See more : Alkane, Inc. (ALKN) Income Statement Analysis – Financial Results

Complete financial analysis of Techtronic Industries Company Limited (TTNDY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Techtronic Industries Company Limited, a leading company in the Manufacturing – Tools & Accessories industry within the Industrials sector.

- Ecovyst Inc. (ECVT) Income Statement Analysis – Financial Results

- Maple Leaf Green World Inc. (MGWFF) Income Statement Analysis – Financial Results

- Maiden Holdings, Ltd. (MH-PD) Income Statement Analysis – Financial Results

- DB (International) Stock Brokers Limited (DBSTOCKBRO.NS) Income Statement Analysis – Financial Results

- Sands China Ltd. (SCHYF) Income Statement Analysis – Financial Results

Techtronic Industries Company Limited (TTNDY)

About Techtronic Industries Company Limited

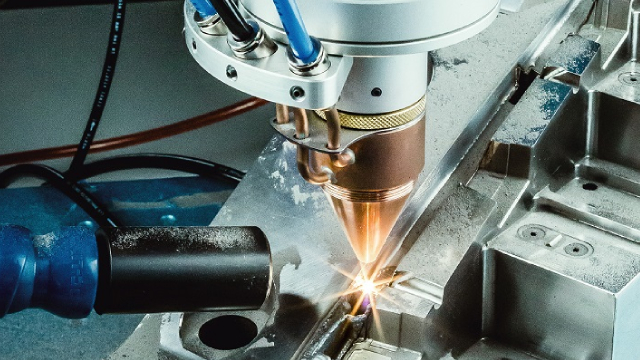

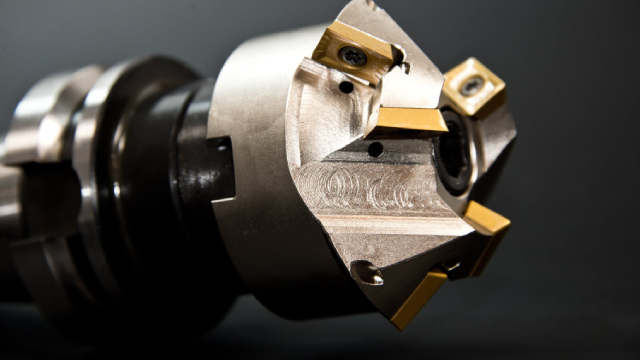

Techtronic Industries Company Limited engages in the design, manufacture, and marketing of power tools, outdoor power equipment, and floorcare and cleaning products worldwide. It offers power tools, power tool accessories, outdoor products, and outdoor product accessories for consumer, trade, professional, and industrial users under the MILWAUKEE, EMPIRE, AEG, RYOBI, HOMELITE, and HART brands, as well as to original equipment manufacturer (OEM) customers. The company provides floorcare products and accessories under the HOOVER, DIRT DEVIL, VAX, and ORECK brands, as well as to OEM customers. It serves Do-It-Yourself, professional, and industrial users in the home improvement, repair, maintenance, construction, and infrastructure industries. The company was founded in 1985 and is based in Kwai Chung, Hong Kong.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 13.73B | 13.25B | 13.20B | 9.81B | 7.67B | 7.02B | 6.06B | 5.48B | 5.04B | 4.75B | 4.30B | 3.85B | 3.67B | 3.39B | 3.09B | 3.43B | 3.18B | 2.81B | 2.88B | 2.10B | 1.70B | 1.22B | 782.17M | 583.59M | 347.14M | 326.80M |

| Cost of Revenue | 8.31B | 8.04B | 8.08B | 6.06B | 4.77B | 4.41B | 3.84B | 3.50B | 3.24B | 3.08B | 2.86B | 2.56B | 2.47B | 2.30B | 2.13B | 2.38B | 2.18B | 1.92B | 1.99B | 1.46B | 1.20B | 900.69M | 588.95M | 459.63M | 278.64M | 271.02M |

| Gross Profit | 5.42B | 5.21B | 5.12B | 3.75B | 2.89B | 2.61B | 2.23B | 1.99B | 1.80B | 1.67B | 1.44B | 1.29B | 1.19B | 1.09B | 966.52M | 1.06B | 1.00B | 886.37M | 895.08M | 635.87M | 502.07M | 316.31M | 193.21M | 123.96M | 68.49M | 55.78M |

| Gross Profit Ratio | 39.47% | 39.33% | 38.79% | 38.25% | 37.73% | 37.24% | 36.71% | 36.22% | 35.68% | 35.20% | 33.53% | 33.47% | 32.55% | 32.19% | 31.25% | 30.83% | 31.52% | 31.59% | 31.05% | 30.30% | 29.57% | 25.99% | 24.70% | 21.24% | 19.73% | 17.07% |

