See more : K K Fincorp Limited (KKFIN.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Smith & Nephew plc (SNN) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Smith & Nephew plc, a leading company in the Medical – Devices industry within the Healthcare sector.

- Link Prop Investment AB (publ) (LINKAB.ST) Income Statement Analysis – Financial Results

- GLAD CUBE Inc. (9561.T) Income Statement Analysis – Financial Results

- Xerox Holdings Corporation (XRX) Income Statement Analysis – Financial Results

- Lan Fa Textile Co.,Ltd. (1459.TW) Income Statement Analysis – Financial Results

- Zhejiang Jiaxin Silk Corp., Ltd. (002404.SZ) Income Statement Analysis – Financial Results

Smith & Nephew plc (SNN)

About Smith & Nephew plc

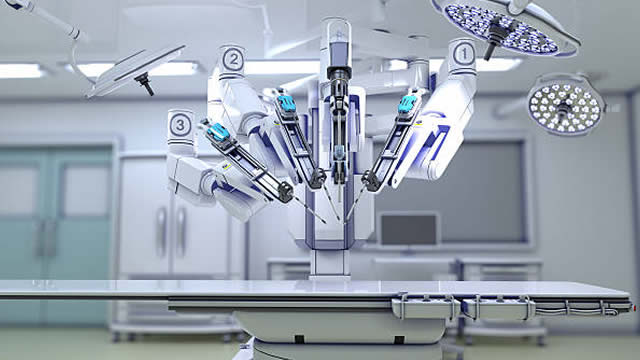

Smith & Nephew plc, together with its subsidiaries, develops, manufactures, markets, and sells medical devices worldwide. The company offers knee implant products for knee replacement procedures; hip implants for the reconstruction of hip joints; and trauma and extremities products that include internal and external devices used in the stabilization of severe fractures and deformity correction procedures. It also provides sports medicine joint repair products for surgeons, including instruments, technologies, and implants necessary to perform minimally invasive surgery of the joints, such as the repair of soft tissue injuries and degenerative conditions of the knee, hip, and shoulder, as well as meniscal repair systems. In addition, the company offers arthroscopic enabling technologies comprising fluid management equipment for surgical access, high-definition cameras, digital image capture, scopes, light sources, and monitors to assist with visualization inside the joints, radio frequency, electromechanical and mechanical tissue resection devices, and hand instruments for removing damaged tissue; and ear, nose, and throat solutions. Further, it provides advanced wound care products for the treatment and prevention of acute and chronic wounds, which comprise leg, diabetic and pressure ulcers, burns, and post-operative wounds; advanced wound bioactives, including biologics and other bioactive technologies for debridement and dermal repair/regeneration, as well as regenerative medicine products including skin, bone graft, and articular cartilage substitutes; and advanced wound devices, such as traditional and single-use negative pressure wound therapy, and hydrosurgery systems. It primarily serves the healthcare providers. Smith & Nephew plc was founded in 1856 and is headquartered in Watford, the United Kingdom.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 5.55B | 5.22B | 5.21B | 4.56B | 5.14B | 4.90B | 4.77B | 4.67B | 4.63B | 4.62B | 4.35B | 4.14B | 4.27B | 3.96B | 3.77B | 3.80B | 3.37B | 2.78B | 2.55B | 2.39B | 2.11B | 1.79B | 1.58B | 1.69B | 1.81B | 1.75B | 1.73B | 1.83B | 1.59B | 1.51B | 1.40B | 1.30B | 1.48B | 1.41B | 1.14B | 1.08B | 1.02B | 709.77M | 609.40M |

| Cost of Revenue | 1.73B | 1.52B | 1.51B | 1.38B | 1.33B | 1.30B | 1.25B | 1.27B | 1.14B | 1.13B | 1.08B | 1.07B | 1.14B | 1.03B | 1.03B | 1.08B | 994.00M | 769.00M | 701.00M | 642.17M | 616.25M | 531.63M | 509.96M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 3.82B | 3.70B | 3.70B | 3.18B | 3.81B | 3.61B | 3.52B | 3.40B | 3.49B | 3.49B | 3.27B | 3.07B | 3.13B | 2.93B | 2.74B | 2.72B | 2.38B | 2.01B | 1.85B | 1.75B | 1.49B | 1.26B | 1.07B | 1.69B | 1.81B | 1.75B | 1.73B | 1.83B | 1.59B | 1.51B | 1.40B | 1.30B | 1.48B | 1.41B | 1.14B | 1.08B | 1.02B | 709.77M | 609.40M |

