See more : More Provident Funds Ltd (MPP.TA) Income Statement Analysis – Financial Results

Complete financial analysis of Unifi, Inc. (UFI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Unifi, Inc., a leading company in the Apparel – Manufacturers industry within the Consumer Cyclical sector.

- Newmark Property REIT (NPR.AX) Income Statement Analysis – Financial Results

- Chilled & Frozen Logistics Holdings Co., Ltd. (9099.T) Income Statement Analysis – Financial Results

- FutureTech II Acquisition Corp. (FTII) Income Statement Analysis – Financial Results

- China Xiangtai Food Co., Ltd. (PLIN) Income Statement Analysis – Financial Results

- Genie Energy Ltd. (GNE) Income Statement Analysis – Financial Results

Unifi, Inc. (UFI)

About Unifi, Inc.

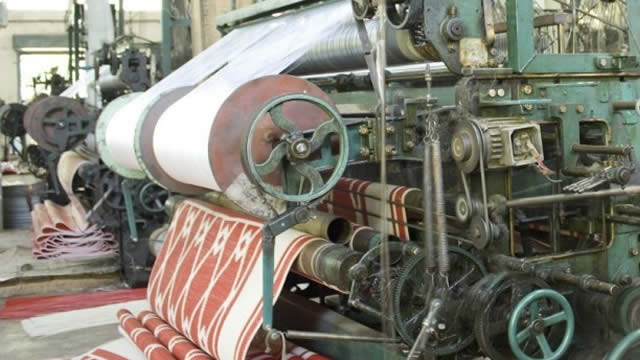

Unifi, Inc., together with its subsidiaries, engages in the manufacture and sale of recycled and synthetic products in the United States, Brazil, China, and internationally. It operates in four segments: Polyester, Nylon, Brazil, and Asia. The Polyester segment offers partially oriented, textured, solution and package dyed, twisted, beamed, and draw wound yarns; and pre-consumer and post-consumer waste products, including plastic bottle flakes, polyester polymer, and staple fiber beads to other yarn manufacturers, and knitters and weavers that produce yarn and/or fabric for the apparel, hosiery, home furnishings, automotive, industrial, and other end-use markets. The Nylon segment provides virgin or recycled textured, solution dyed, and spandex covered yarns to knitters and weavers that produce fabric primarily for the apparel, hosiery, medical markets. The Brazil segment manufactures and sells polyester-based products to knitters and weavers that produce fabric for the apparel, home furnishings, automotive, industrial, and other end-use markets. The Asia segment primarily sells polyester-based products to knitters and weavers that produce fabric for the apparel, home furnishings, automotive, industrial, and other end-use markets. The company sells its products through sales force and independent sales agents under the REPREVE and PROFIBER brands. Unifi, Inc. was incorporated in 1969 and is headquartered in Greensboro, North Carolina.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 582.21M | 623.53M | 815.76M | 667.59M | 606.51M | 708.80M | 678.91M | 647.27M | 643.64M | 687.12M | 687.90M | 713.96M | 705.09M | 707.84M | 616.75M | 553.66M | 713.35M | 690.31M | 738.83M | 799.45M | 746.46M | 849.12M | 914.72M | 1.13B | 1.28B | 1.25B | 1.38B | 1.70B | 1.60B | 1.55B | 1.38B | 1.33B | 1.09B | 441.80M | 398.90M | 392.20M | 298.30M | 275.70M | 248.90M |

| Cost of Revenue | 565.59M | 609.29M | 735.27M | 574.10M | 567.47M | 642.50M | 592.48M | 553.11M | 550.01M | 596.42M | 604.64M | 640.86M | 650.69M | 634.88M | 545.25M | 525.16M | 662.76M | 652.74M | 696.06M | 768.71M | 708.01M | 777.81M | 840.16M | 1.03B | 1.03B | 986.70M | 1.08B | 1.39B | 1.33B | 1.25B | 1.12B | 1.03B | 889.00M | 356.20M | 328.80M | 333.30M | 239.00M | 225.60M | 213.10M |

| Gross Profit | 16.62M | 14.24M | 80.49M | 93.49M | 39.04M | 66.31M | 86.43M | 94.16M | 93.63M | 90.71M | 83.26M | 73.10M | 54.40M | 72.96M | 71.50M | 28.51M | 50.58M | 37.57M | 42.77M | 30.73M | 38.45M | 71.30M | 74.55M | 97.11M | 254.10M | 264.50M | 297.50M | 319.10M | 277.60M | 300.00M | 269.50M | 301.40M | 202.40M | 85.60M | 70.10M | 58.90M | 59.30M | 50.10M | 35.80M |