| Research & Development | 548.34M | 570.15M | 508.50M | 826.03M | 330.32M | 305.12M | 253.58M | 230.06M | 200.69M | 178.54M | 165.36M | 79.52M | 69.16M | 64.75M | 66.20M | 57.14M | 68.63M | 55.08M | 63.46M | 43.62M | 34.55M | 14.33M | 10.25M | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.41B | 1.35B | 1.35B | 1.01B | 804.99M | 708.14M | 623.71M | 598.49M | 577.74M | 564.45M | 505.39M | 421.34M | 405.00M | 366.88M | 359.13M | 388.08M | 371.64M | 310.44M | 314.99M | 199.62M | 160.56M | 135.14M | 76.37M | 66.76M | 36.01M | 26.75M |

| Selling & Marketing | 2.35B | 2.19B | 2.17B | 1.57B | 1.20B | 1.10B | 925.15M | 794.28M | 697.60M | 643.82M | 562.84M | 532.53M | 510.36M | 481.80M | 430.31M | 444.89M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 3.75B | 3.54B | 3.52B | 2.58B | 2.00B | 1.81B | 1.55B | 1.39B | 1.28B | 1.21B | 1.07B | 953.87M | 915.35M | 848.69M | 789.44M | 832.97M | 371.64M | 310.44M | 314.99M | 199.62M | 160.56M | 135.14M | 76.37M | 66.76M | 36.01M | 26.75M |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 10.54M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -3.39M | -9.07M | -17.12M | -15.51M | -92.64M | -34.39M | -33.14M | -32.56M | -17.98M | -12.46M | -10.75M | -11.70M | -9.85M | 7.67M | -5.10M |

| Operating Expenses | 4.28B | 4.01B | 3.93B | 2.88B | 2.22B | 2.01B | 1.71B | 1.54B | 1.40B | 1.32B | 1.14B | 1.03B | 975.44M | 896.32M | 840.13M | 881.17M | 945.34M | 690.81M | 705.62M | 489.93M | 397.92M | 251.48M | 147.55M | 85.73M | 43.68M | 31.42M |

| Cost & Expenses | 12.59B | 12.05B | 12.01B | 8.94B | 6.99B | 6.41B | 5.54B | 5.03B | 4.64B | 4.40B | 4.00B | 3.59B | 3.45B | 3.20B | 2.97B | 3.26B | 3.12B | 2.61B | 2.69B | 1.95B | 1.59B | 1.15B | 736.50M | 545.37M | 322.32M | 302.44M |

| Interest Income | 44.96M | 44.02M | 9.98M | 7.44M | 12.11M | 12.85M | 13.69M | 10.14M | 12.86M | 25.10M | 24.85M | 8.63M | 5.06M | 2.15M | 2.03M | 6.08M | 12.52M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 124.06M | 69.87M | 42.01M | 44.22M | 52.32M | 38.05M | 24.48M | 21.79M | 23.44M | 39.63M | 36.68M | 45.63M | 63.09M | 74.47M | 72.92M | 61.56M | 58.96M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 12.11M | 9.79M | 3.54M | 5.21M |

| Depreciation & Amortization | 598.43M | 500.85M | 398.77M | 404.15M | 325.48M | 241.97M | 212.93M | 192.63M | 99.24M | 89.44M | 82.92M | 130.59M | 119.76M | 113.75M | 103.99M | 93.31M | 88.60M | 69.71M | 67.26M | 46.39M | 43.36M | 35.54M | -12.11M | -9.79M | -3.54M | -5.21M |

| EBITDA | 1.78B | 1.44B | 1.38B | 1.03B | 818.12M | 738.89M | 635.39M | 554.21M | 493.76M | 436.26M | 349.39M | 398.46M | 344.21M | 283.49M | 232.29M | 174.43M | 144.69M | 265.27M | 256.72M | 192.33M | 147.52M | 100.56M | 45.67M | 36.99M | 24.82M | 24.36M |

| EBITDA Ratio | 12.95% | 10.84% | 10.42% | 10.53% | 10.67% | 10.52% | 10.48% | 10.11% | 9.80% | 9.18% | 8.13% | 10.34% | 9.35% | 9.17% | 7.51% | 5.37% | 4.55% | 9.45% | 8.91% | 9.17% | 8.69% | 8.25% | 5.84% | 6.55% | 7.15% | 7.45% |

| Operating Income | 1.13B | 1.19B | 1.18B | 857.09M | 662.73M | 600.44M | 513.73M | 445.13M | 394.52M | 346.82M | 266.47M | 267.87M | 223.16M | 170.53M | 128.43M | 173.77M | 56.08M | 195.56M | 189.45M | 157.84M | 111.41M | 73.70M | 45.67M | 38.22M | 24.82M | 24.36M |

| Operating Income Ratio | 8.26% | 8.96% | 8.93% | 8.74% | 8.64% | 8.55% | 8.47% | 8.12% | 7.83% | 7.30% | 6.20% | 6.95% | 6.09% | 5.03% | 4.15% | 5.06% | 1.77% | 6.97% | 6.57% | 7.52% | 6.56% | 6.06% | 5.84% | 6.55% | 7.15% | 7.45% |