| Gross Profit Ratio | 68.82% | 70.85% | 70.95% | 69.71% | 74.09% | 73.53% | 73.81% | 72.76% | 75.33% | 75.59% | 75.11% | 74.14% | 73.30% | 73.98% | 72.69% | 71.67% | 70.50% | 72.33% | 72.53% | 73.18% | 70.73% | 70.26% | 67.63% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 299.00M | 442.00M | 397.00M | 307.00M | 292.00M | 246.00M | 223.00M | 230.00M | 222.00M | 235.00M | 231.00M | 171.00M | 167.00M | 151.00M | 155.00M | 152.00M | 142.00M | 120.00M | 122.00M | 127.36M | 119.29M | 98.79M | 74.12M | 69.30M | 73.12M | 71.54M | 69.27M | 70.73M | 45.43M | 45.34M | 43.04M | 36.86M | 37.80M | 32.79M | 22.79M | 23.79M | 0.00 | 0.00 | 0.00 |

| General & Administrative | 384.00M | 2.88B | 2.72B | 2.56B | 2.69B | 2.50B | 2.36B | 2.37B | 2.64B | 0.00 | 2.06B | 2.05B | 2.10B | 1.86B | 1.86B | 1.94B | 1.74B | 1.32B | 689.00M | 1.15B | 975.54M | 872.14M | 750.09M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 2.22B | 2.07B | 2.01B | 1.77B | 1.91B | 1.82B | 1.78B | 1.71B | 1.74B | 0.00 | 91.00M | 1.44B | 0.00 | 0.00 | 0.00 | 1.80B | 1.53B | 1.32B | 1.21B | 0.00 | 853.57M | -307.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 2.60B | 2.70B | 2.64B | 2.44B | 2.53B | 2.38B | 2.42B | 2.26B | 2.52B | 2.32B | 2.15B | 2.05B | 2.10B | 1.86B | 1.86B | 1.80B | 1.53B | 1.32B | 1.21B | 1.15B | 975.54M | 872.14M | 750.09M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 493.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -2.00M | 0.00 | 0.00 | -4.00M | 0.00 | -87.50M | -58.47M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 3.39B | 3.39B | 3.04B | 2.88B | 3.01B | 2.77B | 2.59B | 2.29B | 2.89B | 2.75B | 2.47B | 2.22B | 2.27B | 2.01B | 2.02B | 2.08B | 1.77B | 1.45B | 1.35B | 1.28B | 1.09B | 1.52B | 839.35M | 1.60B | 1.65B | 1.51B | 1.45B | 1.52B | 1.33B | 1.02B | 1.18B | 1.10B | 1.12B | 1.41B | 1.14B | 1.08B | 1.02B | 709.77M | 609.40M |

| Cost & Expenses | 5.12B | 4.91B | 4.55B | 4.26B | 4.34B | 4.07B | 3.84B | 3.56B | 4.04B | 3.88B | 3.55B | 3.29B | 3.41B | 3.04B | 3.05B | 3.16B | 2.76B | 2.22B | 2.05B | 1.92B | 1.71B | 1.52B | 1.35B | 1.60B | 1.65B | 1.51B | 1.45B | 1.52B | 1.33B | 1.02B | 1.18B | 1.10B | 1.12B | 1.41B | 1.14B | 1.08B | 1.02B | 709.77M | 609.40M |

| Interest Income | 34.00M | 66.00M | 74.00M | 56.00M | 55.00M | 51.00M | 51.00M | 46.00M | 38.00M | 22.00M | 4.00M | 11.00M | 4.00M | 3.00M | 2.00M | 5.00M | 10.00M | 19.00M | 27.00M | 32.22M | 19.64M | 0.00 | 0.00 | 6.57M | 16.66M | 13.45M | 14.22M | 7.36M | 10.35M | 17.98M | 26.33M | 37.01M | 49.59M | 53.62M | 30.81M | 21.98M | 27.17M | 18.04M | 17.14M |

| Interest Expense | 139.00M | 80.00M | 80.00M | 62.00M | 65.00M | 59.00M | 57.00M | 52.00M | 50.00M | 45.00M | 21.00M | 9.00M | 12.00M | 18.00M | 42.00M | 71.00M | 40.00M | 9.00M | 18.00M | 23.81M | 10.71M | 20.46M | 0.00 | 17.03M | 11.16M | 16.27M | 20.66M | 17.13M | 17.46M | 16.88M | 35.50M | 40.65M | 65.30M | 84.49M | 55.04M | 47.03M | 44.97M | 24.10M | 26.22M |

| Depreciation & Amortization | 527.00M | 548.00M | 563.00M | 545.00M | 496.00M | 427.00M | 435.00M | 415.00M | 445.00M | 351.00M | 297.00M | 324.00M | 306.00M | 288.00M | 312.00M | 287.00M | 237.00M | 169.00M | 180.00M | 137.33M | 143.21M | 152.05M | 87.81M | 79.16M | 87.84M | 82.00M | 67.45M | 72.78M | 61.19M | 57.22M | 53.25M | 49.29M | 52.95M | 51.12M | 36.75M | 33.34M | 35.60M | 24.69M | 20.17M |

