See more : Kakaku.com, Inc. (KKKUF) Income Statement Analysis – Financial Results

Complete financial analysis of Siltronic AG (SSLLF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Siltronic AG, a leading company in the Semiconductors industry within the Technology sector.

- Stewart Information Services Corporation (STC) Income Statement Analysis – Financial Results

- CRI Middleware Co., Ltd. (3698.T) Income Statement Analysis – Financial Results

- Steel Partners Holdings L.P. (SPLP-PA) Income Statement Analysis – Financial Results

- PlasmaTech, Inc. (PMAH) Income Statement Analysis – Financial Results

- Tang Eng Iron Works Co., Ltd. (2035.TWO) Income Statement Analysis – Financial Results

Siltronic AG (SSLLF)

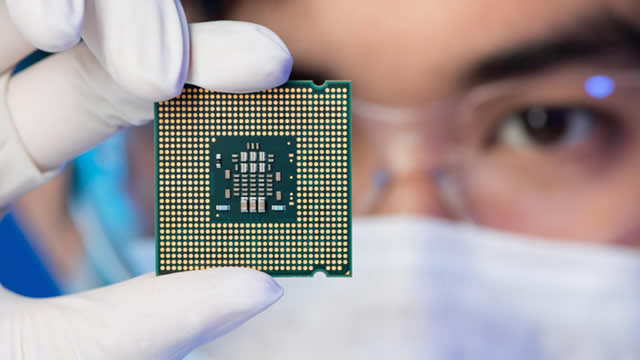

About Siltronic AG

Siltronic AG, together with its subsidiaries, manufactures and sells hyperpure semiconductor silicon wafers with diameters of up to 300 mm worldwide. It offers polished and epitaxial wafers. The company also provides special products, such as Ultimate Silicon, an optimal crystal for polished wafers; PowerFZ, a wafer product based on the float zone method; and HIREF, a high reflective non-polished wafer product. Its silicon wafers are used in computers, smartphones, flat screens, sensors, industrial equipment, navigation systems, electric cars, wind turbines, and other applications. The company was formerly known as Wacker Siltronic AG and changed its name to Siltronic AG in 2004. Siltronic AG was founded in 1953 and is headquartered in Munich, Germany.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.51B | 1.81B | 1.41B | 1.21B | 1.27B | 1.46B | 1.18B | 933.40M | 931.30M | 846.00M | 743.00M | 868.00M |

| Cost of Revenue | 1.14B | 1.19B | 964.20M | 867.50M | 812.80M | 824.80M | 807.00M | 761.50M | 768.40M | 769.40M | 658.80M | 786.90M |

| Gross Profit | 372.20M | 615.30M | 441.20M | 339.50M | 457.60M | 631.90M | 370.30M | 171.90M | 162.90M | 76.60M | 84.20M | 81.10M |

| Gross Profit Ratio | 24.59% | 34.08% | 31.39% | 28.13% | 36.02% | 43.38% | 31.45% | 18.42% | 17.49% | 9.05% | 11.33% | 9.34% |

| Research & Development | 87.60M | 89.50M | 80.40M | 72.60M | 68.40M | 68.10M | 68.30M | 66.40M | 64.40M | 64.30M | 58.80M | 66.80M |

| General & Administrative | 35.40M | 33.80M | 32.50M | 39.90M | 27.80M | 27.50M | 25.60M | 20.60M | 18.50M | 16.00M | 13.90M | 18.90M |

| Selling & Marketing | 35.10M | 34.30M | 34.90M | 31.60M | 36.90M | 35.00M | 37.10M | 33.20M | 34.90M | 30.50M | 28.70M | 34.50M |

| SG&A | 76.50M | 68.10M | 67.40M | 71.50M | 64.70M | 62.50M | 62.70M | 53.80M | 53.40M | 46.50M | 42.60M | 53.40M |

| Other Expenses | -23.20M | 1.70M | 10.10M | 2.80M | 4.00M | 200.00K | 200.00K | -2.20M | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 140.90M | 102.10M | 138.40M | 140.10M | 126.40M | 135.20M | 129.90M | 118.80M | 114.00M | 108.90M | 189.40M | 170.80M |

| Cost & Expenses | 1.28B | 1.29B | 1.10B | 1.01B | 939.20M | 960.00M | 936.90M | 880.30M | 882.40M | 878.30M | 848.20M | 957.70M |

