See more : Shankara Building Products Limited (SHANKARA.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Sorrento Therapeutics, Inc. (SRNE) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Sorrento Therapeutics, Inc., a leading company in the Biotechnology industry within the Healthcare sector.

- Upstart Holdings, Inc. (UPST) Income Statement Analysis – Financial Results

- Forbo Holding AG (FBOHF) Income Statement Analysis – Financial Results

- Jolimark Holdings Limited (JLMKF) Income Statement Analysis – Financial Results

- Amada Co., Ltd. (AMDLY) Income Statement Analysis – Financial Results

- Hexagon Composites ASA (HXGCF) Income Statement Analysis – Financial Results

Sorrento Therapeutics, Inc. (SRNE)

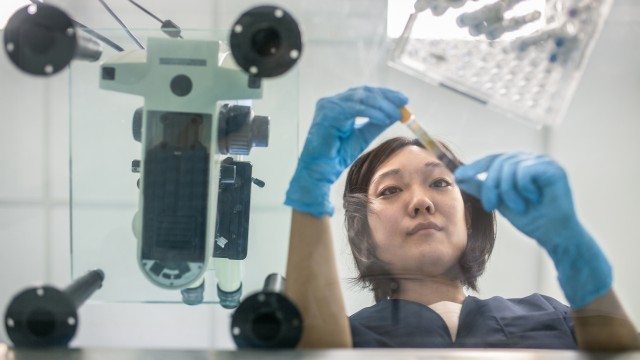

About Sorrento Therapeutics, Inc.

Sorrento Therapeutics, Inc., a clinical stage and commercial biopharmaceutical company, develops therapies for cancer, autoimmune, inflammatory, viral, and neurodegenerative diseases. It operates through two segments, Sorrento Therapeutics and Scilex. The company provides cancer therapeutic by leveraging its proprietary G-MAB antibody library and targeted delivery modalities, which include chimeric antigen receptor T-cell therapy (CAR-T), dimeric antigen receptor T-cell therapy, and antibody drug conjugate, as well as bispecific antibody approach; and Sofusa, a drug delivery technology that deliver biologic directly into the lymphatic system. Its clinical programs in development include anti-CD38 CAR-T therapy for the treatment of multiple myeloma, as well as for amyloidosis and graft versus host disease. The company develops resiniferatoxin, a non-opioid-based TRPV1 agonist neurotoxin for late stage cancer and osteoarthritis knee pain treatment; and ZTlido, a lidocaine delivery system for the treatment of postherpetic neuralgia. It engages in the development of SEMDEXA, an injectable viscous gel formulation, which is Phase III trial for the treatment of sciatica, a pathology of low back pain; SP-103, an investigational non-aqueous lidocaine topical system undergoing clinical development in chronic low back pain condition; and SP-104, a novel low-dose delayed-release naltrexone hydrochloride formulation for the treatment of fibromyalgia. It has collaboration with SmartPharm Therapeutics Inc. to develop gene-encoded antibody vaccine to protect against COVID-19; Celularity, Inc. for initiating Phase I/II clinical study, including up to 94 patients with COVID-19; Mount Sinai Health System to develop COVI-SHIELD, an antibody therapy targeting SARS-CoV-2 infection; and Mayo Clinic for Phase Ib pilot study using sofusa lymphatic drug delivery technology to deliver Ipilimumab in patient with melanoma. The company was founded in 2006 and is based in San Diego, California.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 62.84M | 52.90M | 39.99M | 31.43M | 21.19M | 151.86M | 8.15M | 4.59M | 3.83M | 460.15K | 583.77K | 529.18K | 682.57K | 5.41K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 33.45M | 13.03M | 9.94M | 12.24M | 10.07M | 11.03M | 3.70M | 1.95M | 2.04M | 4.44K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 29.39M | 39.87M | 30.05M | 19.20M | 11.12M | 140.83M | 4.46M | 2.64M | 1.78M | 455.71K | 583.77K | 529.18K | 682.57K | 5.41K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 46.77% | 75.37% | 75.14% | 61.07% | 52.49% | 92.74% | 54.66% | 57.52% | 46.59% | 99.04% | 100.00% | 100.00% | 100.00% | 100.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 221.23M | 206.92M | 111.34M | 106.88M | 76.96M | 55.53M | 42.18M | 31.34M | 23.98M | 9.02M | 3.83M | 2.57M | 1.39M | 410.17K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 63.64M | 38.33M | 24.22M | 20.13M | 9.99M | 6.32M | 1.61M | 0.00 | 0.00 | 0.00 | 0.00 | 240.63K | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -5.37M | -2.04M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 182.34M | 196.86M | 116.18M | 103.56M | 63.64M | 32.96M | 22.18M | 20.13M | 9.99M | 6.32M | 1.61M | 1.20M | 1.10M | 543.95K | 190.52K | 240.63K | 439.29K | 0.00 | 0.00 | 0.00 |

