See more : Marcopolo S.A. (POMO4.SA) Income Statement Analysis – Financial Results

Complete financial analysis of Teradyne, Inc. (TER) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Teradyne, Inc., a leading company in the Semiconductors industry within the Technology sector.

- Civitas Resources, Inc. (BCEI) Income Statement Analysis – Financial Results

- Geolocation Technology, Inc. (4018.F) Income Statement Analysis – Financial Results

- Archer Limited (ARHVF) Income Statement Analysis – Financial Results

- Svolder AB (publ) (SVOL-A.ST) Income Statement Analysis – Financial Results

- Sirios Resources Inc. (SIREF) Income Statement Analysis – Financial Results

Teradyne, Inc. (TER)

About Teradyne, Inc.

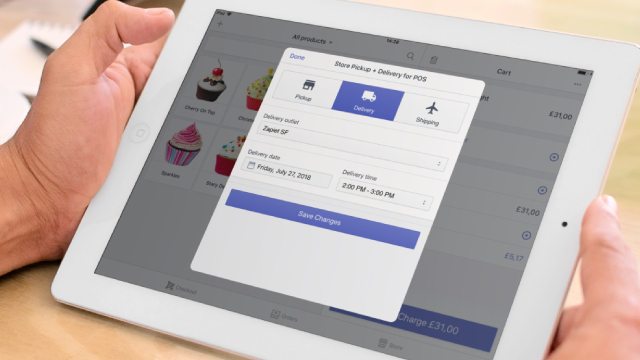

Teradyne, Inc. designs, develops, manufactures, sells, and supports automatic test equipment worldwide. The company operates through Semiconductor Test, System Test, Industrial Automation, and Wireless Test segments. The Semiconductor Test segment offers products and services for wafer level and device package testing in automotive, industrial, communications, consumer, smartphones, cloud computer and electronic game, and other applications. This segment also provides FLEX test platform systems; J750 test system to address the volume semiconductor devices; Magnum platform that tests memory devices, such as flash memory and DRAM; and ETS platform for semiconductor manufacturers, and assembly and test subcontractors in the analog/mixed signal markets. It serves integrated device manufacturers that integrate the fabrication of silicon wafers into their business; fabless companies that outsource the manufacturing of silicon wafers; foundries; and semiconductor assembly and test providers. The System Test segment offers defense/aerospace test instrumentation and systems; storage test systems; and circuit-board test and inspection systems. The Industrial Automation segment provides collaborative robotic arms, autonomous mobile robots, and advanced robotic control software for manufacturing, logistics, and light industrial customers. The Wireless Test segment provides test solutions for use in the development and manufacture of wireless devices and modules, smartphones, tablets, notebooks, laptops, peripherals, and Internet-of-Things devices under the LitePoint brand name. This segment also offers IQxel products for Wi-Fi and other standards; IQxstream solution for testing GSM, EDGE, CDMA2000, TD-SCDMA, WCDMA, HSPA+, LTE, and 5G technologies; IQcell, a multi-device cellular signaling test solution; IQgig test solution; and turnkey test software for wireless chipsets. Teradyne, Inc. was incorporated in 1960 and is headquartered in North Reading, Massachusetts.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.68B | 3.16B | 3.70B | 3.12B | 2.29B | 2.10B | 2.14B | 1.75B | 1.64B | 1.65B | 1.43B | 1.66B | 1.43B | 1.61B | 819.41M | 1.11B | 1.10B | 1.38B | 1.08B | 1.79B | 1.35B | 1.22B | 1.44B | 3.04B | 1.79B | 1.49B | 1.27B | 1.17B | 1.19B | 677.44M | 554.73M | 529.60M | 508.90M | 458.90M | 483.60M | 462.30M | 377.70M | 306.10M | 336.40M |

| Cost of Revenue | 1.14B | 1.29B | 1.50B | 1.34B | 955.14M | 880.41M | 912.73M | 793.68M | 723.94M | 769.02M | 619.13M | 770.71M | 715.37M | 735.90M | 507.77M | 608.85M | 588.85M | 716.39M | 663.46M | 1.07B | 953.97M | 989.57M | 1.18B | 1.67B | 1.05B | 947.17M | 734.37M | 724.62M | 646.38M | 378.93M | 314.60M | 277.10M | 259.80M | 248.10M | 241.20M | 235.10M | 200.70M | 152.30M | 164.60M |

| Gross Profit | 1.54B | 1.87B | 2.21B | 1.79B | 1.34B | 1.22B | 1.22B | 959.57M | 915.64M | 878.81M | 808.80M | 886.04M | 713.69M | 872.75M | 311.63M | 498.19M | 513.43M | 660.43M | 411.77M | 723.87M | 398.90M | 232.67M | 258.77M | 1.37B | 743.16M | 541.98M | 531.90M | 446.99M | 544.64M | 298.51M | 240.14M | 252.50M | 249.10M | 210.80M | 242.40M | 227.20M | 177.00M | 153.80M | 171.80M |