| Gross Profit Ratio | 2.85% | 2.28% | 9.87% | 14.00% | 6.44% | 9.35% | 12.73% | 14.55% | 14.55% | 13.20% | 12.10% | 10.24% | 7.71% | 10.31% | 11.59% | 5.15% | 7.09% | 5.44% | 5.79% | 3.84% | 5.15% | 8.40% | 8.15% | 8.59% | 19.85% | 21.14% | 21.60% | 18.72% | 17.31% | 19.30% | 19.46% | 22.62% | 18.54% | 19.38% | 17.57% | 15.02% | 19.88% | 18.17% | 14.38% |

| Research & Development | 9.60M | 10.87M | 12.10M | 11.48M | 11.26M | 12.36M | 7.79M | 7.18M | 6.91M | 8.11M | 7.92M | 7.07M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 45.11M | 43.34M | 47.82M | 48.42M | 41.77M | 49.05M | 52.64M | 47.76M | 48.80M | 45.70M | 43.25M | 43.61M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 1.52M | 4.00M | 4.67M | 2.92M | 2.04M | 3.64M | 3.44M | 3.07M | -1.29M | 3.98M | 2.95M | 3.78M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 46.63M | 47.35M | 52.49M | 51.33M | 43.81M | 52.69M | 56.08M | 50.83M | 47.50M | 49.67M | 46.20M | 47.39M | 43.48M | 42.97M | 46.18M | 39.12M | 47.79M | 52.06M | 42.79M | 56.62M | 53.32M | 57.61M | 57.38M | 71.48M | 66.76M | 55.30M | 43.30M | 46.20M | 45.10M | 43.10M | 40.40M | 35.70M | 34.70M | 15.50M | 12.80M | 0.00 | 14.20M | 13.20M | 11.50M |

| Other Expenses | 0.00 | 0.00 | 212.00K | -6.17M | 4.05M | 2.66M | 1.55M | -433.00K | 2.26M | 1.32M | -126.00K | -218.00K | 2.28M | 121.00K | -910.00K | -3.08M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 90.53M | 89.90M | 69.70M | 87.90M | 81.80M | 75.80M | 70.10M | 56.00M | 37.40M | 17.90M | 18.70M | 17.20M | 12.50M | 12.80M | 8.30M |

| Operating Expenses | 54.04M | 55.11M | 52.70M | 45.17M | 47.86M | 55.35M | 57.63M | 50.40M | 51.43M | 52.22M | 51.78M | 50.42M | 45.76M | 43.09M | 45.27M | 36.05M | 47.79M | 52.06M | 42.79M | 56.62M | 53.32M | 57.61M | 57.38M | 71.48M | 157.29M | 145.20M | 113.00M | 134.10M | 126.90M | 118.90M | 110.50M | 91.70M | 72.10M | 33.40M | 31.50M | 17.20M | 26.70M | 26.00M | 19.80M |

| Cost & Expenses | 619.63M | 664.40M | 787.97M | 619.26M | 615.33M | 697.84M | 650.11M | 603.50M | 601.44M | 648.64M | 656.42M | 691.28M | 696.45M | 677.97M | 590.53M | 561.20M | 710.55M | 704.80M | 738.85M | 825.34M | 761.33M | 835.42M | 897.54M | 1.11B | 1.18B | 1.13B | 1.19B | 1.52B | 1.45B | 1.37B | 1.23B | 1.12B | 961.10M | 389.60M | 360.30M | 350.50M | 265.70M | 251.60M | 232.90M |

| Interest Income | 2.14M | 2.11M | 1.52M | 603.00K | 722.00K | 628.00K | 560.00K | 517.00K | 610.00K | 916.00K | 1.79M | 698.00K | 1.92M | 2.51M | 3.13M | 2.93M | 2.91M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 9.86M | 7.58M | 3.09M | 3.32M | 4.78M | 5.41M | 4.94M | 3.58M | 3.53M | 4.03M | 4.33M | 4.49M | 16.07M | 19.19M | 21.89M | 23.15M | 26.06M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 27.67M | 27.02M | 25.99M | 25.29M | 23.41M | 22.71M | 22.22M | 19.86M | 16.97M | 18.04M | 17.90M | 24.58M | 27.14M | 25.98M | 27.42M | 32.47M | 41.57M | 44.86M | 49.95M | 52.89M | 64.73M | 73.04M | 78.72M | 90.15M | 90.53M | 89.90M | 69.70M | 87.90M | 81.80M | 75.80M | 70.10M | 56.00M | 37.40M | 17.90M | 18.70M | 17.20M | 12.50M | 12.80M | 8.30M |

