See more : Stove Kraft Limited (STOVEKRAFT.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Tredegar Corporation (TG) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Tredegar Corporation, a leading company in the Manufacturing – Metal Fabrication industry within the Industrials sector.

- Grasim Industries Limited (GRSXY) Income Statement Analysis – Financial Results

- Integrated Research Limited (IRI.AX) Income Statement Analysis – Financial Results

- Black Iron Inc. (BKI.TO) Income Statement Analysis – Financial Results

- Shenzhen Breo Technology Co., Ltd. (688793.SS) Income Statement Analysis – Financial Results

- Silvair, Inc. (SVRS.WA) Income Statement Analysis – Financial Results

Tredegar Corporation (TG)

About Tredegar Corporation

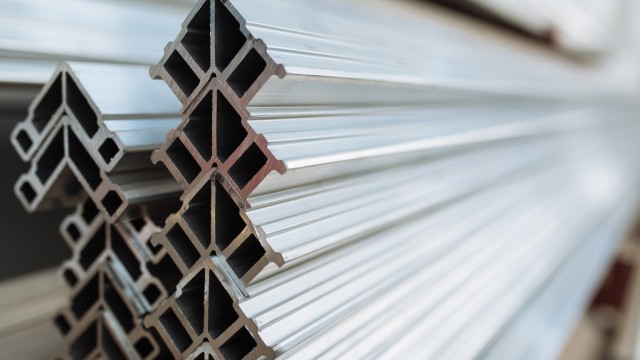

Tredegar Corporation, through its subsidiaries, manufactures and sells aluminum extrusions, polyethylene (PE) films, and polyester films in the United States and internationally. It operates through three segments: Aluminum Extrusions, PE Films, and Flexible Packaging Films. The Aluminum Extrusions segment produces soft-alloy and medium-strength custom fabricated and finished aluminum extrusions for the building and construction, automotive and transportation, consumer durables, machinery and equipment, electrical and renewable energy, and distribution markets; and manufactures mill, anodized, and painted and fabricated aluminum extrusions to fabricators and distributors. The PE Films segment offers single- and multi-layer surface protection films for protecting components of flat panel displays that are used in televisions, monitors, notebooks, smart phones, tablets, e-readers, and digital signage under the UltraMask, ForceField, ForceField PEARL, and Pearl A brands. This segment also provides thin-gauge films as overwrap for bathroom tissue and paper towels, as well as polyethylene overwrap films and films for other markets. The Flexible Packaging Films segment offers polyester-based films for food packaging and industrial applications under the Terphane, Ecophane, and Sealphane brands. Tredegar Corporation was founded in 1955 and is headquartered in Richmond, Virginia.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 704.83M | 938.56M | 826.46M | 755.29M | 972.36M | 1.07B | 961.33M | 828.34M | 896.18M | 951.83M | 959.35M | 882.19M | 800.82M | 739.54M | 657.08M | 894.24M | 924.37M | 1.12B | 956.97M | 876.77M | 746.50M | 737.41M | 767.57M | 869.25M | 820.40M | 699.80M | 581.00M | 523.60M | 589.50M | 502.20M | 449.20M | 479.00M | 474.00M | 547.50M | 637.90M | 624.50M |

| Cost of Revenue | 626.04M | 799.02M | 677.92M | 584.65M | 803.57M | 885.78M | 809.31M | 697.70M | 755.30M | 806.91M | 813.30M | 737.51M | 655.09M | 596.33M | 516.93M | 739.72M | 761.51M | 972.94M | 835.31M | 717.12M | 606.24M | 582.66M | 620.78M | 674.86M | 620.00M | 530.90M | 439.40M | 396.90M | 466.70M | 395.00M | 353.50M | 367.90M | 367.40M | 448.30M | 522.50M | 505.80M |

| Gross Profit | 78.78M | 139.54M | 148.53M | 170.64M | 168.78M | 179.69M | 152.02M | 130.65M | 140.88M | 144.92M | 146.05M | 144.68M | 145.73M | 143.21M | 140.14M | 154.52M | 162.86M | 143.59M | 121.66M | 159.65M | 140.26M | 154.75M | 146.79M | 194.40M | 200.40M | 168.90M | 141.60M | 126.70M | 122.80M | 107.20M | 95.70M | 111.10M | 106.60M | 99.20M | 115.40M | 118.70M |