| Other Expenses | 130.14M | 4.14M | 4.05M | 3.94M | 3.01M | 2.61M | 845.00K | 1.16M | 2.35M | 804.07K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -308.03K | -763.00 | -763.00 |

| Operating Expenses | 533.70M | 407.92M | 231.57M | 214.38M | 140.60M | 88.49M | 64.35M | 52.63M | 36.32M | 16.14M | 5.44M | 3.77M | 2.49M | 954.12K | 190.52K | 240.63K | 439.29K | -308.03K | -763.00 | -763.00 |

| Cost & Expenses | 567.15M | 420.95M | 241.51M | 226.61M | 150.67M | 99.52M | 68.05M | 54.58M | 38.36M | 16.14M | 5.44M | 3.77M | 2.49M | 954.12K | 190.52K | 240.63K | 439.29K | -308.03K | -763.00 | -763.00 |

| Interest Income | 0.00 | 0.00 | 24.00K | 1.09M | 921.00K | 241.00K | 272.00K | 24.00K | 12.00K | 9.62K | 7.30K | 5.95K | 3.79K | 11.86K | 1.61K | 9.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 8.57M | 10.22M | 20.18M | 36.14M | 57.63M | 4.98M | 1.61M | 1.65M | 1.63M | 253.19K | 7.30K | 5.95K | 3.79K | 11.86K | 1.61K | 0.00 | 0.00 | 0.00 | 0.00 | 763.00 |

| Depreciation & Amortization | 13.25M | 16.32M | 14.71M | 15.04M | 9.05M | 7.08M | 2.89M | 2.37M | 3.18M | 1.29M | 293.30K | 159.22K | 23.41K | 2.76K | 3.23K | -29.99K | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA | -539.93M | -435.99M | -275.69M | -308.40M | -147.10M | 27.38M | -60.34M | -9.74M | -31.55M | -20.37M | -4.55M | -3.08M | -1.78M | -939.51K | -187.29K | -270.62K | -439.29K | -308.03K | -763.00 | -763.00 |

| EBITDA Ratio | -859.22% | -724.81% | -479.85% | -582.53% | -568.22% | 39.13% | -699.37% | -119.28% | -824.73% | -4,426.33% | -778.50% | -580.39% | -260.95% | -17,137.52% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -504.32M | -368.05M | -201.53M | -195.18M | -129.48M | 52.34M | -59.90M | -74.01M | -34.74M | -21.67M | -4.85M | -3.24M | -1.81M | -954.12K | -190.52K | -240.63K | -439.29K | -308.03K | -763.00 | -763.00 |

| Operating Income Ratio | -802.55% | -695.68% | -503.99% | -620.97% | -610.94% | 34.46% | -734.76% | -1,612.31% | -908.29% | -4,708.85% | -831.25% | -612.72% | -265.49% | -17,626.51% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -57.43M | -94.48M | -66.06M | -100.18M | -63.36M | -10.02M | -4.94M | 36.23M | -1.62M | -6.23M | 7.30K | 5.95K | 3.79K | 11.86K | 0.00 | -30.00K | 0.00 | -308.03K | 0.00 | 0.00 |

| Income Before Tax | -561.75M | -462.53M | -310.58M | -359.58M | -213.78M | 15.32M | -64.83M | -13.76M | -36.36M | -21.91M | -4.85M | -3.24M | -1.81M | -942.27K | 0.00 | -270.63K | 0.00 | -616.06K | 0.00 | 0.00 |

