- Dollar hits 2-year high after robust US data puts brake on rate cut bets

- Stocks plunge following Fed inflation projections

- Stock Market News Today: Stocks Rise in Shortened Trading Session

- Spotify stock is trading at all-time highs just 2 years after a record low. Here’s how it got there.

- All You Need To Know Going Into Trade On Dec. 24

Ad hoc announcement pursuant to Art. 53 LR

You are watching: Temenos announces preliminary Q4 and FY-24 results; ARR and TSL at top end of guidance, EBIT and FCF above guidance

GENEVA, Switzerland, January 13, 2025 – Temenos AG (SIX: TEMN), the banking software company, today announces its preliminary fourth quarter and full year 2024 results. This press release and all information herein is preliminary and unaudited.

Annual Recurring Revenue

Income statement and Free Cash Flow

This press release and all information herein is preliminary and unaudited. The definition of non-IFRS adjustments is below.

* Constant currency (c.c.) adjusts prior year for movements in currencies

Q4 and FY-24 business update

- Consistent execution in Q4-24 across regions delivered strong end to the year

- Sales environment remained stable in the fourth quarter, with continued positive pipeline development

- Q4-24 total software licensing growth predominantly driven by subscription

- Strong SaaS signings in Q4-24 as expected, with SaaS ACV of USD 24.8m

- Maintenance growth of 12% c.c. in Q4-24, continuing the trend from the first three quarters of the year

- FY-24 EBIT growth of 14% c.c. benefited from strong revenue growth in Q4-24, earlier impact from efficiencies program than previously expected, and a tail-wind from FX

- FY-25 guidance will be provided with the release of full Q4 and FY-24 results on 18th February 2025, after market close

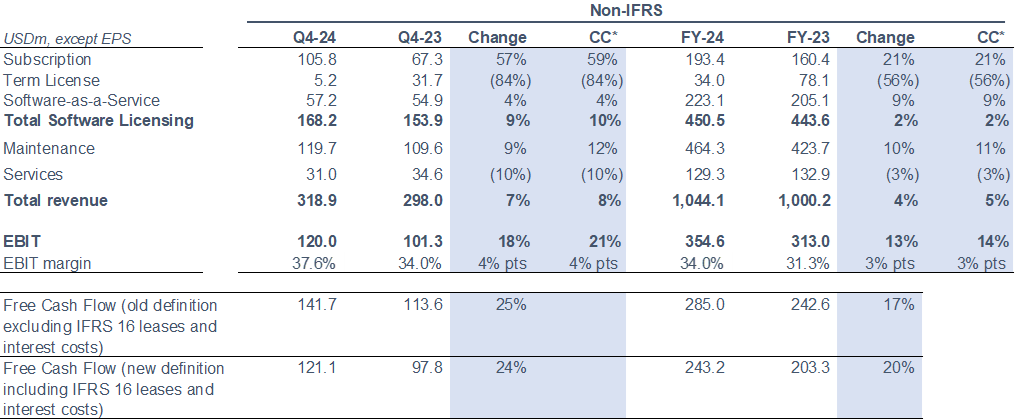

Q4 and FY-24 financial summary (non-IFRS)

- Annual Recurring Revenue (ARR) of USD 804.2m, up 12% c.c.

- Non-IFRS total software licensing revenue up 10% in Q4-24 and 2% in FY-24 c.c.

- Non IFRS maintenance revenue growth of 12% in Q4-24 and 11% in FY-24 c.c.

- Non-IFRS total revenue up 8% in Q4-24 and up 5% in FY-24 c.c.

- Non-IFRS EBIT up 21% in Q4-24 and 14% in FY-24 c.c.

- Q4-24 non-IFRS EBIT margin of 37.6% and FY-24 non-IFRS EBIT margin of 34.0%

- Q4-24 free cash flow of USD141.7m, up 25% y-o-y, FY-24 free cash flow of USD285.0m, up 17% y-o-y (under old definition excluding IFRS 16 leases and interest costs). FY FCF of USD 243.2m in new definition, up 20% y-o-y.

See more : Stocks to buy under ₹100: Sumeet Bagadia recommends three shares to buy on Monday — 13 January 2025

Commenting on the results, Temenos CEO Jean-Pierre Brulard said:

“I am particularly pleased with the consistent execution across the business in the fourth quarter, which has been a key area of focus for our leadership team. After presenting our new strategic plan in November, the critical first step was to deliver a good Q4 which was comparing to a strong Q4 last year and to meet guidance for the full year 2024. We benefited from a stable sales environment, which was particularly visible in deal signings for subscription licenses and SaaS ACV. These are both essential to driving ARR growth and give us visibility on our future cash flow.”

Additional information

This press release and all information herein is preliminary and unaudited.

Fourth quarter and full year 2024 results announcement

Temenos’ fourth quarter and full year 2024 results will be announced on Tuesday 18th February, 2025, after market close, and a webcast will be held at 18.30 CET / 17.30 GMT / 12.00 EST on the same day. Registration details for the webcast will be made available shortly.

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. The Company’s non-IFRS figures exclude share-based payments and related social charges costs, any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition/investment related charges such as financing costs, advisory fees and integration costs and fair value changes on investments, charges as a result of the amortization of acquired intangibles, costs incurred in connection with a restructuring program or other organizational transformation activities planned and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

See more : Will the Stock Market Soar or Crash in 2025? Most Wall Street Analysts Share This Opinion.

Any statements about Temenos’ expectations, plans and prospects in this press release constitute forward-looking financial information and represent the Company’s current view and estimates as of January 14, 2025. We anticipate that subsequent events and developments may cause the Company’s views and estimates to change. Future events are inherently difficult to predict. Accordingly, actual results may differ materially from those indicated by any forward-looking statements as a result of a variety of factors. More information about factors that potentially could affect the Company’s financial results is included in its annual report available on the Company’s website.

Investor & Media Contacts

Investors

Adam Snyder

Head of Investor Relations, Temenos

Email: [email protected]

+44 207 423 3945

International media

Conor McClafferty

FGS Global on belhalf of Temenos

[email protected]

+44 7920 087 914

Swiss media

Martin Meier-Pfister

IRF on belhalf of Temenos

[email protected]

+41 43 244 81 40

Source link https://www.temenos.com/news/2025/01/13/temenos-announces-preliminary-q4-and-fy24-results-k5q11psn8/

Source: https://incomestatements.info

Category: News