| Gross Profit Ratio | 11.18% | 14.87% | 17.97% | 22.59% | 17.36% | 16.86% | 15.81% | 15.77% | 15.72% | 15.23% | 15.22% | 16.40% | 18.20% | 19.36% | 21.33% | 17.28% | 17.62% | 12.86% | 12.71% | 18.21% | 18.79% | 20.99% | 19.12% | 22.36% | 24.43% | 24.14% | 24.37% | 24.20% | 20.83% | 21.35% | 21.30% | 23.19% | 22.49% | 18.12% | 18.09% | 19.01% |

| Research & Development | 3.76M | 6.21M | 6.35M | 8.40M | 19.64M | 18.71M | 18.29M | 19.12M | 16.17M | 12.15M | 12.67M | 13.16M | 13.22M | 13.63M | 11.86M | 11.01M | 8.35M | 8.09M | 8.98M | 15.27M | 18.77M | 20.35M | 32.89M | 27.59M | 22.30M | 14.50M | 13.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 89.05M | 99.57M | 95.47M | 107.36M | 123.63M | 114.40M | 103.79M | 94.88M | 88.08M | 81.67M | 83.86M | 86.88M | 0.00 | 82.24M | 72.34M | 69.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 52.11M | 52.94M | 47.40M | 39.50M | 37.00M | 50.80M | 57.00M | 56.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 85.28M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 24.85M | 0.00 | 17.81M | 16.09M | 20.78M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 89.05M | 99.57M | 95.47M | 107.36M | 123.63M | 114.40M | 103.79M | 94.88M | 88.08M | 81.67M | 83.86M | 86.88M | 87.38M | 100.05M | 88.42M | 90.49M | 88.31M | 68.36M | 64.72M | 82.43M | 71.90M | 57.85M | 52.11M | 52.94M | 47.40M | 39.50M | 37.00M | 50.80M | 57.00M | 56.30M | 57.10M | 56.60M | 58.00M | 103.40M | 58.00M | 47.00M |

| Other Expenses | 0.00 | -3.69M | -4.64M | -5.38M | -6.04M | 30.46M | 51.71M | 2.38M | -20.11M | -6.70M | 1.78M | 18.12M | 1.40M | -30.97M | -27.82M | 123.00K | 149.00K | 149.00K | 299.00K | 330.00K | 268.00K | 100.00K | 4.91M | 36.98M | 31.70M | 22.50M | 18.50M | 20.30M | 23.80M | 24.80M | 25.80M | 23.90M | 31.20M | 28.50M | 28.40M | 27.60M |

| Operating Expenses | 79.97M | 102.09M | 97.18M | 110.38M | 137.23M | 118.37M | 109.99M | 98.85M | 92.16M | 87.07M | 90.61M | 92.69M | 102.00M | 100.51M | 88.54M | 90.61M | 96.81M | 76.60M | 74.00M | 98.02M | 90.94M | 78.29M | 89.91M | 117.51M | 101.40M | 76.50M | 68.70M | 71.10M | 80.80M | 81.10M | 82.90M | 80.50M | 89.20M | 131.90M | 86.40M | 74.60M |

| Cost & Expenses | 716.86M | 901.12M | 775.10M | 695.03M | 940.81M | 1.00B | 919.30M | 796.55M | 847.45M | 893.97M | 903.91M | 830.19M | 757.09M | 696.84M | 605.48M | 830.33M | 858.32M | 1.05B | 909.32M | 815.14M | 697.18M | 660.95M | 710.69M | 792.37M | 721.40M | 607.40M | 508.10M | 468.00M | 547.50M | 476.10M | 436.40M | 448.40M | 456.60M | 580.20M | 608.90M | 580.40M |

| Interest Income | 0.00 | 1.41M | 3.09M | 2.59M | 13.55M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.01M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 11.61M | 4.99M | 3.39M | 2.59M | 4.05M | 5.70M | 6.17M | 3.81M | 3.50M | 2.71M | 2.87M | 3.59M | 1.93M | 1.14M | 783.00K | 2.39M | 2.72M | 5.52M | 4.57M | 3.17M | 6.79M | 9.35M | 12.67M | 17.32M | 0.00 | 1.30M | 0.00 | 2.20M | 3.00M | 4.00M | 5.00M | 6.30M | 8.30M | 8.10M | 4.50M | 0.00 |

| Depreciation & Amortization | -102.59M | 28.50M | 25.87M | 34.71M | 46.87M | 33.80M | 40.28M | 32.47M | 34.98M | 40.82M | 44.66M | 49.27M | 44.74M | 43.59M | 40.00M | 43.19M | 46.04M | 44.28M | 38.79M | 34.42M | 32.62M | 31.93M | 37.91M | 36.98M | 31.70M | 22.50M | 18.50M | 20.30M | 23.80M | 24.80M | 25.80M | 23.90M | 31.20M | 28.50M | 28.40M | 27.60M |

