See more : Enbridge Inc (ENB-PN.TO) Income Statement Analysis – Financial Results

Complete financial analysis of Sitio Royalties Corp. (STR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Sitio Royalties Corp., a leading company in the Industrial Materials industry within the Basic Materials sector.

- Excel Realty N Infra Limited (EXCEL.BO) Income Statement Analysis – Financial Results

- Dish Network Corp. (EOT.DE) Income Statement Analysis – Financial Results

- Saratoga Investment Corp 8.00% (SAJ) Income Statement Analysis – Financial Results

- Sinopower Semiconductor, Inc. (6435.TWO) Income Statement Analysis – Financial Results

- Analyst I.M.S. Investment Management Services Ltd (ANLT.TA) Income Statement Analysis – Financial Results

Sitio Royalties Corp. (STR)

About Sitio Royalties Corp.

Sitio Royalties Corp. operates as oil and gas mineral and royalty company. The company acquires oil-weighted rights in productive and the United States basins. It has approximately 140,000 net royalty acres through the consummation of over 180 acquisitions. The company was founded in 2016 and is headquartered in Denver, Colorado.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 593.36M | 369.61M | 120.59M | 45.70M | 68.46M | 98.66M | 95.97M | 70.12M | 1.13B | 1.19B | 1.22B | 1.10B | 1.19B | 1.12B | 3.04B | 3.47B | 2.73B | 2.84B | 2.72B | 1.90B | 1.46B | 25.49M |

| Cost of Revenue | 170.09M | 104.51M | 40.91M | 32.05M | 17.00M | 22.11M | 39.08M | 40.37M | 8.90M | 4.00M | 6.10M | 6.70M | 3.10M | 280.00M | 716.00M | 1.01B | 917.00M | 1.22B | 1.37B | 840.54M | 542.44M | 0.00 |

| Gross Profit | 423.27M | 265.10M | 79.68M | 13.65M | 51.46M | 76.55M | 56.89M | 29.75M | 1.13B | 1.19B | 1.21B | 1.09B | 1.19B | 843.00M | 2.32B | 2.46B | 1.81B | 1.61B | 1.35B | 1.06B | 920.75M | 25.49M |

| Gross Profit Ratio | 71.33% | 71.72% | 66.08% | 29.87% | 75.17% | 77.59% | 59.28% | 42.43% | 99.22% | 99.66% | 99.50% | 99.39% | 99.74% | 75.07% | 76.43% | 70.94% | 66.36% | 56.86% | 49.67% | 55.79% | 62.93% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 49.62M | 42.30M | 13.00M | 9.39M | 10.52M | 9.54M | 8.21M | 6.11M | 109.00M | 127.90M | 121.00M | 120.80M | 117.90M | 108.00M | 183.00M | 159.00M | 165.00M | 135.00M | 123.06M | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | -3.50M | 0.00 | 1.75M | 1.99M | 2.40M | 2.37M | 6.51M | 6.61M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 46.12M | 42.30M | 13.00M | 9.39M | 14.31M | 11.91M | 14.72M | 532.00 | 109.00M | 127.90M | 121.00M | 120.80M | 117.90M | 108.00M | 183.00M | 159.00M | 165.00M | 135.00M | 123.06M | 0.00 | 0.00 | 0.00 |

| Other Expenses | 341.76M | 3.24M | 7.48M | 7.48M | 0.00 | 0.00 | 0.00 | 0.00 | 653.30M | 657.20M | 793.00M | 607.50M | 709.80M | 672.00M | 1.94B | 2.13B | 1.72B | 1.97B | 2.04B | 1.49B | 1.12B | 16.69M |

| Operating Expenses | 387.88M | 45.54M | 20.48M | 16.87M | 14.31M | 11.91M | 14.72M | 532.00 | 762.30M | 785.10M | 914.00M | 728.30M | 827.70M | 780.00M | 2.13B | 2.29B | 1.88B | 2.10B | 2.16B | 1.49B | 1.12B | 16.69M |

| Cost & Expenses | 557.97M | 150.05M | 61.38M | 48.92M | 31.31M | 34.02M | 53.80M | 532.00 | 771.20M | 789.10M | 920.10M | 735.00M | 830.80M | 1.06B | 2.84B | 3.30B | 2.80B | 3.33B | 3.53B | 2.33B | 1.67B | 16.69M |

