Profit | 2.87B | 1.87B | 1.78B | 1.70B | 1.68B | 1.61B | 1.60B | 2.10B | 3.12B | 3.07B | 3.15B | 3.08B | 2.88B | 2.85B | 2.04B | 1.61B | 1.53B | 1.49B | 1.55B | 1.59B | 1.56B |

| Gross Profit Ratio | 66.98% | 53.55% | 54.31% | 61.86% | 63.80% | 63.01% | 64.02% | 84.36% | 79.98% | 80.10% | 82.52% | 79.98% | 81.38% | 82.07% | 83.47% | 84.54% | 85.59% | 84.38% | 86.05% | 82.23% | 80.58% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 248.00M | 237.00M | 216.00M | 188.00M | 0.00 | 0.00 | 0.00 | 0.00 | 1.00M | 3.00M | 4.00M | 1.00M | 0.00 | 0.00 | 178.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 8.00M | 7.00M | 6.00M | 3.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 256.00M | 438.00M | 317.00M | 301.00M | 202.00M | 187.00M | 221.00M | 205.00M | 1.00M | 3.00M | 4.00M | 1.00M | 0.00 | 0.00 | 178.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 0.00 | -94.00M | -57.00M | -35.00M | -26.00M | -42.00M | -47.00M | -10.00M | -14.00M | 0.00 | -13.00M | -11.00M | 0.00 | 0.00 | -44.00M | 0.00 | 0.00 | 0.00 | 0.00 | 972.00M | 926.00M |

| Operating Expenses | 256.00M | 532.00M | 374.00M | 336.00M | 228.00M | 229.00M | 268.00M | 776.00M | 1.18B | 1.10B | 1.12B | 1.01B | 922.00M | 990.00M | 761.00M | 586.00M | 510.00M | 574.00M | 579.00M | 972.00M | 926.00M |

| Cost & Expenses | 1.67B | 2.16B | 1.88B | 1.39B | 1.18B | 1.17B | 1.17B | 1.17B | 1.96B | 1.86B | 1.78B | 1.78B | 1.58B | 1.61B | 1.16B | 880.00M | 768.00M | 849.00M | 831.00M | 344.00M | 377.00M |

| Interest Income | 0.00 | 12.00M | 29.00M | 24.00M | 9.00M | 11.00M | 7.00M | 123.00M | 3.00M | 348.00M | 15.00M | 7.00M | 3.00M | 5.00M | 7.00M | 2.00M | 28.00M | 4.00M | 4.00M | 2.00M | 0.00 |

| Interest Expense | 221.00M | 190.00M | 149.00M | 180.00M | 216.00M | 241.00M | 279.00M | 621.00M | 15.00M | 65.00M | 468.00M | 293.00M | 247.00M | 174.00M | 158.00M | 255.00M | 228.00M | 172.00M | 108.00M | 103.00M | 0.00 |

| Depreciation & Amortization | 916.00M | 879.00M | 814.00M | 768.00M | 730.00M | 693.00M | 657.00M | 626.00M | 846.00M | 797.00M | 759.00M | 702.00M | 663.00M | 668.00M | 613.00M | 489.00M | 489.00M | 483.00M | 479.00M | 487.00M | 477.00M |

| EBITDA | 2.42B | 2.07B | 2.22B | 2.14B | 2.18B | 2.07B | 2.01B | 2.38B | 2.36B | 2.76B | 2.78B | 2.74B | 2.60B | 2.49B | 1.89B | 1.54B | 1.54B | 1.40B | 1.46B | 1.46B | 2.04B |

| EBITDA Ratio | 56.44% | 63.47% | 67.70% | 77.55% | 82.85% | 81.17% | 79.62% | 96.83% | 65.69% | 67.12% | 73.24% | 71.16% | 75.59% | 71.65% | 77.69% | 80.97% | 85.98% | 79.43% | 80.73% | 107.49% | 105.15% |

| Operating Income | 2.62B | 1.34B | 1.41B | 1.37B | 1.45B | 1.38B | 1.33B | 1.56B | 1.72B | 1.97B | 2.02B | 2.04B | 1.96B | 1.86B | 1.27B | 1.02B | 1.02B | 911.00M | 975.00M | 1.59B | 1.56B |

| Operating Income Ratio | 61.01% | 38.33% | 42.92% | 49.65% | 55.14% | 54.05% | 53.27% | 62.39% | 44.03% | 51.24% | 53.05% | 52.96% | 55.33% | 53.58% | 52.26% | 53.73% | 57.09% | 51.76% | 53.99% | 82.33% | 80.58% |

| Total Other Income/Expenses | -1.08B | -329.00M | -1.01B | -1.04B | -990.00M | -83.00M | -795.00M | -1.06B | -305.00M | -265.00M | -425.00M | -703.00M | -262.00M | -224.00M | -196.00M | -226.00M | -200.00M | -168.00M | -104.00M | -101.00M | -762.00M |