| EBITDA | -8.16M | -10.85M | 55.90M | 76.31M | -28.08M | 35.03M | 57.37M | 66.91M | 68.68M | 75.88M | 70.11M | 58.09M | 51.19M | 77.59M | 67.68M | 10.87M | 37.30M | 1.47M | 53.30M | 38.08M | 49.95M | 85.42M | 95.90M | 115.78M | 187.34M | 207.98M | 254.20M | 272.90M | 232.50M | 256.90M | 229.10M | 265.70M | 167.70M | 70.10M | 57.30M | 58.90M | 45.10M | 36.90M | 24.30M |

| EBITDA Ratio | -1.40% | -1.71% | 6.88% | 11.26% | 2.49% | 5.44% | 8.50% | 10.64% | 10.77% | 11.19% | 10.19% | 8.29% | 8.14% | 11.69% | 11.12% | 5.03% | 7.82% | 18.70% | 7.02% | 3.13% | 15.20% | 13.89% | 10.84% | 15.07% | 14.95% | 16.51% | 16.70% | 15.95% | 15.29% | 15.23% | 16.83% | 18.52% | 17.01% | 14.94% | 14.14% | 15.07% | 13.31% | 13.09% | 8.64% |

| Operating Income | -37.42M | -40.87M | 28.60M | 38.61M | -8.58M | 15.56M | 28.80M | 43.77M | 42.20M | 38.49M | 31.48M | 22.68M | 8.63M | 28.69M | 26.23M | -7.54M | -1.23M | -14.34M | 234.00K | -25.55M | -42.59M | 13.69M | 17.17M | 25.63M | 96.81M | 119.30M | 184.50M | 185.00M | 150.70M | 181.10M | 159.00M | 209.70M | 130.30M | 52.20M | 38.60M | 41.70M | 32.60M | 24.10M | 16.00M |

| Operating Income Ratio | -6.43% | -6.55% | 3.51% | 5.78% | -1.41% | 2.19% | 4.24% | 6.76% | 6.56% | 5.60% | 4.58% | 3.18% | 1.22% | 4.05% | 4.25% | -1.36% | -0.17% | -2.08% | 0.03% | -3.20% | -5.71% | 1.61% | 1.88% | 2.27% | 7.56% | 9.53% | 13.39% | 10.85% | 9.40% | 11.65% | 11.48% | 15.74% | 11.94% | 11.82% | 9.68% | 10.63% | 10.93% | 8.74% | 6.43% |

| Total Other Income/Expenses | -8.12M | -4.57M | -1.77M | 7.74M | -47.44M | -949.00K | 1.41M | -493.00K | 6.05M | 15.33M | 16.40M | 6.55M | 217.00K | 3.73M | -7.02M | -37.22M | -10.95M | -125.52M | -16.13M | -9.26M | -60.52M | -27.94M | -25.34M | -81.90M | -41.11M | -30.69M | 7.20M | -10.70M | -27.40M | 4.50M | -22.20M | -4.20M | -27.70M | 3.30M | 800.00K | -1.00M | 5.50M | -1.70M | 600.00K |

| Income Before Tax | -45.54M | -45.44M | 26.83M | 46.35M | -56.27M | 10.01M | 30.21M | 43.28M | 48.24M | 53.81M | 47.88M | 29.01M | 8.85M | 32.42M | 18.37M | -48.05M | -30.33M | -139.86M | -15.90M | -34.85M | -95.13M | -29.71M | -8.17M | -56.27M | 55.71M | 87.40M | 191.70M | 174.30M | 123.30M | 185.60M | 136.80M | 205.50M | 102.60M | 55.50M | 39.40M | 40.70M | 38.10M | 22.40M | 16.60M |

| Income Before Tax Ratio | -7.82% | -7.29% | 3.29% | 6.94% | -9.28% | 1.41% | 4.45% | 6.69% | 7.50% | 7.83% | 6.96% | 4.06% | 1.26% | 4.58% | 2.98% | -8.68% | -4.25% | -20.26% | -2.15% | -4.36% | -12.74% | -3.50% | -0.89% | -4.97% | 4.35% | 6.99% | 13.92% | 10.22% | 7.69% | 11.94% | 9.88% | 15.43% | 9.40% | 12.56% | 9.88% | 10.38% | 12.77% | 8.12% | 6.67% |