| Income Before Tax Ratio | -893.95% | -874.28% | -776.72% | -1,143.98% | -1,008.73% | 10.09% | -795.30% | -299.78% | -950.56% | -4,761.79% | -830.00% | -611.60% | -264.94% | -17,407.46% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | -2.42M | -33.52M | -2.01M | -473.00K | -6.27M | -36.04M | -896.00K | 36.31M | -1.70M | 9.62K | 14.60K | 11.90K | 7.57K | 23.71K | -1.61K | -9.00 | 439.29K | -308.03K | 763.00 | 763.00 |

| Net Income | -572.84M | -429.01M | -308.57M | -359.10M | -203.54M | 9.06M | -60.92M | -45.81M | -34.66M | -21.91M | -4.85M | -3.24M | -1.81M | -942.27K | -188.90K | -270.62K | -439.29K | -308.03K | -763.00 | -763.00 |

| Net Income Ratio | -911.60% | -810.93% | -771.69% | -1,142.48% | -960.41% | 5.97% | -747.34% | -998.06% | -906.07% | -4,761.79% | -830.00% | -611.60% | -264.94% | -17,407.46% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | -1.37 | -1.46 | -1.34 | -2.56 | -1.92 | 0.13 | -1.21 | -1.24 | -1.30 | -1.46 | -0.42 | -0.33 | -0.20 | -0.15 | -0.50 | -1.05 | -15.46 | -10.84 | -0.03 | -0.03 |

| EPS Diluted | -1.37 | -1.46 | -1.34 | -2.56 | -1.92 | 0.13 | -1.21 | -1.24 | -1.30 | -1.46 | -0.42 | -0.33 | -0.20 | -0.15 | -0.50 | -1.05 | -15.46 | -10.84 | -0.03 | -0.03 |

| Weighted Avg Shares Out | 419.32M | 294.77M | 229.82M | 140.51M | 106.15M | 69.74M | 50.36M | 36.91M | 26.68M | 15.05M | 11.41M | 9.92M | 8.83M | 6.08M | 378.02K | 257.93K | 28.41K | 28.41K | 28.41K | 28.41K |

| Weighted Avg Shares Out (Dil) | 419.32M | 294.77M | 229.82M | 140.51M | 106.15M | 70.38M | 50.36M | 36.91M | 26.68M | 15.05M | 11.41M | 9.92M | 8.83M | 6.08M | 378.02K | 257.93K | 28.41K | 28.41K | 28.41K | 28.41K |

Scilex Holding Company (“Scilex”), a Sorrento Company (nearly 100% or over 99.9% majority-owned subsidiary of Sorrento Therapeutics, Inc.) (Nasdaq: SRNE, “Sorrento”), and Vickers Vantage Corp. I Announce Effectiveness of Registration Statement on Form S-4, Date of Vickers Vantage Extraordinary General Meeting to Approve Proposed Business Combination

Nutriband Subsidiary, 4P Therapeutics LLC, Conducts Phase 1b Clinical Study for Sorrento Therapeutics, Inc. on Lymphatic Etanercept Delivery in Rheumatoid Arthritis Patients With Results To Be Presented at the 2022 American College of Rheumatology Confere

7 of the Best Contrarian Stocks to Buy When Investors Are Fearful

Why Sorrento Therapeutics Stock Is on the Rise Today

Sorrento Successfully Completes Phase 1 Study and Is Proceeding to Implement Global Registrational Trials with STI-1558, an Oral Mpro Inhibitor as a Standalone Oral Treatment and Prevention of COVID-19 without the Need for a Ritonavir Booster

Sorrento Announces Publication of Data in Cell Press Journal Med Describing Discovery and Preclinical Efficacy of a Broadly-Acting SARS-CoV-2 Neutralizing Antibody Administered IV (STI-9167) or IN (STI-9199)

Sorrento Therapeutics to Participate in Key Opinion Leader Panel Discussion on “New Horizons for the Treatment of Non-small Cell Lung Cancer”

Why Sorrento Therapeutics' Shares Tumbled 23.4% in September

Scilex Holding Company, a Sorrento Company, Announces Pre-Emptive Pay Off of Remaining Balance of its Senior Secured Notes

Sorrento Therapeutics Completes Enrollment of Phase 2 Clinical Trial of Resiniferatoxin (RTX) for Treatment of Knee Pain in Moderate to Severe Osteoarthritis of the Knee (OAK) Patients

Source: https://incomestatements.info

Category: Stock Reports