| Interest Income | 0.00 | 35.39M | 1.89M | 1.97M | 868.00K | 0.00 | 1.46M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 93.41M | 35.50M | 1.89M | 1.97M | 2.49M | 2.35M | 2.75M | 3.10M | 63.00M | 63.10M | 56.90M | 57.90M | 56.80M | 0.00 | 128.00M | 119.00M | 72.00M | 73.00M | 69.30M | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 291.32M | 104.51M | 40.91M | 14.70M | 12.81M | 16.97M | 33.87M | 37.27M | 284.10M | 293.20M | 256.50M | 241.30M | 218.60M | 49.00M | 714.00M | 502.00M | 375.00M | 316.00M | 255.54M | 225.88M | 2.04M | 194.37M |

| EBITDA | 323.75M | 354.24M | 90.78M | 7.98M | 50.13M | 121.58M | 109.31M | -532.00 | 666.40M | 708.70M | 575.90M | 627.70M | 599.70M | 350.00M | 1.24B | 1.30B | 954.00M | 833.00M | 650.52M | 455.18M | 175.66M | 203.24M |

| EBITDA Ratio | 54.56% | 87.68% | 83.02% | 63.09% | 72.99% | 82.72% | 79.24% | 78.54% | 58.72% | 59.59% | 47.20% | 57.12% | 50.21% | 31.17% | 40.72% | 37.63% | 35.00% | 29.38% | 23.87% | 23.94% | 12.01% | 797.32% |

| Operating Income | 35.39M | 193.99M | 49.87M | -3.22M | 37.16M | 64.64M | 42.18M | -530.00 | 374.40M | 405.40M | 305.80M | 375.70M | 366.90M | 343.00M | 913.00M | 1.24B | 841.00M | 756.00M | 561.73M | 415.59M | 339.83M | 8.81M |

| Operating Income Ratio | 5.96% | 52.48% | 41.36% | -7.04% | 54.27% | 65.52% | 43.95% | 0.00% | 32.99% | 34.09% | 25.07% | 34.19% | 30.72% | 30.54% | 30.05% | 35.79% | 30.85% | 26.67% | 20.61% | 21.86% | 23.23% | 34.54% |

| Total Other Income/Expenses | -96.37M | -4.18M | -1.89M | -10.97M | -2.32M | 37.62M | 30.52M | -2.00 | -55.10M | -53.00M | -43.30M | -183.90M | -42.60M | -42.00M | -296.00M | -179.00M | -43.00M | -57.00M | -236.05M | -56.71M | -166.21M | 64.00K |

| Income Before Tax | -60.98M | 189.81M | 47.98M | -14.19M | 34.83M | 102.26M | 72.70M | -532.00 | 319.30M | 352.40M | 262.50M | 191.80M | 324.30M | 301.00M | 617.00M | 1.06B | 798.00M | 699.00M | 325.68M | 358.88M | 173.62M | 8.87M |

| Income Before Tax Ratio | -10.28% | 51.35% | 39.79% | -31.06% | 50.88% | 103.65% | 75.75% | 0.00% | 28.13% | 29.63% | 21.52% | 17.45% | 27.15% | 26.80% | 20.31% | 30.62% | 29.27% | 24.66% | 11.95% | 18.87% | 11.87% | 34.79% |

| Income Tax Expense | -14.28M | 5.68M | 486.00K | 22.00K | 3.92M | 3.29M | -369.51K | 823.00K | 110.60M | 125.90M | 101.30M | 116.50M | 116.40M | -42.00M | -168.00M | -60.00M | 29.00M | 16.00M | -166.75M | -56.71M | -166.21M | 64.00K |

| Net Income | -15.54M | 184.18M | 47.50M | -14.21M | 14.24M | 90.13M | 75.52M | -532.00 | 208.70M | 226.50M | 161.20M | 212.00M | 207.90M | 301.00M | 395.00M | 683.00M | 507.00M | 444.00M | 325.68M | 229.30M | 173.62M | 8.87M |

| Net Income Ratio | -2.62% | 49.83% | 39.39% | -31.10% | 20.79% | 91.35% | 78.69% | 0.00% | 18.39% | 19.04% | 13.21% | 19.29% | 17.41% | 26.80% | 13.00% | 19.71% | 18.60% | 15.66% | 11.95% | 12.06% | 11.87% | 34.79% |

| EPS | -0.20 | 1.10 | 3.75 | -1.24 | 1.24 | 7.86 | 9.10 | 0.00 | 1.19 | 1.29 | 0.92 | 1.20 | 1.17 | 1.70 | 2.26 | 3.97 | 2.95 | 5.22 | 3.84 | 2.74 | 2.10 | 0.03 |

