See more : Alabama Power Company (APRDP) Income Statement Analysis – Financial Results

Complete financial analysis of Surgalign Holdings, Inc. (SRGA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Surgalign Holdings, Inc., a leading company in the Medical – Devices industry within the Healthcare sector.

- Aspen Technology, Inc. (AZPN) Income Statement Analysis – Financial Results

- China State Construction International Holdings Limited (CCOHF) Income Statement Analysis – Financial Results

- Thai Rayon Public Company Limited (TR.BK) Income Statement Analysis – Financial Results

- Wealth Management, Inc. (3772.T) Income Statement Analysis – Financial Results

- Hillcrest Energy Technologies Ltd. (HEAT.CN) Income Statement Analysis – Financial Results

Surgalign Holdings, Inc. (SRGA)

About Surgalign Holdings, Inc.

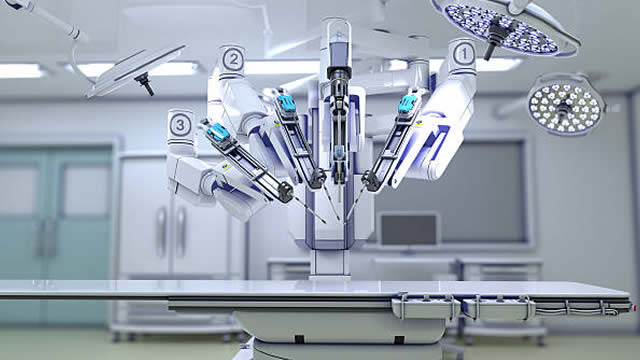

Surgalign Holdings, Inc., a medical technology company, develops, manufactures, distributes, and markets spine implants worldwide. It offers products for thoracolumbar procedures, including Streamline TL Spinal Fixation system, a system for degenerative and complex spine procedures; and Streamline MIS Spinal Fixation system, a range of implants and instruments used via a percutaneous or mini-open approach; and interbody fusion devices, as well as products for cervical procedures, such as CervAlign ACP system, a comprehensive anterior cervical plate system; Fortilink-C IBF system, a cervical interbody fusion device that utilizes TETRAfuse 3D technology; and Streamline OCT system, a range of implants used in the occipito-cervico-thoracic posterior spine. The company also provides motion preservation systems comprising Coflex Interlaminar Stabilization device for the treatment of moderate to severe lumbar spinal stenosis in conjunction with decompression; HPS 2.0 Universal Fixation system, a pedicle screw system used for posterior stabilization of the thoracolumbar spine; and SImmetry SI Joint Fusion system, a minimally invasive surgical implant system to decrease opioid use, pain, and disability. In addition, it develops Augmented Reality and Artificial Intelligence digital surgery platform to enable digital spine surgery. The company markets its products through independent spine and biomaterial distributors to hospitals, ambulatory surgery centers, and healthcare providers, as well as through direct sales force. The company was incorporated in 1997 and is headquartered in Deerfield, Illinois.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 81.98M | 90.50M | 101.75M | 117.42M | 280.86M | 279.56M | 272.87M | 282.29M | 262.81M | 197.98M | 178.11M | 169.32M | 166.17M | 164.53M | 146.64M | 94.21M | 73.97M | 75.20M | 92.70M | 75.51M | 118.49M | 140.73M | 122.50M | 33.03M |

| Cost of Revenue | 41.69M | 29.78M | 44.00M | 32.78M | 140.73M | 137.04M | 140.52M | 132.55M | 129.01M | 117.87M | 92.90M | 92.10M | 90.17M | 87.03M | 77.82M | 56.56M | 54.65M | 55.46M | 55.53M | 42.77M | 94.31M | 112.63M | 91.28M | 18.60M |

| Gross Profit | 40.29M | 60.73M | 57.75M | 84.65M | 140.12M | 142.52M | 132.35M | 149.74M | 133.80M | 80.11M | 85.22M | 77.21M | 76.00M | 77.49M | 68.81M | 37.65M | 19.32M | 19.74M | 37.18M | 32.74M | 24.18M | 28.10M | 31.22M | 14.43M |

| Gross Profit Ratio | 49.14% | 67.10% | 56.75% | 72.09% | 49.89% | 50.98% | 48.50% | 53.04% | 50.91% | 40.46% | 47.84% | 45.60% | 45.74% | 47.10% | 46.93% | 39.97% | 26.12% | 26.25% | 40.10% | 43.36% | 20.41% | 19.96% | 25.49% | 43.69% |

| Research & Development | 15.74M | 13.89M | 11.95M | 16.84M | 14.41M | 13.38M | 16.09M | 15.07M | 15.54M | 15.24M | 12.23M | 9.81M | 9.44M | 8.90M | 8.14M | 5.19M | 5.40M | 5.00M | 3.84M | 2.44M | 2.46M | 2.63M | 2.39M | 1.68M |

