See more : Fomento de Construcciones y Contratas, S.A. (FMOCY) Income Statement Analysis – Financial Results

Complete financial analysis of Toro Corp. (TORO) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Toro Corp., a leading company in the Marine Shipping industry within the Industrials sector.

- Bank of Cyprus Holdings Public Limited Company (BOCH.L) Income Statement Analysis – Financial Results

- MicroCloud Hologram Inc. (HOLO) Income Statement Analysis – Financial Results

- Armata Pharmaceuticals, Inc. (ARMP) Income Statement Analysis – Financial Results

- NIO Inc. (0A1K.L) Income Statement Analysis – Financial Results

- Malayan Cement Berhad (3794.KL) Income Statement Analysis – Financial Results

Toro Corp. (TORO)

About Toro Corp.

Toro Corp. acquires, owns, charters, and operates oceangoing tanker vessels and provides seaborne transportation services for crude oil and refined petroleum products worldwide. The company operates through Aframax/LR2 tanker and Handysize tanker segments. It operates a fleet of eight tanker vessels with an aggregate cargo carrying capacity of 0.7 million dwt. The company was incorporated in 2022 and is headquartered in Limassol, Cyprus.

| Metric | 2023 | 2022 | 2021 |

|---|---|---|---|

| Revenue | 78.47M | 111.89M | 29.26M |

| Cost of Revenue | 25.23M | 61.16M | 29.11M |

| Gross Profit | 53.23M | 50.73M | 154.91K |

| Gross Profit Ratio | 67.84% | 45.34% | 0.53% |

| Research & Development | 0.00 | 0.00 | 0.00 |

| General & Administrative | 5.36M | 2.09M | 889.10K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 |

| SG&A | 5.36M | 2.09M | 889.10K |

| Other Expenses | -89.01M | 0.00 | 0.00 |

| Operating Expenses | -83.65M | 2.36M | 889.10K |

| Cost & Expenses | -58.41M | 63.52M | 30.00M |

| Interest Income | 4.07M | 202.61K | 652.00 |

| Interest Expense | 964.25K | 719.11K | 383.19K |

| Depreciation & Amortization | 7.39M | 7.67M | 4.53M |

| EBITDA | 160.86M | 55.68M | 2.99M |

| EBITDA Ratio | 205.00% | 49.77% | 10.18% |

| Operating Income | 136.88M | 51.59M | -734.18K |

| Operating Income Ratio | 174.44% | 46.11% | -2.51% |

| Total Other Income/Expenses | 4.11M | -706.17K | -490.03K |

| Income Before Tax | 140.99M | 50.89M | -1.22M |

| Income Before Tax Ratio | 179.67% | 45.48% | -4.18% |

| Income Tax Expense | 350.67K | 960.18K | 206.17K |

| Net Income | 140.64M | 49.93M | -1.43M |

| Net Income Ratio | 179.23% | 44.62% | -4.89% |

| EPS | 9.05 | 5.55 | -0.15 |

| EPS Diluted | 2.87 | 1.23 | -0.15 |

| Weighted Avg Shares Out | 15.44M | 9.46M | 9.46M |

| Weighted Avg Shares Out (Dil) | 48.66M | 42.68M | 9.46M |

Toro Corp. Announces the Completion of the Sale of M/T Wonder Musica

The Toro Company Names Joanna M. Totsky Vice President, General Counsel and Corporate Secretary

The Toro Company Declares Regular Quarterly Cash Dividend

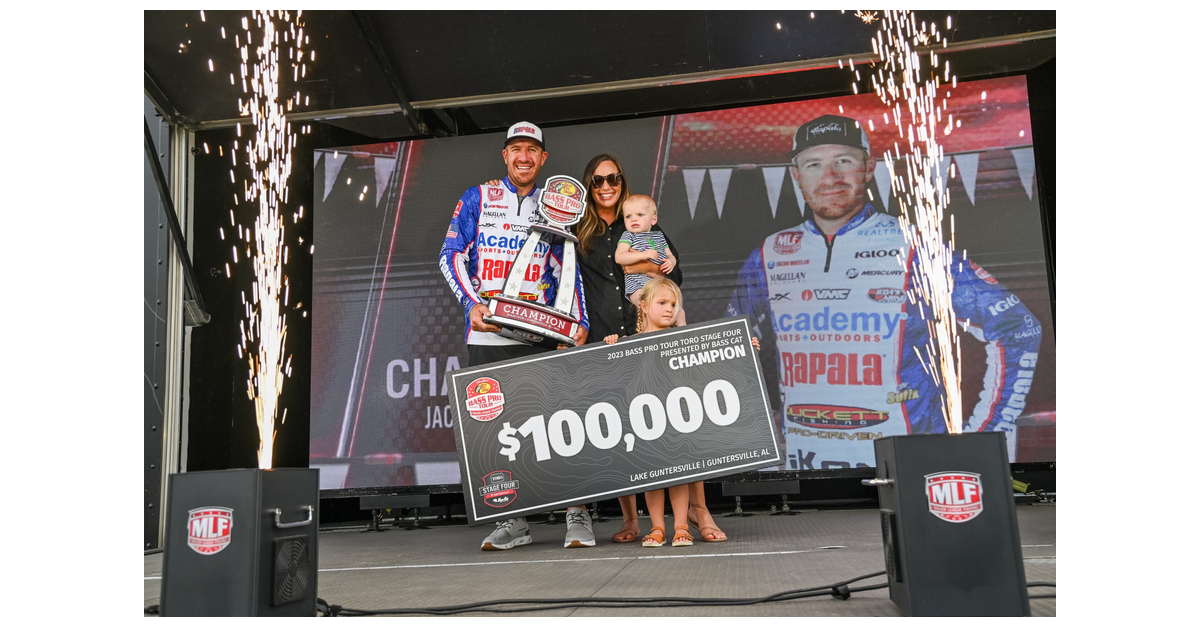

Wheeler Earns Win at MLF Bass Pro Tour Toro Stage Four on Lake Guntersville Presented by Bass Cat Boats

Global Gardening Equipment Market Report 2023: Sector is Projected to Reach $138.89 Billion by 2030 at a 6% CAGR - ResearchAndMarkets.com

Viceroy Hotels & Resorts, Modern Luxury Hotel Brand, Appoints Hospitality Veteran Yoav Gery as Chief Development Officer

World Precision Irrigation Market Analysis and Forecasts Report 2022-2027 - Focus on Low-Cost Precision Irrigation Solutions to Enter Untapped Markets - ResearchAndMarkets.com

7 Strategies for Trading Penny Stocks During a Stock Market Crash

The Toro Company to Announce Fiscal 2023 Second Quarter Results

Global Outdoor Power Equipment Market Report 2023: Surge in Landscaping Services & Garden Maintenance Drives Growth - ResearchAndMarkets.com

Source: https://incomestatements.info

Category: Stock Reports