| Gross Profit Ratio | 57.42% | 59.18% | 59.59% | 57.21% | 58.38% | 58.09% | 57.28% | 54.73% | 55.85% | 53.33% | 56.64% | 53.48% | 49.94% | 54.25% | 38.03% | 45.00% | 46.58% | 47.97% | 38.30% | 40.40% | 29.49% | 19.04% | 17.96% | 45.15% | 41.50% | 36.40% | 42.01% | 38.15% | 45.73% | 44.06% | 43.29% | 47.68% | 48.95% | 45.94% | 50.12% | 49.15% | 46.86% | 50.25% | 51.07% |

| Research & Development | 418.09M | 440.59M | 427.61M | 374.96M | 322.82M | 301.51M | 305.67M | 291.03M | 292.25M | 291.64M | 264.06M | 251.38M | 195.60M | 197.02M | 164.84M | 216.46M | 204.34M | 208.70M | 223.02M | 262.00M | 254.60M | 293.92M | 288.66M | 300.92M | 228.57M | 195.16M | 162.50M | 143.93M | 123.49M | 70.44M | 62.36M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 571.43M | 558.10M | 547.56M | 464.77M | 437.08M | 390.67M | 348.29M | 315.68M | 306.31M | 319.71M | 279.56M | 281.50M | 233.71M | 230.10M | 200.43M | 247.79M | 250.84M | 289.01M | 252.81M | 268.58M | 249.46M | 290.38M | 270.08M | 362.56M | 256.39M | 212.89M | 194.10M | 180.27M | 176.80M | 129.94M | 126.51M | 189.50M | 188.50M | 196.90M | 190.90M | 178.10M | 176.60M | 136.70M | 128.70M |

| Other Expenses | 46.17M | 19.33M | 21.46M | 30.80M | 40.15M | -947.00K | -1.76M | -704.00K | 4.82M | -372.00K | 72.45M | 73.51M | 40.47M | 29.25M | 32.30M | 353.91M | 454.53M | 463.60M | 493.47M | -865.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -5.60M | 0.00 | 0.00 | 35.30M | 36.60M | 34.60M | 33.80M | 29.30M | 32.50M | 23.70M | 23.90M |

| Operating Expenses | 1.04B | 1.02B | 996.62M | 870.54M | 800.05M | 731.37M | 684.48M | 659.36M | 667.59M | 682.12M | 616.06M | 606.39M | 469.78M | 456.37M | 397.56M | 818.16M | 455.19M | 497.71M | 475.82M | 529.71M | 504.06M | 584.30M | 558.74M | 663.48M | 484.96M | 408.04M | 356.60M | 324.20M | 294.68M | 200.38M | 188.86M | 224.80M | 225.10M | 231.50M | 224.70M | 207.40M | 209.10M | 160.40M | 152.60M |

| Cost & Expenses | 2.18B | 2.31B | 2.49B | 2.21B | 1.76B | 1.61B | 1.60B | 1.45B | 1.39B | 1.45B | 1.24B | 1.38B | 1.19B | 1.19B | 905.34M | 1.43B | 1.04B | 1.21B | 1.14B | 1.60B | 1.46B | 1.57B | 1.74B | 2.33B | 1.53B | 1.36B | 1.09B | 1.05B | 941.07M | 579.31M | 503.46M | 501.90M | 484.90M | 479.60M | 465.90M | 442.50M | 409.80M | 312.70M | 317.20M |

| Interest Income | 27.35M | 8.45M | 2.63M | 5.98M | 24.79M | 26.70M | 17.81M | 4.96M | 10.16M | 6.26M | 11.26M | 4.09M | 6.62M | 8.10M | 3.42M | 12.56M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 3.81M | 3.72M | 39.77M | 27.39M | 12.88M | 6.00M | 5.62M | 4.96M | 10.16M | 1.05M | 11.26M | 21.39M | 17.08M | 18.96M | 20.22M | 14.24M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 110.89M | 110.10M | 112.53M | 110.92M | 120.66M | 113.22M | 108.08M | 120.01M | 140.77M | 152.54M | 150.69M | 142.80M | 113.32M | 99.76M | 32.30M | 94.76M | 67.50M | 73.54M | 91.17M | 124.31M | 152.49M | 159.69M | 138.67M | 101.86M | 86.39M | 76.30M | 59.15M | 50.90M | 43.15M | 35.30M | 34.54M | 35.30M | 36.60M | 34.60M | 33.80M | 29.30M | 32.50M | 23.70M | 23.90M |