| General & Administrative | 95.89M | 104.67M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.80M | 0.00 | 20.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 119.22M | 115.10M | 116.13M | 107.44M | 107.65M | 81.64M | 58.38M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 95.89M | 104.67M | 124.39M | 135.40M | 119.22M | 115.10M | 116.13M | 107.44M | 112.45M | 81.64M | 58.40M | 55.64M | 59.23M | 59.33M | 54.17M | 31.04M | 27.25M | 23.35M | 23.22M | 23.52M | 29.24M | 35.96M | 20.58M | 9.74M |

| Other Expenses | -898.00K | -3.93M | 75.43M | 41.21M | 0.00 | 0.00 | 3.83M | 0.00 | -4.80M | 0.00 | -20.00K | 0.00 | 0.00 | 0.00 | 104.41M | 4.19M | 4.20M | 336.00K | 136.00K | 169.00K | 5.10M | 0.00 | 1.45M | 576.09K |

| Operating Expenses | 110.73M | 114.62M | 136.34M | 152.23M | 133.63M | 128.48M | 136.05M | 122.50M | 123.19M | 96.88M | 70.61M | 65.44M | 68.67M | 68.22M | 166.72M | 40.42M | 36.86M | 28.69M | 27.20M | 26.13M | 36.79M | 38.59M | 24.42M | 11.99M |

| Cost & Expenses | 152.42M | 144.40M | 180.34M | 185.01M | 274.36M | 265.52M | 276.56M | 255.06M | 252.20M | 214.75M | 163.50M | 157.55M | 158.84M | 155.26M | 244.54M | 96.97M | 91.50M | 84.15M | 82.72M | 68.89M | 131.10M | 151.22M | 115.70M | 30.59M |

| Interest Income | 0.00 | 0.00 | 92.00K | 161.00K | 35.00K | 8.00K | 8.00K | 3.00K | 9.00K | 23.00K | 185.00K | 193.00K | 114.00K | 273.00K | 567.00K | 849.00K | 934.00K | 361.00K | 96.00K | 235.00K | 186.00K | 1.31M | 1.21M | 0.00 |

| Interest Expense | 1.01M | 0.00 | 31.00K | 12.57M | 2.77M | 3.18M | 1.66M | 1.49M | 1.36M | 542.00K | 0.00 | 201.00K | 537.00K | 544.00K | 797.00K | 753.00K | 898.00K | 862.00K | 967.00K | 981.00K | 2.76M | 106.00K | 434.00K | 0.00 |

| Depreciation & Amortization | 2.16M | 2.48M | 6.67M | 22.68M | 14.57M | 14.23M | 16.51M | 16.52M | 15.40M | 12.20M | 7.99M | 8.03M | 7.50M | 7.14M | 6.16M | 5.42M | 5.33M | 4.33M | 4.06M | 4.41M | 2.89M | 2.34M | 1.45M | 576.09K |

| EBITDA | -68.28M | -3.93M | -71.92M | -181.86M | 11.76M | 43.13M | 705.00K | 41.23M | 20.94M | -16.18M | 20.44M | 19.83M | -119.76M | 16.14M | -91.63M | 3.70M | -11.27M | -4.26M | 14.13M | 11.27M | -10.89M | -124.24M | 9.46M | 2.92M |

| EBITDA Ratio | -83.29% | 20.64% | -70.68% | 111.15% | 4.19% | 15.43% | 0.26% | 14.60% | 7.97% | -8.17% | 11.47% | 11.71% | -72.07% | 9.81% | -62.49% | 3.93% | -15.23% | -5.66% | 15.24% | 14.92% | -9.19% | -4.86% | 7.72% | 8.83% |

| Operating Income | -70.44M | 16.20M | -78.59M | 107.85M | -2.50M | 28.81M | -15.68M | 24.63M | 5.63M | -28.66M | 12.24M | 11.77M | -127.38M | 9.02M | -98.36M | -2.57M | -17.53M | -8.95M | 9.98M | 6.62M | -13.97M | -10.50M | 6.80M | 2.44M |

| Operating Income Ratio | -85.92% | 17.90% | -77.24% | 91.84% | -0.89% | 10.31% | -5.75% | 8.72% | 2.14% | -14.47% | 6.87% | 6.95% | -76.65% | 5.48% | -67.08% | -2.73% | -23.70% | -11.90% | 10.76% | 8.77% | -11.79% | -7.46% | 5.55% | 7.38% |

| Total Other Income/Expenses | 14.79M | -119.86M | -119.09M | -61.00M | -1.27M | -3.09M | -1.78M | -1.41M | -1.44M | -268.00K | 204.00K | -167.00K | -419.00K | -564.00K | -230.00K | 96.00K | 36.00K | -501.00K | -871.00K | -746.00K | -2.57M | 1.21M | 774.00K | -98.15K |