| Income Before Tax | 1.53B | 1.19B | 1.32B | 1.22B | 1.25B | 1.14B | 1.07B | 899.00M | 1.71B | 1.71B | 1.61B | 1.37B | 1.70B | 1.64B | 1.08B | 796.00M | 822.00M | 743.00M | 871.00M | 858.00M | 802.00M |

| Income Before Tax Ratio | 35.77% | 33.98% | 40.21% | 44.46% | 47.32% | 44.77% | 42.72% | 36.05% | 43.65% | 44.51% | 42.12% | 35.58% | 47.92% | 47.14% | 44.26% | 41.85% | 45.92% | 42.22% | 48.23% | 44.32% | 41.32% |

| Income Tax Expense | 389.00M | 378.00M | 115.00M | 370.00M | 375.00M | 341.00M | 329.00M | 308.00M | 467.00M | 509.00M | 690.00M | 593.00M | 906.00M | 532.00M | 347.00M | 266.00M | 228.00M | 295.00M | 347.00M | 332.00M | 257.00M |

| Net Income | 1.14B | 671.00M | 1.50B | 1.10B | 1.09B | 960.00M | 897.00M | 861.00M | 1.24B | 1.20B | 917.00M | 779.00M | 790.00M | 1.11B | 732.00M | 530.00M | 594.00M | 448.00M | 524.00M | 538.00M | 545.00M |

| Net Income Ratio | 26.47% | 19.19% | 45.54% | 39.99% | 41.37% | 37.57% | 35.98% | 34.52% | 31.69% | 31.24% | 24.04% | 20.20% | 22.32% | 31.83% | 30.02% | 27.87% | 33.18% | 25.45% | 29.01% | 27.79% | 28.08% |

| EPS | 0.34 | 0.20 | 0.46 | 0.34 | 0.33 | 0.29 | 0.26 | 0.50 | 0.70 | 0.70 | 0.54 | 0.46 | 0.46 | 0.66 | 0.56 | 0.48 | 0.54 | 0.37 | 0.41 | 0.44 | 0.44 |

| EPS Diluted | 0.34 | 0.20 | 0.45 | 0.33 | 0.32 | 0.28 | 0.26 | 0.50 | 0.70 | 0.70 | 0.54 | 0.46 | 0.46 | 0.66 | 0.56 | 0.48 | 0.54 | 0.37 | 0.41 | 0.44 | 0.44 |

| Weighted Avg Shares Out | 3.36B | 3.34B | 3.27B | 3.27B | 3.30B | 3.36B | 3.42B | 1.74B | 1.75B | 1.69B | 1.69B | 1.69B | 1.69B | 1.69B | 1.29B | 1.11B | 1.11B | 1.20B | 1.20B | 1.23B | 1.23B |

| Weighted Avg Shares Out (Dil) | 3.36B | 3.34B | 3.36B | 3.36B | 3.39B | 3.44B | 3.48B | 1.74B | 1.75B | 1.69B | 1.69B | 1.69B | 1.69B | 1.69B | 1.29B | 1.11B | 1.11B | 1.20B | 1.20B | 1.23B | 1.23B |

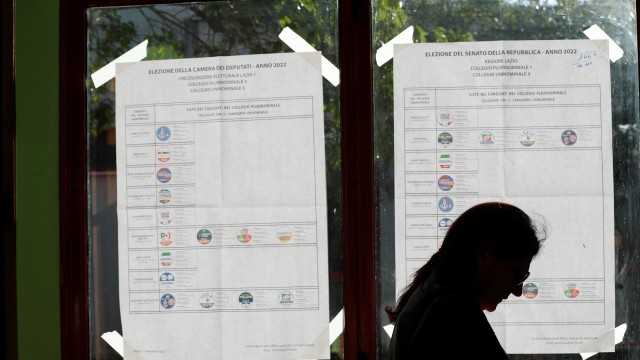

Factbox: Companies potentially affected by Italy's election

Snam S.p.A. (SNMRF) CEO Stefano Venier on Q2 2022 Results - Earnings Call Transcript

Snam S.p.A. (SNMRF) CEO Stefano Venier on Q1 2022 Results - Earnings Call Transcript

Snam S.p.A. (SNMRF) CEO Marco Alverà on Q4 2021 Results - Earnings Call Transcript

Nel ASA: Waiting For The Turnaround Moment

Snam S.p.A. (SNMRF) Q3 2021 Results - Earnings Call Transcript

The Hydrogen Economy: A Strategy To Prolong The Life Of The Natural Gas Industry

Snam S.p.A.'s (SNMRF) CFO Alessandra Pasini on Q1 2021 Results - Earnings Call Transcript

The Nest Egg Portfolio: Adding Italgas As A Resilient Gas Distribution Company

Source: https://incomestatements.info

Category: Stock Reports