| Income Tax Expense | 1.86M | 901.00K | 11.66M | 17.27M | 972.00K | 7.56M | -1.49M | 10.90M | 15.07M | 13.35M | 20.16M | 13.34M | -1.98M | 7.33M | 7.69M | 4.30M | -10.95M | -22.09M | -1.17M | -14.10M | -25.34M | -2.53M | -2.09M | -11.60M | 17.68M | 28.40M | 62.80M | 58.60M | 44.90M | 69.40M | 60.30M | 77.40M | 40.00M | 17.20M | 13.00M | 14.50M | 13.30M | 10.40M | 6.20M |

| Net Income | -47.40M | -46.34M | 15.17M | 29.07M | -57.24M | 2.46M | 31.70M | 32.88M | 34.42M | 42.15M | 28.82M | 16.64M | 11.49M | 25.09M | 10.69M | -52.28M | -16.15M | -116.31M | -14.37M | -41.23M | -69.79M | -27.18M | -43.93M | -44.67M | 38.03M | 56.20M | 124.30M | 115.70M | 72.50M | 116.20M | 76.50M | 128.10M | 62.60M | 38.30M | 26.40M | 26.20M | 24.80M | 12.00M | 10.40M |

| Net Income Ratio | -8.14% | -7.43% | 1.86% | 4.35% | -9.44% | 0.35% | 4.67% | 5.08% | 5.35% | 6.13% | 4.19% | 2.33% | 1.63% | 3.54% | 1.73% | -9.44% | -2.26% | -16.85% | -1.94% | -5.16% | -9.35% | -3.20% | -4.80% | -3.95% | 2.97% | 4.49% | 9.02% | 6.79% | 4.52% | 7.47% | 5.52% | 9.62% | 5.74% | 8.67% | 6.62% | 6.68% | 8.31% | 4.35% | 4.18% |

| EPS | -2.61 | -2.57 | 0.82 | 1.57 | -3.10 | 0.13 | 1.73 | 1.81 | 1.93 | 2.32 | 1.52 | 0.84 | 0.57 | 1.25 | 0.54 | -2.54 | -0.80 | -6.21 | -0.83 | -2.40 | -4.05 | -1.53 | -2.46 | -2.49 | 1.95 | 2.79 | 6.09 | 5.49 | 3.27 | 5.01 | 3.24 | 5.61 | 3.12 | 3.24 | 2.10 | 2.73 | 1.89 | 0.93 | 0.87 |

| EPS Diluted | -2.61 | -2.57 | 0.80 | 1.54 | -3.10 | 0.13 | 1.70 | 1.78 | 1.87 | 2.24 | 1.47 | 0.80 | 0.56 | 1.22 | 0.51 | -2.54 | -0.80 | -6.21 | -0.83 | -2.40 | -4.05 | -1.51 | -2.45 | -2.49 | 1.95 | 2.79 | 6.03 | 5.43 | 3.27 | 4.86 | 3.24 | 5.37 | 3.12 | 3.24 | 2.10 | 2.73 | 1.89 | 0.93 | 0.84 |

| Weighted Avg Shares Out | 18.15M | 18.04M | 18.43M | 18.47M | 18.46M | 18.40M | 18.29M | 18.14M | 17.86M | 18.21M | 18.92M | 19.91M | 20.09M | 20.07M | 20.32M | 20.61M | 20.19M | 18.73M | 17.38M | 17.19M | 17.23M | 17.76M | 17.86M | 17.94M | 19.50M | 20.16M | 20.41M | 21.07M | 22.17M | 23.19M | 23.61M | 22.83M | 20.06M | 11.82M | 12.57M | 9.60M | 13.12M | 12.90M | 11.95M |

| Weighted Avg Shares Out (Dil) | 18.15M | 18.06M | 18.87M | 18.86M | 18.48M | 18.70M | 18.64M | 18.44M | 18.42M | 18.84M | 19.62M | 20.71M | 20.39M | 20.49M | 20.47M | 20.61M | 20.19M | 18.73M | 17.38M | 17.19M | 17.23M | 17.94M | 17.91M | 17.97M | 19.50M | 20.16M | 20.61M | 21.31M | 22.17M | 23.91M | 23.61M | 23.85M | 20.06M | 11.82M | 12.57M | 9.60M | 13.12M | 12.90M | 12.38M |

Unifi (UFI) Tops Q2 Earnings and Revenue Estimates

Unifi Elects Emma Battle to the Board of Directors

Top Stocks To Short Today As Markets Rise From Vaccine News

Top Stocks To Short Today As Markets Gain Despite Disappointing Jobs Report

5 Big Gainers From Solid Rise in US Manufacturing Output

Unifi, Inc. (UFI) CEO Edmund Ingle on Q1 2021 Results - Earnings Call Transcript

Unifi (UFI) Q1 Earnings and Revenues Beat Estimates

Source: https://incomestatements.info

Category: Stock Reports