| Interest Income | 23.00M | 13.80M | 3.80M | 6.00M | 8.60M | 4.00M | 1.90M | 1.30M | 600.00K | 600.00K | 6.10M | 5.30M |

| Interest Expense | 23.70M | 16.00M | 8.60M | 10.30M | 10.70M | 9.50M | 9.60M | 12.20M | 12.80M | 9.50M | 0.00 | 0.00 |

| Depreciation & Amortization | 202.50M | 181.70M | 156.90M | 138.60M | 106.10M | 93.20M | 117.40M | 119.00M | 121.30M | 149.20M | 87.30M | 90.30M |

| EBITDA | 459.30M | 679.10M | 476.40M | 339.30M | 423.80M | 581.20M | 349.40M | 147.10M | 124.60M | 133.90M | 71.70M | 45.70M |

| EBITDA Ratio | 30.34% | 37.44% | 33.58% | 28.40% | 33.82% | 40.45% | 30.23% | 16.32% | 13.43% | 16.97% | 9.65% | 5.26% |

| Operating Income | 231.30M | 495.60M | 316.90M | 192.20M | 298.30M | 497.70M | 235.70M | 27.00M | 2.70M | -13.60M | -15.60M | -44.60M |

| Operating Income Ratio | 15.28% | 27.45% | 22.55% | 15.92% | 23.48% | 34.17% | 20.02% | 2.89% | 0.29% | -1.61% | -2.10% | -5.14% |

| Total Other Income/Expenses | -500.00K | -8.50M | 1.40M | -3.00M | 4.40M | -9.30M | -8.50M | -11.10M | -12.20M | -11.20M | -45.90M | -39.80M |

| Income Before Tax | 230.80M | 487.10M | 318.30M | 189.20M | 302.70M | 488.40M | 227.20M | 15.90M | -9.50M | -24.80M | -99.10M | -84.40M |

| Income Before Tax Ratio | 15.25% | 26.98% | 22.65% | 15.68% | 23.83% | 33.53% | 19.30% | 1.70% | -1.02% | -2.93% | -13.34% | -9.72% |

| Income Tax Expense | 29.50M | 52.70M | 28.70M | 2.40M | 41.70M | 87.80M | 35.00M | 7.20M | 10.60M | 2.20M | 10.20M | 6.20M |

| Net Income | 184.40M | 390.60M | 253.30M | 160.80M | 225.60M | 373.20M | 185.30M | 12.00M | -14.00M | -16.00M | -109.30M | -90.60M |

| Net Income Ratio | 12.18% | 21.64% | 18.02% | 13.32% | 17.76% | 25.62% | 15.74% | 1.29% | -1.50% | -1.89% | -14.71% | -10.44% |

| EPS | 6.15 | 13.02 | 8.44 | 5.36 | 7.52 | 12.44 | 6.18 | 0.40 | -0.50 | -0.53 | -2.19 | -1.81 |

| EPS Diluted | 6.15 | 13.02 | 8.44 | 5.36 | 7.52 | 12.44 | 6.18 | 0.40 | -0.50 | -0.53 | -2.19 | -1.81 |

| Weighted Avg Shares Out | 30.00M | 30.00M | 30.00M | 30.00M | 30.00M | 30.00M | 30.00M | 30.00M | 27.79M | 30.00M | 50.00M | 50.00M |

| Weighted Avg Shares Out (Dil) | 30.00M | 30.00M | 30.00M | 30.00M | 30.00M | 30.00M | 30.00M | 30.00M | 27.79M | 30.00M | 50.00M | 50.00M |

Siltronic AG (SSLLF) Q3 2024 Earnings Call Transcript

Siltronic Q3 revenue rises 1.7%

Siltronic: Exposure To AI, Amid Chip Recovery (Rating Upgrade)

Siltronic AG (SSLLF) Q2 2024 Earnings Call Transcript

Siltronic H1 revenue falls 14% on weak demand

Siltronic AG (SSLLF) Q1 2024 Earnings Call Transcript

Chip parts supplier Siltronic's profit falls on high client inventories

Siltronic to stop small diameter wafer production at Burghausen site

Siltronic AG (SSLLF) Q4 2023 Earnings Call Transcript

German chip parts supplier Siltronic posts 16% drop in 2023 sales

Source: https://incomestatements.info

Category: Stock Reports