See more : Lehto Group Oyj (0RFZ.L) Income Statement Analysis – Financial Results

Complete financial analysis of Tartisan Nickel Corp. (TTSRF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Tartisan Nickel Corp., a leading company in the Industrial Materials industry within the Basic Materials sector.

- USANA Health Sciences, Inc. (USNA) Income Statement Analysis – Financial Results

- uPI Semiconductor Corp. (6719.TW) Income Statement Analysis – Financial Results

- Ortivus AB (publ) (ORTI-A.ST) Income Statement Analysis – Financial Results

- Atturra Limited (ATA.AX) Income Statement Analysis – Financial Results

- Southern Energy Corp. (SOUC.L) Income Statement Analysis – Financial Results

Tartisan Nickel Corp. (TTSRF)

About Tartisan Nickel Corp.

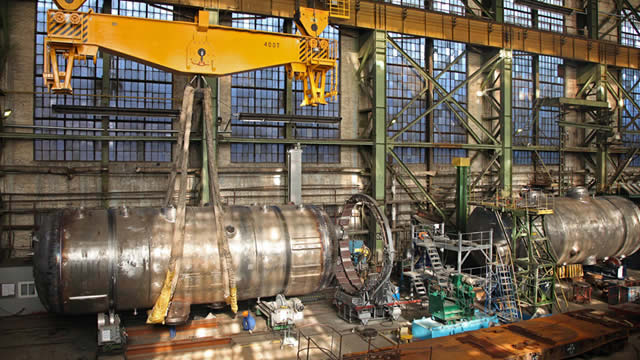

Tartisan Nickel Corp. engages in the acquisition, exploration, and development of mineral properties in Canada and Peru. The company primarily explores for nickel, copper, and cobalt deposits. Its flagship property is the 100% owned Kenbridge nickel project, which includes 93 contiguous patented mining claims, 114 unpatented single cell mining claims, and four mining licenses covering an area of approximately 3,668.13 hectares located in Kenora Mining Division, Northwestern Ontario. The company was formerly known as Tartisan Resources Corp. and changed its name to Tartisan Nickel Corp. in February 2018. Tartisan Nickel Corp. was incorporated in 2008 and is headquartered in Toronto, Canada.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 3.29K | 1.03K | 925.00 | 963.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 0.00 | 0.00 | 0.00 | -3.29K | -1.03K | -925.00 | -963.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.05M | 775.79K | 1.78M | 1.72M | 563.81K | 571.98K | 610.52K | 585.88K | 369.37K | 318.85K | 452.90K | 702.80K | 733.51K | 656.03K | 320.93K | 280.61K |

| Selling & Marketing | 343.91K | 250.44K | 189.15K | 222.88K | 5.00K | 243.91K | 739.74K | 162.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1.40M | 1.03M | 1.97M | 1.95M | 568.81K | 815.90K | 1.35M | 747.88K | 369.37K | 318.85K | 452.90K | 702.80K | 733.51K | 656.03K | 320.93K | 280.61K |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 1.40M | 1.03M | 1.97M | 1.95M | 568.81K | 815.90K | 1.37M | 765.42K | 407.30K | 358.87K | 480.09K | 822.57K | 1.01M | 1.07M | 473.60K | 484.17K |

| Cost & Expenses | 1.40M | 1.03M | 1.97M | 1.95M | 569.84K | 816.82K | 1.37M | 765.42K | 407.30K | 358.87K | 480.09K | 822.57K | 1.01M | 1.07M | 473.60K | 484.17K |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 2.19K | 4.56K | 13.18K | 1.30K | 892.00 | 1.25K | 5.64K | 9.25K | 9.05K | 18.64K | 17.76K | 6.81K | 3.40K | 3.83K | 887.00 | 2.34K |

| Depreciation & Amortization | 229.93K | 1.03M | 115.79K | 3.29K | 1.03K | 925.00 | 963.00 | 963.00 | 963.00 | 849.00 | 999.00 | 1.14K | 1.10K | 1.19K | 1.48K | 823.00 |