| EBITDA | 640.50M | 954.20M | 1.29B | 1.04B | 650.40M | 603.75M | 647.99M | 68.09M | 390.44M | 355.80M | 342.85M | 433.73M | 353.93M | 514.31M | -20.58M | -290.13M | 147.43M | 315.00M | 27.26M | 273.35M | 47.32M | -191.94M | -161.30M | 812.63M | 344.58M | 210.24M | 234.45M | 173.70M | 293.10M | 133.43M | 85.82M | 63.00M | 60.60M | 13.90M | 51.50M | 49.10M | 400.00K | 17.10M | 43.10M |

| EBITDA Ratio | 23.93% | 30.97% | 36.07% | 33.38% | 28.78% | 28.67% | 30.30% | 44.51% | 24.02% | 21.19% | 24.20% | 25.50% | 25.00% | 32.08% | -6.55% | 15.58% | 12.70% | 14.68% | 4.16% | 17.88% | 8.98% | 1.03% | -8.08% | 26.70% | 19.24% | 14.12% | 18.52% | 14.83% | 25.08% | 19.70% | 15.47% | 11.42% | 11.63% | 3.27% | 10.03% | 13.35% | -0.48% | 4.31% | 9.81% |

| Operating Income | 501.07M | 831.94M | 1.21B | 928.41M | 553.65M | 473.80M | 530.03M | -60.02M | 242.97M | 96.42M | 190.66M | 287.37M | 235.71M | 413.47M | -122.42M | -384.35M | 42.21M | 196.83M | -81.70M | 188.80M | -176.45M | -555.81M | -352.85M | 710.77M | 258.20M | 133.93M | 175.30M | 122.80M | 244.36M | 98.13M | 51.27M | 27.70M | 24.00M | -20.70M | 17.70M | 19.80M | -32.10M | -6.60M | 19.20M |

| Operating Income Ratio | 18.72% | 26.37% | 32.64% | 29.74% | 24.12% | 22.55% | 24.81% | -3.42% | 14.82% | 5.85% | 13.35% | 17.35% | 16.49% | 25.70% | -14.94% | -34.72% | 3.83% | 14.30% | -7.60% | 10.54% | -13.04% | -45.47% | -24.49% | 23.35% | 14.42% | 8.99% | 13.84% | 10.48% | 20.52% | 14.49% | 9.24% | 5.23% | 4.72% | -4.51% | 3.66% | 4.28% | -8.50% | -2.16% | 5.71% |

| Total Other Income/Expenses | 24.50M | 8.45M | -39.77M | -27.39M | -27.88M | -6.00M | -5.62M | 7.91M | 10.16M | -1.05M | 11.26M | -19.69M | -17.08M | -18.96M | -20.22M | -1.68M | 37.04M | 33.56M | 1.56M | -34.34M | -9.74M | -5.14M | 26.69M | 28.88M | 15.65M | 11.95M | 18.04M | 16.87M | 5.57M | 4.68M | 26.00K | -1.70M | -3.70M | -7.10M | -3.70M | -19.70M | -1.10M | 3.90M | 8.40M |

| Income Before Tax | 525.57M | 840.39M | 1.17B | 901.02M | 540.77M | 467.80M | 524.41M | -55.06M | 253.12M | 95.38M | 201.92M | 265.98M | 218.64M | 394.51M | -142.64M | -386.03M | 79.24M | 230.40M | -80.14M | 187.97M | -186.19M | -560.95M | -326.15M | 739.65M | 273.85M | 145.88M | 193.35M | 139.66M | 249.93M | 102.81M | 51.32M | 26.00M | 20.30M | -27.80M | 14.00M | 100.00K | -33.20M | -2.70M | 27.60M |

| Income Before Tax Ratio | 19.64% | 26.64% | 31.57% | 28.87% | 23.56% | 22.27% | 24.54% | -3.14% | 15.44% | 5.79% | 14.14% | 16.05% | 15.30% | 24.52% | -17.41% | -34.87% | 7.19% | 16.73% | -7.45% | 10.49% | -13.76% | -45.89% | -22.64% | 24.30% | 15.29% | 9.80% | 15.27% | 11.92% | 20.98% | 15.18% | 9.25% | 4.91% | 3.99% | -6.06% | 2.89% | 0.02% | -8.79% | -0.88% | 8.20% |

| Income Tax Expense | 76.82M | 124.88M | 148.12M | 116.87M | 61.60M | 16.02M | 266.72M | -11.64M | 46.65M | 14.10M | 36.98M | 48.93M | -119.20M | 14.78M | -8.80M | 12.58M | 7.36M | 27.75M | -19.68M | 22.74M | 7.80M | 157.52M | -123.94M | 221.89M | 82.16M | 43.77M | 65.74M | 46.09M | 90.64M | 31.87M | 15.40M | 3.50M | 2.00M | -6.50M | 3.80M | 3.40M | -11.70M | -2.90M | 7.40M |