| Total Other Income/Expenses | -79.07M | -44.01M | 85.82M | 513.58M | -11.99M | -12.85M | -13.69M | -10.14M | -7.56M | -21.66M | 68.21M | -45.63M | -58.39M | -74.83M | -73.05M | -154.20M | -34.39M | -33.14M | -32.56M | -19.42M | -12.46M | -10.13M | -11.70M | -11.09M | -3.31M | -5.10M |

| Income Before Tax | 1.06B | 1.16B | 1.18B | 861.25M | 661.29M | 594.61M | 505.50M | 440.03M | 386.96M | 325.16M | 276.40M | 222.25M | 160.17M | 95.90M | 55.38M | 19.57M | 21.69M | 162.42M | 156.90M | 139.86M | 98.95M | 62.95M | 33.96M | 28.37M | 21.50M | 19.26M |

| Income Before Tax Ratio | 7.69% | 8.73% | 8.95% | 8.78% | 8.63% | 8.47% | 8.34% | 8.03% | 7.68% | 6.84% | 6.43% | 5.77% | 4.37% | 2.83% | 1.79% | 0.57% | 0.68% | 5.79% | 5.44% | 6.67% | 5.83% | 5.17% | 4.34% | 4.86% | 6.19% | 5.89% |

| Income Tax Expense | 79.28M | 79.75M | 82.72M | 60.26M | 46.29M | 42.07M | 34.97M | 31.24M | 32.81M | 25.68M | 29.04M | 22.14M | 9.24M | -70.41K | -8.08M | -5.18M | 5.00M | 23.66M | 20.33M | 14.01M | 8.61M | 8.97M | 2.94M | 4.00M | 1.10M | 940.77K |

| Net Income | 976.34M | 1.08B | 1.10B | 800.76M | 614.90M | 552.46M | 470.43M | 408.98M | 354.43M | 300.33M | 250.28M | 200.99M | 150.83M | 95.10M | 63.27M | 22.56M | 16.69M | 137.83M | 131.38M | 120.66M | 86.81M | 52.41M | 30.62M | 24.43M | 20.18M | 18.21M |

| Net Income Ratio | 7.11% | 8.13% | 8.32% | 8.16% | 8.02% | 7.87% | 7.76% | 7.46% | 7.04% | 6.32% | 5.82% | 5.22% | 4.11% | 2.81% | 2.05% | 0.66% | 0.53% | 4.91% | 4.56% | 5.75% | 5.11% | 4.31% | 3.91% | 4.19% | 5.81% | 5.57% |

| EPS | 2.67 | 0.59 | 0.60 | 0.44 | 0.34 | 0.30 | 0.26 | 0.22 | 0.19 | 0.16 | 0.14 | 0.11 | 0.09 | 0.06 | 0.04 | 0.02 | 0.01 | 0.09 | 0.09 | 0.09 | 0.13 | 0.08 | 0.05 | 0.04 | 0.04 | 0.03 |

| EPS Diluted | 0.53 | 0.59 | 0.60 | 0.44 | 0.34 | 0.30 | 0.26 | 0.22 | 0.19 | 0.16 | 0.14 | 0.11 | 0.09 | 0.06 | 0.04 | 0.02 | 0.01 | 0.09 | 0.09 | 0.09 | 0.13 | 0.08 | 0.05 | 0.04 | 0.04 | 0.03 |

| Weighted Avg Shares Out | 365.97M | 1.83B | 1.83B | 1.83B | 1.83B | 1.83B | 1.83B | 1.83B | 1.83B | 1.83B | 1.83B | 1.76B | 1.83B | 1.60B | 1.54B | 1.50B | 1.49B | 1.46B | 1.46B | 1.34B | 662.49M | 626.38M | 568.41M | 559.94M | 557.30M | 555.32M |

| Weighted Avg Shares Out (Dil) | 1.84B | 1.84B | 1.84B | 1.84B | 1.83B | 1.84B | 1.84B | 1.84B | 1.84B | 1.84B | 1.84B | 1.83B | 1.83B | 1.60B | 1.55B | 1.50B | 1.50B | 1.53B | 1.46B | 1.39B | 662.49M | 626.38M | 570.99M | 563.60M | 559.09M | 558.62M |

Zacks Industry Outlook Stanley Black & Decker and Techtronic Industries

2 Manufacturing Tool Stocks to Overcome Industry Headwinds

Northern Tool + Equipment Announces Partnership with Monster Jam®: Includes a Monster Jam Mini Build with Texas High School Students

Techtronic Industries: Focus On Cash Flow And Geographical Expansion

Techtronic Industries Company Limited (TTNDY) Q2 2024 Earnings Call Transcript

TECHTRONIC INDUSTRIES DELIVERS STRONG 2024 FIRST HALF RESULTS

Techtronic Industries: Good Reasons To Stay Positive

Techtronic Industries: Favorable Takeaways From Customer's Acquisition And Peer's Comments

Techtronic Industries Co. (TTNDY) Upgraded to Buy: What Does It Mean for the Stock?

Techtronic Industries Company Limited (TTNDY) Q4 2023 Earnings Call Transcript

Source: https://incomestatements.info

Category: Stock Reports