See more : Entrada Therapeutics, Inc. (TRDA) Income Statement Analysis – Financial Results

Complete financial analysis of TerrAscend Corp. (TRSSF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of TerrAscend Corp., a leading company in the Drug Manufacturers – Specialty & Generic industry within the Healthcare sector.

- Pegavision Corporation (6491.TW) Income Statement Analysis – Financial Results

- Shandong Link Science and Technology Co.,Ltd. (001207.SZ) Income Statement Analysis – Financial Results

- LIBERO Football Finance AG (TUF.F) Income Statement Analysis – Financial Results

- Sunplus Technology Company Limited (2401.TW) Income Statement Analysis – Financial Results

- Catena AB (publ) (0GVS.L) Income Statement Analysis – Financial Results

TerrAscend Corp. (TRSSF)

Industry: Drug Manufacturers - Specialty & Generic

Sector: Healthcare

Website: https://www.terrascend.com

About TerrAscend Corp.

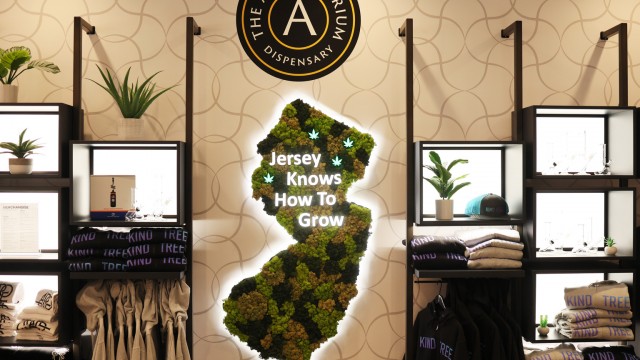

TerrAscend Corp. cultivates, processes, and sells medical and adult use cannabis in Canada and the United States. It produces and distributes hemp-derived wellness products to retail locations; and manufactures cannabis infused artisan edibles. The company also operates three retail dispensaries under the Apothecarium brand name in California and Pennsylvania. In addition, it owns various synergistic under Gage Cannabis, Ilera Healthcare, Kind Tree, Prism, State Flower, Valhalla Confections, and Arise Bioscience Inc. brands. As of July 26, 2022, the company operated 27 dispensaries, including 3 Cookies dispensaries in Michigan and 1 in Toronto. TerrAscend Corp. was incorporated in 2017 and is headquartered in Mississauga, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 317.33M | 322.64M | 243.49M | 198.32M | 84.87M | 6.83M | 0.00 | 0.00 |

| Cost of Revenue | 157.63M | 203.07M | 109.38M | 171.98M | 87.52M | 10.17M | 381.32K | 0.00 |

| Gross Profit | 159.70M | 119.57M | 134.11M | 26.34M | -2.65M | -3.34M | -381.32K | 0.00 |

| Gross Profit Ratio | 50.33% | 37.06% | 55.08% | 13.28% | -3.12% | -48.96% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 426.00K | 709.00K | 141.00K | 0.00 | 0.00 |

| General & Administrative | 100.35M | 101.22M | 71.85M | 57.01M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 9.66M | 10.32M | 1.86M | 1.67M | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 110.01M | 150.48M | 94.16M | 75.17M | 61.68M | 24.67M | 6.27M | 866.94K |

| Other Expenses | 72.69M | 206.00K | 230.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 182.69M | 150.48M | 94.16M | 75.60M | 62.39M | 24.81M | 6.27M | 866.94K |

| Cost & Expenses | 340.32M | 353.55M | 203.54M | 247.58M | 149.91M | 34.98M | 6.66M | 866.94K |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 640.18K | 36.28K | 9.00 |

| Interest Expense | 35.11M | 39.06M | 24.99M | 7.03M | 4.09M | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 22.70M | 32.03M | 17.38M | 16.57M | 7.32M | 921.00K | 244.08K | 0.00 |

| EBITDA | -1.03M | -320.94M | 104.54M | -96.45M | -204.22M | -20.52M | -6.56M | -866.94K |

| EBITDA Ratio | -0.32% | 0.35% | 23.54% | -16.48% | -68.01% | -398.97% | 0.00% | 0.00% |

| Operating Income | -23.00M | -30.91M | 39.95M | -49.26M | -65.04M | -28.16M | -6.66M | -866.94K |

| Operating Income Ratio | -7.25% | -9.58% | 16.41% | -24.84% | -76.63% | -412.47% | 0.00% | 0.00% |

| Total Other Income/Expenses | -35.84M | -279.28M | 15.88M | -77.21M | -152.29M | 6.72M | -149.23K | -244.00 |

| Income Before Tax | -58.83M | -403.82M | 55.83M | -126.47M | -217.33M | -21.44M | -6.81M | -867.18K |

| Income Before Tax Ratio | -18.54% | -125.16% | 22.93% | -63.77% | -256.08% | -314.09% | 0.00% | 0.00% |

| Income Tax Expense | 23.45M | -14.04M | 36.20M | 27.87M | 1.62M | 704.00K | -3.00 | 0.00 |

| Net Income | -91.10M | -429.49M | 3.90M | -155.12M | -215.79M | -22.03M | -6.81M | -867.18K |

| Net Income Ratio | -28.71% | -133.12% | 1.60% | -78.22% | -254.26% | -322.71% | 0.00% | 0.00% |

| EPS | -0.33 | -1.76 | 0.02 | -1.04 | -2.17 | -0.24 | -0.18 | -0.03 |

| EPS Diluted | -0.33 | -1.76 | 0.02 | -1.04 | -2.17 | -0.24 | -0.18 | -0.03 |

| Weighted Avg Shares Out | 279.29M | 244.35M | 181.06M | 149.74M | 99.59M | 90.98M | 37.63M | 29.24M |

| Weighted Avg Shares Out (Dil) | 279.29M | 244.35M | 208.71M | 149.74M | 99.59M | 90.98M | 37.63M | 29.24M |

Top Marijuana Penny Stocks To Buy In Q3 2022? 3 To Watch In July

These 2 Marijuana Stocks Could Be Something To Watch This Week

Top Marijuana Stocks To Invest In Right Now? 3 To Watch At The End Of June

Top US Marijuana Stocks For June 2022 Watchlist

Market Sending False Signals

Top Marijuana Stocks To Watch Right Now In June

TerrAscend: Not The Most Desirable MSO

Top Penny Stocks To Buy Right Now? 3 Cannabis Stocks For Your Watchlist

TerrAscend Corp. (TRSSF) Management on Q1 2022 Results - Earnings Call Transcript

3 Marijuana Stocks To Watch To Kick Off Your Trading Week

Source: https://incomestatements.info

Category: Stock Reports