| EBITDA | -118.52M | 66.33M | 96.48M | 12.25M | 122.93M | 92.02M | 31.54M | 63.96M | 15.28M | 99.57M | 101.99M | 84.36M | 86.55M | 85.51M | 58.09M | 94.71M | 108.06M | 108.64M | 69.56M | 80.44M | 81.94M | 114.53M | 111.25M | 119.46M | 130.70M | 114.90M | 91.40M | 75.90M | 65.80M | 50.90M | 38.60M | 54.50M | 48.60M | -4.20M | 57.40M | 71.70M |

| EBITDA Ratio | -16.82% | 6.90% | 11.56% | 3.30% | 11.38% | 11.79% | 13.94% | 8.05% | 7.10% | 9.66% | 10.62% | 13.53% | 11.05% | 11.67% | 13.94% | 11.98% | 12.80% | 10.57% | 12.50% | 14.42% | 11.74% | 22.24% | 18.91% | 2.54% | 17.47% | 15.82% | 12.41% | 11.52% | 11.26% | 13.48% | 8.77% | 11.13% | 10.30% | -0.95% | 8.50% | 9.03% |

| Operating Income | -15.93M | 38.38M | 71.73M | -7.04M | 66.35M | 61.32M | 93.75M | 34.17M | 28.61M | 51.16M | 57.21M | 70.12M | 41.82M | 42.69M | 51.60M | 63.91M | 62.02M | 62.91M | 31.32M | 38.65M | 36.83M | 78.72M | 40.92M | 53.66M | 94.90M | 92.50M | 72.90M | 55.60M | 42.00M | 26.10M | 12.80M | 30.60M | 17.40M | -32.70M | 29.00M | 44.10M |

| Operating Income Ratio | -2.26% | 4.09% | 8.68% | -0.93% | 6.82% | 5.75% | 9.75% | 4.13% | 3.19% | 5.37% | 5.96% | 7.95% | 5.22% | 5.77% | 7.85% | 7.15% | 6.71% | 5.63% | 3.27% | 4.41% | 4.93% | 10.68% | 5.33% | 6.17% | 11.57% | 13.22% | 12.55% | 10.62% | 7.12% | 5.20% | 2.85% | 6.39% | 3.67% | -5.97% | 4.55% | 7.06% |

| Total Other Income/Expenses | -144.10M | -4.60M | -4.51M | -8.21M | 5.66M | -24.95M | -76.54M | -4.11M | -82.10M | -18.73M | -4.99M | 5.91M | -3.03M | -2.20M | -34.29M | -14.78M | -6.75M | -9.92M | -5.12M | 9.22M | -6.79M | -75.65M | -47.53M | 115.30M | -13.40M | 2.80M | 17.20M | 13.40M | -3.60M | -20.80M | -5.90M | -5.10M | -8.60M | -7.10M | -1.30M | 15.20M |

| Income Before Tax | -160.03M | 32.77M | 67.22M | -25.05M | 58.17M | 36.37M | -14.91M | 27.68M | -23.21M | 45.42M | 52.93M | 61.50M | 39.89M | 40.78M | 17.31M | 49.13M | 59.30M | 58.84M | 26.20M | 35.48M | 30.04M | 9.21M | 9.85M | 174.55M | 81.50M | 95.30M | 90.10M | 69.00M | 38.40M | 5.30M | 6.90M | 25.50M | 8.80M | -39.80M | 27.70M | 59.30M |

| Income Before Tax Ratio | -22.70% | 3.49% | 8.13% | -3.32% | 5.98% | 3.41% | -1.55% | 3.34% | -2.59% | 4.77% | 5.52% | 6.97% | 4.98% | 5.51% | 2.63% | 5.49% | 6.41% | 5.27% | 2.74% | 4.05% | 4.02% | 1.25% | 1.28% | 20.08% | 9.93% | 13.62% | 15.51% | 13.18% | 6.51% | 1.06% | 1.54% | 5.32% | 1.86% | -7.27% | 4.34% | 9.50% |

| Income Tax Expense | -54.13M | 4.39M | 9.28M | -8.21M | 9.91M | 11.53M | -53.16M | 3.22M | 8.93M | 9.39M | 17.00M | 18.32M | 10.65M | 13.76M | 18.66M | 19.49M | 24.37M | 20.64M | 9.97M | 9.22M | 10.72M | 3.02M | 1.49M | 63.17M | 28.90M | 31.10M | 31.70M | 24.00M | 14.30M | 3.90M | 3.20M | 10.20M | 3.20M | -15.10M | 10.40M | 22.60M |

