See more : Guangzhou R&F Properties Co., Ltd. (GZUHF) Income Statement Analysis – Financial Results

Complete financial analysis of Tiziana Life Sciences Ltd (TLSA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Tiziana Life Sciences Ltd, a leading company in the Biotechnology industry within the Healthcare sector.

- NAOS Small Cap Opportunities Company Limited (NSC.AX) Income Statement Analysis – Financial Results

- Aurora Design Public Company Limited (AURA.BK) Income Statement Analysis – Financial Results

- Wing Tai Properties Limited (0369.HK) Income Statement Analysis – Financial Results

- St. Modwen Properties Limited (1IG.F) Income Statement Analysis – Financial Results

- LiveRamp Holdings, Inc. (RAMP) Income Statement Analysis – Financial Results

Tiziana Life Sciences Ltd (TLSA)

About Tiziana Life Sciences Ltd

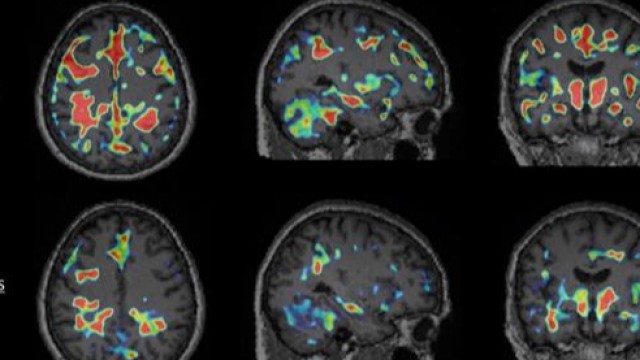

Tiziana Life Sciences Ltd, a biotechnology company, focuses on the discovery and development of molecules to treat human diseases in oncology and immunology. The company's lead product candidate in immunology is Foralumab (TZLS-401), a human anti-CD3 monoclonal antibody (mAb) for the treatment of Crohn's, graft versus host, ulcerative colitis, multiple sclerosis, type-1 diabetes, inflammatory bowel, psoriasis, and rheumatoid arthritis diseases. It also develops Milciclib (TZLS-201), a small molecule inhibitor of various cyclin-dependent kinases, tropomycin receptor kinases, and Src family kinases controlling cell growth and malignant progression of cancer; and anti-Interleukin 6 receptor (IL6R) mAb (TZLS-501), a fully human monoclonal antibody for the treatment of IL6-induced inflammation and to treat COVID-19 patients. The company was incorporated in 1998 and is headquatered in London, the United Kingdom.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.00K | 0.00 | -82.00K | 0.00 | 56.00K | 92.00K | 64.00K | 405.00K | 116.00K | 99.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 11.00K | 20.00K | 24.00K | 209.00K | 40.00K | 45.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.00K | 0.00 | -82.00K | 0.00 | 45.00K | 72.00K | 40.00K | 196.00K | 76.00K | 54.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 100.00% | 0.00% | 100.00% | 0.00% | 80.36% | 78.26% | 62.50% | 48.40% | 65.52% | 54.55% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 8.11M | 12.96M | 13.21M | 5.99M | 2.91M | 4.34M | 4.67M | 2.96M | 6.29M | 794.00K | 0.00 | 0.00 | 0.00 | 0.00 | 80.00K | 412.00K | 737.00K | 826.00K | 745.00K | 457.00K | 326.00K | 580.00K | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 855.00K | 13.21M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 286.00K | 458.00K | 207.00K | 0.00 | 719.00K | 1.18M | 1.53M | 1.67M | 0.00 | 0.00 | 0.00 | 1.29M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 0.00 | 0.00 | 855.00K | 13.21M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 286.00K | 458.00K | 207.00K | 0.00 | 719.00K | 1.18M | 1.53M | 1.67M | 0.00 | 0.00 | 0.00 | 1.29M | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 9.87M | 1.63M | 13.31M | 8.82M | 4.86M | 3.48M | 3.57M | 4.33M | 2.33M | 1.97M | 0.00 | 0.00 | 82.00K | -3.03M | -9.00K | -2.00K | 63.00K | 0.00 | 1.50M | 1.06M | 218.00K | 451.00K | 2.42M | 2.43M | 488.00K | 199.00K |