| Net Income | 448.75M | 715.50M | 1.01B | 784.15M | 479.18M | 451.78M | 257.69M | -43.42M | 206.48M | 81.27M | 164.95M | 217.05M | 363.75M | 379.73M | -133.84M | -397.83M | 77.71M | 198.76M | 90.65M | 165.24M | -193.99M | -718.47M | -202.22M | 453.62M | 191.69M | 102.12M | 127.61M | 93.57M | 159.28M | 70.94M | 35.19M | 22.50M | 18.30M | -21.30M | 10.20M | -3.30M | -21.50M | 200.00K | 20.20M |

| Net Income Ratio | 16.77% | 22.68% | 27.40% | 25.12% | 20.88% | 21.51% | 12.06% | -2.48% | 12.59% | 4.93% | 11.55% | 13.10% | 25.45% | 23.61% | -16.33% | -35.94% | 7.05% | 14.44% | 8.43% | 9.22% | -14.34% | -58.78% | -14.04% | 14.90% | 10.70% | 6.86% | 10.08% | 7.99% | 13.37% | 10.47% | 6.34% | 4.25% | 3.60% | -4.64% | 2.11% | -0.71% | -5.69% | 0.07% | 6.00% |

| EPS | 2.91 | 4.52 | 6.15 | 4.72 | 2.74 | 2.41 | 1.30 | -0.21 | 0.98 | 0.40 | 0.86 | 1.16 | 1.97 | 2.11 | -0.77 | -2.33 | 0.42 | 1.02 | 0.46 | 0.85 | -1.03 | -3.93 | -1.15 | 2.62 | 1.12 | 0.31 | 0.38 | 0.55 | 0.95 | 0.48 | 0.06 | 0.04 | 0.04 | -0.18 | 0.02 | -0.03 | -0.22 | 0.00 | 0.06 |

| EPS Diluted | 2.73 | 4.22 | 5.53 | 4.28 | 2.60 | 2.35 | 1.28 | -0.21 | 0.97 | 0.37 | 0.70 | 0.94 | 1.60 | 1.73 | -0.77 | -2.33 | 0.42 | 1.01 | 0.46 | 0.84 | -1.03 | -3.93 | -1.15 | 2.51 | 1.07 | 0.30 | 0.37 | 0.55 | 0.95 | 0.48 | 0.06 | 0.04 | 0.04 | -0.18 | 0.02 | -0.03 | -0.22 | 0.00 | 0.06 |

| Weighted Avg Shares Out | 154.31M | 158.43M | 164.96M | 166.12M | 170.43M | 187.67M | 198.07M | 202.58M | 211.54M | 202.91M | 190.77M | 186.88M | 184.68M | 179.92M | 173.60M | 170.59M | 184.02M | 194.73M | 196.28M | 194.40M | 188.34M | 182.82M | 175.83M | 173.31M | 170.52M | 335.29M | 345.38M | 170.12M | 168.51M | 148.38M | 142.75M | 132.18M | 125.30M | 118.66M | 117.01M | 115.10M | 96.65M | 80.00M | 91.01M |

| Weighted Avg Shares Out (Dil) | 164.30M | 169.73M | 183.63M | 183.04M | 179.46M | 192.61M | 201.64M | 202.58M | 213.32M | 222.55M | 235.60M | 230.25M | 226.82M | 226.81M | 173.60M | 170.59M | 185.37M | 204.41M | 196.28M | 196.71M | 188.34M | 182.82M | 175.83M | 181.01M | 178.55M | 343.86M | 345.38M | 339.89M | 309.01M | 591.81M | 142.75M | 132.18M | 125.30M | 118.66M | 117.01M | 115.10M | 96.65M | 80.00M | 91.01M |

Teradyne: How To Get Better Protection With Still Some Unlimited Upside

Cathie Wood Goes Bargain Hunting: 3 Stocks She Just Bought

New Mobile Collaborative Robot Combines High-Payload Autonomous Mobility and Precision Robotics Arm to Drive Industrial Automation to New Heights

Teradyne Declares Quarterly Cash Dividend and Increases Share Repurchase Plan for 2024

Teradyne: Attractive After Earnings

Unlocking Teradyne (TER) International Revenues: Trends, Surprises, and Prospects

Teradyne (TER) Reports Q3 Earnings: What Key Metrics Have to Say

Teradyne Beats Q3 Earnings Estimates: Will Raised View Aid Shares?

Teradyne, Inc. (TER) Q3 2024 Earnings Call Transcript

Teradyne (TER) Tops Q3 Earnings and Revenue Estimates

Source: https://incomestatements.info

Category: Stock Reports