| Net Income | -105.91M | 28.46M | 57.83M | -16.83M | 48.26M | 24.84M | 38.25M | 24.47M | -32.14M | 36.88M | 21.95M | 28.25M | 24.86M | 27.03M | -1.35M | 28.94M | 15.25M | 38.20M | 16.23M | 29.18M | -26.35M | -2.53M | 9.75M | 111.38M | 52.60M | 68.90M | 58.40M | 45.00M | 24.10M | 38.60M | 9.60M | 15.30M | 5.60M | -24.70M | 17.30M | 36.70M |

| Net Income Ratio | -15.03% | 3.03% | 7.00% | -2.23% | 4.96% | 2.33% | 3.98% | 2.95% | -3.59% | 3.87% | 2.29% | 3.20% | 3.10% | 3.65% | -0.21% | 3.24% | 1.65% | 3.42% | 1.70% | 3.33% | -3.53% | -0.34% | 1.27% | 12.81% | 6.41% | 9.85% | 10.05% | 8.59% | 4.09% | 7.69% | 2.14% | 3.19% | 1.18% | -4.51% | 2.71% | 5.88% |

| EPS | -3.10 | 0.84 | 1.72 | -0.50 | 1.45 | 0.75 | 1.16 | 0.75 | -0.99 | 1.14 | 0.68 | 0.88 | 0.77 | 0.84 | -0.04 | 0.85 | 0.40 | 0.99 | 0.42 | 0.76 | -0.69 | -0.07 | 0.26 | 2.92 | 1.40 | 1.88 | 0.49 | 0.41 | 0.40 | 0.83 | 0.04 | 0.07 | 0.02 | -0.50 | 0.07 | 0.15 |

| EPS Diluted | -3.10 | 0.84 | 1.72 | -0.50 | 1.45 | 0.75 | 1.16 | 0.75 | -0.99 | 1.13 | 0.67 | 0.88 | 0.77 | 0.83 | -0.04 | 0.85 | 0.39 | 0.98 | 0.42 | 0.76 | -0.69 | -0.07 | 0.25 | 2.86 | 1.36 | 1.78 | 0.49 | 0.38 | 0.40 | 0.83 | 0.04 | 0.07 | 0.02 | -0.50 | 0.07 | 0.15 |

| Weighted Avg Shares Out | 34.13M | 33.81M | 33.56M | 33.40M | 33.24M | 33.07M | 32.95M | 32.76M | 32.46M | 32.30M | 32.17M | 32.03M | 31.93M | 32.29M | 33.86M | 33.98M | 34.77M | 38.59M | 38.64M | 38.26M | 38.19M | 36.16M | 38.06M | 37.86M | 37.06M | 36.22M | 37.15M | 36.75M | 36.57M | 46.57M | 49.05M | 49.05M | 49.05M | 49.05M | 53.11M | 54.48M |

| Weighted Avg Shares Out (Dil) | 34.13M | 33.83M | 33.67M | 33.40M | 33.26M | 33.09M | 32.95M | 32.78M | 32.58M | 32.55M | 32.60M | 32.19M | 32.21M | 32.57M | 33.86M | 34.19M | 39.10M | 38.98M | 38.64M | 38.40M | 38.19M | 36.16M | 39.01M | 38.94M | 38.68M | 38.71M | 37.15M | 36.75M | 36.57M | 46.57M | 49.05M | 49.05M | 49.05M | 49.05M | 53.11M | 54.48M |

Bonnell Aluminum Commenting on Preliminary Dumping Determinations

Tredegar Will Host Virtual Annual Meeting of Shareholders; Announces Schedule for First-Quarter Earnings

Tredegar Reports Fourth Quarter and Full Year 2023 Results

Tredegar Plans to Release Fourth Quarter 2023 Financial Results on March 15, 2024

Bonnell Aluminum Commenting on Preliminary Countervailing Duty Ruling

Tredegar: A Corporate Restructuring And Downcycle Mask A Great Opportunity

3 Underperforming Aluminum Stocks You Better Not Be Buying

Tredegar Reports Third Quarter 2023 Results

Tredegar: A Brighter Future But Not A Value Buy Yet

Bonnell Aluminum Commenting on Recent Trade Filing from Aluminum Extruders Coalition and United Steelworkers Union

Source: https://incomestatements.info

Category: Stock Reports