| EBITDA | 979.00M | 1.00B | 1.22B | 839.00M | 1.43B | 1.29B | 1.39B | 1.53B | 1.07B | 1.28B | 1.19B | 1.18B | 1.16B | 1.25B | 1.01B | 936.00M | 721.00M | 703.00M | 591.00M | 250.00M | 265.00M | 362.43M | 313.67M | 409.69M | 361.29M | 305.02M | 340.04M | 395.93M | 351.84M | 65.51M | 332.67M | 324.42M | 249.80M | 390.42M | 314.83M | 295.16M | 279.73M | 179.18M | 148.10M |

| EBITDA Ratio | 17.64% | 21.36% | 22.60% | 20.33% | 27.77% | 28.61% | 27.49% | 28.42% | 25.68% | 27.79% | 27.24% | 28.57% | 27.31% | 30.57% | 27.55% | 24.63% | 25.59% | 26.92% | 27.82% | 26.58% | 26.29% | 24.52% | 20.01% | 21.99% | 21.06% | 19.96% | 20.41% | 21.68% | 22.29% | 22.72% | 22.60% | 23.50% | 24.48% | 27.74% | 27.63% | 27.40% | 27.32% | 25.24% | 24.30% |

| Operating Income | 425.00M | 665.00M | 712.00M | 433.00M | 981.00M | 976.00M | 875.00M | 912.00M | 745.00M | 932.00M | 888.00M | 846.00M | 862.00M | 920.00M | 723.00M | 630.00M | 493.00M | 537.00M | 422.00M | 317.06M | 321.07M | 242.73M | 225.86M | 214.78M | 178.43M | 209.98M | 269.29M | 311.50M | 253.11M | 215.12M | 238.60M | 214.92M | 252.61M | 339.30M | 278.08M | 261.82M | 244.13M | 154.49M | 127.93M |

| Operating Income Ratio | 7.66% | 12.75% | 13.66% | 9.50% | 19.09% | 19.90% | 18.36% | 19.53% | 16.08% | 20.19% | 20.41% | 20.45% | 20.19% | 23.22% | 19.17% | 16.57% | 14.63% | 19.32% | 16.54% | 13.24% | 15.25% | 13.58% | 14.34% | 12.67% | 9.85% | 12.01% | 15.54% | 17.01% | 15.96% | 14.26% | 17.00% | 16.52% | 17.05% | 24.11% | 24.41% | 24.30% | 23.85% | 21.77% | 20.99% |

| Total Other Income/Expenses | -135.00M | -215.00M | -7.00M | -49.00M | -72.00M | -82.00M | -55.00M | 150.00M | -69.00M | -35.00M | -8.00M | 242.00M | -14.00M | -25.00M | -53.00M | -66.00M | -24.00M | 35.00M | -54.00M | 2.00M | -9.00M | 43.83M | -15.58M | -10.47M | 116.15M | 13.28M | -17.36M | -5.48M | 20.09M | -223.72M | 5.33M | 19.57M | -121.07M | -84.49M | -55.04M | -47.03M | -44.97M | -24.10M | -26.22M |

| Income Before Tax | 290.00M | 235.00M | 586.00M | 246.00M | 743.00M | 781.00M | 879.00M | 1.06B | 559.00M | 714.00M | 802.00M | 1.10B | 848.00M | 895.00M | 670.00M | 564.00M | 469.00M | 550.00M | 428.00M | 345.83M | 410.89M | 290.73M | 210.28M | 396.10M | 294.58M | 223.26M | 251.93M | 306.02M | 273.19M | -8.60M | 243.92M | 234.48M | 131.54M | 254.81M | 223.04M | 214.79M | 199.16M | 130.39M | 101.71M |

| Income Before Tax Ratio | 5.23% | 4.51% | 11.24% | 5.39% | 14.46% | 15.93% | 18.45% | 22.75% | 12.06% | 15.46% | 18.43% | 26.59% | 19.86% | 22.59% | 17.76% | 14.84% | 13.92% | 19.79% | 16.77% | 14.44% | 19.52% | 16.26% | 13.35% | 23.37% | 16.26% | 12.77% | 14.54% | 16.71% | 17.23% | -0.57% | 17.38% | 18.02% | 8.88% | 18.10% | 19.57% | 19.94% | 19.45% | 18.37% | 16.69% |

| Income Tax Expense | 27.00M | 12.00M | 62.00M | 202.00M | 143.00M | 118.00M | 112.00M | 278.00M | 149.00M | 213.00M | 246.00M | 371.00M | 266.00M | 280.00M | 198.00M | 187.00M | 153.00M | 156.00M | 126.00M | 85.55M | 146.43M | 105.98M | 93.20M | 86.18M | 125.05M | 67.72M | 63.98M | 99.33M | 98.89M | 75.67M | 83.13M | 67.95M | 43.79M | 65.01M | 59.53M | 64.33M | 58.64M | 41.10M | 33.14M |

