See more : Sun Rise E&T Corporation (1343.TWO) Income Statement Analysis – Financial Results

Complete financial analysis of TeamViewer AG (TMVWY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of TeamViewer AG, a leading company in the Software – Application industry within the Technology sector.

- Fuji Oil Holdings Inc. (FJLLF) Income Statement Analysis – Financial Results

- Founder Holdings Limited (0418.HK) Income Statement Analysis – Financial Results

- EJF Acquisition Corp. (EJFA) Income Statement Analysis – Financial Results

- Delta Resources Limited (DLTA.V) Income Statement Analysis – Financial Results

- Baristas Coffee Company, Inc. (BCCI) Income Statement Analysis – Financial Results

TeamViewer AG (TMVWY)

About TeamViewer AG

TeamViewer AG, together with its subsidiaries, develops and distributes remote connectivity solutions worldwide. The company offers TeamViewer, a remote access, remote control, and remote support solution that works with every desktop and mobile platform; TeamViewer Tensor, an enterprise remote connectivity cloud platform enabling organizations to deploy a large-scale IT management framework to access, support, and control any device or machine from anywhere at anytime; TeamViewer Assist AR, a remote support solution with augmented reality; and TeamViewer IoT, which enables to instantly access, control, and manage connected products from anywhere. It also provides TeamViewer Frontline, an augmented reality productivity solution platform; TeamViewer Engage, a next-gen digital customer engagement platform for online sales, digital customer service, and video consultations; TeamViewer Remote Management that manages, monitors, tracks, patches, and protects computers, devices, and software from a single platform; TeamViewer Servicecamp, a solution for service desk management and remote connectivity; TeamViewer Remote Access, a secure and stable remote access to remote PCs, smartphones, servers, payment terminals and IoT devices; and TeamViewer Meeting, a meeting function that offers video conferencing and VoIP calls, instant chat, screen sharing across devices and platforms. The company was formerly known as Regit Beteiligungs-GmbH and changed its name to TeamViewer AG in September 2019. TeamViewer AG was founded in 2005 and is headquartered in Göppingen, Germany.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 626.69M | 565.87M | 501.10M | 455.61M | 390.19M | 258.16M | 138.47M | 91.67M |

| Cost of Revenue | 81.74M | 81.30M | 70.94M | 64.10M | 50.23M | 46.61M | 41.37M | 39.70M |

| Gross Profit | 544.95M | 484.58M | 430.15M | 391.51M | 339.96M | 211.55M | 97.10M | 51.97M |

| Gross Profit Ratio | 86.96% | 85.63% | 85.84% | 85.93% | 87.13% | 81.95% | 70.12% | 56.69% |

| Research & Development | 80.14M | 69.54M | 62.14M | 46.63M | 37.93M | 23.04M | 16.54M | 13.02M |

| General & Administrative | 49.38M | 53.48M | 51.53M | 5.71M | 16.20M | 26.09M | 21.00M | 15.69M |

| Selling & Marketing | 245.39M | 227.46M | 185.24M | 33.40M | 34.79M | 48.43M | 35.44M | 32.06M |

| SG&A | 303.28M | 280.93M | 236.77M | 39.10M | 50.99M | 74.52M | 56.45M | 47.75M |

| Other Expenses | -5.03M | -22.02M | -2.17M | 127.16M | 82.51M | 1.42M | 2.08M | 1.53M |

| Operating Expenses | 378.38M | 328.45M | 296.73M | 212.89M | 171.43M | 96.14M | 70.90M | 59.24M |

| Cost & Expenses | 460.13M | 409.75M | 367.68M | 276.99M | 221.65M | 142.75M | 112.27M | 98.94M |

| Interest Income | 1.38M | 4.27M | 599.00K | 2.95M | 38.94M | 12.31M | 7.09M | 26.77M |

| Interest Expense | 16.86M | 20.71M | 12.66M | 18.77M | 52.68M | 60.70M | 57.96M | 61.80M |

| Depreciation & Amortization | 31.21M | 53.74M | 50.92M | 41.10M | 36.44M | 30.11M | 27.71M | 26.37M |

| EBITDA | 197.77M | 191.14M | 164.96M | 230.25M | 184.26M | 95.31M | 15.47M | 19.95M |

| EBITDA Ratio | 31.56% | 35.97% | 32.92% | 53.74% | 51.19% | 40.13% | 11.17% | 21.76% |

| Operating Income | 166.56M | 143.73M | 117.42M | 164.05M | 153.05M | 107.13M | 26.19M | -7.27M |

| Operating Income Ratio | 26.58% | 25.40% | 23.43% | 36.01% | 39.22% | 41.50% | 18.92% | -7.93% |

| Total Other Income/Expenses | -19.11M | -27.04M | -32.04M | 6.34M | -57.91M | -102.63M | -96.40M | -60.95M |

| Income Before Tax | 147.46M | 116.69M | 85.39M | 170.39M | 95.14M | 4.50M | -70.21M | -68.22M |

| Income Before Tax Ratio | 23.53% | 20.62% | 17.04% | 37.40% | 24.38% | 1.74% | -50.70% | -74.42% |

| Income Tax Expense | 33.44M | 49.09M | 35.34M | 67.36M | -8.72M | 16.91M | -1.05M | -9.40M |

| Net Income | 114.02M | 67.60M | 50.05M | 103.03M | 103.86M | -12.41M | -69.15M | -58.82M |

| Net Income Ratio | 18.19% | 11.95% | 9.99% | 22.61% | 26.62% | -4.81% | -49.94% | -64.17% |

| EPS | 0.66 | 0.37 | 0.25 | 0.52 | 0.52 | -0.03 | -0.17 | -0.15 |

| EPS Diluted | 0.66 | 0.37 | 0.25 | 0.52 | 0.52 | -0.03 | -0.17 | -0.15 |

| Weighted Avg Shares Out | 172.75M | 184.62M | 200.13M | 200.00M | 200.00M | 400.00M | 400.00M | 400.00M |

| Weighted Avg Shares Out (Dil) | 172.98M | 185.06M | 200.61M | 200.06M | 200.00M | 400.00M | 400.00M | 400.00M |

TeamViewer Still Getting Billings Growth

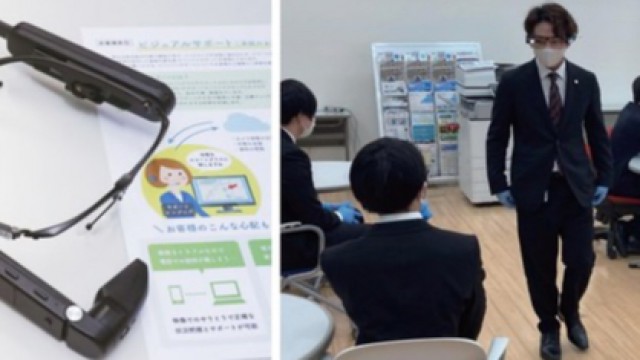

Vuzix says it and TeamViewer support the broadening use of smart glasses at Ricoh

TeamViewer Is Even An AR Play Now

Best Growth Stocks For Q2 2022: We Like TeamViewer

TeamViewer AG (TMVWF) CEO Oliver Steil on Q4 2021 Results - Earnings Call Transcript

Vuzix collaborates with European optical giant Fielmann and TeamViewer to support enterprise personnel

TeamViewer: A Fair Price For An Attractive Risk/Reward Profile

Teamviewer says CFO to quit next year

Due To Unjustified Market Reaction, TeamViewer Is Worth $67

TeamViewer cuts guidance on disappointing growth in enterprise deals

Source: https://incomestatements.info

Category: Stock Reports