| EPS Diluted | -0.20 | 1.10 | 3.75 | -0.66 | 1.24 | 7.86 | 9.10 | 0.00 | 1.18 | 1.29 | 0.92 | 1.19 | 1.16 | 1.69 | 2.23 | 3.88 | 2.90 | 5.10 | 3.74 | 2.67 | 2.06 | 0.03 |

| Weighted Avg Shares Out | 81.27M | 13.72M | 20.04M | 11.51M | 11.47M | 11.46M | 8.30M | 8.59M | 176.10M | 175.80M | 175.40M | 176.50M | 177.40M | 177.00M | 175.00M | 172.00M | 172.00M | 85.00M | 84.79M | 83.76M | 82.70M | 285.00M |

| Weighted Avg Shares Out (Dil) | 81.27M | 13.72M | 20.04M | 21.51M | 11.47M | 11.46M | 8.30M | 8.59M | 176.30M | 176.10M | 176.00M | 177.50M | 178.80M | 178.50M | 177.40M | 176.00M | 175.00M | 87.00M | 87.13M | 85.72M | 84.19M | 285.00M |

NYSE American to Commence Delisting Proceedings in Warrants of Sitio Royalties Corp. (STR WS) and Suspends Trading Immediately

NYSE American to Commence Delisting Proceedings in Warrants of Sitio Royalties Corp. (STR WS) and Suspends Trading Immediately

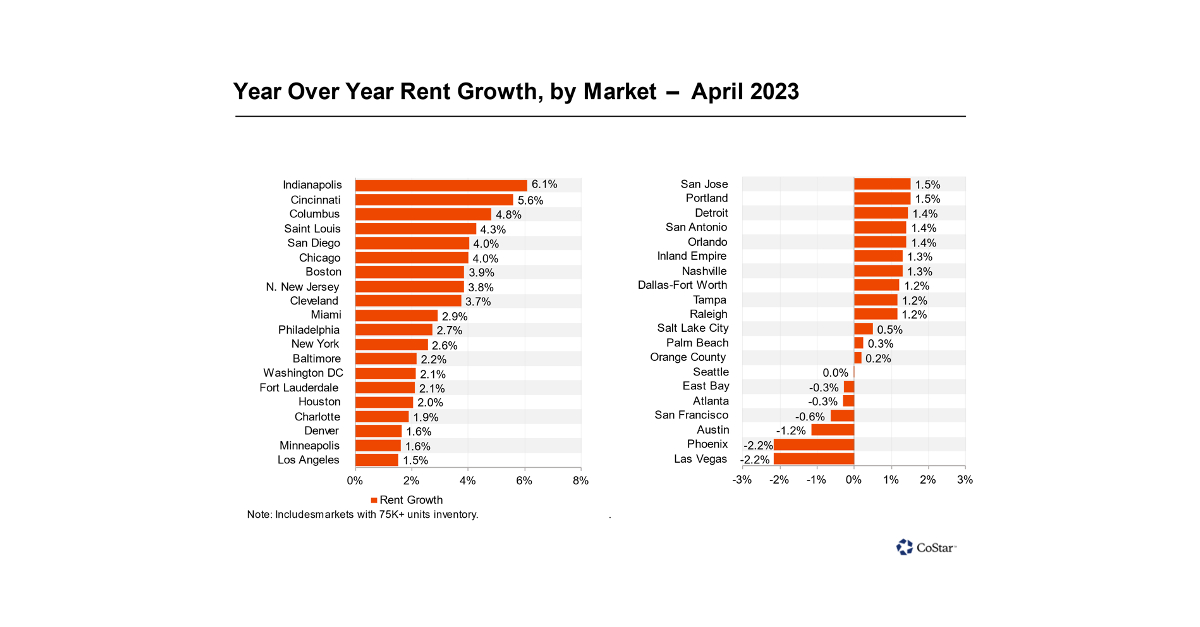

Apartments.com Publishes April 2023 Rent Growth Report

Sitio Royalties Schedules First Quarter 2023 Earnings Call

Sitio Royalties Schedules First Quarter 2023 Earnings Call

The 7 Best Oil and Gas Stocks to Buy in April 2023

10 Biggest Energy Companies With Very High Dividend Yields

Sitio Royalties Corp. (STR) Q4 2022 Earnings Call Transcript

Sitio Royalties (STR) Beats Q4 Earnings Estimates

Sitio Royalties Reports Fourth Quarter and Full Year 2022 Operational and Financial Results, Recent Developments and Provides Full Year 2023 Guidance

Source: https://incomestatements.info

Category: Stock Reports