| Income Before Tax | -55.65M | -123.79M | -197.68M | -242.86M | -5.58M | 25.73M | -17.46M | 23.21M | 4.19M | -28.92M | 12.44M | 11.60M | -127.79M | 8.46M | -98.59M | -2.47M | -17.50M | -9.45M | 9.11M | 5.87M | -16.54M | -9.29M | 7.58M | 2.34M |

| Income Before Tax Ratio | -67.88% | -136.79% | -194.28% | -206.82% | -1.99% | 9.20% | -6.40% | 8.22% | 1.59% | -14.61% | 6.99% | 6.85% | -76.91% | 5.14% | -67.23% | -2.62% | -23.66% | -12.56% | 9.82% | 7.78% | -13.96% | -6.60% | 6.18% | 7.09% |

| Income Tax Expense | -1.04M | -886.00K | -3.49M | 5.92M | -4.33M | 19.45M | -3.06M | 8.30M | 1.49M | -11.11M | 4.04M | 3.23M | 1.61M | 2.60M | 1.39M | -376.00K | -6.37M | -3.90M | 2.95M | -483.00K | -3.03M | -3.79M | 3.12M | -618.86K |

| Net Income | -54.61M | -122.91M | -194.20M | -248.78M | -1.25M | 6.27M | -14.40M | 14.92M | 2.70M | -17.81M | 8.40M | 8.38M | -129.40M | 5.86M | -99.98M | -2.10M | -11.13M | -5.55M | 6.16M | 6.36M | -13.51M | -5.51M | 4.46M | 2.96M |

| Net Income Ratio | -66.61% | -135.81% | -190.86% | -211.86% | -0.45% | 2.24% | -5.28% | 5.28% | 1.03% | -9.00% | 4.72% | 4.95% | -77.87% | 3.56% | -68.18% | -2.22% | -15.04% | -7.38% | 6.64% | 8.42% | -11.40% | -3.91% | 3.64% | 8.96% |

| EPS | -8.33 | -30.08 | -78.30 | -106.39 | -0.02 | 0.11 | -0.25 | 0.26 | 0.05 | -0.32 | 0.15 | 0.15 | -2.36 | 0.11 | -2.00 | -0.07 | -0.37 | -0.20 | 0.23 | 0.24 | -0.60 | -0.25 | 0.42 | 0.81 |

| EPS Diluted | -8.33 | -30.08 | -78.30 | -106.39 | -0.02 | 0.10 | -0.25 | 0.25 | 0.05 | -0.32 | 0.15 | 0.15 | -2.36 | 0.11 | -2.00 | -0.07 | -0.37 | -0.20 | 0.23 | 0.24 | -0.60 | -0.25 | 0.22 | 0.18 |

| Weighted Avg Shares Out | 6.56M | 4.09M | 2.48M | 2.34M | 63.52M | 59.68M | 58.24M | 57.61M | 56.74M | 56.26M | 55.86M | 55.15M | 54.73M | 54.35M | 49.91M | 29.82M | 29.75M | 27.75M | 26.59M | 26.37M | 22.43M | 21.76M | 10.64M | 3.67M |

| Weighted Avg Shares Out (Dil) | 6.56M | 4.09M | 2.48M | 2.34M | 63.52M | 60.60M | 58.24M | 58.59M | 56.74M | 56.26M | 56.07M | 55.35M | 54.73M | 54.77M | 49.91M | 29.82M | 29.75M | 27.75M | 27.06M | 27.00M | 22.43M | 21.76M | 20.34M | 16.64M |

Do Options Traders Know Something About Surgalign Holdings (SRGA) Stock We Don't?

Surgalign Announces Issuance of U.S. Patent Covering the Use of Artificial Intelligence in Medical Image Segmentation

Surgalign Shares Increase Over 20% Pre-Market: Why It Happened

Surgalign Holdings: Pinocchio Has A Happy Ending

Surgalign Holdings, Inc. (SRGA) CEO Terry Rich on Q2 2021 Results - Earnings Call Transcript

Surgalign Holdings (SRGA) Reports Q2 Loss, Tops Revenue Estimates

Surgalign Holdings, Inc. Announces Second Quarter 2021 Results

Surgalign Holdings, Inc. Reports Inducement Grants Under Nasdaq Listing Rule 5635(C)(4)

Surgalign Holdings, Inc. Schedules Second Quarter 2021 Earnings Release for August 6, 2021

Surgalign Holdings, Inc. Reports Inducement Grants Under Nasdaq Listing Rule 5635(C)(4)

Source: https://incomestatements.info

Category: Stock Reports