| EBITDA | -1.40M | 0.00 | -1.85M | -1.95M | -569.02K | -815.90K | -1.37M | -764.46K | -406.33K | -358.03K | -479.10K | -825.18K | -1.01M | -1.07M | -472.12K | -488.99K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -1.40M | -1.03M | -1.97M | -1.95M | -569.84K | -816.82K | -1.37M | -765.42K | -407.30K | -358.87K | -480.09K | -824.45K | -1.02M | -1.08M | -473.60K | -484.17K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -1.90M | -5.51M | 1.08M | 13.57M | -265.55K | -4.56M | 2.39M | 4.47M | 91.20K | 4.33K | 68.10K | -2.23K | -3.40K | 0.00 | 17.90K | -6.54K |

| Income Before Tax | -3.30M | -6.54M | -885.38K | 11.63M | -834.36K | -5.37M | 1.02M | 3.70M | -316.09K | -354.54K | -411.99K | -835.02K | -1.02M | -1.08M | -455.71K | -490.70K |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 0.00 | -585.00K | 215.00K | 370.00K | 5.00 | 1.25K | 5.64K | 9.25K | 9.05K | 18.64K | 17.76K | 6.81K | 3.40K | 3.83K | 887.00 | 2.34K |

| Net Income | -3.30M | -5.95M | -1.10M | 11.26M | -834.36K | -5.37M | 1.02M | 3.70M | -316.09K | -354.54K | -411.99K | -835.02K | -1.02M | -1.08M | -455.71K | -490.70K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | -0.03 | -0.05 | -0.01 | 0.11 | -0.01 | -0.05 | 0.01 | 0.06 | -0.01 | -0.01 | -0.01 | -0.03 | -0.04 | -0.06 | -0.03 | -0.05 |

| EPS Diluted | -0.03 | -0.05 | -0.01 | 0.11 | -0.01 | -0.05 | 0.01 | 0.05 | -0.01 | -0.01 | -0.01 | -0.03 | -0.04 | -0.06 | -0.03 | -0.05 |

| Weighted Avg Shares Out | 110.00M | 110.94M | 109.68M | 102.14M | 100.15M | 99.11M | 76.79M | 59.32M | 43.47M | 35.69M | 29.94M | 26.29M | 24.81M | 19.42M | 15.19M | 9.81M |

| Weighted Avg Shares Out (Dil) | 115.68M | 110.94M | 109.68M | 103.14M | 100.15M | 99.11M | 76.79M | 79.30M | 43.47M | 35.69M | 29.94M | 26.29M | 24.81M | 19.42M | 15.19M | 9.81M |

Tartisan Nickel intersects high-grade nickel in deepest hole to date at its Kenbridge project in Ontario

Nickel Miners News For The Month Of October 2021

Tartisan Nickel nearing the finish line of its drill program at Kenbridge nickel project; shares start trading on OTCQX

OTC Markets Group Welcomes Tartisan Nickel Corp. to OTCQX

Tartisan Nickel posts encouraging latest assays from Kenbridge nickel project, Ontario

Tartisan Nickel Corp. Intersects 25.5 metres of 1.13% Ni, 0.61% Cu, Including 4.5 metres of 2.96% Ni, 1.66% Cu, and 1.5 metres of 4.17% Ni, 2.14% Cu at the Kenbridge Nickel-Copper-Cobalt Project, NW Ontario.

Tartisan Nickel Corp. Intersects 25.6 Metres of 1.03% NI, 0.41% CU Including 2.7 Metres of 2.76% NI, 0.88% CU at the Kenbridge Nickel-copper-Cobalt Project, NW Ontario.

Tartisan Nickel Corp. Provides Update on the 10,000 Meter Drill Program at the Kenbridge Nickel Deposit and Grants Stock Options

Tartisan Nickel launches 10,000-meter drill program at Kenbridge project in Ontario

Tartisan Nickel closes second tranche of its C$4.5M flow-through financing

Source: https://incomestatements.info

Category: Stock Reports