| Operating Expenses | 17.98M | 14.59M | 27.37M | 30.04M | 7.77M | 7.82M | 8.25M | 7.29M | 8.61M | 2.76M | 286.00K | 458.00K | 289.00K | -3.03M | 790.00K | 1.59M | 2.33M | 2.50M | 2.24M | 1.52M | 544.00K | 2.32M | 2.42M | 2.43M | 488.00K | 199.00K |

| Cost & Expenses | 17.98M | 14.59M | 27.37M | 28.03M | 7.77M | 7.82M | 8.25M | 7.29M | 8.61M | 2.76M | 286.00K | 458.00K | 289.00K | -3.03M | 801.00K | 1.61M | 2.35M | 2.71M | 2.28M | 1.57M | 544.00K | 2.32M | 2.42M | 2.43M | 488.00K | 199.00K |

| Interest Income | 1.15M | 0.00 | 0.00 | 8.00K | 1.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 10.00K | 56.00K | 36.00K | 47.00K | 47.00K | 10.00K | 22.00K | 79.00K | 157.00K | 8.00K | 1.00K |

| Interest Expense | 10.00K | 7.00K | 176.00K | 320.00K | 73.00K | 9.46K | 9.00K | 9.00K | 18.00K | 14.00K | 0.00 | 0.00 | 0.00 | 0.00 | 4.00K | 3.00K | 5.00K | 8.00K | 10.00K | 5.00K | 8.00K | 2.00K | 4.00K | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 96.00K | 51.00K | 141.00K | 89.76K | 198.00K | 12.61K | 11.00K | 8.00K | 0.00 | -794.00K | 3.00K | -195.00K | -489.00K | 0.00 | 238.00K | 300.00K | 59.00K | 133.00K | 33.00K | 20.00K | 32.00K | 21.00K | 20.00K | 25.00K | 1.00K | 1.00K |

| EBITDA | -17.14M | -15.34M | -26.34M | -27.93M | -7.58M | -7.81M | -8.24M | -7.28M | -8.61M | -3.56M | -283.00K | -653.00K | -778.00K | -3.03M | -516.00K | -1.24M | -2.49M | -2.15M | -2.18M | -1.48M | -1.95M | -2.35M | -2.39M | -2.33M | -553.00K | -271.00K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -9,433.33% | 0.00% | 948.78% | 0.00% | -921.43% | -1,348.91% | -3,890.63% | -531.60% | -1,879.31% | -1,491.92% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -17.98M | -14.59M | -27.37M | -28.03M | -7.77M | -7.82M | -8.25M | -7.29M | -8.61M | -2.76M | -286.00K | -458.00K | -289.00K | -3.03M | -754.00K | -1.54M | -2.55M | -2.29M | -2.21M | -1.50M | -1.98M | -2.37M | -2.41M | -2.35M | -554.00K | -272.00K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -9,533.33% | 0.00% | 352.44% | 0.00% | -1,346.43% | -1,675.00% | -3,982.81% | -564.44% | -1,907.76% | -1,512.12% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | 742.00K | -811.00K | 717.00K | -312.00K | -73.00K | -8.67K | -9.00K | -9.00K | -18.00K | -808.00K | 3.00K | -195.00K | 0.00 | 0.00 | -4.00K | 31.00K | -37.00K | -8.00K | -10.00K | -5.00K | -8.00K | -2.00K | -4.00K | 0.00 | 0.00 | 0.00 |