| Net Income | 263.00M | 223.00M | 524.00M | 448.00M | 600.00M | 663.00M | 767.00M | 784.00M | 410.00M | 501.00M | 556.00M | 729.00M | 582.00M | 615.00M | 472.00M | 377.00M | 316.00M | 745.00M | 333.00M | 290.01M | 264.46M | 184.75M | 188.72M | 309.92M | 169.54M | 155.53M | 187.96M | 206.70M | 174.30M | -84.27M | 160.79M | 155.92M | 74.66M | 143.13M | 147.63M | 145.24M | 140.52M | 89.29M | 68.43M |

| Net Income Ratio | 4.74% | 4.28% | 10.05% | 9.82% | 11.68% | 13.52% | 16.10% | 16.79% | 8.85% | 10.85% | 12.78% | 17.62% | 13.63% | 15.52% | 12.51% | 9.92% | 9.38% | 26.81% | 13.05% | 12.11% | 12.56% | 10.33% | 11.98% | 18.29% | 9.36% | 8.90% | 10.85% | 11.29% | 10.99% | -5.59% | 11.46% | 11.99% | 5.04% | 10.17% | 12.96% | 13.48% | 13.73% | 12.58% | 11.23% |

| EPS | 0.60 | 0.51 | 1.20 | 1.02 | 1.37 | 0.76 | 0.88 | 0.88 | 0.46 | 0.56 | 0.61 | 1.63 | 1.31 | 1.39 | 1.07 | 0.85 | 0.68 | 1.58 | 0.71 | 0.57 | 0.57 | 0.20 | 0.20 | 0.30 | 0.18 | 0.17 | 0.21 | 0.23 | 0.19 | -0.09 | 0.19 | 0.19 | 0.09 | 0.18 | 0.18 | 0.18 | 0.18 | 0.16 | 0.20 |

| EPS Diluted | 0.60 | 0.51 | 1.19 | 1.02 | 1.37 | 0.76 | 0.88 | 0.88 | 0.46 | 0.56 | 0.61 | 1.62 | 1.30 | 1.38 | 1.07 | 0.85 | 0.68 | 1.58 | 0.71 | 0.56 | 0.56 | 0.19 | 0.20 | 0.30 | 0.18 | 0.17 | 0.21 | 0.23 | 0.19 | -0.09 | 0.19 | 0.19 | 0.09 | 0.18 | 0.18 | 0.18 | 0.18 | 0.16 | 0.20 |

| Weighted Avg Shares Out | 435.50M | 436.00M | 438.50M | 437.50M | 437.00M | 875.83M | 874.57M | 892.94M | 899.00M | 899.46M | 905.54M | 448.50M | 445.50M | 444.00M | 441.95M | 443.00M | 461.50M | 470.50M | 465.00M | 467.50M | 465.00M | 925.68M | 921.00M | 1.03B | 801.94M | 908.18M | 908.20M | 904.11M | 896.75M | 889.38M | 842.75M | 823.11M | 817.38M | 811.65M | 802.25M | 791.20M | 778.11M | 551.88M | 333.83M |

| Weighted Avg Shares Out (Dil) | 436.88M | 436.50M | 439.00M | 438.50M | 438.50M | 876.00M | 875.00M | 893.00M | 899.00M | 899.00M | 906.00M | 450.50M | 447.50M | 444.50M | 442.78M | 445.00M | 464.00M | 472.00M | 471.50M | 470.50M | 468.00M | 954.24M | 929.55M | 1.03B | 803.65M | 910.35M | 910.66M | 904.11M | 896.75M | 889.38M | 842.75M | 823.11M | 817.38M | 811.65M | 802.25M | 791.20M | 778.11M | 551.88M | 333.83M |

Smith & Nephew has the potential to pop next year, says leading US investment bank

Big investors call for break-up of Smith & Nephew, FT reports

Smith & Nephew: Ready To Reap Demographic, Turnaround Dividends

Smith & Nephew plc (SNN) Q3 2024 Earnings Conference Call Transcript

Smith+Nephew slashes revenue outlook as China headwinds emerge

Smith & Nephew slashes annual revenue forecast on weak China

RENASYS™ EDGE Negative Pressure Wound Therapy System wins Red Dot Award for Design

SNN Stock May Gain Following the Co-Marketing Deal With JointVue

SNN Boosts Knee Revision Surgery With Its LEGION Hinged Knee System

Smith+Nephew partners with JointVue™ for Ultrasound preoperative planning in robotics-assisted surgery

Source: https://incomestatements.info

Category: Stock Reports