| Income Before Tax | -17.24M | -15.40M | -26.66M | -28.34M | -7.85M | -7.83M | -8.26M | -7.30M | -8.63M | -3.57M | -283.00K | -653.00K | -289.00K | 0.00 | -758.00K | -1.51M | -2.59M | -2.29M | -2.22M | -1.50M | -1.99M | -2.37M | -2.41M | -2.35M | -554.00K | -272.00K |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -9,433.33% | 0.00% | 352.44% | 0.00% | -1,353.57% | -1,641.30% | -4,040.63% | -566.42% | -1,916.38% | -1,517.17% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 449.00K | 0.00 | -3.24M | -2.21M | -540.00K | -1.53M | -1.49M | -89.00K | 0.00 | -60.00K | -3.00K | 195.00K | 489.00K | 3.03M | -28.00K | -81.00K | -169.00K | -118.00K | -82.00K | -114.00K | -30.00K | -65.00K | -89.00K | -83.00K | 0.00 | 0.00 |

| Net Income | -17.69M | -15.40M | -23.42M | -26.13M | -7.31M | -6.30M | -6.77M | -7.21M | -8.63M | -3.51M | -280.00K | -848.00K | -778.00K | -3.03M | -730.00K | -1.43M | -2.42M | -2.18M | -2.14M | -1.39M | -1.96M | -2.31M | -2.33M | -2.27M | -554.00K | -272.00K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -9,333.33% | 0.00% | 948.78% | 0.00% | -1,303.57% | -1,553.26% | -3,776.56% | -537.28% | -1,845.69% | -1,402.02% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | 0.00 | -0.15 | -0.24 | -0.27 | -0.05 | -0.10 | -0.13 | -0.15 | -0.19 | -0.31 | 0.00 | 0.00 | 0.00 | -0.10 | -0.05 | -0.24 | -0.52 | -0.01 | -0.01 | -0.01 | -0.02 | -0.06 | -0.09 | -0.09 | -0.02 | -0.01 |

| EPS Diluted | 0.00 | -0.15 | -0.24 | -0.27 | -0.05 | -0.10 | -0.13 | -0.15 | -0.19 | -0.31 | 0.00 | 0.00 | 0.00 | -0.10 | -0.05 | -0.24 | -0.52 | -0.01 | -0.01 | -0.01 | -0.02 | -0.06 | -0.09 | -0.09 | -0.02 | -0.01 |

| Weighted Avg Shares Out | 0.00 | 101.53M | 97.93M | 97.31M | 136.48M | 63.78M | 53.20M | 46.80M | 45.62M | 11.43M | 273.43M | 214.38M | 179.12M | 31.08M | 13.67M | 5.96M | 4.64M | 297.60M | 191.67M | 140.37M | 100.40M | 37.75M | 25.07M | 24.09M | 25.77M | 25.77M |

| Weighted Avg Shares Out (Dil) | 0.00 | 101.53M | 97.93M | 97.31M | 136.48M | 63.78M | 53.20M | 46.80M | 45.62M | 11.43M | 273.43M | 214.38M | 179.12M | 31.08M | 13.67M | 5.96M | 4.64M | 297.60M | 191.67M | 140.37M | 100.40M | 37.75M | 25.07M | 24.09M | 25.77M | 25.77M |

Tiziana Life Sciences Promotes Matthew W. Davis, MD, RPh to Chief Operating Officer

Tiziana Life Sciences finds promising indicator of MS treatment success

Tiziana Life Sciences Announces Reduction in Microglial Activation in a Total of 5 Out of 6 Intranasal Foralumab Expanded Access Patients with Non-Active Secondary Progressive Multiple Sclerosis

Tiziana Life Sciences to Host KOL Webinar on Foralumab in Non-Active Secondary Progressive Multiple Sclerosis (SPMS)

Tiziana Life Sciences Announces Participation on the Webull Corporate Communications Service Platform

Tiziana Life Sciences Announces Chief Medical Officer Invited to Give Presentation on Intranasal Foralumab on May 17

Tiziana shares positive findings on intranasal foralumab in treating intracerebral hemorrhage

Tiziana Life Sciences Announces Findings from Intranasal Anti-CD3 mAb Treatment in Intracerebral Hemorrhage at the Annual American Academy of Neurology Conference

Tiziana Life Sciences provides update on development pipeline

Tiziana Life Sciences Ltd Reports Annual Results for the Twelve Months Ended December 31, 2022, and Corporate Update

Source: https://incomestatements.info

Category: Stock Reports